Good morning, MetaMacro readers! Here's the latest update on FX market flows and catalysts for price movement

FX overview

FX News

FX update: FX implied vol, FX positioning

Economic dashboard

FX Views

FX overview

The dollar hasn't benefited from reduced tariffs as much as equities have—an indication that a substantial recovery will require more good news on the tariff front before another negative development occurs.

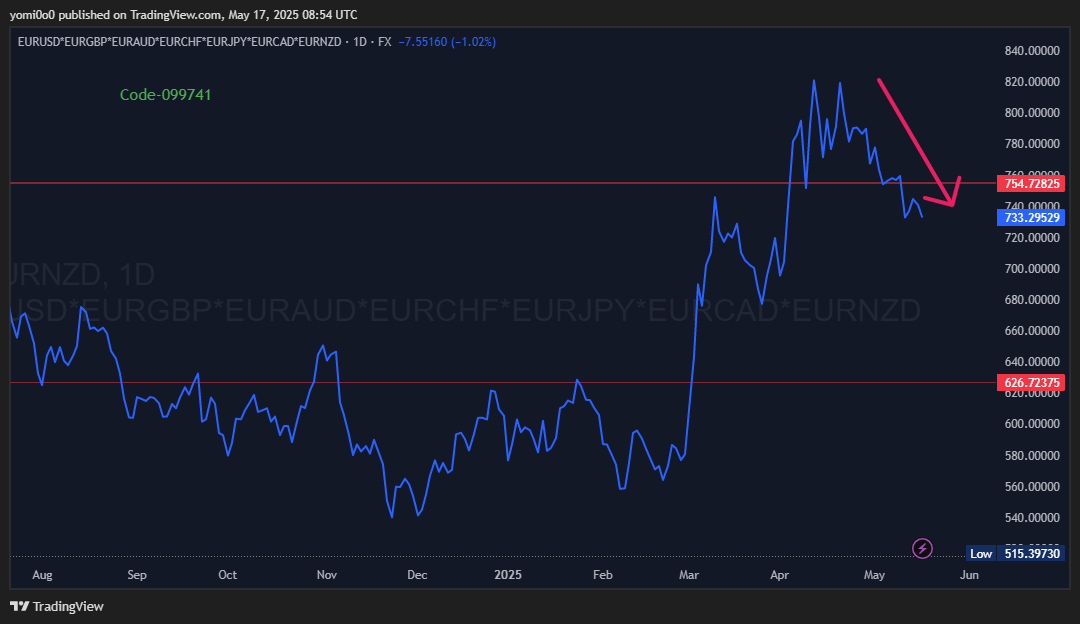

The euro absorbed safe-haven flows during the dollar's decline but has since given back a significant portion of the profits made from that rally—approximately 10.5%.

What we initially thought was a retracement now appears to be the foundation of a bearish trend that could continue if the dollar keeps gaining ground. The euro's recent top coincided with the dollar’s bottom

Our bullish view on the pound since mid April is currently unactionable

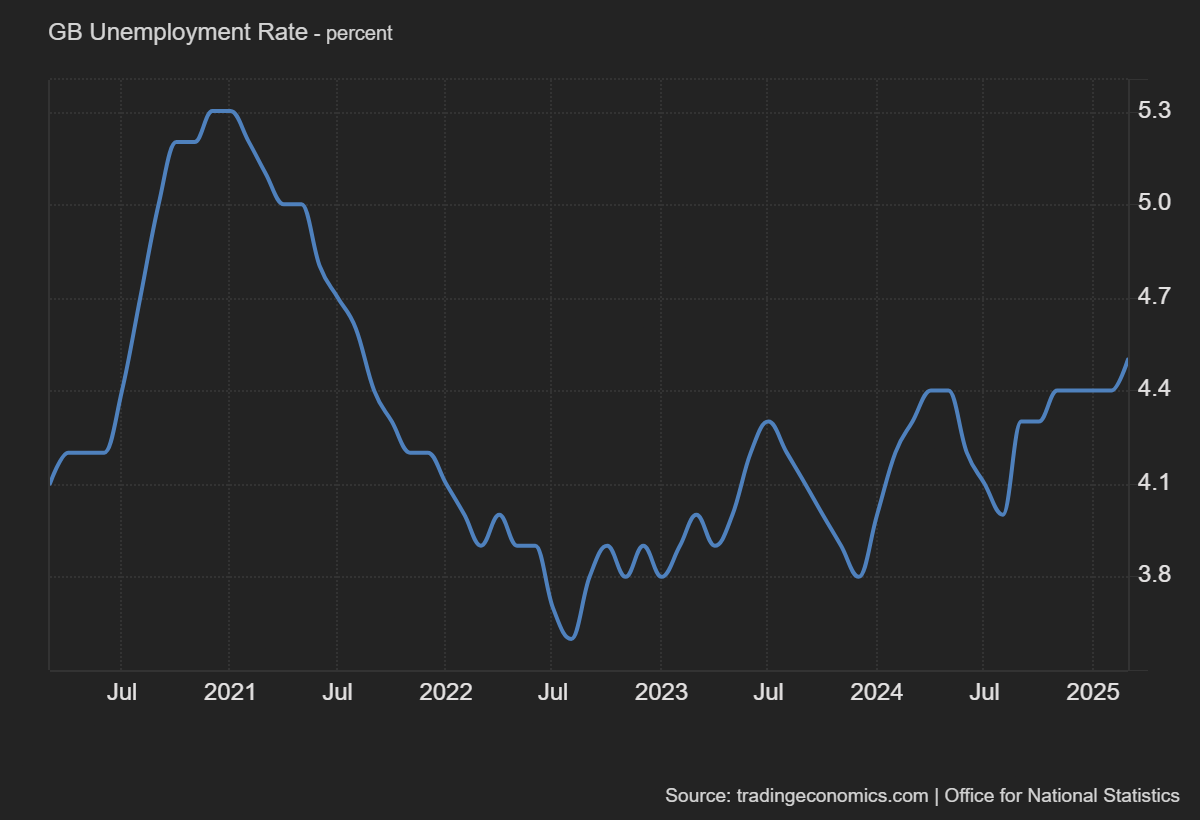

The pound may decline or range bound (more likely) from here. Labor report on Tuesday showed some underlying weakness in the UK economy. Unemployment rate report ticked higher to 4.5% albeit was in line with expectations

Meanwhile, the employment change, which represents a 3-month moving average of employment, came in below both the consensus (120K) and the previous figure (260K). Not the worst report, but it indicates a need for caution.

The pound rally has significantly increased the asymmetry for a short. A bearish catalyst—even a minor one—could push the pound substantially lower. We have the CPI report next Wednesday. Some hedging ahead of the report could pressure GBP lower. The consensus for core CPI YoY is 3.5%, compared to the current 3.4%. If we do see a decline, it could present another opportunity to go long on the pound.

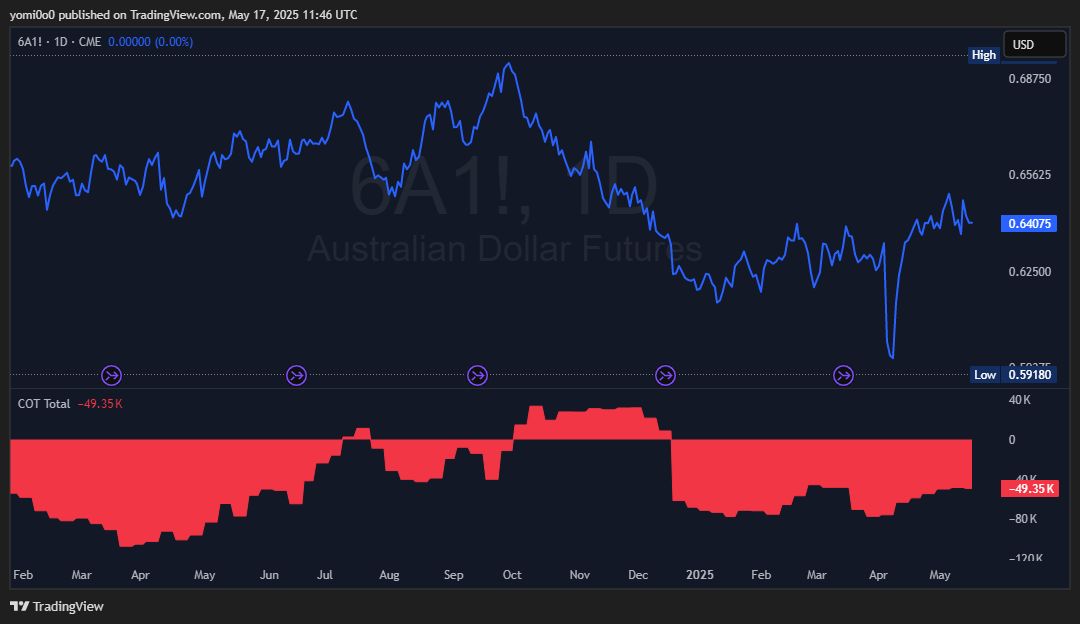

Australia released its employment report on Thursday and wage growth figures on Wednesday. Both showed resilience in the Australian labor market. Unemployment remained unchanged at 4.1%, wage growth rose to 3.4%—above both the consensus and the previous 3.2%—and the employment rate increased to 64.4% from 64.1%.

FX News

https://www.washingtonpost.com/world/2025/05/16/russia-ukraine-talks-istanbul-peace/

https://m.piqsuite.com/forexLive/japan-not-keen-for-compromise-in-us-trade-talks-2025-05-16-13-52-09

FX update

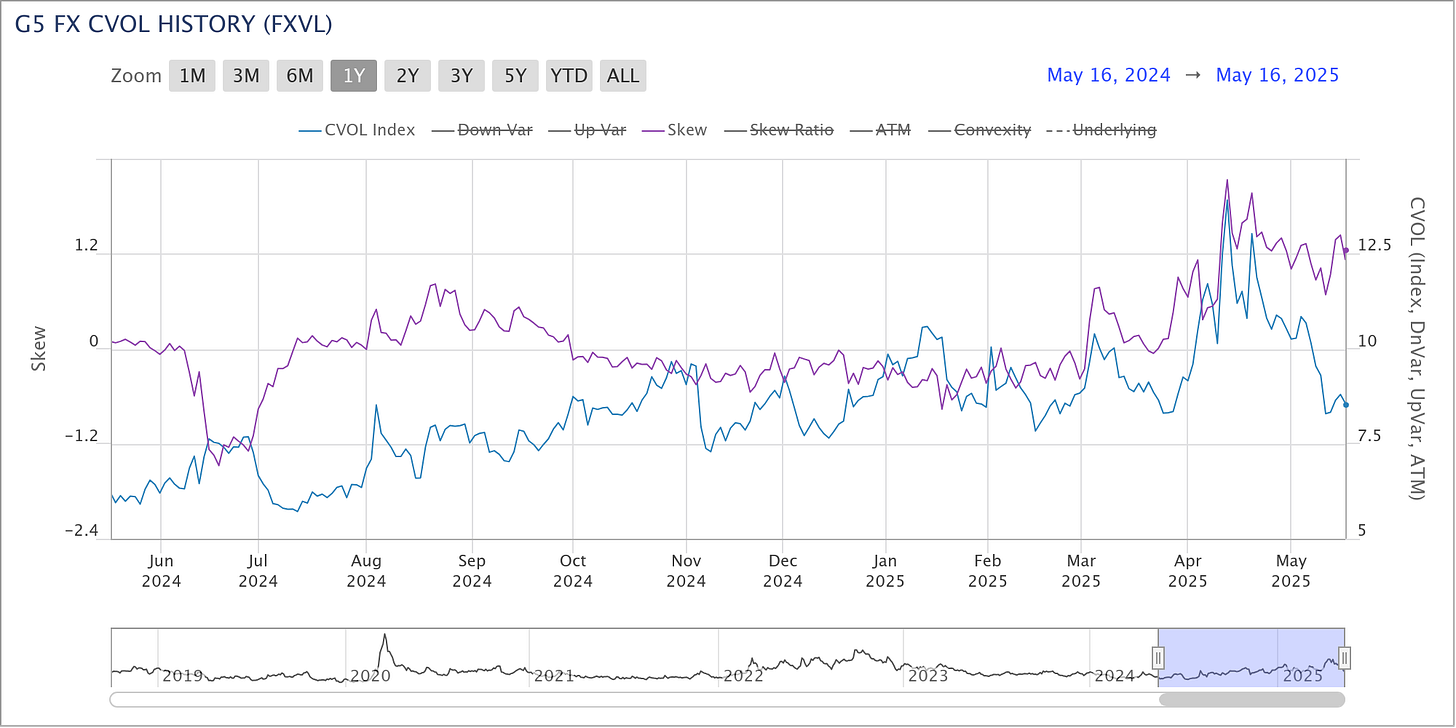

Implied Volatility

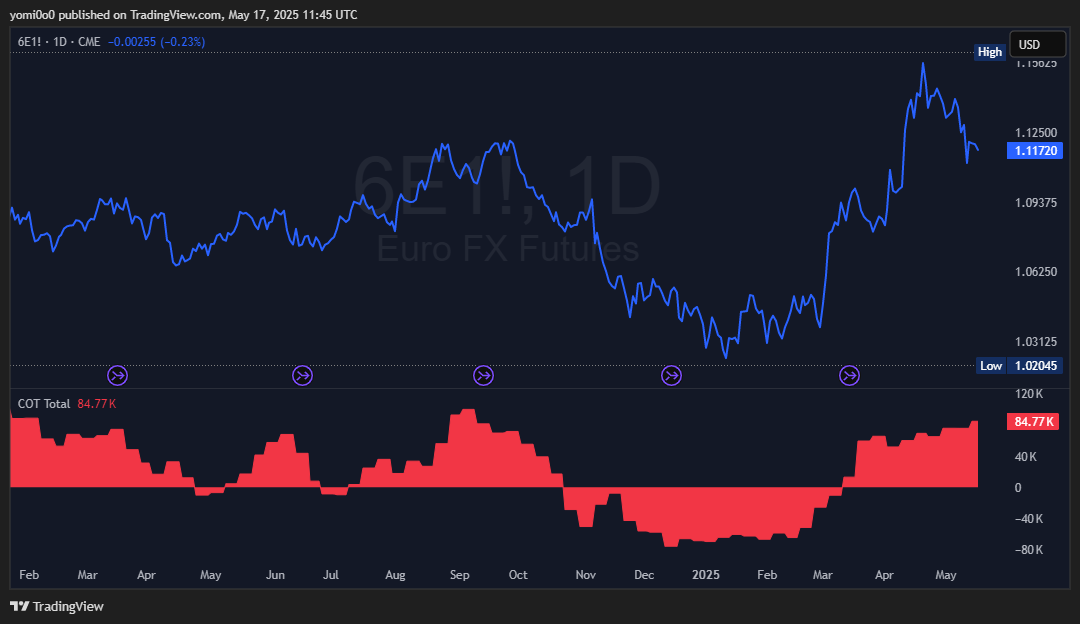

COT Positioning (Non commercial net positions)

Economic dashboard

FX Views

Easing tariff pressures between the US and China, strength in risk assets, and the recent Australian jobs report are all bullish signals for the AUD. The jobs report didn’t significantly alter rate expectations, but if AUD can retrace its recent decline up to the 0.382 Fibonacci level, our long AUD thesis becomes more concrete.

Long AUDCAD

Long AUDJPY

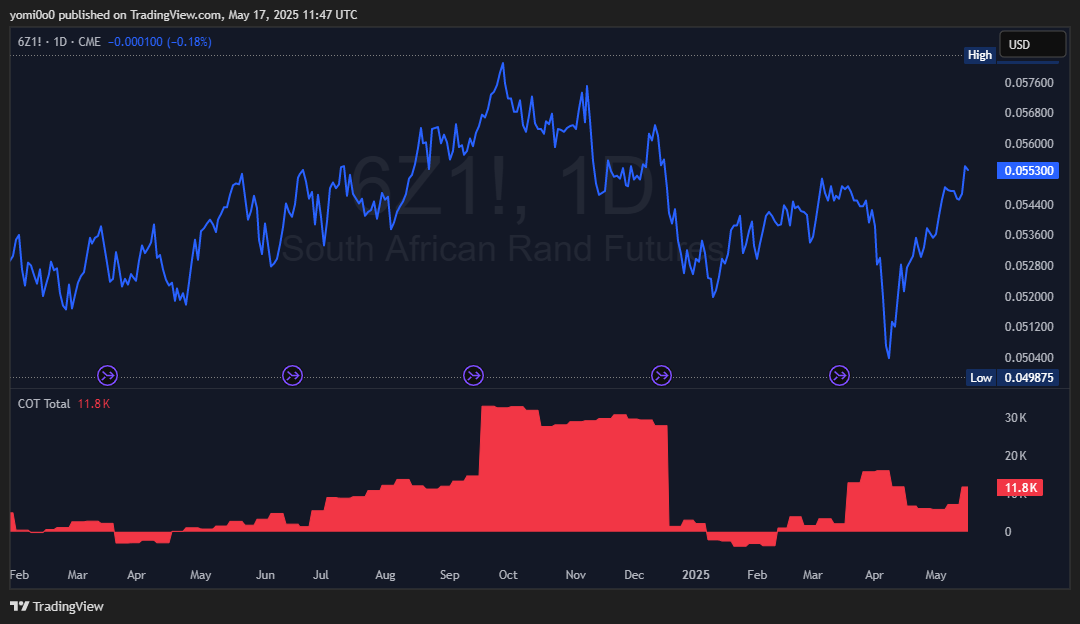

Any view on AUDCHF vs AUDJPY? Thanks