Nigeria: Inflation Regime Model

A Model, Dissecting Inflation, Connecting to Asset Class and Taking Bets

Nigeria macro economy has been a captivating and interesting one for the past couple of months, especially from my quiet time here, evident by the monetary policy actions of the Central Bank of Nigeria (CBN) to rein in inflation, currency depreciation and also to concurrently attract Foreign Portfolio Investors (FPIs), as such the CBN has hiked rates by 750bps this year, holding firm on its hawkish stance, while inflation also remains resilient to the upside, with new highs at 33.69%.

In this report, my focus is on dissecting Nigeria inflation practically into its moving parts, some of which are quantitative and others are relatively qualitative. The key is to have a model to work with to quantify the components of inflation and how the variables connects to the performance of asset class specifically Equities and Fixed Income, and lastly on providing some form of relative guidance on anticipated inflation and rates level, to position and make strategic bets.

Before I delve into the component of the model, I would like to lay a foundation around inflation dynamics specifically for a developing country. This is critical, as it adds some color on the variables for modelling inflation regime in Nigeria and also connecting that to asset class for investment. In addition, I included list of academic papers I read that I find insightful, extracted some information and consolidated it all into the model.

Conversation on Dynamics of Inflation

Across academic papers and theoretical economics, there are different sources of inflation to an economy. I do not aim to give a crash course here, but to draw on what is important to shape our thinking conceptually, I think that’s the most important thing, especially towards extracting insights and taking bets in the financial markets.

Some key variable I would anchor this conversation around are:

Country Specific Factors

Globalization

Policies (Fiscal and Monetary)

Shocks - Demand and Supply

Correlation and Causality

Inflation forces largely stem from two broad factors which are unique to every country and also as a result of increasing globalization between countries, as international trade becomes predominant. The country specific factors, would provide unique insights into what is driving inflationary pressures domestically, although, these factors may not exactly be quantitative in nature but leaned more towards qualitative analysis, but that doesn’t substitute the fact that data points can be quantified and that is key to building a model.

With reference to country specific factors, understanding the structure of a country from Production/Output, Balance of Payments and its Structural Factors would provide insights into the drivers of inflation. In addition to country specific factors, globalization has also become an increasing factor contributing to inflation both globally and also domestically. However, how globalization impacts a country is also as function of how the country relates with the rest of the world, think Trade.

For a country like Nigeria, globalization would mean import/exports and exchange rate; additionally, globalization would also mean factors that impact global supply and demand, and how that transmits into the country specific factors. A classic scenario would be during the Russia-Ukraine war, when the world economies had a disruption in global supply, there was an increase in commodity prices, but the level to which that would transmit into various economies differs, which is as a function of its trade activity with the rest of the world, such that a country that relies heavily on imported oil and food commodities would be impacted severely than a country which doesn’t.

While considering Globalization and Country Specific factors, another variable that comes into play is the policies that takes place domestically, both on the fiscal and monetary policy side. Monetary policy side would largely stem into Credit, Money Supply, Price Stability and to some extent Employment, while Fiscal policy would have its focus on the structural/infrastructural side of things towards ensuring Foreign Direct Investment(FDIs), production, growth and development altogether. These two policy factor have their corresponding role to play when it comes to inflationary pressures in an economy.

Nigeria is relatively uniquely known to have some structural imbalances especially on the food production end, which calls for increasing attention on the structural side, to increase the country output, reduce its reliance on import, to meet up adequately with the demand of its economy, while also reducing its exposure to external shocks.

All of the above factors then transmit to shocks on the economy or inflation either from the demand or supply side, both globally and domestically. However, as analysts aiming to forecast or build a path on how this macro economic variable would potentially evolve, and its impact on the financial markets, and more importantly, how we can utilize the information, analysis and knowledge to take bets across asset class to generate returns.

To effectively and consistently execute the above, what better way than building a model to determine how the path is likely to evolve and applying some discretionary thinking towards taking bets in the market.

Another important thing I need to draw on is the concept of Correlation and Causality. Due to the fact that we will be dealing with collecting and assessing data that could have its impact on inflation, and how we expect inflationary path to develop, to enable us take bets across asset class, it is very important for us to be able to distinguish between Correlation and Causality across data points. These data points being both domestic and global data points, the line might be blurry to be able to effectively distinguish between the two but it is important we try as much to.

Simply put:

Understanding the difference between the two is quite critical, and to be honest I could also make the mistake of mixing up the two, but the whole point of a model is to continue to refine it but not over-fit it to ensure it delivers the right signals for you to take bets on. It is also important for me to disclose that this model isn’t a binary model that spits out a arbitrary output but rather to serve as a pathway to apply discretionary thinking to, and then make sound decisions in the financial market.

The conversation on this dynamics is as a result of I trying to summarize the broad based moving parts to the model and readings from all the papers at the end of this article.

Inflation Regime Model

Before I delve into the model, I would like to point out that this isn’t “THE” model, it is my interpretation of how I see the macro moving part of inflation in Nigeria and what I deem useful or critical to anticipating the path of inflation and using the information from the model to position and/or take bets across asset class.

I have been able to classify the regime model on Inflation Path into Domestic and Global factors. The domestic factors take the following variables: Fuel Prices, Money Supply, Monetary Policy and Structural Factors. While the Global factors I considered are Oil prices, Commodities and Nigeria Exchange Rate.

I could not explicitly quantify the structural factors, so they are largely qualitative but if you are curious about the component of the structural factors, they are: Insecurity and Agriculture Production output. Although, I could reference the GDP data on quantify this, but it is a quarterly data and not exactly immediately useful, however, I could make some inference on that from the other factors.

Before delving into the analysis of the model, I would like to walk through how I built the model. I built the model on an Excel sheet, nothing complicated, if I recall, I have shared a view on my full MacroEconomic Diagnostic Model for Nigeria. However, if you would like to learn how to build a full Macro Model, I recommend this program: Link

I participated in the IMF Fund Challenge while in University for Economic analysis in 2020/2021 from November into February, if I recall. It is an intense one but if you manage to pull through, you should be able to build some of the macro models I have.

Alright, back to the Inflation Regime Model, a quick summary of it:

I computed Headline Inflation using index data from Nigeria Bureau of Statistics(NBS)

I used the CPI Laspereyes method to manually compute other Core CPI data excluding certain components (Food, Electricity, Gas & Fuel and Transportation)

Data on Money Supply, MPR Rate and Average Treasury Bill(TBills) Stop Rates from Bloomberg Terminal, then I computed TBills yield from the stop rates

Data on Fuel Prices across LPG, Kerosene, Automotive Gas and Premium Motor Spirit from NBS

USD/NGN Exchange Rate

Commodities Prices (Crude Oil, Natural Gas and Gasoline) also from Bloomberg

That’s all the data point for the model. Then some MoM and YoY % Change. The other thing required would be some descriptive statistics and other statistical analysis, but to be honest, I am not that smart, so I outsource these to ChatGPT lol. Excel has a data analysis tool which I use, and if you are very good with Python for Finance, then you can run statistical analysis quickly.

Conceptual Foundation to the Model

The conceptual foundation around the model is that Nigeria inflation is subject to shocks and forces stemming from domestic factors and global factors. In 2023, Nigeria took some economic turn where policies were passed to remove fuel subsidies, also to unify the exchange rate and leave the forces of demand and supply to determine the price level for USD/NGN, as a result we saw a pass through effects from Exchange Rate depreciation and PMS prices.

Subsequent to those events, or prior to those events, Nigeria had faced challenges in meeting up with production towards meeting the demand of its the micro-economic agents both Households and Firms, as a result the depreciation of FX created an additional pass-through effect to prices of consumer discretionary and staples goods, while also impacting the cost line of companies across all sectors. Due to this factor, we had a cost-push inflation in an economy that wasn’t meeting up sufficiently in terms of output levels to meet up with demand. Hence, Nigeria has a combination of cost-push inflation and demand-pull inflation.

The demand pull inflation would be resolved if Nigeria fixes the challenges of insecurity, storage and increased output from its Agricultural sector, which is a task more for fiscal policy than monetary policy.

Nonetheless, Nigeria had also faced a turmoil in its monetary policy, where the previous CBN governor Godwin Emefiele, embarked on unorthodox monetary policies that resulted in increase in Money Supply, which to some extent contributed to inflationary pressures as a result of excess liquidity. However, the new CBN governor (Cardoso) , currently focused on attracting Foreign Portfolio Investors (FPIs) to alleviate pressure on the Global side of the inflation model, more specifically the Foreign Exchange, to alleviate the pass-through effect of FX into the Domestic side of the model. As a result, we experienced an increase in interest rate and also a somewhat effective transmission mechanism into the Treasury Bills market to increase the demand for Naira against the USD through Capital flows to short dated securities.

In the Papers section at the end of this article I included papers I read on Twin Crisis - a Banking and Currency Crisis, and one thing to draw out from all the papers I read is the impact of Capital Flows to short dated securities and expansion in Credit Cycle, and how a banking/economic crisis looms when the capital flows from FPIs leave the country, and how that results in pressure in FX and also transmitting to both the Banking and Industrial sector of the economy.

However, it does seem like the current CBN governor seems to be aware of the potential risks from a twin crisis, hence there has been a shift in policies to increase the regulatory capital requirement of banks to reflect the true state of the economy from an FX standpoint, and also the policy on Net Open Positions for banks, I think primarily to rein in excess exposure on the liability side to FX instruments. While these are preventive measures, it doesn’t necessarily eliminate the risks.

In summary, the inflation regime model I have designed takes into cognizance virtually all the factors that seems to be driving inflation conceptually.

Analysis of the Model

Inflation Barometers

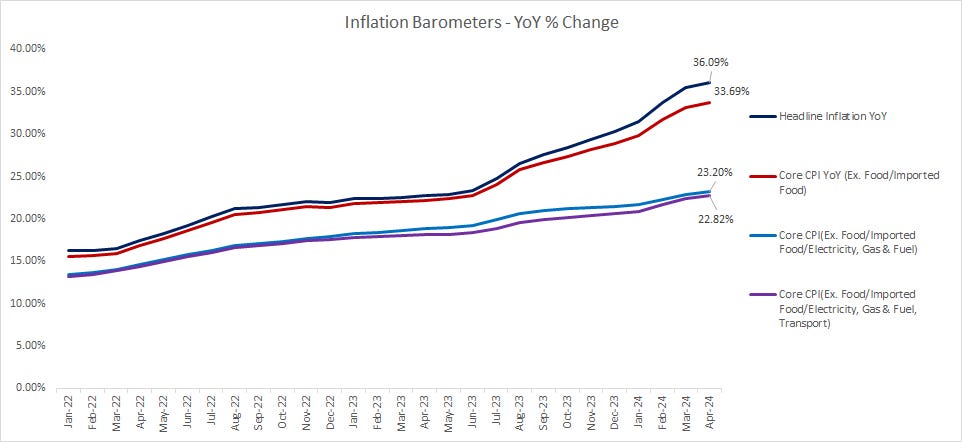

Headline Inflation YoY stands at 36.09% as at April-2024, we have seen a persistent increase in inflationary pressure, and like I have said in previous macro reports, contradictory to what everyone thinks, base year effect is not even to be expected to kick in until some point around August 2024, if things improve:

While Headline inflation is elevated at 36.09%, and Core CPI excluding Food and Imported Food (to discount FX pressures) is lower than the Headline print, at 33.69%. If we go the step further and exclude both Food, Imported Food, Electricity, Gas & Fuel inflation is at 23.20% which goes to show the pass through effect of PMS, Diesel and LPG prices into inflation prints in Nigeria.

Additionally, if you take a step further and exclude both Food, Imported Food, Electricity, Gas & Fuel and Transportation, inflation is at 22.82%, transport inflation basically accounts for the pass through effect of fuel prices into transportation cost.

If you remove all of Nigeria problems from inflation prints, inflation is somewhere around 20% - 22%, still elevated from 16% headline inflation levels in January 2022, but around the CBN medium term target. Essentially, if you solve:

Food demand/shortage problems

FX pass through effect from demand of imported goods

Demand for Crude Oil/Reliance on external importation of crude oil

Nigeria inflation should be around 20-22%, then monetary policy can start to tinker around on bringing inflation down to say 16% levels. Now out of all the problems, the only thing CBN can solve in the medium term is FX pass through effect, so that implies that if things do not improve drastically Nigeria inflation would anchor around the 25% - 30% mark relative to Core CPI.

FX Pressures, Monetary Policy and Imported Food Inflation

Since 2022, the Nigerian Naira has declined by over -70% on YoY basis relative to the USD. The depreciation of the currency rapidly from -10% to -40% between March and June 2023 ascribed to the floating of the Naira, has contributed immensely to inflationary pressures. However, we have had a slight rebound in the currency due to monetary policy actions by the CBN

Since MPR rose from 18.75% to 24.75%, we have also corresponding gains in FX prices for the Nigerian Naira.

Fuel Prices Pressure

Between March and June 2023, we had a MoM increase in PMS by 120%+, little contribution from LPG and Kerosene. However, evaluating recent data PMS prices seem to have stabilized at elevated levels, but we are starting to see an increase in prices of LPG and Diesel on a MoM basis.

on a YoY basis, PMS and Diesel are the top contributor to rise in fuel prices, as such the component of Fuel in inflation is a causality effect from PMS prices and Diesel.

In addition to domestic increase in fuel prices, from a global view, global oil commodities bottomed in 2023 and started to increase in price on a YoY basis, while this might be attributed to correlation or causality into domestic fuel prices in Nigeria, it is hard to really draw into the conclusion, but I will touch on this shortly.

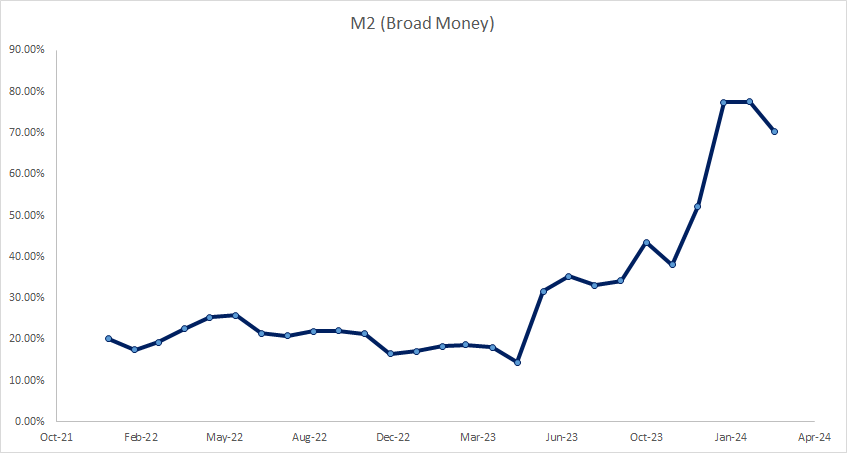

Money Supply, Liquidity Pressures

The M2 Broad money supply measures the money in circulation in the economy including demand demand deposits. YoY We have seen a persistent rise in Broad Money supply since 2023 into January 2024. The mandate of the CBN has been to mop up excess liquidity from the financial system, and we are starting to see a slow down in M2 levels into April 2024 on a YoY basis although slightly elevated.

Correlation Analysis on Inflation and Fuel Prices

There exists a positive correlation across the variables in the model and its impact to headline inflation on a YoY basis:

While there exists a negative correlation between Crude Oil prices and PMS prices on a YoY basis, on a MoM basis, there exists a positive correlation by 89.6% between FX depreciation and increase in PMS prices, as such FX depreciation transmits into petroleum prices and thus rising headline inflation, and if this case does hold through a corresponding pass-through effect would be transmitted to other components of inflation in Nigeria.

Conclusively, the data does support the regime model of a mix in both Global shocks to Nigeria inflation from Commodity Oil prices and FX pressure alongside Domestic shocks to inflation from Fuel Prices (PMS and now LPG) including other structural driven factors such as rising prices of food domestically.

Impact on Asset Class

The rising inflation, alongside the pass-through effects of shocks transmitted from variables within the inflation regime model, there are corresponding impacts across two asset class: The Fixed Income assets and Equity Markets.

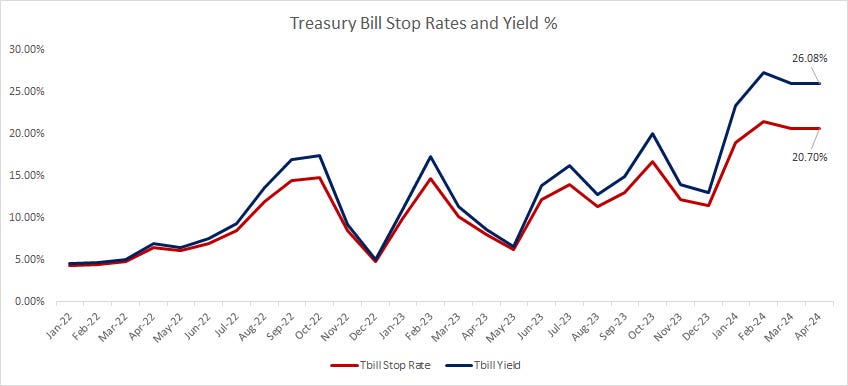

The action of the CBN is to increase interest rate to reduce money supply and also alleviate pressures from FX by attracting FPIs, through offering positive real rate of return relative to inflation, or better put, higher rates due to rising inflation, as such we have seen an increase in the stop rates of Treasury Bills (correspondingly the yields) from around 5% in 2023 to 20.7% in 2024

The increase in yields in relative risk-free instruments has resulted in increase flows to fixed income asset class, seen by increase demand for treasury bills and perhaps short duration bonds. While the equity markets seem to be in a bear market:

The Nigeria ASI has declined by 8% from the top in Feb’24, we have seen the selling pressure across the Banking(-32% from top), Consumer Goods and Industrial sector all for reasons I have extrapolated above:

In conclusion, the inflation regime model points a pathway dependent on shocks from a mix of Global and Domestic factors, and impact on asset class due to the CBN policy actions to rein in inflation, stabilize the FX market and prevent a future banking crisis through a recapitalization exercise. As long as these factors are persistent, inflation is not going anywhere.

I would rather hold conversations around data points and models, take bets from discretionary thinking based on the information from the model and learn, make adjustments on the go - not to over fit the model but to adjust for variables not captured for or errors from misinterpreting the roles the variables play in contributing to the pathway of inflation.

Thank you for your attention, while I have been away, as said I would rather spend time to write constructive content than dilute my work for the sake of activity.

Knowledge workers function like athletes — train and sprint, then rest and reassess.

Papers

As promised, all the resources I read before constructing the model, I had a foundational idea of drivers of inflation, I only needed to read broadly to understand more dynamics, the how and the why specifically for developing countries, and I can say these covers most of it: