Hi readers, this is a mid week report on the back of yesterday market color and trades, coupled with new trade ideas I intend to run into the end of the week and potentially hold into next week.

Core CPI m/m came in below forecast and previous levels, while CPI y/y was above previous levels and in-line with expectations:

I also highlighted yesterday how we would likely trade back to 6,000 levels on S&P:

and we are currently trading couple of points below that level:

While CPI came in line with expectations, yields have re-priced significantly lower and closer to where we started 2025 at, thus enabling equities to consequently rally:

To wrap the week, we only have a growth related data in play, while inflation risks is currently underpriced by the markets, growth data remain in focus. Without any strong focus on growth risks, we only need retail sales and unemployment claims data to either come in line with expectations or above for equities to continue rallying:

Given the economic data set-up into next week, we are likely to continue rallying into Trump’s inauguration, the relative risk ahead is the Carry Trade Risk which could be sparked by BoJ monetary policy decision next week Thursday:

Trump’s inauguration on Monday, with market staying closed could spark volatility ahead of market open next week Tuesday depending on what he says in his speech, hence any positioning that involves taking advantage of his policy agenda or hedging against such volatility would/should take place on Friday.

Looking two weeks ahead, I do not think we are out of the woodshed on the monetary policy side of things, like I iterated in yesterday’s market color report:

Managing the oscillating dynamics around risks and events taking place is key right now, so make sure you understand what you are buying :)

Fresh Trade Ideas

Technology Sector Trades

I executed TSM 0.00%↑ longs yesterday and shared the trade idea:

Trade Open: Taiwan Semiconductor

I shared the update around this trade on the market color report for today, so re-opening the long here

The trade is currently ITM, and if you refer back to the weekly macro report shared on Sunday:

Weekly Macro Report: Inflation Vol

Hi, hope you are having a splendid weekend. We’ve had the first week of some key macro data fleshed into the market place and driving volatility that has us raising our eyebrows on the pathway for 2025.

I highlighted the earnings release on TSM 0.00%↑ due today during pre-market hours. I am already positioned for that, I expect a positive earnings release and if it does beat estimates, we could see a rally in XLK 0.00%↑ (Technology ETF) during pre-market hours offering a potential long trade. Alternatively I could increase size on TSM 0.00%↑ long for a rally above 220 level :

Banking Sector Trades

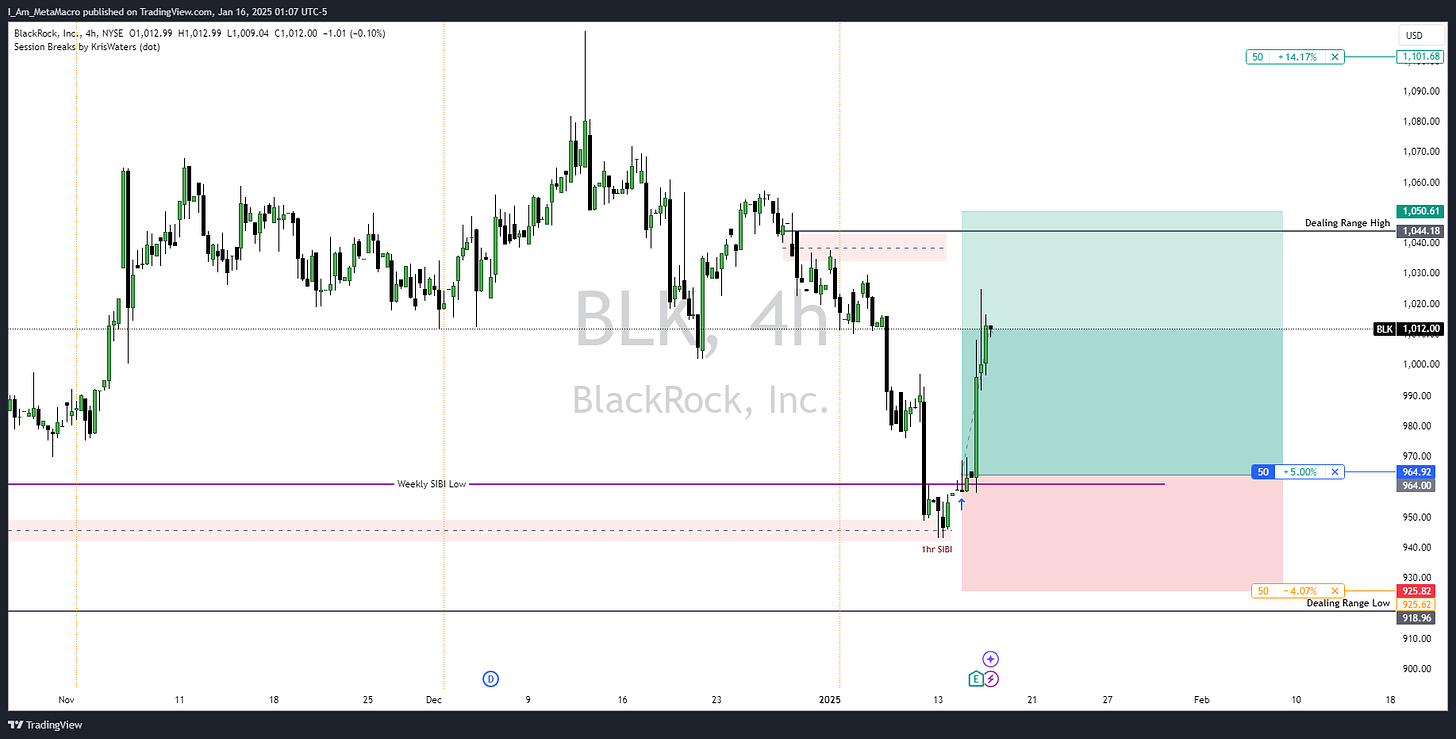

The other trade idea is around the banks earnings, the watchlist I shared of which I only executed on BLK 0.00%↑ (Blackrock) which is also ITM(In The Money), with XLF 0.00%↑ also rallying significantly. We still have other earnings release today, so I intend to explore a long position in KRE 0.00%↑ regional banking ETF

Trump Inauguration Trades

For the trump inauguration trades, I will be executing post Retail Sales data release, full credit to my friend

for narrowing down the trump trade list.Alright, there are quite a couple ideas I am aiming for here, but I won’t be executing on all of them:

CXW, GEO Longs around Immigration Policy

Vistra Energy Longs

Gold ETF Longs, Volatility Risk

EWW 0.00%↑ Mexico ETF Short

TSLA 0.00%↑ Longs, most likely will run a call option on this

SOFI 0.00%↑ Longs

Equities Index and Quantum Computing Trades

While S&P rallied on the inflation print, Russell2k hasn’t moved significantly, I think we get some positive vol here on positive retail sales data, hence I might explore a long trade here on the cash market.

Also, we saw Quantum Computing beta stocks sell off from last week, I think we’ve hit a short term low and I will be exploring some long trades around here on:

Will run a mix of call options and underlying on them . This will be all, will provide updates on running trades and any new trades, no-brainer I will be trailing some of the open positions stop to break even to reduce my VaR(Value at Risk) to enable me take on new positioning risks + we got a very good price for the entry on some of the positions.

First that $BLK trade was excellent! Also I’m glad you brought up the next BoJ meeting I feel like that does not get enough attention, especially considering how important it is to US assets.