Macro Insights: Nigeria Profile and Macro Analysis Framework Primer 1

For when fear is overcome, curiosity and constructiveness are free.

Hello MetaMacro readers, trust you are having a splendid weekend.

Early in the week, I wrote the macro analysis GILPTS framework that explains my approach to performing macroeconomic analysis on various economies. I also promised to analyze multiple countries economy using the framework.

Nigeria would be the first of the countries in my macro analysis to-do book, because it is my local market and I need to keep track of it.

This article focuses on establishing a base for the country profile, the framework for macro analysis specifically for Nigeria and investment vehicles. This publication is named Primer 1 for two reasons:

It sets the foundation for performing macro analysis on Nigeria economy

Combining this article with the actual macro analysis will make it bulky

Hence, there will be a second primer (Primer 2) for the data focus, and subsequent to that I will provide macro insights based on events that occur in the economy that feeds up into this analysis, and every quarter I get to write an updated but succinct version.

So, without further ado, let’s delve in.

Country Profile

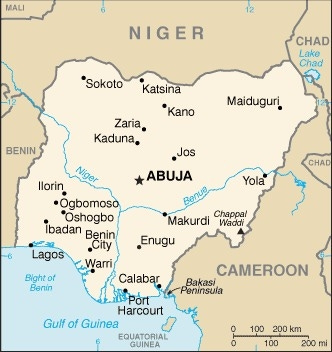

Nigeria is a Petroleum based economy, located in Western Africa, between Benin and Cameroon, bordering the Gulf of Guinea. The advantage of Nigeria's location is its access to the Gulf Guinea, which provides access to the Atlantic Ocean to leverage on International Trade, Maritime Activities and Fishing. It has access to a shipping route to Africa, Europe and the Americas.

Nigeria is expected to utilize the leverage from its geographical location via trade movement with neighboring countries and access to offshore oil exploration and production. However, the economy hasn’t been flourishing as expected majorly due to problems from Corruption and Mismanagement of public funds and the nation's resources.

Natural Resources

Nigeria is quite endowed with a plethora of natural resources, ranging from Natural Gas, Petroleum, Tin, Iron Ore, Coal, Limestone, Niobium, Lead, Zinc and its Land. From hindsight, Nigeria has been heavily reliant on its Petroleum resources and Agricultural Land. However, these resources are yet to contribute positively to the economy as inflation levels on goods remain elevated, which is odd for a country with vast land resources. However, other natural resources have been underplayed as to what their contribution could be to the nation's economy.

Demographics

Nigeria has a favorable demographics with a population of 222 million people with 40.69% of its population within the age group of 0-14 years, 55.95% within the age group of 15-64 years and 3.36% above 65 years of age. Nigeria demographic structure indicates that it has more working population class which is expected to contribute positively to the economy production activities.

International Trade

As earlier stated, Nigeria is well endowed with natural resources and a working class population demographics, and that should enable it to not only facilitate international trade but be a major exporter to other Neighboring countries and European Countries.

Nigeria as a country is capable of exporting Petroleum Oil, Natural Gas, Cocoa Beans, Cashew Nuts, Soya Beans and Non-Monetary Gold. Nigeria also imports Motor Spirits, Gas Oil, Durum Wheat, Cane Sugar, Kerosine, Used Vehicles, Machines for the Telecommunication sector, Motorcycles, Medicines, Herbicides, Lubricating Oils and other more.

Merely from examining the structure of Nigeria International trade above, for a Petroleum Based economy endowed with Petroleum as a natural resource, it still ends up importing Motor Spirit and Kerosene type jet fuel, but why?

Why Nigeria Export Petroleum Oil and Import Motor Spirit and Kerosene

In Nigeria, when Petroleum Oil is sourced and extracted, they are sourced from Bituminous Minerals. Bituminous minerals are sedimentary rocks that contain a significant amount of organic material known as kerogen. When this kerogen is heated, it can be converted into petroleum-like liquids, this process can simply be phased as the mining process of which Nigeria is capable of, but these oils are not suitable for direct use in internal combustion engines(Cars, bikes, machines, e.t.c) due to their high viscosity and impurities, therefore further refining is required.

Nigeria hasn't been able to efficiently refine these Bituminous minerals, so it exports them and imports the refined product - Motor Spirit. Motor Spirit on the other hand is a refined product obtained from crude oil through fractional distillation. During this process, crude oil is heated, and its different components are separated based on their boiling points, with Gasoline being a lighter fraction of the boiling points.

The reason why Nigeria exports Petroleum Oil in the mining phase as Bituminous Minerals to other countries and import Motor Spirit and Kerosene is due to the lack of specific refining facilities to produce enough of the lighter products like gasoline, diesel, and jet fuel leading to the need for importation. Other reasons could include a higher demand and consumption pattern domestically, than Nigeria refineries can meet up with.

However, due to increased global interconnectivity and developed financial markets, for commodities such as Natural Gas and Crude Oil, the prices of these assets fluctuates and as they do, so does the selling price domestically in Nigeria.

Prior to the election of the current President of Nigeria, Bola Ahmed Tinubu, the importation of lighter crude products had been subsidized by the Government, but that plug has been pulled and the cost is now being passed directly to the people(although it is still currently subsidized, but at a lower cost to the government compared to before), so the nation now understand the downside of exporting Bituminous Minerals and importing the refined product.

Economic Regime

Currency Regime

The President of Nigeria, Bola Ahmed Tinubu as part of his Pro-Economic reforms policy implemented the Unified Exchange Rate system for the system, where the Parallel/Black market is expected to merge with the Investors & Exporters window (I&E) towards ensuring that the value of Naira is determined explicitly by market forces. This makes the Nigerian economy interesting for Macroeconomic analysts, as we get to see the workings of the economy adequately reflected in its currency strength and its equity markets.

As at the time of this writing, the Naira to Dollar had depreciated from N700/$ to N1000/$ primarily due to scarcity of dollars, low FX reserves in the Central Bank of Nigeria, Backlog of Dollar obligations yet to be settled and of course, the external imbalances it faces from Trade Balance, declining Foreign Direct and Portfolio Investments and heavy reliance on importation - all of these factors interplays and has resulted in the decline in the value of the Naira against the Dollar, Pound, Euro and Canadian Dollar.

Monetary Policy Regime

The Central Bank of Nigeria (CBN) has a dual mandate of price stability and attaining maximum sustainable employment. Therefore, their objectives include:

Price Stability

Economic Growth

Full Employment

Financial Stability - Credit and the overall Financial System

Exchange Rate

The CBN conducts monetary policy by utilizing Open Market Operations, Reserve Requirements and Discount/Interbank Rates. The CBN utilizes any of the above measures in influencing the money supply in Nigeria economy, either for expansionary or contractionary purposes.

Currently, Nigeria is trying to put its house in order, with the newly elected CBN Governor Dr. Olayemi Michael Cardoso alongside the deputy governors. Prior to the confirmation of the resumption of Cardoso as the CBN Governor, the September MPC meeting was postponed for good reasons. I genuinely think they need to develop a clear plan to bringing the economy back to stability than just traditionally hiking rates as a ploy to attract foreign capital via positive real rates, adjusted for inflation.

It is also important for me to emphasize that the core focus of the CBN right now is Exchange Rate stability and attracting Foreign Flows into the economy, while as a byproduct keeping inflations from elevating further (if it were up-to me, inflation target levels probably need to be revised).

All investors and market participants, are in suspense mode to evaluate the plans and proceedings of the new CBN team.

Fiscal Policy Regime

The purpose of fiscal policy is to utilize government spending and taxation to influence the overall economy's performance and achieve specific macroeconomic objectives. These objectives often include promoting economic growth, controlling inflation, ensuring full employment, and addressing income inequality.

The current fiscal policy regime under the current administration is centered around revenue generation from taxes, decreased borrowings externally, oil production at 1.69m barrels/day, inflation below 17.8%.

The 2023 fiscal budget has an estimated revenue of N11.05 trillion, an expenditure of N21.83 trillion, with an overall budget deficit of N10.78 trillion. The budget deficit will be financed from Domestic sources (N7.04 trillion), Foreign Sources (N1.76 trillion), Multi-lateral and bi-lateral loans (N1.77 trillion) and Privatization Proceeds (N206.18 billion)

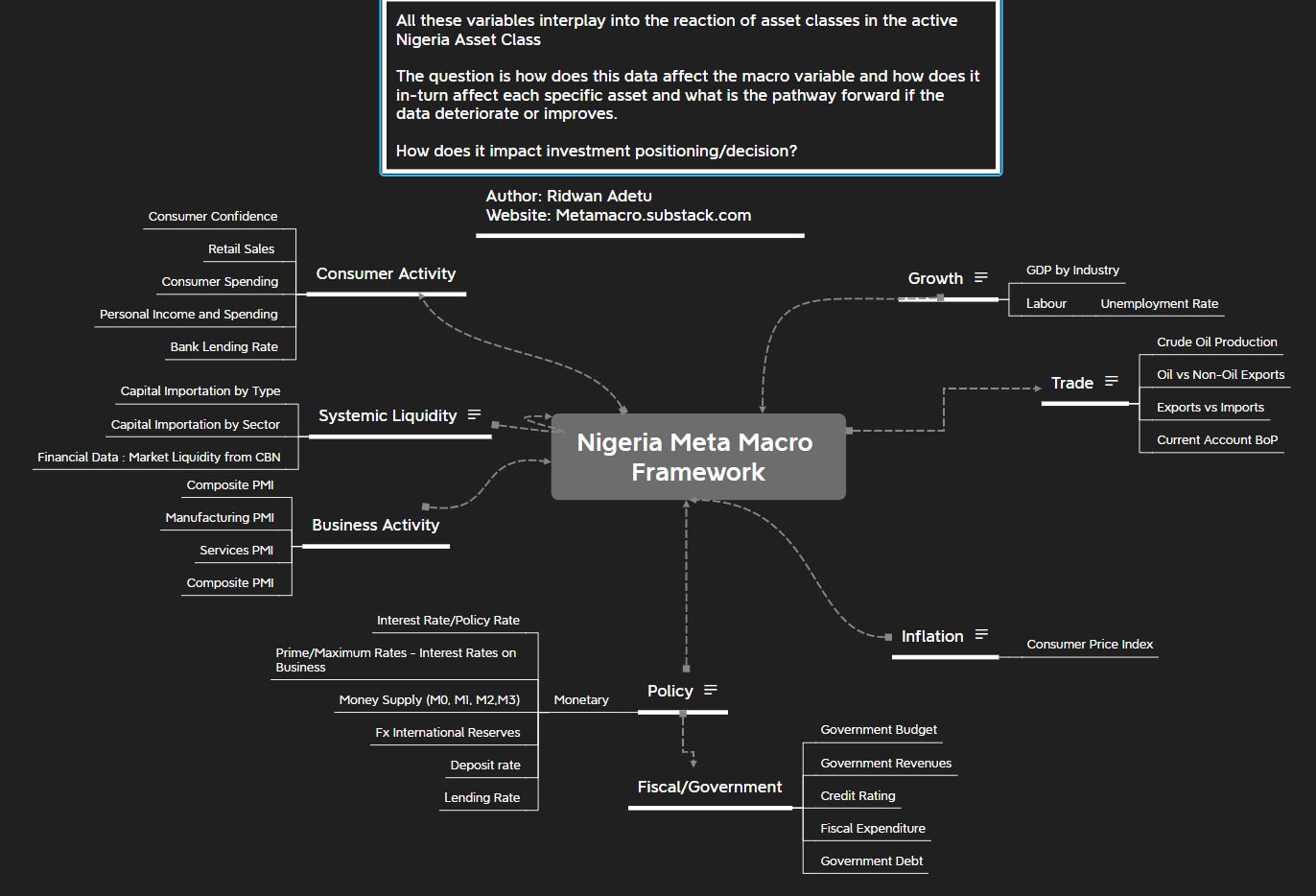

Nigeria Macro Analysis Framework

I have been able to narrow down the macro system of Nigeria and develop the above macro framework. The above interconnected systems are the map to Primer 2 - Nigeria Macro Analysis. However, before Primer 2, I would like to touch base on each of the variable and its Meta-variables in the above framework.

The macro analysis will analyze and form a narrative/thesis (subjective) across the following spectrum:

Growth: Examining Consumer, Business and Trade Activity

Inflation

Liquidity: Assessment of Capital Flows

Monetary and Fiscal Policy: More emphasis will be on the Monetary Policy

The above variables encapsulate the GILPTS framework (Growth, Inflation, Liquidity and Policy)

In each section, I will try to link the narrative with Technicals and Sentiment across the “Active” asset class in the Nigerian market, based on actual investment positioning and generating ideas.

I have also classified the active assets based on class, and investment positioning will revolve around each asset class, based on developing and evolving narrative and price action.

If you made it up to this point:

Thank you for lending me your attention and keep an eye out for Primer 2 on Nigeria Macro Analysis.

Have a wonderful weekend.