Hi, some context around this trade. I wrote this over the weekend, as such the price data is reflective as at that day and decisions/executions are solely reflective based on price data up until Monday March 25th, anything forward from the said date filters into the P&L

Let’s delve in.

Real-world assets (RWAs) token are digital tokens that represent physical and traditional financial assets, such as currencies, commodities, equities and bonds. In my previous article, I established my view on the future of digital assets around tokenization of real world assets to derive utility for the token itself, and I believe the growing attention in this segment of the Crypto market is worth paying attention to at the early stage:

Research: A Framework for Investing in The Cryptocurrency Market

Hi, the following set of article I will be releasing have been in the draft segment for more than two weeks. Keep that in mind. Let’s get started.

One of the earliest forms of RWAs are Stablecoins, a tokenized version of fiat currencies (USDT → USD) of which it has proven its immense value within the industry, and these tokens are backed by real-world collateral asset such as bank deposits, treasury notes and gold.

Additionally, we have seen platforms like Maple and Clearpool that has evolved towards bridging traditional finance activity into the blockchain, via lending services although without collateral, but the due diligence exercise ensures they are lending to clients with sound creditworthiness.

The RWAs landscape involves the tokenization of assets in the Treasuries & Securities landscape, Private Credit, Real Estate, Exchanges, Regenerative Finance and Art & Collectibles:

My focus is entirely on adding Tokenized Treasuries and Private Credit to my portfolio allocation.

Private Credit On-Chain

The private credit sector focuses on banking currently unserved regions/markets and decentralizing the concentration of control in large financial institutions. Basically, this sector focuses on supplying loans to underserved segments of the demanding side for these credit facilities.

This serves as a platform for peer-2-peer lending whereby customers deposit funds and earn yield on the blockchain, with added layer of security and transparency, while the middle entity takes only a fraction of the interest as opposed to what the Banks take in the case of Traditional Finance (TradeFi)

Some of the top players in the sector are:

Maple

TrueFi

Centrifuge

Clearpool

Goldfinch

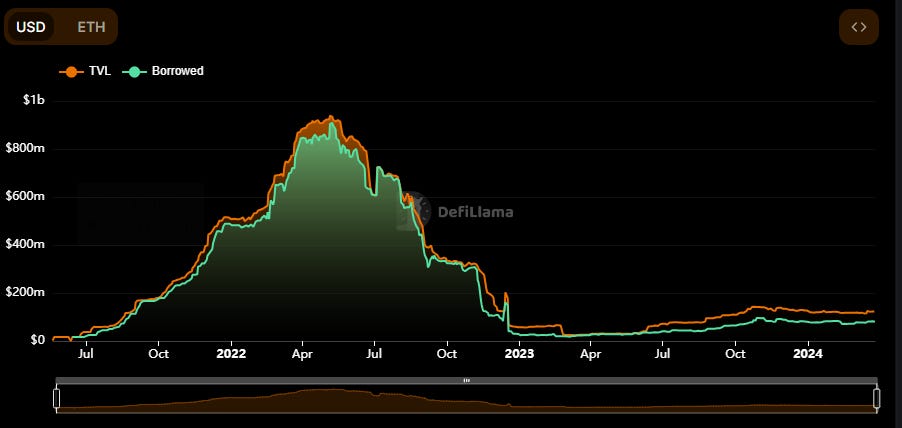

On a quick overview of the evolution of the sector examining Maple and Centrifuge. Maple had a growth in funds borrowed reaching an ATH of $851m before crashing 2022 due to the contagion effect of the wide Cryptocurrency market crash (FTX and Terra UST) resulting in funds borrowed reaching an ATL of $24.6m borrowed. However, we start to see considerable growth in its loan book in a sustainable manner slightly below $200m

Centrifuge on the other hand only faced a stagnation in its loan book (funds borrowed) in 2022, and in 2023, it experienced a significant growth in its position currently hovering around $250m:

I think what is notably to say is that the sector has gone through immense restructuring process around its risk management.

With the high-level overview in place, I have done my research checklist, and I will be adding Centrifuge and Benqi to my portfolio.

For additional context, I filtered through the following pairs both from a valuation perspective, lending activity, negative events occurrence relative to the token and customer inflows amongst other factors before I ended up with these two.

I will also add OCEAN to the portfolio, for some reasons not touched on, but that will be all.