Hi guys, as we unwind into the year end, I would like to share my thoughts for the year ahead, my focus and how MetaMacro will function next year. This is going to be a long report, so without further ado let’s get started.

MetaMacro in 2025

Before I begin with the report, will start with the plan ahead for MetaMacro. Going into 2025, I will set-up two paper trading account on TradingView:

One with $100k this will be used to execute the trade ideas I share here and the rationale for them, so that way there is an actual PnL to track performance primarily for foreign markets

The other with $100m, I can’t set up a local currency on TradingView, so will just duplicate the equivalent of it. This will be for the local equities trading.

On the substack, there are sections for trades asset class I will be focused on. I will be more active on Equities, FX and Commodities, because that’s my core competency and my day job. I will occasionally run trades on Fixed Income also.

On each asset class, I will be running two types of trades:

Strategic

Tactical

The strategic trades could have a longer duration of a month or quarter, while tactical trades are more of extracting return from short to intermediate term volatility within the market across the asset class.

As we move into the end of the year, I will be focused on sharing more on Macro Trading within the Models/Research tab.

Now, to the report

2024 Market Review

On a macro basis, we had significant events that took place over the course of 2024 that drove market performance, with some carryover of the respective macro themes into 2025, they include:

Geopolitical Tension

Fed Monetary Policy Actions

Recessionary Fears

Japan Carry Trade Unwind

China Stimulus Bazooka

US Presidential Election

S&P500 2024 Performance

On the S&P500 YTD return is currently at 23.08% bolstered by the rally in AI/Semiconductor names, led by NVIDIA and Palantir. We also experienced gains from the Utilities/Energy sector and the Airlines sector.

While negative return were driven by Commodity Chemicals, Industrial REITS, Personal Care, Drug Retail and Footwear sub industry.

NASDAQ 2024 Performance

NQ YTD return currently at 21.21%, driven by return in AI/Semiconductor ecosystem equities and Utilities/Energy sector. The negative return was also led by the AI/Semiconductor ecosystem.

Dow30 2024 Performance

The Dow Index YTD return also at 15.27%, led by Consumer Discretionary, Financial and Machinery equity names. While downside performance led by Boeing and Nike:

Russell 2k 2024 Performance

YTD performance on Russell2k at 13.65%, led by equity names I have no clue about lol. Okay, led by pharmaceutical and Energy. Worst performing also led by pharmaceuticals:

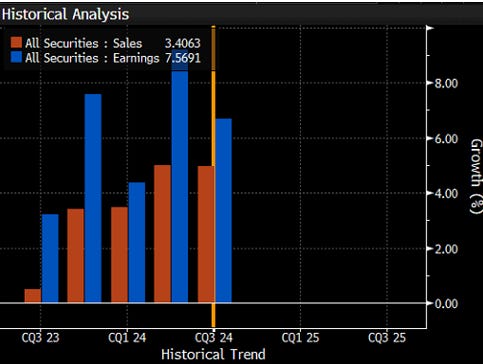

Earnings Surprise improved in Q3’24 but below levels in Q1’24, while earnings growth has contracted in Q3’24 compared to previous quarters:

Active Market Risk

The two risks in place as we move into 2025 are inflation and positioning risk. As the US Fed have embarked on a dovish monetary policy regime, inflation swaps have risen alongside the US treasury yields, while the December 2024 Implied rate remain flat, as speculation on whether the Fed will hold rate unchanged at the December FOMC meeting increase due to sticky inflation.

As the S&P500 rally on the back of the Trump trade, positioning has shifted grounds to net long, creating room for a positioning unwind as weak hands chase the market rally

Moving into 2025, I will be drawing on the themes in focus, segmenting them into:

Economic

Policy

Industry

2025 Economic Theme in Focus

Slowing Growth and Re-Inflation

Nominal GDP currently at 4.7% in Q3’24 a decline from 5.6% in Q2’24. While Real GDP currently at 2.8% in Q3’24 a decline from 3.0% in Q2’24. While GDP seems to be slowing down from previous quarter levels, we aren’t exactly in a recession yet.

Personal Consumption Expenditure continues to expand as at Q3’24 currently at 3.7% from 2.8%

led by increased spending on durable and non-durable goods:

Gross Private Investment has been mixed across quarters:

Government expenditure also remain positive and increasing:

Additionally, corporate profit after tax continue to grow since 2023 and for the entirety of 2024.

On a net basis, yeah, GDP seems to be slowing down from QoQ % change but still largely positive as household continue to spend on the economy, alongside government expenditure.

However, with equity markets rallying to ATH supported by positive growth conditions, and monetary easing, one variable remain unaccounted for which is inflation.

US CPI on All Items remain sticky at 2.598%, while Core-CPI also remain sticky at 3.3% below the Fed target of 2%. However, the US Fed have cut interest rate by 75bps to 4.75% with the rationale of achieving a soft-landing by alleviating pressures stemming from the labor market.

As we move into the end of the year, the market is now split on a 58.2% of an additional rate cut at the December FOMC meeting, primarily because the Fed is now shifting its focus to inflation levels.

The Fed most likely would have to hold rate unchanged at the next meeting, as inflation swaps have risen from the low levels corresponding to when the Fed switched regime from an hawkish to dovish stance.

Correspondingly, bonds market have sold off, with yields rising to 4.43% on 10year, 4.30% on 5year and 4.3% on 2 year, also right from when the Fed started cutting rates.

Despite yields rallying, the Equities market continued its move towards ATHs driven by Post-Election Trump Trade. However, this movement into the end of the year might be over-done and we might see a repricing in the equities market as inflation will take center stage into 2025 and also the pathway of rate cut.

The permutation of these variables in play create a playbook for the aggregate impact on broad equities:

Slowing Growth and Neutral Inflation = US Fed Neutral on Rate + Equities Long/Neutral + Dollar Long

Slowing Growth and Falling Inflation = US Fed Cut Rate + Equities Long + Dollar Long/Neutral + Gold Long/Neutral

Neutral Growth and Falling Inflation = US Fed Cut Rate + Equities Long/Neutral

Falling Growth and Falling Inflation = US Fed Cut Rate + Equities Short + Flight to Safety

Falling Growth and Rising Inflation = US Fed Cut/Hold Rate + Equities Short + Flight to Safety

2025 Policy Theme in Focus

The election of Donald Trump as the President of the US brings to the foreground policies to be implemented which has its impact on market performance both from a macro view and individual equities/industry view.

Here are the key points in focus for me:

The important thinking framework for me is that, for each policy, what is the value chain of opportunity that exists.

Immigration and Border Wall:

Defense & Security Contractors: RTX, NOC and LDOS

Private Detention and Prison Operators: CXW and GEO

Technology & Data Management Companies: PLTR and AXON

Make America the Largest Energy Producer:

Oil & Gas Producer: XOM, CVX, COP

Midstream Energy Companies: ET, KMI, TARGA, ONEOK, WMB

Liquified Natural Gas Exporters: LNG Cheniere

Manufacturing Superpower:

Industrial & Manufacturing: CAT, DE, ITW

Steel and Aluminum: NUE, X, AA

Technology Hardware: INTC

Automobile: GM, TSLA and FORD

Strengthen Military:

Defense Contractors: LMT, RTX, NOC and GDD

Cybersecurity: PANW, CRWD, FTNT

Infrastructure and Equipment Suppliers: CAT and OSK

US Dollar as the World Reserve Currency

DXY and UUP ETF

Protect Social Security and Medicare with no Cuts:

Health Insurance Providers: UnitedHealth Group, Humana

Pharma and Biotech: Eli Lilly, Biogen

Telehealth: HIMS

Tariffs

Tariffs is the major concern around trump policy mandate, so will spend a bit of time breaking this down. The major trading partners for the US are:

Hence, tariffs will have corresponding impact on Mexico, Canada, China and Eurozone. The major exports from Mexico to US are Automotives, while its major imports from the US are Refined Petroleum.

The US, Canada and Mexico are bounded by the USMCA trade agreement, setting rules for automobiles and trucks. While trade relationship with China includes import of Computer Equipment, and exports to China include Soybeans, Corn and Crude Oil.

To adequately create a playbook for Tariffs, I think the asset class to monitor to evaluate this dynamic once policy measures are implemented are:

Dollar and Trading Partners Currencies

US Yields

US Industrial Sector

The dollar is overvalued primarily because of its function as the world reserve currency. The overvaluation of the Dollar also weighs into trade, such that the manufacturing sector bear the brunt as exports are more expensive and less competitive, but US imports cheaper relative to foreign countries and trade partners.

Trump’s view I believe is the necessity for the US domestic manufacturing sector to produce weapons and defense system, as opposed to relying on the importation of such commodities from trade partners, which opens them up to national security risks from countries like China and Russia.

The Dollar over-valuation is the key mechanism for trade imbalances, keeping imports from abroad cheap, hence why some American companies go out to build, and the import back to their country.

2025 Industry Theme in Focus

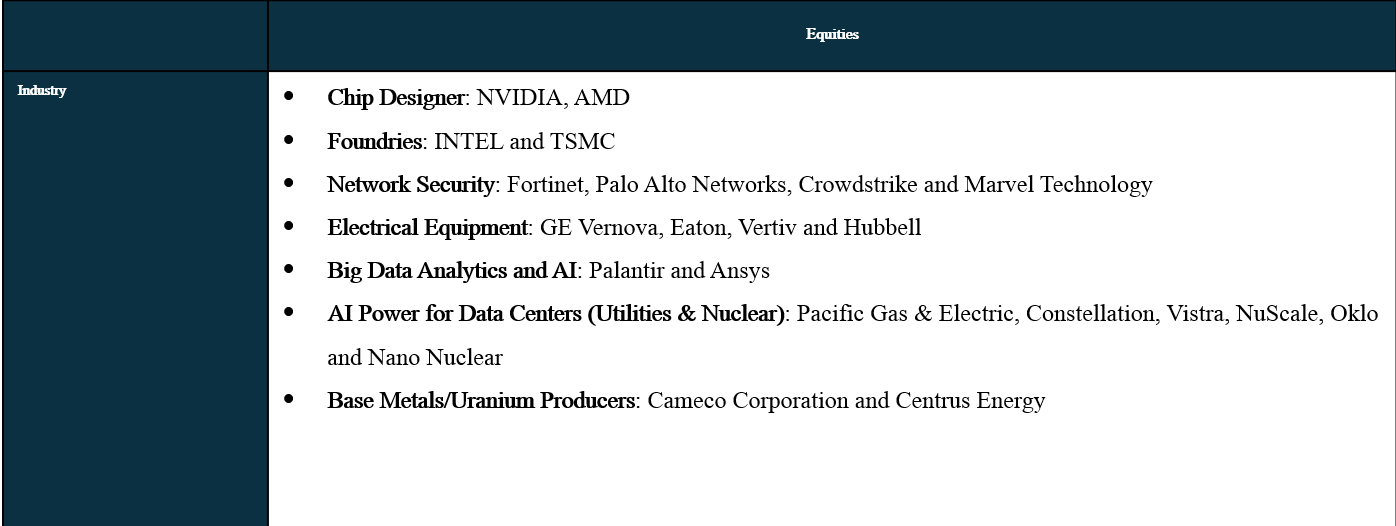

This is more on the equity side of things. Generative AI landscape continue to evolve rapidly with revenue potential expect to grow to $456.78bn by 2027 from $63.5bn in 2023, driven by Large Language Models (LLM) and On-Device AI features.

For education purpose, LLMs are advanced machine learning models designed to process and generate human-like text. These models are trained on vast datasets and use neural network architectures to understand and produce natural text.

Additionally, the AI Network, Security Infrastructure and Data Center Power Demand provides ample opportunity for growth due to the expansion of the AI ecosystem. Networking & Security has emerged as a crucial component of AI infrastructure alongside the server and GPUs, as growing cloud workloads increase.

Furthermore, the increase in data center also correspond to increase in demand for electricity with natural gas playing a critical role as base-load provider, serving key demand from major data-center location such as Texas and Virginia. In addition to the demand for electricity, electrical equipment manufacturers may see growth in sales as grids upgrades and data center expansion require advanced electrical equipment.

Moreover, the growth in AI and Data Center has also rejuvenated the need for Nuclear power as a promising futuristic solution, and across the value chain are Uranium producers essential for fueling nuclear reactors, major power producers and small modular & micro reactor developers.

The AI value chain on a Macro to Micro level consist of the following:

Macro:

Data Ecosystem: Which includes companies like Google, Meta, AMZN and MSFT

Cloud and Compute Infrastructure: AWS, Google Cloud, MSFT Azure, NVIDIA

Data Engineering and Model Training: Databricks, Snowflake and Scale AI

Micro Level:

Consumer Applications and Interfaces: Apple, Tesla

Enterprise and Industry Applications: SAP, PLTR, C3.AI

Moving deeper (on a surface level), the AI Semiconductor Value Chain critical for powering AI workloads, including training, inference and edge computing is as follows:

Upstream: R&D, Design and IP Development

The focus here is on developing new architectures and technologies for AI workloads e.g GPUs, and to design chip architectures

Key Players:

ARM: Dominates in IP for edge AI Chips

Synopsys and Cadence: Leaders in electronic design automation for AI Chip

Midstream: Fabrication and Packaging

Chip Design and Prototyping: Focused on designing physical layouts, validating performance and simulating workloads of chips

Key players: AMD and NVIDIA

Semiconductor Manufacturing (Foundries): Focused on fabricating AI chips at advanced process nodes for high performance and efficiency

Key players: TSMC, Samsung and Intel Foundry Services

Chip packaging and Assembly: Focused on advanced packaging techniques to integrate AI chips with other components, and to test them.

Key Players: ASE Group, Amkor Technology

Downstream: Deployment and Applications

AI Chip Integration: Focused on integrating AI chips into serves, edge devices and IoT hardware into data centers, autonomous vehicles, robotics and consumer devices

Key Players: NVIDIA

Cloud AI Infrastructure: Focused on offering AI chip-power infrastructure as a service

Key Players: AWS, Google Cloud, MSFT Azure

Edge AI Development: Focuses on AI inference on low-power, decentralized devices e.g IoT and Smartphones

Key Players: Qualcomm, MeidaTk and Intel

There is a huge value chain of opportunities within the AI space, beyond the hardware segment (NVDIA) which the market is focusing on, and exploring those segments with a relatively easier base to “grow” from will make them attractive next year.

To provide a more succinct view on the AI value chain, the market has primarily been focused on the hardware layer driven by intense demand and attention for Data Center components (CPUs and GPUs) for computation of LLM models. However, there is a broader opportunity set beyond hardware which includes:

Memory

Networking

Energy

Additionally, the data infrastructure layer which includes Cloud Service Providers and Data Ecosystem, which have only experienced single digit revenue so far for companies like Snowflake and Confluent:

While NVIDIA has been the poster child for the AI ecosystem, it is already reaching a point where the ability for expectations of a large surprise has contracted, with gross profit margin expected to stabilize within 70-75% over the course of 2025, inclusive of the ramp up in Blackwell:

In summary here are my watchlist for 2025:

This section focuses on the domestic equity market in Nigeria.

2024 Market Performance Review

Since Nigeria floated its currency against the Dollar right around March to May and also removed fuel subsidy, there has been an increase in concerns by FPIs on the state and direction of the economy especially with reference to the FX liquidity issue and rising inflation, as a result, we have seen FPIs participation in the equity markets decline, with a larger chunk of these flows diverted into the fixed income markets, due to elevated yields.

Yields in the FI market are elevated above 20% across the curve:

As a result, domestic investor actions have been the major driver of return for the Nigerian equity markets.

Market Index Return

NGXASI:

The NGXASI posted a 30.69% return in 2024, driven by gains within the Oil & Gas, Industrial and Automotive Retailers.

Other sectors performance include:

Insurance:

Banking:

Consumer Goods:

Industrial:

Nigeria Macro Conditions (Growth, Inflation and Policy)

I have written primers on Nigeria macro economy before, you can check the models and research. However, I intend to write more in-depth primers next year.

Nigeria does not publish Real GDP by Expenditure data, just the GDP by Industry dataset is available. Nigeria Real GDP YoY is at 3.19% an improvement from Q1’24 2.98%:

With a larger share of that attributable to Agriculture, Crude Petroleum & Gas, Cement, Food & Beverages, Telecommunications & Information Services and Financial Institutions.

Inflation in Nigeria continue to accelerate, with All Items at 34.2% as at October’2024:

Attributable to rising cost of Food due to pass through effect of FX pressure, Transportation attributable to pass through effect of Fuel Prices and Education.

To delve deeper into the drivers of inflation in Nigeria, I already wrote a research report on the substack and built an inflation regime model:

Nigeria: Inflation Regime Model

Nigeria macro economy has been a captivating and interesting one for the past couple of months, especially from my quiet time here, evident by the monetary policy actions of the Central Bank of Nigeria (CBN) to rein in inflation, currency depreciation and also to concurrently attract Foreign Portfolio Investors (FPIs), as such the CBN has hiked rates by…

On the monetary side of things, Nigeria has two problems:

Inflation/Price Stability

Exchange Rate Management

It also needs to attract FPIs and FDIs to shore up its FX Reserves, most of which is currently being done by offering higher interest rates to narrow the gap in Real Rate due to rising inflation. As a result, the CBN has been on a hawkish policy regime, hiking interest rate from 22.75% to 27.25% to combat these pressures.

Linking this to the equity markets, in other to ensure financial stability, the CBN also mandated the shoring up of the regulatory capital of banks which led to capital raising activity, some restructuring and M&A in 2024 to meet up with these requirements.

Banking Recapitalization Exercise

The announcement of the recapitalization exercise led to the sell off in equity markets driven by the Banking Index in Q2’2024 as investors re-position their funds to evaluate the impact of the recapitalization exercise. To define some terms around the capital raise options:

Right Issue: is an offer made by a company to its existing shareholders, allowing them to buy additional shares in proportion to their current holdings, usually at a discounted price. A right issue of 1 to 6 indicates that the investor can buy 1 new share for every 6 shares held

Public Offer: Public offer involves offering shares to the general public, including institutional and retail investors

Private Placement: This is the sale of shares to a select group of investors rather than to the public

The focus for me into next year on the banking/financial names are across:

FBNH

They announced a N350bn capital raise plan, with N150bn through right issues ( 1 for 6 at 25N), the balance of N200bn hasn’t be disclosed on how it will be raised, but most likely through a public offer or private placement.

Balance yet to be funded, further announcement plans expected

UBA

They announced a N239.4bn capital raise through right issues 1 for 5 at N35

Recently announced and ongoing, expected to close in December

GTCO

They announced plans to raise N400.5bn through public offer of N9bn shares at N50

The funding round has been completed, but no disclosure if all was subscribed for to meet the funding gap

ACCESS

They announced plans to raise N365bn through right issues, 1 for 2 at N19.75

The funding round has been completed, but no disclosure if all was subscribed for to meet the funding gap

ZENITH

They announced plans to raise N290bn through a combination of right issues (1 for 6) at N36 and public offer of 2.7bn shares at 36.5

The funding round has been completed, but no disclosure if all was subscribed for to meet the funding gap

FCMB

They announced plans to raise N110.9bn which was done via public offer of N15.2bn shares at N7.30

They have met their funding gap of N200bn requirement

FIDELITY

They raised N127.1bn through right issues 1 for 10 at N9.25 and 10bn shares public offer at N9.75

They have met their funding gap of N200bn requirements.

WEMA

They announced plans to raise N150bn new capital through a mix of both right issue and public offer

The date remain tentative

UCAP

These banks continue to see expansion in their interest income, gross revenue, PAT, EPS and also dividend per share. 2025 will also be characterized with a selection for the best among these names in terms of asset allocation for portfolio managers.

Oil & Gas Sector

Additionally, on the fiscal side, there has been activities within the Oil & Gas sector following the removal of fuel subsidy. The measures taken were:

Policy Reforms and Deregulation of the downstream sector to create more competitive environment.

Strategic shifts by multinational corporations such as Shell, ExxonMobil and others have been divesting from onshore and shallow water assets in Nigeria.

Shell Plc sold its onshore subsidiary Shell Petroleum Development Company to a consortium of five Nigerian companies, including ND Western, Aradel Energy and First E&P. The deal was valued at $2.4bn

ExconMobil finalized the sale of its shallow-water offshore assets to Seplat Energy Offshore Ltd for $1.28bn

OANDO acquisition of Nigerian Agip Oil Company (NAOC) from Italian energy company Eni for $783million

Launch of Dangote Refinery to reduce reliance on imported refined products

Listing prospects and market activities: The anticipated listing of major players like the NNPC and Dangote Refinery also drove some optimism.

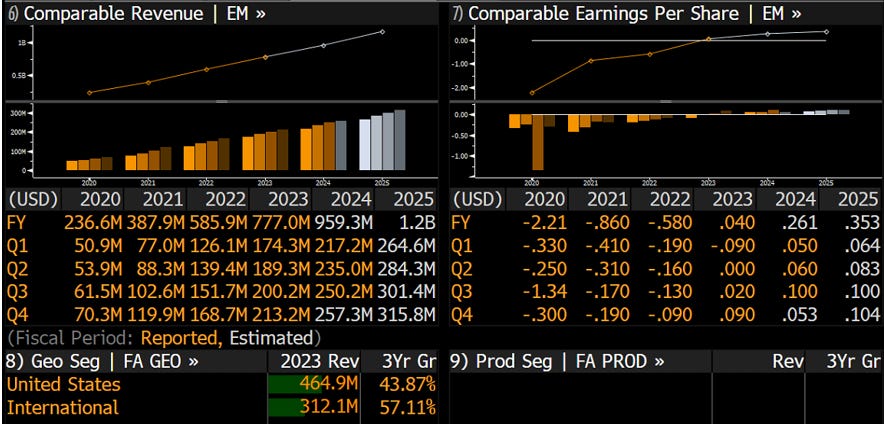

Returns in the Oil & Gas sector throughout 2024 were driven by the Valuation function and not the earnings, in 2024 I expect a shift in market participants focus towards Oil & Gas companies growing, positing revenue/earnings growth and also with attractive dividend and the only two on the list that effectively fits these criteria are:

SEPLAT

ARADEL

While OANDO has appreciated significantly, there are concerns on the direction of the company, given that there was an initial plan to delist, and there also other issues that requires clarity on the business performance and future direction of the company.

The other company on my list within this sector is Eterna Oil:

A company with growing revenue, but bottom line has been volatile to the downside, quite some optimization that needs to be done on this front for stability.

Consumer Goods and Industrial Sector

Due to macro headwinds of high interest rate, high inflation and FX depreciation which has impacted the purchasing power of consumers negatively, consumer goods companies have managed to record growth in their earnings driven by strategic price increase and smaller packaging to avoid margin erosion.

OKOMU and PRESCO continue to deliver solid margins in their financials, but we have seen profit taking activity over Q3 and Q4 2024, but they would still be of interest. DANGSUGAR fell out of favor when the proposed merger of Dangote Rice LTD and NASCON was suspended, this led to the unwinding of the premium built into the stock, not to mention that they have been posting negative Return on Assets and Net Profit Margin.

While on Industrial Goods, DANGCEM and BUACEM have been on full offer for the better part of 2024, I don’t think this will change in Q1’2025. The other stock with some prospect is WAPCO. WAPCO continues to deliver consistent revenue growth, and has a higher Return on Assets compared to it’s peers.

In summary, here is what my watchlist looks like for 2025:

See ya in 2025, by God’s Grace.

Cheers,