Positioning Update

Soft View on Macro into Central Bank Meeting

A brief update on macro views from the September macro report and trades I am running.

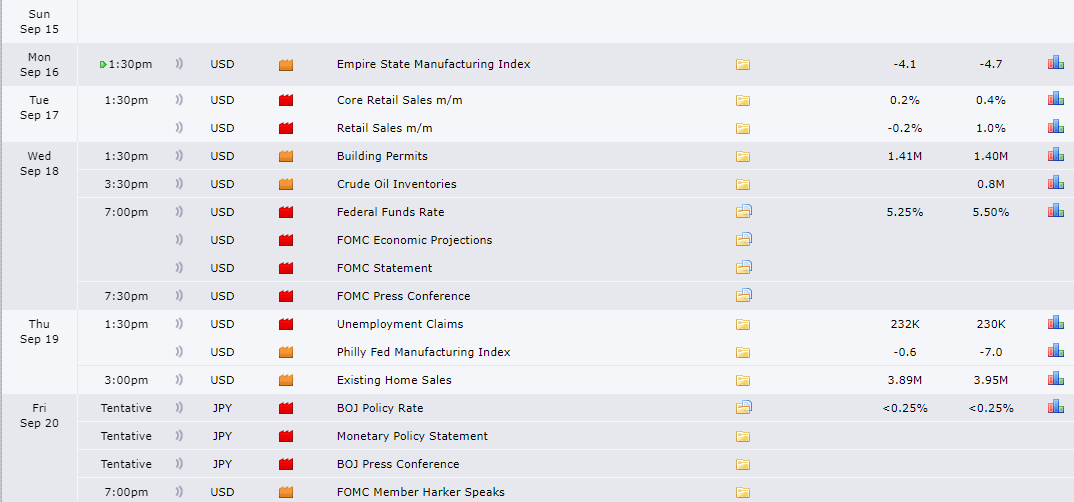

Last week, we had CPI and PPI data release setting up to FOMC meeting this Wednesday:

My positioning views hasn’t changed from the last major macro report I shared:

Macro Pulse: September

Towards the end of the month of August, I shared my views on where I think we are across the macro regime, and my sector focus within the equities market:

The market is purely focused on the rate cut either by 25bps or 50bps, with sentiment skewed towards a 50/50 chance on the size of the cut. CPI data increased by 0.2% on a m/m basis, driven by acceleration in the Shelter component, while Fuel and Utilities has declined significantly to 2.93% from 4% attributable to the broad decline in energy commodities asset.

Overall, inflation trajectory is slowing down but still largely mixed, especially from the services sector. Inflation swaps rose marginally on the back of the CPI print:

While the Fed seem to be focused on the Full Employment mandate, and which the market also seems to be focused on, the slowdown in Labour market, and pivoting away from a potential re-acceleration in inflation.

Equities market rallied into the close last week, I relatively expect a continuation in that sentiment leading into the FOMC meeting on Wednesday.

We also have Bank of Japan meeting on Friday, I think it is important to also pay attention to it.

Overall, I am neutral going into Wednesday, still running and holding active long position in the Equities and short in the FX market. CPI from CAD on Tuesday, will be watching how that impact active position, see running trades below:

Long JPY looks like the right trade to have on right now, for sure!

Yields down both on a bit of recessionary fears, and FED about to cut 50bps most likely.

So that puts the carry trade back at risk again.