Research: Monetary Policy Transmission Mechanism, A Primer to Macro Analysis

Understanding The Transmission Process of Monetary Policy Actions

Hi, I am still writing more research before the year ends, so let’s get into it.

One of the central tenet of understanding macro conditions of a country is to start with how the country monetary policy transmission mechanism works, because the decision carried out by the Monetary Policy Committee affects both the economy and the market activity, hence why it is a good place to start from.

Introduction

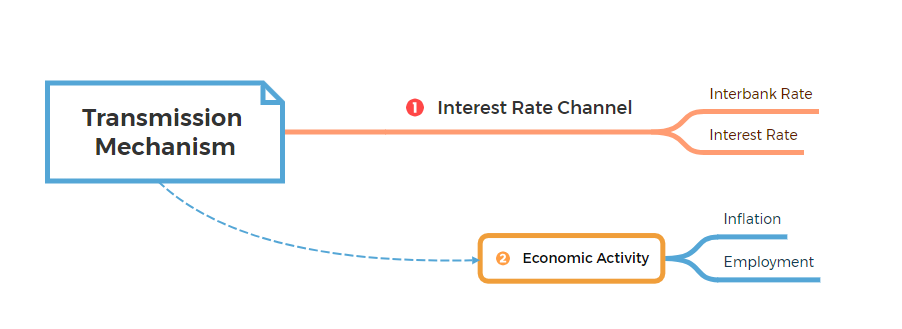

Transmission mechanism is the process by which changes in interbank and interest rate affect economic activity and inflation, and more specifically, how changes in monetary policy flow through to economic activity - Employment and Inflation.

The basic working of monetary policy is illustrated as follows:

When the interbank rate is lowered, it stimulates spending because businesses respond by producing more, leading to increased economic activity and employment, which also impacts disposable income:

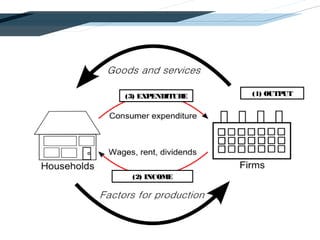

Back in my undergraduate days of theoretical economics, we were taught the Circular flow of Income, the missing piece of that explanation is how monetary policy and fiscal policy impacts that flow of income - by the way I am 22 years old, back in my undergrad days is sort of 3 years ago, not quite recent😂.

To reiterate, if interbank rate is lowered, the firms will be able to borrow from the banks at a discounted rate, which enables them to invest in their business activities to expand production. The expansion of production results in increased employment and thus increased wages/disposable income to households. Consequently, the excess of disposable income can then flow into the financial markets, resulting in the appreciation of financial assets (stocks, bonds etc) price.

With the basic understanding of transmission mechanism delivered, let’s delve into the various stages of the monetary policy transmission mechanism process.

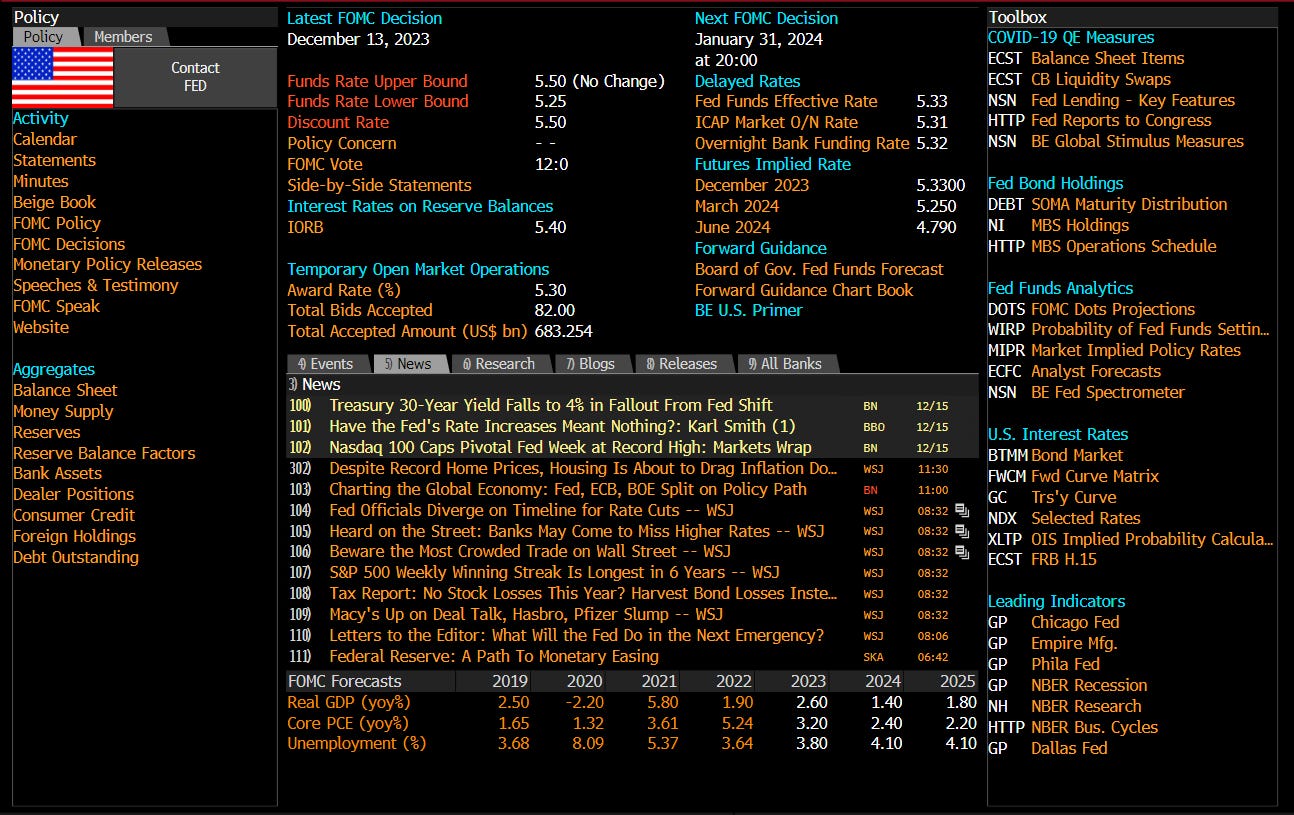

Stage 1: Interbank Rates vs Interest Rates

The first process of monetary policy transmission mechanism is to influence other interest rate in the economy via the interbank rate (overnight rate, or simply put, the market for overnight loans between Financial Institutions (Commercial Banks, primarily)).

In addition, it also serves as a benchmark for interest rates at which funds are borrowed from different sources including wholesale and demand deposits due to its strong influence over lending and deposit rates.

Yes, there are obvious dissimilarity between the interbank rate of Nigeria and that of the US, which is the absence of stability.

Furthermore, it is important to note that the extent to which changes in inter-bank rates affect other rates is often known as “Interest Rate Pass Through”, and the speed of this ”Pass Through” is a function of whether loans and deposits are given at a variable or fixed rates.

One of the fundamental reason that the US interest rate hike hasn’t really had much of a damning effect on the US economy is that during the era of ultra low interest rates in 2020, most of the loans were financed at a fixed rates of close to zero percent, hence with interest rates rising, it doesn’t completely affect the loans issued then, only newly financed loans or re-financed loans.

Stage 2: Influencing Economic Activity- Employment and Inflation

It is a no brainer that the core mandate of every country monetary policy is to achieve full employment and stable prices. The effect of monetary policy on economic activity pass through the following channel as illustrated:

Savings and Investment Channel

Economic activity can be influenced through monetary policy pass through effect in the Savings and Investment Channel. In this channel, the monetary authorities can impose higher rates to lower both household consumption and savings, if savings reduce the amount available to invest also reduces.

Furthermore, when savings reduces, investment reduces, which also reduces business investments, and impacts its ability to produce more due to lower household consumption and savings. The reduction in business investments also result in reduced employment, and reduction in the prices of goods and services.

The inverse relationship is the case when interest rate are lowered to expand all other components.

Interest Rate → Savings → Investments → Business Activity → Employment → Inflation(Prices)

Cash Flow Channel

This channel involves the pass through effect on disposable income, but more specifically between the movement of funds (flow of funds/cash) between Borrowers and Lenders.

There are two scenarios within this channel, which are:

Fixed

Variable

In a Variable Scenario, when interest rate rises, the lender of funds are able to generate more income as loans issued will yield a higher interest income, particularly for banks. However, higher rates could also result in lower interest income if the borrower can’t afford such loans, as such disposable income reduces, and the inverse occurs when interest rate falls.

On the other hand, in a Fixed Scenario, loans are borrowed at previous historical rates, such that when rates rises, the borrower of the funds doesn’t feel the effect especially when the fixed rate is lower than ever expanding rates, but what this implies for banks is that, when consumers deposit funds in the bank, they would have to earn interest based on the current interest rate levels, so this scenario is quite favorable for the Borrowers of funds and not the lender - and the inverse occurs when interest rate rises.

The key is to understand the % of household debt in the economy offered at a fixed and variable rate, as this will aid in gauging the impact of current interest rate levels on the economy.

The above is a classic distinction between the effect of Fixed and Variable rates on consumers. In 2020 we had a period of zero rates, where we evidently had an increase in Household Mortgage and Consumer Credit debt in the United States. In 2022/2023 we witnessed a consistent increase in rates from 0% to 5.3% and consequently, household mortgage and consumer credit debt has declined, in fact, it peaked when interest rate was at 0.83% before we had a significant hiking cycle.

The above chart visualizes US Household sector borrowing. In 2020, we see an increase in Consumer Credit borrowing up until July 2022, when rates increased above 1% from 0%, then consumer credit peaked and borrowing activities declined as rate rises into 2023.

Despite slowing consumer borrowings and higher rates, the S&P500 rallied from 2022 to 2023, illustrating the relationship of variable and fixed rates lending in the cashflow channel.

Asset Prices and Wealth Channel

A reduction in interest rates stimulates the demand for equities, but this is linked to the initial effect on the savings and investment channel. But more specifically, a period of rising rates leads to a decrease in the valuation metrics of stocks and vice versa.

Thus, all things being equal, higher rates is bad for the Stocks and Real Estate market and lower rates is good for the Stocks and Real Estate market. Therefore, as the value of these asset increases or decreases, the wealth of the household may increase or decrease.

Additionally, within this spectrum, rates also have its impact on the balance sheet of economic agents, such that changes in interest rates directly impact the cost of servicing existing debt and the cost of new borrowing.

Exchange Rate Channel

Monetary policy actions also transmit into the FX market of the economy, such that lower rates results in reduced demand for the country currencies, but an increase in export volumes (decrease in imports). When a country domestically have higher rates, there will be an increase in the demand of the country currency in order to partake in its financial market and thus earn relative higher interest, resulting in the appreciation of the country domestic currency.

From the chart above, there is an obvious positive correlation between the rising rates in the US and the appreciation of the Dollar since August 2021. It is important to note that it is not always a symmetrical price movement but with lead/lag effect based on market participants future expectations of monetary policy decisions.

That concludes the understanding of the transmission mechanism of monetary policy. The other component of understanding the transmission mechanism is understanding the activities of the Central Bank of the target country, so I will touch briefly on that below.

I have written a short article that sets a foundational understanding to Central Banking (link), but if you are like me and you love to read, here is a recommendation below:

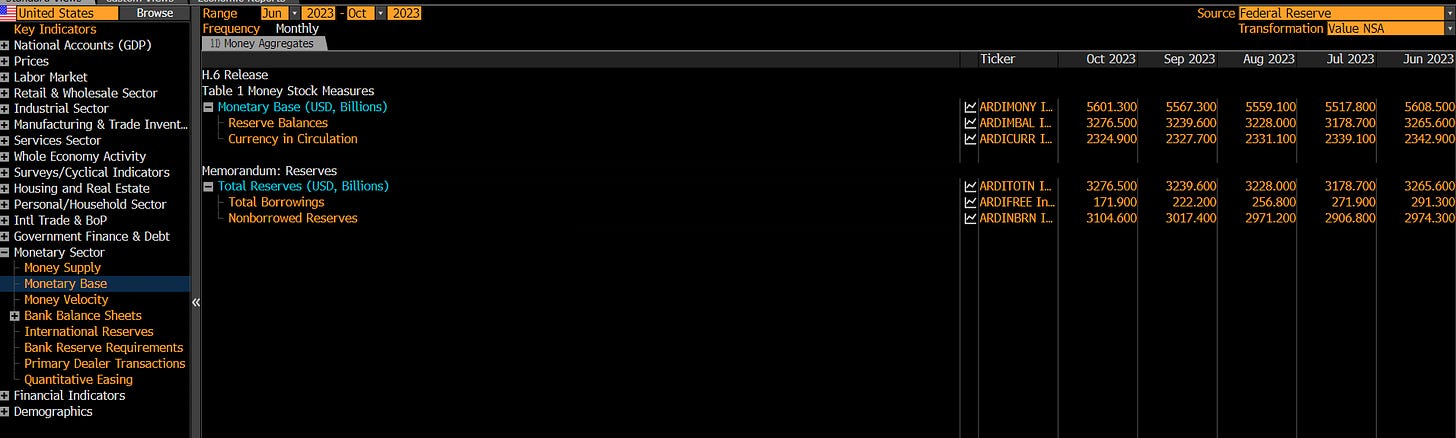

The key to understanding the activities of the Central Banks is to evaluate the liabilities and the components of the monetary base (Currency and Bank Reserves):

The Central Bank controls the monetary base, and monetary policy activities begin with changes in the Monetary Base through Open Market Operations (OMO). OMO involves the purchasing of securities ( to increase the monetary base) or selling securities (to decrease the monetary base):

In 2020, there was an increase in the monetary base as rates stay at zero levels, which eventually peaked in January 2022, also resulting in an increase in rates. The increase or decrease in the Fed Funds Rate also lead to an increase or decrease in long term nominal interest rates, which also impact investment decisions, aggregate output and employment.

I do not intend to delve into Central Banking Aggregates in this research (reserved for future research).

In this article, I have been able to explain and illustrates how Monetary Policy works and how it transmits into the activities of the financial markets. I will cover a case study of Nigeria Transmission Mechanism subsequently.

Have a splendid weekend.