Nigeria SSA Report: Inflation, GDP, FX, Fixed Income and Equities

Economic Uncertainty, Future Prospects?

Hi, this is the first SSA Report for Nigeria economy this year, subsequent to the previously shared 2024 outlook:

I had refrained from writing any macro report until the release of key economic data and post-MPC meeting holding next week Monday and Tuesday. But I believe a view of where we are is necessary ahead of the MPC meeting.

Without further ado let’s delve into the report.

Inflation

Going into 2024, the question had been what will be the direction of inflation, and in response to that, the buzz-word has been “base year effect” will kick in, hence inflation prints should decline.

Base effect occurs whenever two data points are compared as a ratio where the current data point or point of interest is divided or expressed as a percentage of another data point, the base or point of comparison.

Is Base Effect Coming to Save Inflation Print?

I have a chart of the index level of the major components of inflation (the major components driving inflation). What is worthy of note is that for base effect to kick in, we need to see declining index level relative to historical data in 2023, however, in January, we continue to see a higher index level across all components in Jan-24 relative to Jan-23 index level.

Base effect is sort of an illusion to posture that inflationary pressures are declining, the fact is if the core factors contributing to inflation are not resolved, sorry inflation is going to keep dragging with personal disposable income.

Going forward there are two combinations to declining inflation prints (not inflationary pressure) from the data point:

Future Index Level has to be lower than previous month level and lower than last year comparison level

To be candid, I am of the view that the larger chunk of inflationary pressures are not a battle for the Monetary Policy but more for the Fiscal Policy side, e.g how do you expect CBN to tackle insecurity? poor transportation network? low agricultural activity(maybe a bit of influence here)? Hence, I believe the CBN is more focused on FX as opposed to inflation, and just maybe the by-product of that might result in declining inflationary pressures, but the bulk of the work is on the fiscal side.

Food Inflation: Higher for Longer

The narrative hasn’t changed with respect to food inflation, imported food inflation will keep trending higher as long as the Naira depreciates and the Federal Government maintain or increase import duties/tariff. In my macro report on Kenya economy, I highlighted how the Kenya government had to reduce import duty to tackle imported food inflation while I am not agnostic to the impact it would have on the revenue side of the fiscal position, they aren’t just much you can do with imported inflation given the current pressure within the economy.

SSA Report: Kenya Macro Economic Analysis

Kenya stands out as a prominent player in the emerging markets of the East Africa region, exhibiting notable growth and development within the Sub-Saharan African (SSA) context. While this report does not delve extensively into the intricacies of the country's economy, it serves as an introductory exploration, positioning itself as a stepping stone onto…

On a MoM change, Food inflation components broadly accelerated, now we are back above September 2023 levels from a trend perspective, however, imported food inflation seems to be stabilizing.

Above is an heatmap I developed based on the MoM change average for the past 3 years to illustrate how Hot or Cool inflation print is across the components. Evidently, Imported Food Inflation has been hot since June 2023 after the floating of the FX, Food inflation has been hot since January 2023 before the floating of the FX and Housing Water/Electricity/Gas and Other Fuel has been hot since November 2022 and they are not slowing down.

Gross Domestic Product (GDP)

Nigeria GDDP grew by 3.46% in Q4’2023 from 2.54% reported in Q3’2023, a notable improvement compared to levels seen since Q1’2022. On a QoQ basis there was continuous expansion in Manufacturing, Construction, Transport & Storage and Real Estate activities, there was also a notable improvement in Financial Institutions, Trade and ICT. However, Mining & Quarrying declined while Agriculture had little to no growth in Q4’2023

Diving deeper into the GDP data, on the components of Agriculture, growth was recorded in livestock, forestry and fishing, while crop production decline; I think we can link inflation to crop production activities. The crop production sub-component of Agriculture has been very volatile and if there is to be an increase in domestically produced goods and services, we should start to see both growth and stability within this sub-component:

A quick overview on the Mining & Quarrying component, the net contribution on a QoQ was down -2% compared to last quarter, while the manufacturing sector expanded by 10% in Q4’23 compared to 7% in Q3’23, the Cement sector declined QoQ, but we are starting to see expansion in Food, Textile and the Steel industry within the manufacturing component.

Here are snapshot of other sectors:

Foreign Exchange and Fixed Income

The elephant in the room, Nigeria currency situation. The Nigeria naira depreciated further against the US Dollar in February above the 1,400 mark, odds were that, this was as far as the Nigerian Naira could depreciate, but Nooo! the Naira was asked:

The question is where do we go from here? I have been consistently asked should I buy the Dollar, hold and ditch the Naira, with the speculative anticipation that the Naira should depreciate further above the N2,000 mark. Honestly, it is hard to tell where the Naira could trade to, but I wouldn’t bet heavily on trading significantly above the N2,000 mark and the spike between N1,000 and N1,400 seems highly speculative.

As at Feb 20th, the Nigeria FX Reserve stands at $US32.67bn, growing but not significant enough. The obvious strategy of the CBN is to jack up rates in the Fixed income market to ensure a positive real return when adjusted for rising inflation and to ultimately attract FPIs, additionally, the CBN has been deploying policies that technically discourages the holding of the US Dollar domestically, so it seems to be attacking on all front.

In the Fixed Income market, while the CBN action is indicative of increasing rates on fixed income instruments to attract FPIs and FDIs to invest domestically in the Nigeria market, I think the other side of the coin is to close up the gap in the transmission mechanism of monetary policy. I have covered the importance of an effective monetary policy transmission mechanism in this article:

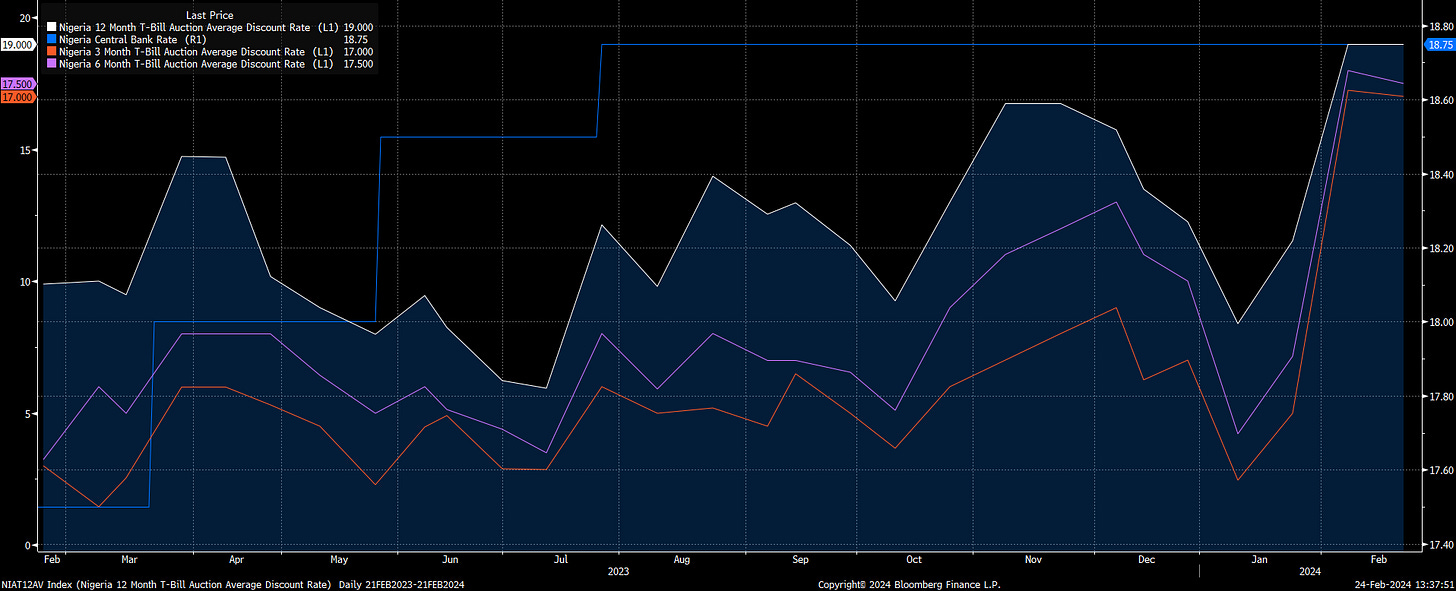

The Nigeria 12 month Tbill auction closed at 19%, the 3-month bill closed at 17% and the 6-month bill closed at 17.5% at the recent auctions held in February, recall I said:

I think the CBN is trying to bring the Fixed Income instruments rates close to the MPR rate such that any monetary policy decision that takes place can transmit effectively into the market.

From the image above we can now see that the 1 year tbill auction discount rate is slightly above the current MPR rate, while the other tenors are slightly below. At the secondary market, the discount rate of the 1 year T-bill is at 17.710% discount rate, also not largely in deviation from the MPR rate.

While expectations are that the CBN should hike rates by 200bps, I personally expect a hike between 50-100bps to test the waters on how it transmits into the fixed income market. I am also of the opinion that the CBN should not hike rate too fast so we don’t get to exceedingly high levels as much as we aim to combat inflation (which is less of a monetary problem) and FX stability (the primary focus).

Equities

How does all of these data translate into the equities market?

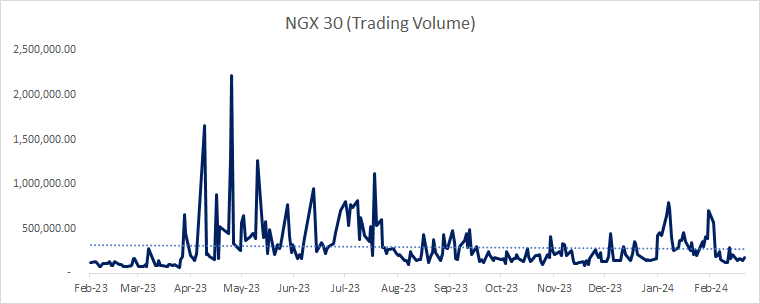

In 2023, the Nigeria equities market enjoyed a smooth ride to new all time highs. However, in 2024 at least for the past 2 months, the heat has cooled down, with the NGX30 holding slightly below the 4,000 point level, and consolidating.

In addition we have also seen a decline in trading volume compared to levels seen during appreciation in prices in 2023. The simplest explanation for this is that it does seem like players are taking profits from the bull run in 2023 into the Fixed Income market, via the auctions that took place in the past couple of weeks.

The forward looking question is will the equities market decline further or it would stay in a consolidation as investors re-allocate their holdings into the fixed income market for high yielding and risk-free investments.

This brings me to the end of the macro report, gearing up for the CBN MPC meeting next week.

Other reports will come in, Cheers.

watching this substack get better every report, awesome read brother

Great report, keep up the good work, is there a way to keep in touch privately?