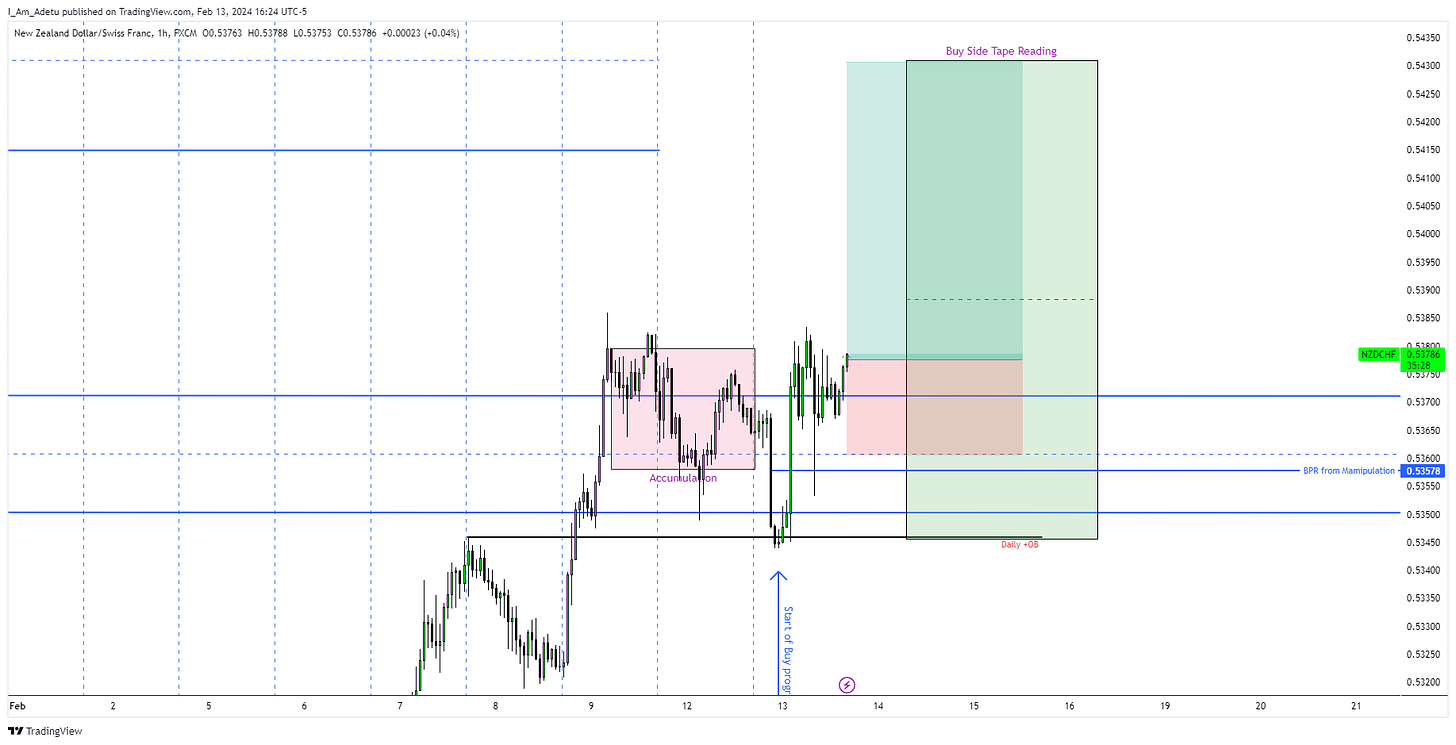

Running a long trade on New Zealand Dollar (NZD) against the Swiss Franc (CHF). Potentially anticipating buyside expansion into the 0.54200 x 0.54300 price area, and I have my protection stop at 0.53609, I might expand the stop lower below 0.53550 primarily to avoid being caught up on spread widening during the cross-over window into the next Asia Session.

Particularly positioning pre-Asia session, cause I expect the expansion swing by that time window, which would enable me to reduce my open risk on the position by London or New York session tomorrow, then I can leave the trade to run.

Flat on NZDCHF here.