I shared the end of week market review/macro update around growth and recessionary concerns due to slow-down in the labor market. In addition, I also highlighted the Japanese Yen move, which might have sparked a Carry Trade unwinding between USD/JPY:

US Market Meltdown?

We experienced a highly eventful week in global markets, with significant movements in equities, foreign exchange, and interest rates due to various unfolding events. This volatility has influenced perspectives on how to strategically position for future returns.

Going into the week, on Monday, we have the ISM Services PMI and on Thursday Summary of Opinions by Bank of Japan. While the major currencies rallied into the close of the week due to the sequence of events highlighted in the macro update report I shared, the natural urge would be to hop on the opportunity of a long Yen or follow the momentum trade into the week, but I would prefer to be on the side of caution and clarity on the next move around the major and within the market assessment of economic data.

My focus early in the week would be on seeing how the Equities market react to ISM Services number and on the currency side I will wait for the summary of opinion on Thursday by BoJ before making any Yen related play, while keeping an eye on the JGBs and NIKKEI.

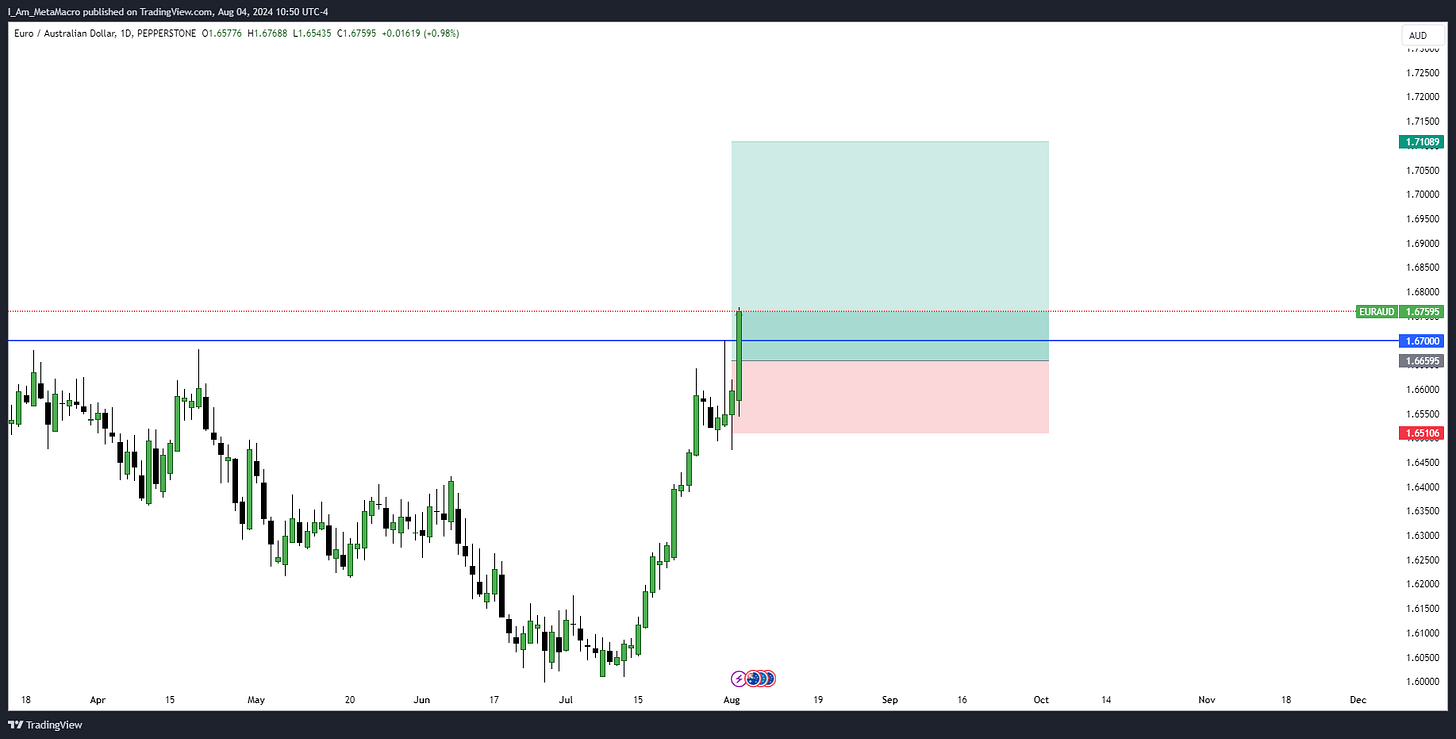

Trading opportunities on my watchlist are long EURAUD and GBPCAD, a mix of both a short-term and possibly hold as a swing trade.

I will look for an execution on EURAUD long at or below 1.6700.

I will look for an execution on GBPCAD long at or below 1.77500 x 1.77250.