Hi, Trade update on my positioning:

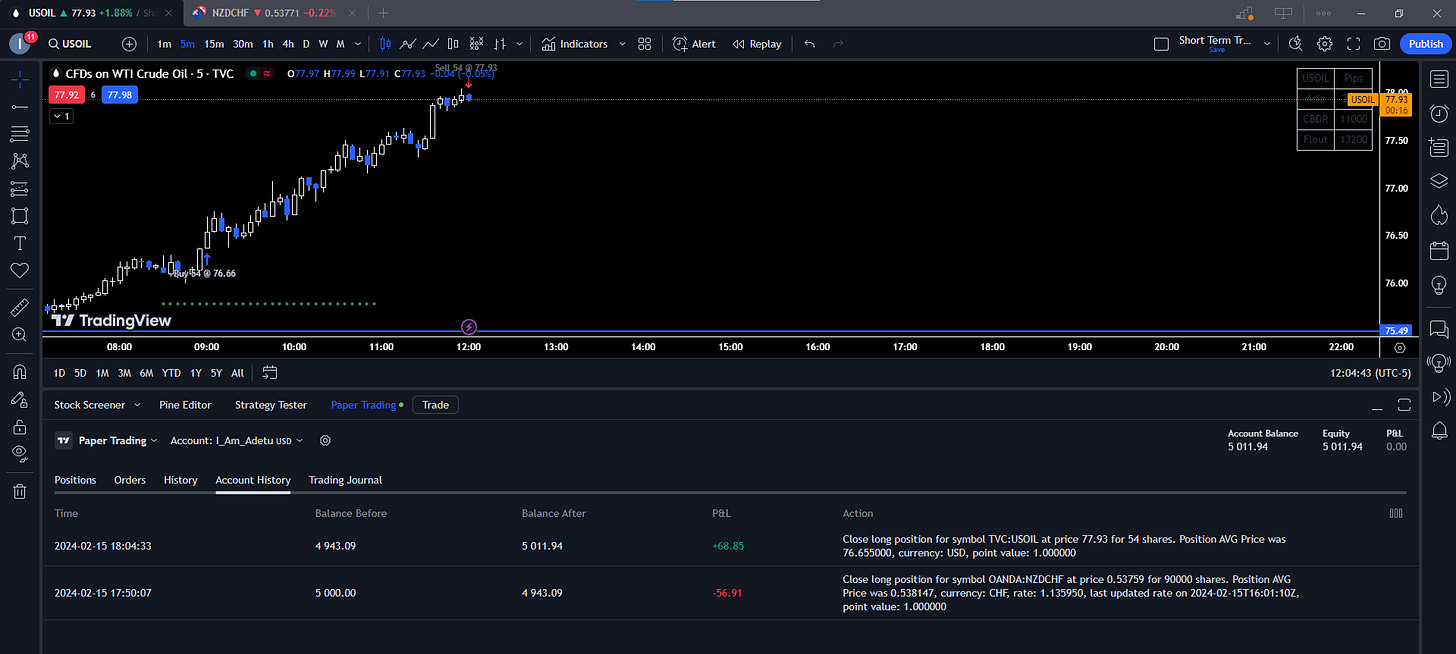

I exited NZDCHF this afternoon, post core-retail sales release, I expected the asset to pick up the pace, after repricing into a discount level in the Asia session today, but it was lackluster and I didn’t see the volatility I expected, hence I collapsed slightly below breakeven:

On Crude Oil, we had a repricing deeper into a 4hour liquidity pool at 75.49, so I was stopped out. But, I executed a long trade around the 76.66 level

The Long position in NY Session.

As an update, I am running a 5k paper trading account to keep track of trades update, and a transparent form of reviewing trades I execute on or not, if you view the account history, you won’t see the Crude Oil loss, I had not created the account before running on the trade.

Here’s what the account journal looks like as at the time of the writing, after booking the gains on Crude Oil to close the day at a relative breakeven:

Will be less active on twitter and more focused on the trading bit, and I will be sharing the updates here.

Cheers,