Hi, hope you are having a splendid weekend. We’ve had the first week of some key macro data fleshed into the market place and driving volatility that has us raising our eyebrows on the pathway for 2025.

For the week in review, we had major jobs data that indicates strength in the US Labour market, and not one that seems to be tapering on growth outlook from this sector of the economy:

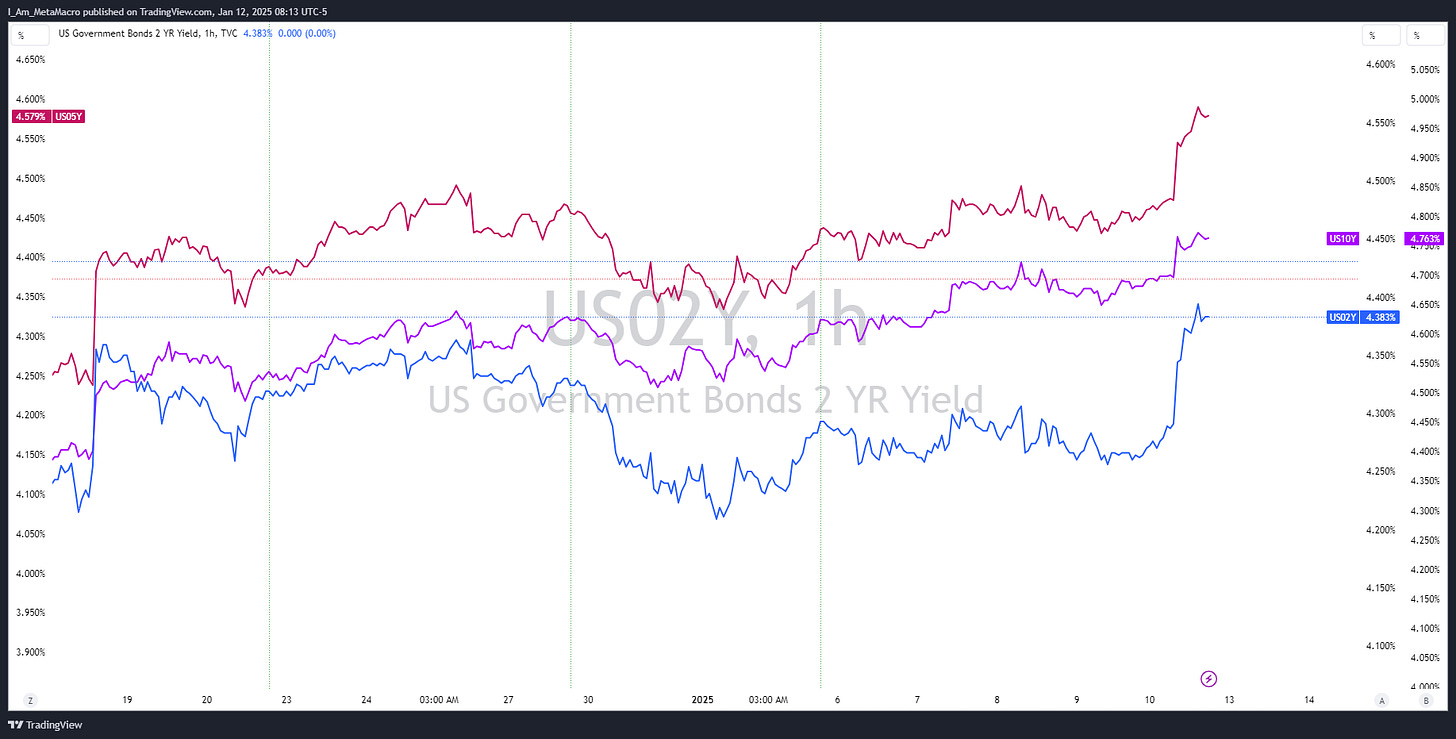

The impact of the positive Labour market data sent chills down the Bond market , with yields surging above 4.3% and correspondingly impacting the Equities market:

The macro data provided some context on sentiment around the risks being priced in across the market. I highlighted these risks in the daily market color report, which are as follows:

Macro Basis:

Equity Risk Premium

Term Risk and Inflation Risk Premium

Monetary Policy Risk Premium

Policy Risk Premium

Bond Markets:

Interest Rate Expectations and Term Risk

Equities Markets:

Equity Risk Premium

Growth Risk Premium

Sector Risk Premium

Macro Risks in Play

Due to the surge in yields within the bond market, we are starting to see build-up in equity risk premium, driven pre-dominantly by monetary policy pathway. If you recall, the positioning moving into Jan’2025 was that the Fed would likely hold rates unchanged in Jan FOMC meeting, but the direction of rates into February remain unclear.

While the rhetoric is that the U.S economy remain resilient, evident by the positive jobs data we had this week, then there isn’t any strong rationale to keep cutting rates, primarily due to the fact that there are potentially policy risks that could weigh in on inflation risks across the horizon.

The bond market has to some extent reflected the views around interest rate expectations and term risk, alongside the equities market. On an intraday basis we have had bearish flows from the current week:

But, IMO not in magnitude that could result in a bear market. The flows experienced over the week was primarily attributable to the equity risk premium, however there are no significant concerns around growth risks, given the positive data print around the Labour market.

However, there are sector risks in place from a valuation perspective. The risk stemming from equity names that have gained significant valuation premium from Artificial Intelligence, Quantum Computing and other adjacent thematic narratives. The increase in bond yields, or the risk of building further premium within this market would likely result in the unwinding of the valuation premium built in equity names within the thematic sectors highlighted.

Equities: Week Ahead

If you think last week was difficult, wait until this week. The main variable that probably makes or break the equities market are in play. Inflation takes the center focus for the week ahead.

Market expectations is that inflation prints higher on a Y/Y basis and unchanged on a M/M basis. The game plan around this is that:

If Inflation data prints higher above forecast, bond market sell off, yields rise, equities sell off

If Inflation data print below forecast, bond market neutral, yields retrace marginally, equities rally

Also on the earning calendar we have earnings release from the banks on Wednesday and in focus for me on Thursday is TSMC. This builds my watchlist for the week:

Details on key levels, will be shared in Monday Market Color.