January has been a relatively good month of slow and steady progress, although relatively mixed market action. Trade calls have materialized positively on a net basis, and as we move into the last week for the month an important volatility event is in the mix.

Before I run down the macro report for the week ahead, a random musing(you can skip this section): I spend quite a lot of time adjusting or fine tuning my strat on the market, sometimes I think way too much, of which I should be diverting the time into other things probably reading for an exam or sorts, but I genuinely have little interest in reading stuff (which are finance related) for the sake of passing an exam, no matter how much I try to re-wire my brain to not see it that way, lol, it just wouldn’t. Anyways, will try to push through on it this week.

Okay, musings done, a quick run down on positions I am running:

Trade Update:

I am currently running the following positions:

I closed NVDL 0.00%↑ for a loss and eventually closed PLTR 0.00%↑ before market close. Will post a review on these positions at the end of this report also.

All trades opened and closed can be found under the Equities Trade section

Macro Risk Premium

Last week, I was thoroughly concerned about Trump risk/policy risk following the inauguration and the ability for him to blab his way into volatility within the market place.

While I built long exposure to one of his policy stance around immigration hence the CXW 0.00%↑ long, the market didn’t budge, but I am still holding the position. Moreso, I wasn’t really concerned with hedging via put options and I think that was the right call in hindsight

Less attention was allocated to Flash PMI print and BoJ policy decision raising rate from 0.25% to 0.5%, the NIKKEI was up while Yen gained marginally:

The Dollar Yen also slid marginally on an intraday basis, but broadly still remain relatively rangebound:

Policy Risk Premium

Following the inauguration of Trump and his speech coupled with executive orders, the market was keenly focused on Trump commitment to Tariffs and his actions around the Cryptocurrency Market. Attached below are the statements from Trump at the inauguration:

What is of significance is how Trump had a change in tone around imposing Tariffs from being aggressive during his election campaign to taking a bit of a step back on implementing the policy at scale:

The resulting effect is the pair back in gains in DXY:

Synonymously, the S&P rallied into the end of the week as most of the policy statements from Trump was priced in, and the re-iteration of them coupled with the laid back foot on imposing Tariffs brought a bit of calm to the market:

On the commodities market, Crude Oil declined over the week as Trump emphasized the need for OPEC to lower crude oil prices at the World Economic Forum(WEF), and in addition his policy stance iterated at the inauguration to ensure the oil sector continues to drill to boost energy production:

In lieu of the uncertainty around Trump inauguration, pathway of Bank of Japan and the upcoming FOMC, this resulted in Gold rally primarily driven as a hedge against potential volatility:

I stated the long trade idea on Gold in the mid week report, but failed to follow through on it:

While Policy Risk Premium has been the center focus over the week, there is going to be a gradual shift into other risk factors, given the economic event for the week ahead:

Monday and Tuesday has a pretty clean economic event, while FOMC takes center stage for Wednesday. The market already expects the Fed to hold rate, hence the main factor in focus is the FOMC statement and Press Conference to provide a clue on the direction of rates.

If the Fed posits a hawkish stance that is bearish for Equities and could see DXY rally and vice versa if dovish or neutral.

The S&P500 is already at an ATH, I think we probably see some hedging pressure into FOMC resulting in equities declining leading into Wednesday. This bring in focus the following key levels on the up/down-side for S&P. I think we might have a bearish sentiment below 6,050 and probably closer to 6,000 ahead of FOMC

If FOMC stance seems to be dovish then we could press higher to 6,150 and potentially to 6,200.

Equities View

My current equity strategy prioritizes earnings-driven opportunities and exposure to select technology stocks. While I remain cautious about taking aggressive positions in the near term, developments in artificial intelligence (AI)—particularly China’s release of Deepseek AI—warrant attention. This tool, positioned as a cost-efficient rival to ChatGPT and other AI models, raises broader questions about the sustainability of heavy AI-related capital expenditures (CAPEX).

Deepseek’s development at a lower cost underscores China’s accelerating progress in AI and highlights potential inefficiencies in the global AI arms race. If investors begin questioning whether sky-high infrastructure spending (e.g., data centers, chip demand) is justified, sentiment toward leading AI infrastructure players—Nvidia (NVDA), AMD, or cloud providers—could soften. This narrative may gain traction ahead of Nvidia’s earnings (Feb. 21), especially given the stock’s recent rangebound trading.

Furthermore, the AI sector has thrived on a “spend now, monetize later” mindset, but Deepseek’s emergence introduces a counter-narrative: efficiency. If cost-effective AI models gain credibility, markets may re-evaluate the growth premiums priced into companies reliant on massive hardware investments. This could pressure stocks levered to AI infrastructure demand until clearer ROI timelines emerge:

I think we could see NVDA 0.00%↑ trade lower to 140 and potentially 135 level.

My long position on KBE 0.00%↑ was framed around earnings release for banks and my expectations for broadly positive earnings highlight. Rather than gaining exposure to single names, I chose to stay on the ETF to minimize single name exposure risk. Below are key levels I am focusing on, I will also continue to hold the position:

SNOW 0.00%↑ has been a turtle stock, and in the presence of macro volatility risk, Snowflake is a ticker that doesn’t throw me into the woodshed due to low volatility. I am still holding this as long as we can stay above 160 levels, there is also an absence of catalyst until the earnings release towards month end:

LMT 0.00%↑ was executed on Friday as an earnings play for the week ahead, I will also monitor how this unfold, would also prefer if it can find support above 490 levels:

CXW 0.00%↑ this play was made on trump immigration policy and inauguration, but it seems it has run out of steam. I intend to close this position, but will wait until February before I do. I also do not have any specific levels in mind, just my risk and any upside it has to offer:

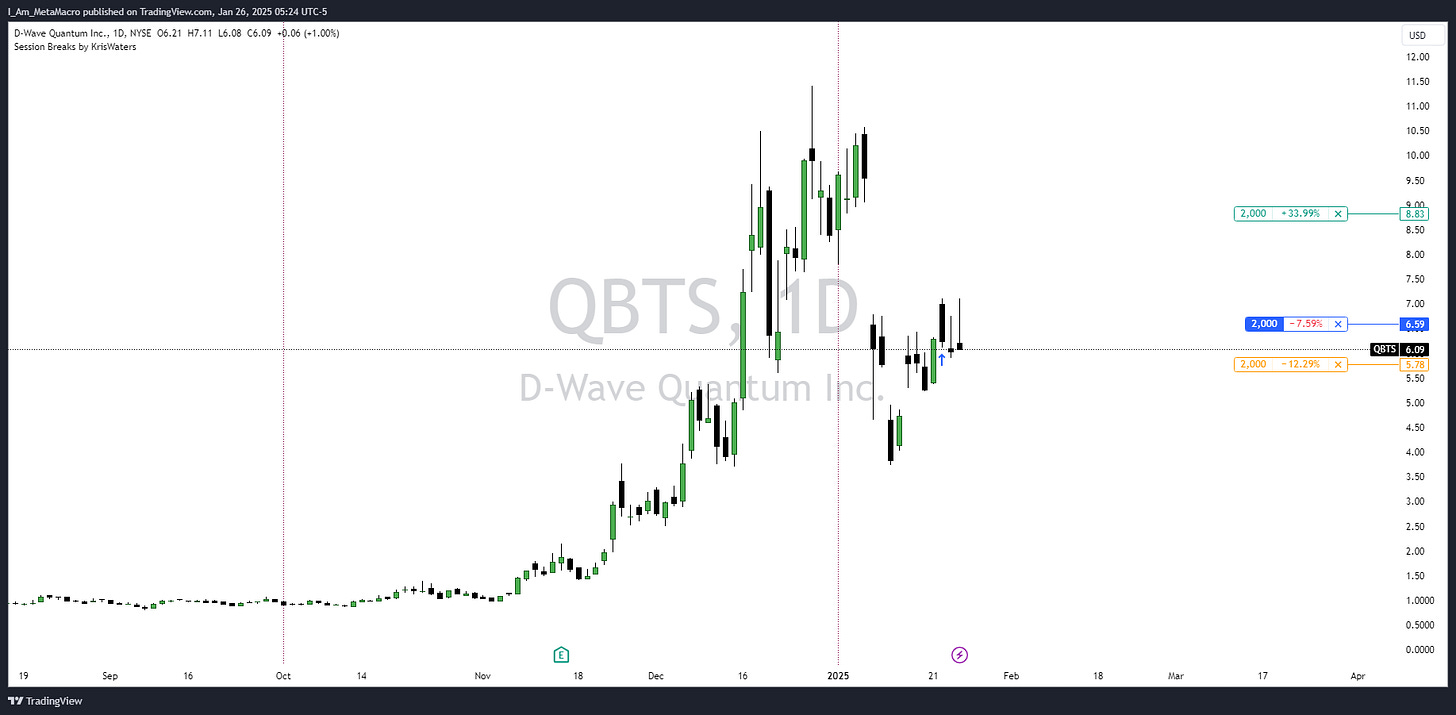

QBTS 0.00%↑ this was a pure tactical play, with the notion that the sell off in quantum computing stocks could be over and we probably mean revert and potentially trade higher, also not monitoring any specific levels, just running based on risk management:

I will update my views as we progress into FOMC next week. Also, I will be introducing the portfolio section that shows the monthly performance of the trading portfolio where I am running all the trades in, as stated in the 2025 outlook back in November:

2025 Path Ahead

Hi guys, as we unwind into the year end, I would like to share my thoughts for the year ahead, my focus and how MetaMacro will function next year. This is going to be a long report, so without further ado let’s get started.

Have a wonderful weekend. Wishing you good luck and good trading.

Very nice 👍