Research: A Framework for Investing in The Cryptocurrency Market

The true measure of a man isn't in what he reveals to the world but in what he hides from it.

Hi, the following set of article I will be releasing have been in the draft segment for more than two weeks.

Keep that in mind. Let’s get started.

The Cryptocurrency market has and still is an interesting asset class to play in. I stopped trading Cryptos in 2022. I mostly was into the futures trading aspect, as opposed to the spot coin holding, and over my time exploring the space, I had written a research on the future of Cryptocurrencies or Digital Assets at large, some of which are already taking place.

See research attached below:

I was scrolling through my feed on twitter early in March as Bitcoin rallied, and I saw a tweet on how tokenization of real world asset is the future of crypto. The tweet is actually a video interview with Larry Fink of Blackrock in January, 2024:

and, here is an excerpt from the mini-research paper I wrote in 2022, and how I highlighted the future of tokenization.

Nonetheless, the focus of this report is on how I frame my actions towards trading or investing in the crypto market. I honestly do doubt I would be heavy on trading, would most likely just focus on the spot market and hold an asset like you would in Equities, I could also be constructive once in a while in Perpetual Futures.

The crypto market asset structure is as follows, and within this is where opportunities exist.

However, there are quite a list of sectors or categories within the crypto market, over 200+ if you use Coingecko as a reference point: link. The question for me is then, how do I effectively play in this market, filter for assets and be able to construct a narrative behind them with context as to why I am buying or selling, whereby each category has at least 50 coins. Hence, there are two problems here:

Selecting the right category

Selecting the right asset within the category

My framework to how I navigate this is entirely structured within this matrix:

I am not handing out how I approach this word for word, I think that’s something for me, but I will issue a framework and some variables below.

Performance Drivers For Crypto Markets

There are numerous factors that could drive the performance or volatility of the crypto market which include:

Macro-economic Factor: Inflation, Interest Rates and Monetary Policy Decisions

Global Liquidity/Money Supply

Quantitative Easing and Tightening effect on Liquidity

The US Dollar and VIX Factor

Market Confidence/Sentiment

Regulatory Environment/Factor

Technological Developments endogenous to the Crypto Market and exogenous to the Global Economy as a whole

Supply/Demand and Liquidity

These are the major factors that I consider dominant in the industry. A classic example is both within the Macro-economic Factor and Technological Developments.

Recently, we have seen how the US Fed has kept a relatively easing monetary policy stance by holding rates and also signaling the start of a rate cut cycle. While these factors are majorly impactful in the FX and Stock market, there are spill-over effects that trickle into other assets class.

A classic scenario is when we have a Risk-on or Risk-off market condition. In a Risk-on condition, there is an expected increase in demand for risky assets that would offer higher yield relative to safe assets, further out of the curve of the traditional asset class, and the crypto market serve as an avenue, vis-à-vis Risk-off condition.

There has been an increase in correlation between the level of liquidity within the financial system and the flow of funds into risky assets. Such that, during period of rising broad money supply (M2) and global liquidity, the excess funds is likely to flow into riskier assets across the curve:

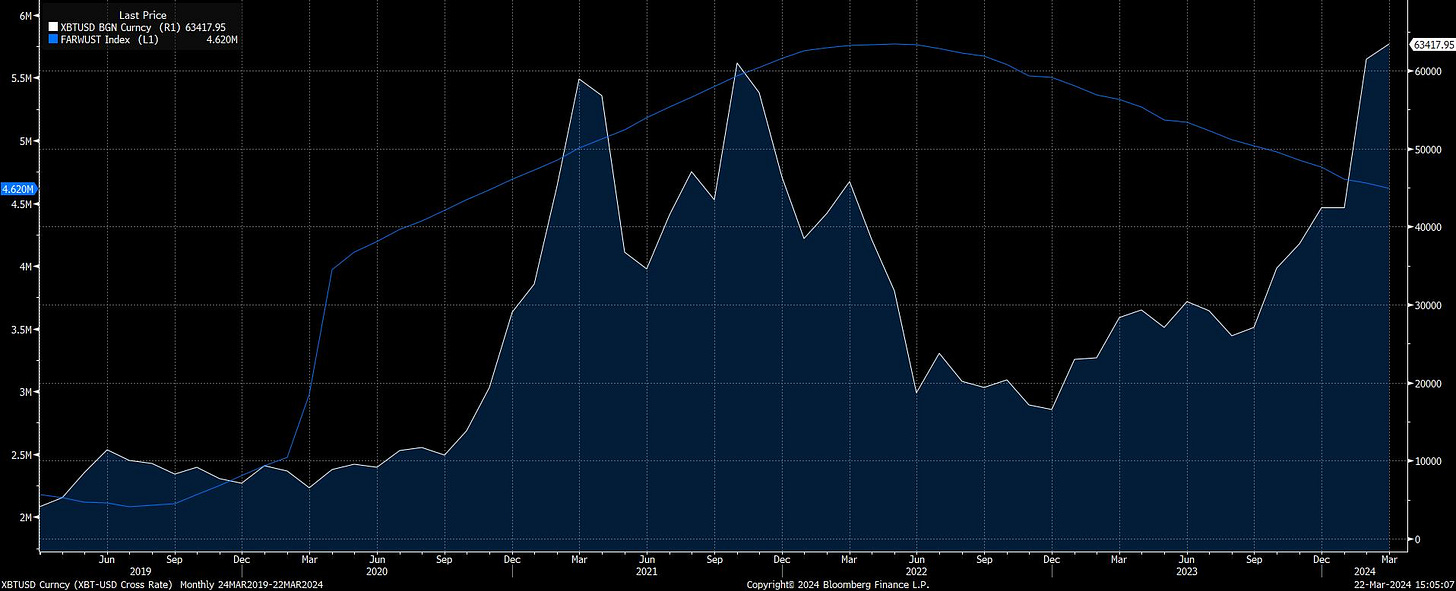

Notably, during period of Quantitative Easing, liquidity is expected to remain elevated in the financial system, as a result such excess funds will move out the spectrum of investment risk to seek out high return, albeit in risky asset class, and at the top of the curve is Crypto.

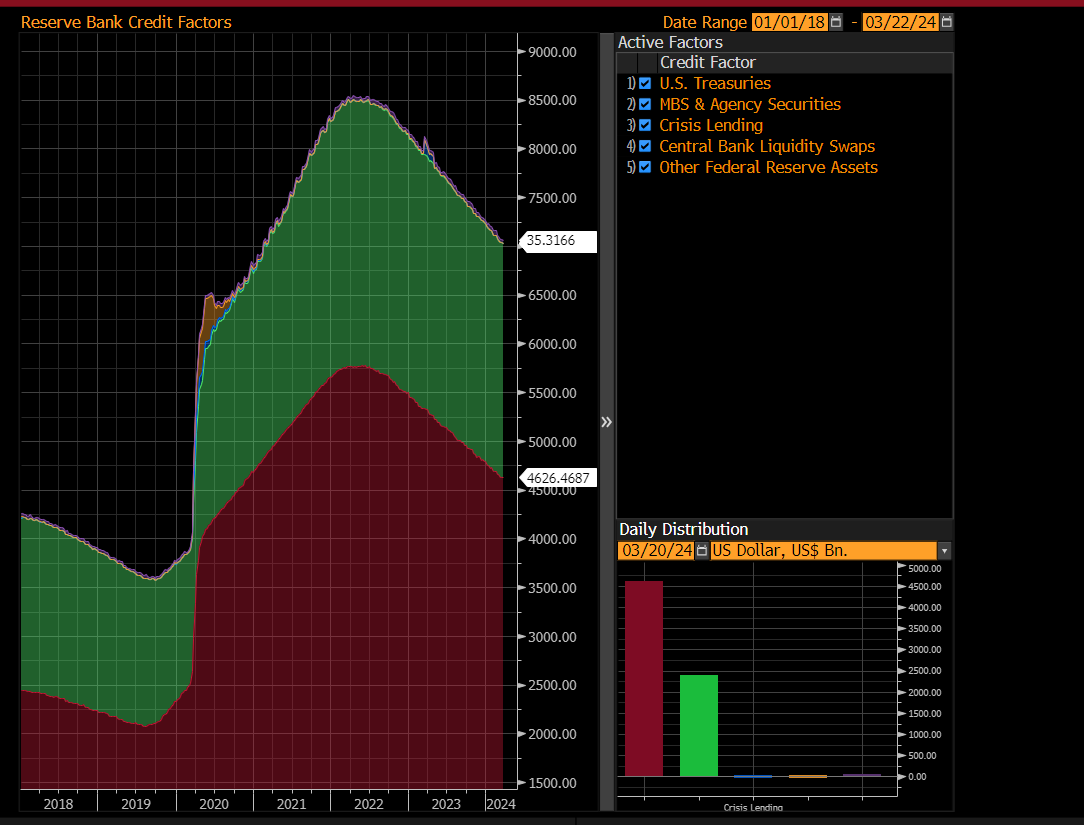

Fed Balance Sheet, Quantitative Easing and Tightening - A Pointer on Liquidity

A simple rule of thumb: When the fed increases the assets in its balance sheet by buying large quantities of treasury securities and mortgage-linked securities, this activity is known as Quantitative Easing, and vice-versa for Quantitative Tightening.

In 2020, during the COVID-19 Pandemic, the Fed embarked on Quantitative Easing which increased money supply. Also in 2023, we saw a decline in the balance sheet as the Fed embark on Quantitative Tightening to curb rising inflationary pressures.

Layering the US Fed balance sheet curve on the prices of Bitcoin, we notably realize the correlation. In 2020, we see an increase in the Fed balance sheet due to Quantitative Easing measure, which also coincides with the rise in value of Bitcoin in 2020 from $10,000 to around $58,000. However, the Fed balance sheet continued its expansion while the Crypto Market didn’t follow suit, and this was attributed to an endogenous variable within the ecosystem due to the US Terra Token Collapse in 2022, FTX Collapse in 2023 and then Silicon Valley Bank Collapse in 2023/2024.

The above scenario basically points out how despite liquidity flows, predominant asset specific event will likely take the stage while disregarding other exogenous factor.

The US Dollar and VIX Factor

The CBOE VIX offers some insights on the performance of the Crypto market. As more institutional investors turn to crypto, contagion risk between traditional and crypto asset may rise, and if that seems to be the case, then the Volatility Index which indicates expectations for increased volatility in the financial market should offer some clues to the direction of the Crypto market.

In 2020, the VIX level rose from 12.0 to 80.0 during the COVID-19 pandemic which also coincided with the decline in the prices of Bitcoin from $10,000 to $4,000. However as VIX pressure cools off, we start to see a rebound in the Crypto market.

Since 2023, we have seen a consistent decline in VIX which also correlates with an increase in the prices of Bitcoin

Meanwhile, this is not to discount the fact that there are time-periods notable in the VIX, where volatility declines, but the prices of Bitcoin continues to decline, and the key to navigating this to add a bit more context around the endogenous variable in the Crypto market or the dominant market theme that is being focused on.

Additionally, there also exists some form of correlation in the mid-long term horizon between the US Dollar and Bitcoin. I have always found this to be useful and dominant as far back as 2022. However, it is not to be used as a signal in isolation for long term positioning.

Technological Developments endogenous to the Crypto Market and exogenous to the Global Economy as a whole

I would like to touch base on this. Full disclosure, I am no expert in the Crypto space, half of the stunts that happens here I have no clue especially on the technology side, but I guess that’s why you have the news platform and research platform to aid in filtering what Technological Development niche is currently receiving attention.

The reason I would like to touch on this is because if you observed the US Stock market rally so far in 2024, it has been driven by Artificial Intelligence, Data Technology/Science and Software. If you also layer the exogenous focus in these areas of technology advancement in the global economy and transpose that into the Crypto market, what that leads you to, are specific tokens or assets built around offering services or infrastructure in the same technological advancement area.

Focusing on the Artificial Intelligence category on Coingecko and sorting by market cap, I have the top 5 names within that niche, and if I plot those names on the chart, we find that they have performed significantly well:

This same framework of exogenous global factors transposed to endogenous assets within the crypto market can be applied broadly.

Personally, I run a Holistic Fusion approach when investing or trading Crypto (to be honest across asset class), mostly with a blend of rotation across sectors, macro factor, fundamental context, technical analysis and quantitative criteria. How I utilize these factors varies and differ across asset class especially in Crypto.

Here are some reference link and docs you might find useful to help you put together an approach that could work for you:

https://insights.glassnode.com/

https://public.bnbstatic.com/static/files/research/industry-map-dec23.pdf

https://www.coindesk.com/dacs/#dacs-500-list

https://www.sparklinecapital.com/post/value-investors-guide-to-web3

https://hanetf.com/monthly-reports/?theme=cryptocurrencies

https://www.ark-invest.com/the-bitcoin-monthly/

https://research.kaiko.com/reports

https://people.duke.edu/~charvey/Research/Published_Papers/P164_An_investors_guide.pdf