Equity Markets: Comprehensive Systematic Model

A mix of Global and Sub Saharan Equity Markets (SSA)

A ship is safe in the harbor, but that is not what ships are for - highlights that life is not about playing it safe. The real purpose of life is to take risks, explore the unknown, and live a life full of adventure. The metaphor of a ship represents our lives, and the harbor represents our comfort zone

In previous reports, I have shared a framework for Macro analysis and equity analysis that would lay a foundation for this report:

The table of content for this report is as follows:

Foundation to Equity Systematic Modelling

Emerging Equity Markets Equity Modelling Considerations

Development of Volatility Regimes

Dangote Cement Stock: Case Study on Volatility Regime

Julius Berger Stock: Case Study on Momentum Factor and Volatility Regimes

Market Regime Model

Macro Regime Switching Variables

Thematic Investing

Bond and Equity Market Relationship

S&P500: Case Study on Bond & Equity Market Relationship + Macro Regime Switching model

Sector Impact and Opportunities

Factor Profiling

Nigeria ASI: Factor Profiling

Fundamental Analysis

Quantitative Signals

Reading List

Foundation to Equity Systematic Modelling

This section will focus more on the systematic approach and a bit of narrative on the structure underneath. A systematic model implies a level of generic applicability to various markets, with little variations to different economies especially across the Sub-Saharan Africa (SSA) equity markets.

The foundation for approaching equity markets is through a regime model, risk factor identification, and factor style profiling.

The idea behind a regime model is built on the premise that there are multiple variables and as such states that the market will operate in, and the combination of those variables would likely result in a movement in asset prices within the market.

Since the equity market is to a large extent an interpretation of the welfare of an economy across various sectors, macroeconomic variables and how they interact become pivotal for companies that operate in such an environment, as they would impact their growth, profitability, sustainability and to a large extent the broad business environment.

There are two layers to systematically approach any economy equity market, by identifying:

Risk Factor

Macro Regimes

Risk factors are usually designed after identifying a sound economic rationale from evaluating macro market regimes. The approach of focusing on risk factors enables the analyst to identify the Risk Permia applicable to the target economy market which also filters directly into the equity market.

Traditionally, quant equity managers model portfolios based on equity risk factors such as growth, value, earnings, momentum, short interest, etc. However, behind every risk factor, there should at least be a strong economic rationale that explains the existence of the risk premium.

Note that every decision to take a bet on a stock is the manager essentially taking on risk, based on the expectation of a premium consistent with the economic expectation for the risk behind the factor.

However, relying on risk factors alone without consistently evaluating where we are in the macro regime implies that we would most likely be on the other side of a position as the market evolves to price in new risk factors.

Emerging Equity Market: Equity Modelling Considerations

Leaning more into the developing emerging equity markets, risks particularly include political instability, fragmented economic cycles, and currency volatility. Therefore, classifying macro regimes has a little bit of distinction to a well-developed equity market such as the United States.

In emerging markets, investors are confronted with markets lacking adequate risk characterization, besides the traditional classification which would properly direct the flow of capital, primarily as a result of dense markets with little information flow on assets, poor reporting standards, and others. In essence, emerging markets have quite several inefficiencies in their market, which constrict the ability of investors to price these risks and adequately hedge them in the market.

Development of Volatility Regime

A major problem in emerging equity markets is the lack of symmetry in information flow and as a result market inefficiencies. These effects thereby adequately reflect in the nature of asset returns primarily characterized by what we call Volatility.

Therefore, one major risk factor in emerging equity markets is the volatility characteristic inherent in its nature particularly for active investments, as such being able to position well within macro regimes and risk factor style is also a function of the anticipation of volatility to yield good returns.

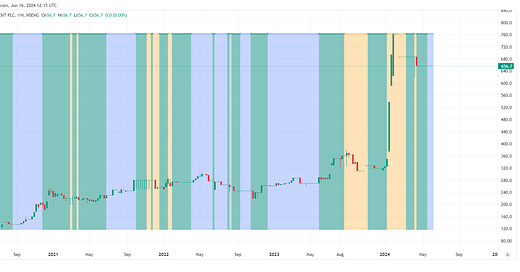

Dangote Cement Stock: Case Study on Volatility Regime

A case in point is within the Nigeria Index 30, more specifically the Dangote Cement stock, classified using volatility regimes:

Orange = High Volatility

Blue = Low Volatility

Green = Normal Volatility

In February’2024, the stock offered a return of 135.95% wildly absurd but hey, not for me to judge. After the period of high volatility, the market undergoes a mean reversion to a period of normal volatility and subsequently to a low volatility period, oscillating across possible volatility regimes.

The key takeaway is how inefficiencies in emerging equity markets and lack of proper information flow do not enable the full implementation of traditional risk factors, as you would expect in a developed equity market, like the US. However, some of the traditional risk factors do have some weight such as Value, Quality, and Momentum, but overall they would oscillate within a Volatility regime.

Julius Berger Stock: Case Study on Momentum Factor and Volatility Regimes

We see a period of normal volatility with a rising momentum factor. However, the decision on what stock to buy and within what factor style to play in, is contingent on the Macro regimes, but I need to lay a foundation on the risk factors in play before we proceed into the classification of macro regimes, and then the systematic approach to equity analysis.

Market Regimes Model

The regime model is built upon the foundation laid by Regime Switching models. The regime model built on time series data characterizes data as falling into different recurring regimes or states, allowing the states to transition from one regime to another.

At each regime interaction, the output parameters would differ, and more importantly, there is a finite number of regimes, which can be recurring or temporary. The regime model is then used to model the effects of cyclical changes in the economy.

The switches or changes in regimes observed in the markets extrapolated by the behavior of asset prices are a function of several factors such as Growth, Inflation, Macroeconomic Policy, and Fiscal Policy responsible for the switching of asset returns in the equity markets.

The macro market regime model is quite reliable in developed markets. However, limitations in the equity market are due to the volatile nature of Sub-Saharan African (SSA) markets, as it is primarily known for abrupt changes, which become disruptive to even the smartest investment strategies.

Macro Regime Switching Variables

Given the problem of inadequate flow of information, the addition of volatility to the regime states becomes pertinent but only majorly applicable to emerging equity markets. As a result, the Macro Regime is as follows:

Growth

Inflation

Interest Rate

Liquidity

Policy:

Fiscal

Monetary

Volatility

The above macro regime isn’t just applicable to the equity markets but to also the traditional asset class (Currencies, Fixed Income, Commodities, and Volatilities). As stated earlier, there are finite states for the regime-switching model, based on the regime variables:

Some sub-variables would be tracked under each macro regime to determine whether growth is High, Moderate, Low, or Contracting (a recession is a little bit extreme). What you are essentially aiming to do is understand where the economy is based on the mix of regime variables and evaluate:

Investors behavior to the regime states (in terms of capital flows)

Asset price behavior to the regime states

With the understanding of where the economy is in the regime model and how investors and asset prices are reacting to it, we would be able to build a narrative on how the broad-based asset class index should move and potentially identify expected returns from the information.

However, identifying the macro regime model state and asset price behavior alone does not exactly provide insight into what I should buy or sell within the equity market, and this is where I plug in thematic investing as the next step, post evaluating the regime state.

Thematic Investing

I am a believer in Thematic Investing. Thematic investing is a form of investment that aims to identify macro-level trends and the underlying investments that stand to benefit from the materialization of those trends.

The focus is on trends that result in growth drivers of the index, the smart play would be to focus on sectors within the index and economy that would likely gain from the themes in the play, and probably short the opposite end of the theme likely to lose or constrain, while linking them into specific sub-sectors or industry.

A classic example would be the Technology sector with the Artificial Intelligence thematic play, then drilling down to the specific sub-sectors likely to benefit from such thematic play.

Furthermore, thematic could be broadly classified as either Event-driven, Cyclical driven, or Structural driven. Most of the events that take place would fall under one or more of the categories.

For example, the decline in Nigeria’s Banking Stocks could be attributed to an Event-driven thematic play, due to the CBN regulatory exercise to increase the banking re-capitalization exercise, as such the thematic play on how investors would react would be to short stocks that have a low probability of raising capital and holding stocks that can meet the capital requirement.

Sequel to evaluating the Thematic in play, it slowly lays the foundation for the area of focus to invest or play in, but before delving deeper into this, it would also be useful to touch on the Asset class relationship, more specifically the relationship between the Bond and Equity market.

Bond and Equity Market Relationship

The return in the equity market is an interplay between growth expectations and bond yields, which can also be extrapolated from the Macro Regime model. The movement in bond yields across the yield curve whether higher or lower has an impact on the equity market, as the rise in bond yields is also a reflection of inflation expectations as such growth evolution.

More important is the role the bond market plays in the valuation of the equity markets, such that when bond yield rises, the risk-free rate which also serves as a reference for the discount rate in the equity market for the weighted average cost of capital, would increase, thereby the discounting of future cash flows into the present, becomes less valuable, hence why rising interest rate environment are not the best conditions for the equity markets.

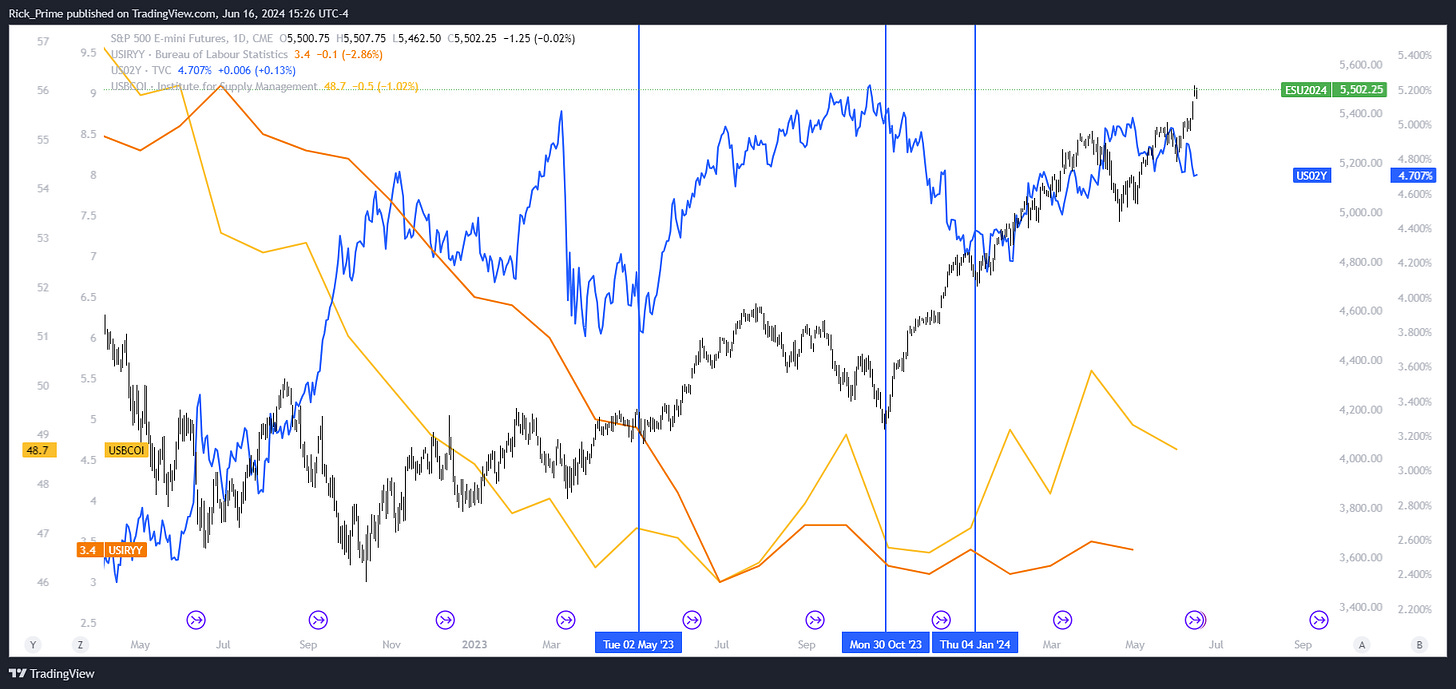

S&P500: Case Study on Bond & Equity Market Relationship + Macro Regime Switching Model

However, it is important to note that the market is a complex system and these variables do not interact perfectly every time, which is why the macro regime model helps put things in perfect context and here is why:

In 2020 during and post Covid’19, we see US 2-year yields at around 0% levels(blue line), see inflation rate rising(orange line) and ISM PMI a proxy for growth (yellow line) rising, as the macro regime is: + Growth, + Inflation, -Yields

Despite accelerating inflation, the bond yields aren’t exactly pricing that in, and as growth expands we see the US Stock market offer a strong bull run from 2020 to 2022:

If we shift our focus to where we are now, we have mixed growth, and elevated inflation, but better than 2023 levels, bond yields are elevated which means this isn’t good for the equity market valuation, yet we continue to see the US equity market press higher. The point here is that there is no direct relationship across the variables, but the interplay between the variables and how investors are reacting provides more context to build a proper narrative.

In an ideal world, there is an inverse relationship between bond yields and stock prices, but this isn’t always the case. The key thing to measure is the starting levels of these variables, the rate, and speed of change in the variables, as they would impact the underlying asset class.

The above narration so far covers deciphering the Macro and Thematic factors in play. What happens next is connecting the narrative on the macro level to sector impacts and opportunities.

Evaluating Sector Impact and Opportunities

The process for this is to examine the index of an economic stock market and evaluate the attribution of returns, earnings expectations, and valuation changes. What happens here is that the stocks driving returns should somehow connect to your macro and thematic narrative, or should somehow provide a context to the transition of asset returns to line up with the macro narrative.

The next layer is to evaluate sector beta to economic variables/expectations and the impact of economic variables on corporate performance. This provides additional context on the impact of economic releases on specific sectors of the equity market.

At the end of the process, you now have the sector/sub-sector or industry to focus on.

Factor Profiling

The next step is to profile the equity names that make up a sector or sub-sector into various factor styles, such as Size, Value, Yield, Momentum, Quality, Volatility, and Liquidity.

Bloomberg Terminal as Portfolio Admin function that can provide details on this. The key here is you are trying to understand what factor styles are funds active on within the index or sector and the macro/thematic narrative. If momentum and quality factors are what seem to be driving returns, then you simply would wanna focus on where the money is flowing in and review the specific stock names that are within the factor.

Nigeria ASI: Factor Profiling

Here is an example of the Nigeria ASI:

I did a factor attribution of MTD returns of the index, and what I can pick out from the factor profiling is the contribution to the return of the index based on specific factor styles. From the above breakdown, Momentum, Residual Volatility, and LongReversals are what the index has some exposure to and also contributing returns, the other factor styles are useful, but I won’t draw attention to that.

When you evaluate the specific equity names within the factor styles, you then develop a watchlist to perform fundamental and technical analysis on, before deciding on executing a trade.

Fundamental Analysis

I honestly like to keep things simple, once you have security from the factor profiling, the key thing to do is read the latest industry report to:

Identify the key active themes within the market

Industry valuation and drivers

This provides a more in-depth picture of the sector focus and also helps in filtering the names within each factor style if they are the right selection that would yield alpha from the underlying industry themes.

For example, under the Long Reversal factor profile, we have GTCO which is a banking name, yes the key theme within the banking sector is the re-capitalization exercise which has resulted in the depreciation of the banking name asset prices, however, GTCO is a strong name and what we can infer from the factor profile is that the security is a candidate for a long trade reversal after depreciation in prices:

Long reversal trade on GTCO post banking recapitalization even driven decline in banking sector securities.

The other component of fundamental analysis is the company analysis, which involves evaluating revenue sources, income statement analysis to evaluate the drivers of earnings, and whether it is sustainable, and also balance sheet analysis. The use of financial ratios on profitability, liquidity, leverage, efficiency, and returns to shareholders are also useful indicators.

In addition to company analysis, evaluating metrics such as Earnings Yield and Dividend Yield/per Share are also useful, and lastly justifying valuation metrics applicable to the industry.

At the end of this stage, you should then have a strong thesis on buying or selling a stock, the addition to it is implementing some form of technical analysis to generate quantitative signals for trade execution, and I would leave that for you to fill in as it deems fit for you.

This covers the model of Equity markets. So far so good, I have shared models for Equity and FX asset class, which can always be improved upon.

Thank you for your attention, and happy Eid Mubarak to the dear Muslim on my reading list. As always, see below resources that might be useful:

https://www.wellington.com/en/insights/market-regime-indicator-portfolio-resilience

https://assetmanagementuk.seic.com/pdf/download?uri=/sites/seiuk.com/files/News/Emerging-Markets Factor Investing (UK).pdf

https://www.theemergingmarketsinvestor.com/investment-factors-in-emerging-markets/

https://www.tandfonline.com/doi/full/10.1080/23322039.2023.2258704

https://caia.org/sites/default/files/03_factor-investing-in-sa_9-14-17.pdf

https://www.morningstar.com/funds/morningstar-factor-profile-new-way-better-understand-funds

Thank you for these articles.