We experienced a highly eventful week in global markets, with significant movements in equities, foreign exchange, and interest rates due to various unfolding events. This volatility has influenced perspectives on how to strategically position for future returns.

Going into the week, this was my view across growth, inflation and monetary policy potential impact on Equities:

On a net basis, my observations suggest that growth data is generally solid but showing signs of slowing, with notable concerns in the Industrial, Manufacturing, and Labor sectors. Although I was hesitant to short the S&P or the Technology Index to avoid prematurely calling a peak in equities, my focus had shifted to trading the defensive sectors like Utilities and Healthcare, based off the aforementioned factors.

However, I had concerns about the Rate Cut trade, as the market anticipated weak data to bolster expectations for a Fed rate cut. This presented an opportunity to pursue that trade while hedging risks on the equities side, leading to the trade signal I shared on Thursday, here:

I went long on the IEF (iShares 7-10 Year Bond ETF) because I anticipated that a rate cut would lead to a correction in the yield curve, particularly on the short end, causing funds to flow toward the mid or long end of the curve. Additionally, I took a long position in TIPS (Treasury Inflation-Protected Securities) to hedge against the possibility of resilient growth data, which could drive higher inflation expectations and reduce the likelihood of a rate cut.

Both positions are currently in the money, with the IEF performing better than TIPS, and I have set stops at break-even. However, recent dramatic shifts in the market landscape necessitate a reevaluation to determine the optimal positioning for the week ahead.

Sequence of Events in Focus

JOLTS Job Openings on Tuesday

Bank of Japan Rate Hike on Wednesday

Japan Markets Impact

US Fed FOMC Meeting on Wednesday

Currency Markets Impact

Unemployment Claims and Manufacturing PMI on Thursday

Non-Farm Payrolls and Unemployment Rate

Volatility Index

Before I delve into these events, let’s keep some thematic in focus, which includes:

Rising Inflation

Anticipation of a Rate Cut

Slowdown in US Economy/Recessionary Concerns

AI Positioning Unwinding

All Time Highs in Equities?

JOLTS Job Openings on Tuesday

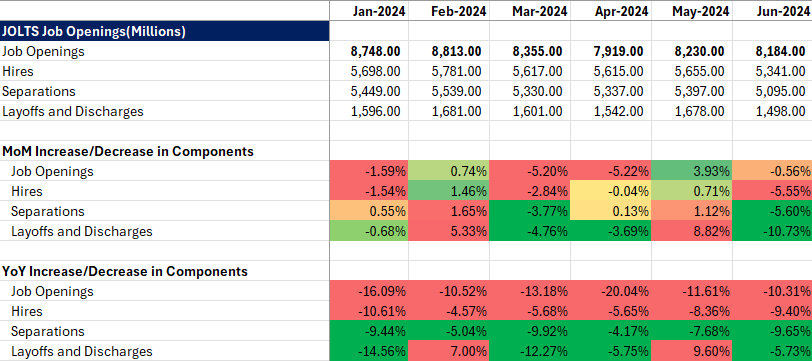

With market concerns centered on whether macro data will support the thesis of the US Fed initiating a rate cut cycle in September, the latest JOLTS Job Openings report came in at 8.18 million, above the market expectation of 8.02 million but below the previous level of 8.3 million.

The data release was relatively positive. Job openings decreased by 0.56% month-over-month, while layoffs and discharges dropped by 10.73% month-over-month. On a year-over-year basis, job openings remain tight but are showing marginal improvement, along with layoffs and discharges. Notably, hires saw a significant month-over-month decrease of 5.55%, although they increased year-over-year, rising from -4.57% in February 2024 to -9.40% in June 2024.

Overall, while the job openings data points to a slowdown, it is not severe enough to trigger a drastic market reaction similar to the COVID-19 period.

Bank of Japan Rate Hike on Wednesday

Summary of Opinions from Bank of Japan is available here.

The main takeaway from the minute released on June 24 prior to the policy meeting on the 31st July includes the following:

Japan economy seems to recovering moderately, with growth above its potential and corporate profits remain high plus significant wage growth

Wage growth is anticipated to meet or increase above inflation levels

Underlying inflation is gradually increasing, influenced by import prices, a tight labor market and high shipping cost.

Policy actions are planned around raising rates to reign in inflationary pressures, market operations by reducing its purchase of Japanese Govies(JGBs) and to allow long term interest rates to form more freely.

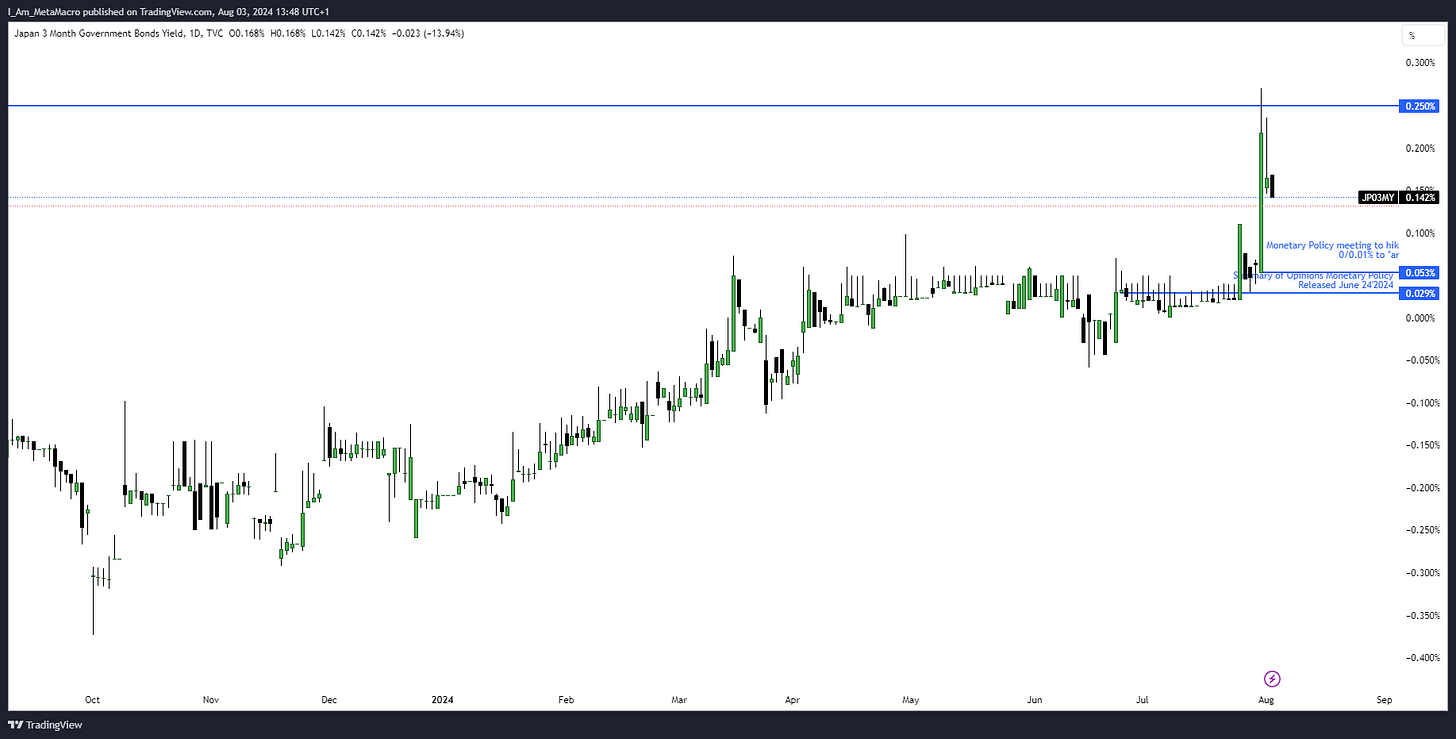

On Wednesday, the BoJ decided to raise rates from 0/0.01% to around 0.25% with a 7-2 majority vote (a hawkish stance) and to reduce its purchase of JGBs by 3 trillion yen, full highlight available here

In response, Japan 3 Month Govies yield rose to 0.25% and declined back into the range.

However, the 2 year and 5 year maturity did not move significantly compared to the short end.

Concurrently, the Japanese Yen Currency Futures rose as yields increased (Carry Trade):

And the NIKKEI225 (Japan Equities Market Indices) declined:

US Fed FOMC Meeting on Wednesday

Sigh, what a week.

Following the BoJ monetary policy meeting, the US Fed held its FOMC meeting on the same day. The market's primary focus was on whether the Fed would confirm a rate cut in September, given stable inflation and a softening labor market.

The FOMC meeting highlighted the Fed's efforts to balance the risks between controlling inflation and achieving maximum employment. The Fed Chair confirmed that, with macro data continuing to soften and disinflation trends persisting, the probability of a rate cut in September is higher, aligning with market expectations.

After the FOMC meeting, it seemed like the ideal trade was set up for new highs in equities, provided that the upcoming macro data aligns with expectations and the labor market continues to soften but does not become weak.

The Dollar declined on Wednesday post FOMC and BOJ meeting, so did 2 years yield.

Meanwhile, Equities on the other end bid higher post FOMC and BoJ meeting as we expected:

Positioned for long equities while bond prices were rallying, all that was needed was a labor sector print that wouldn’t surprise the market and would confirm our expectations of a rate cut. With this alignment, the rationale for the long equities trade was firmly established.

Unemployment Claims and Manufacturing PMI on Thursday

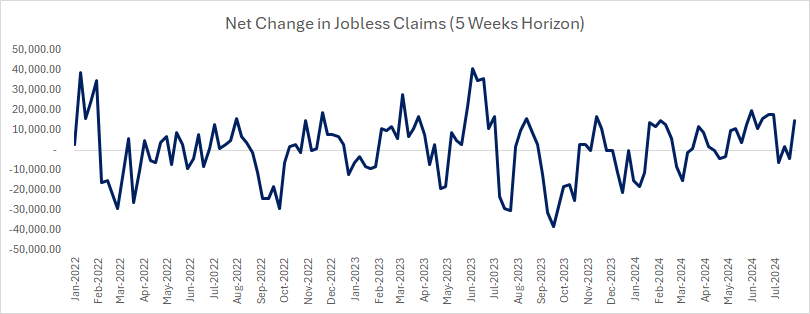

The Unemployment Claims print hit the market at 249k higher than market expectation of 236k and prior 235k.

While the WoW change in claims increased by 6.0%, on a net change basis I don’t think the economy is really in a bad place.

Coming out of COVID in 2020 and the era of loose interest rates, we observed a significant decline in unemployment claims into 2021. However, a shift occurred in 2022 with the Fed beginning to hike rates, followed by bank failures in 2023. Despite these events, the data indicates that we are relatively at equilibrium and below historical levels, which suggests there's no immediate cause for panic.

If we exclude the COVID-19 recovery period, it becomes clear that we are oscillating within a normal range and are not near an extreme end. However, the current data may seem more extreme in the context of recent trends.

I believe the broad market expectation of a softening, as compared to the Fed's estimates and actual data, reveals a mismatch that makes current conditions appear more extreme and recessionary than they may be.

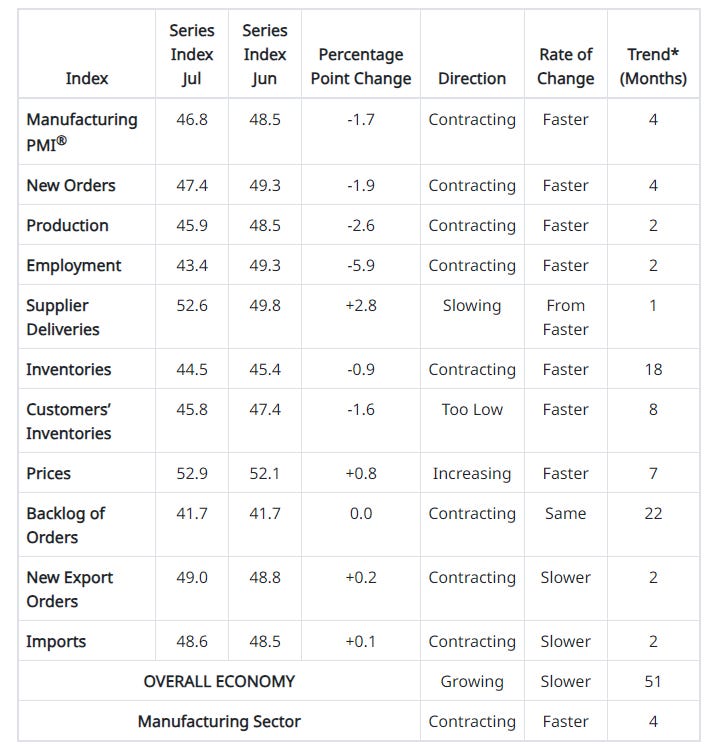

Additionally, the Manufacturing PMI numbers were released at 46.8, which is lower than the previous level of 48.5 and below the market expectation of 48.8.

The effect of both data release, resulted in the reversal of the gains in equities, posted during the FOMC meeting, confirming rate cuts in September:

The Dollar on the other end retraced higher, while USDJPY had a slight pause:

At this point, the focus of the market turned to Non-Farm Payrolls and Unemployment Rate as fingers were crossed on where equities would go next.

Non-Farm Payrolls and Unemployment Rate

"The straw that broke the S&P 500's back." Here's a meme to capture the moment, influenced by

:Non-Farm Payrolls came in at 114,000, below market expectations of 176,000 and prior levels of 179,000. Additionally, the Unemployment Rate increased to 4.3%, exceeding the market estimate of 4.1% and previous levels of 4.1%.

On a case-by-case basis, yes, the job market is showing signs of slowing down.

Over a 3 to 6 month time horizon, the job market is indeed slowing down. However, is it exceptionally bad? Not really. To reiterate: while there are signs of deceleration, the situation does not appear to be severe.

I believe there's a divergence between the broad market estimates for an economic slowdown based on forecasts and the actual slowing of the economy compared to historical performance. The more widespread this belief is among economic agents, the further financial assets might be repriced downward.

Volatility Index

Holding on to my view of the divergence between actual data releases and widespread economic beliefs, the VIX seems to support my perspective. The VIX, reflecting market volatility and investor sentiment, appears to validate the notion that there is a mismatch between the current data and broader market expectations.

The sequence of events led to a rise in the Volatility Index (VIX) for both 9-day and 3-month periods. After the Non-Farm Payrolls release, the 9-day VIX spiked above 32 but closed lower as market sentiment shifted toward recession fears due to the slowdown in the labor market.

In contrast, while the MOVE Index, which measures bond market volatility, also increased in response to these events, the movement was less pronounced compared to the VIX, which is more sensitive to equities market fluctuations.

The volatility in the MOVE Index is primarily driven by the rapid adjustment of expectations for lower rates in the US bond market, rather than a flight to safety triggered by recessionary fears.

While the market has reacted strongly—equities selling off due to recession fears and the bond market pricing in over 50 basis points of rate cuts by year-end.

The key questions are whether the market will continue lower next week especially in the bond market(2-year yields) and if the Fed will implement a 50 basis point cut in September, which would be quite aggressive. Additionally, there's speculation about a possible emergency Fed meeting due to the volatility observed between Thursday and Friday….not gonna happen lol.

I hope this provides some clarity. It certainly has for me. I’ll be sharing another report on my positioning for next week, but I plan to wait until Monday to assess market reactions. Next week’s Services PMI and Unemployment Claims will also offer valuable insights.

Cheers.