FX Context | Opening Gambit - April 28, 2025

Evolving Markets, Evolving Team: A New Chapter in FX Analysis

Hello MetaMacro readers,

Its with great pleasure to introduce Yomi to the team.

Yomi will cover the FX market specifically, and hopefully the team collectively continue to provide value to its readers.

Macro developments have brought a substantial amount of unprecedented patterns in price movements to the markets. This occurs so frequently that it’s becoming the new normal. No one is shocked anymore by a positive stock-bond correlation or by large divergences between bond yields and currencies.

One thing hasn't changed, though: market participants. They continue to react to narratives in ways that overstate the consequences of events. Over time, however, usual patterns and corrections return due to the inherent functions of assets. Bonds will eventually rally on bad hard data or rate cuts, as they are safe-haven assets, and equities will find better prices to match current growth and valuations.

Thoughts on prices and levels

There has been some decline in the effects of Trump tariffs on markets due to the possibility of de-escalation. Both Trump and Scott Bessent has commented on these possibilities and there's been some pushback. However there is no actual meaningful reversal in market prices on the de-escalation and after the 90 day pause.

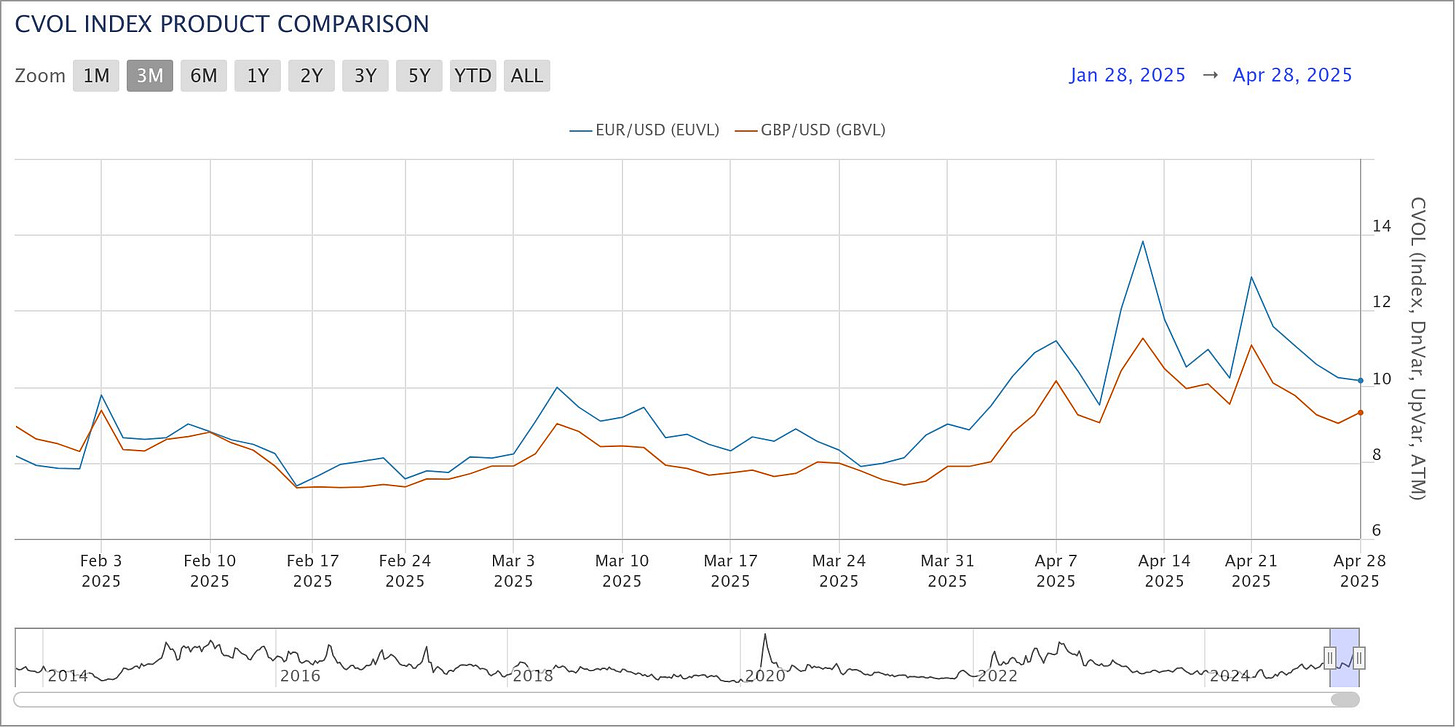

FX remain at the bottom of their range. Implied volatility has declined marginally, although it is still elevated by historical standards, while skew remains very much at the top of its range.

This shows the tension thus market participants are buying protection. The risk off vector still exists, just not as substantial as before. The decline in the Dollar, stemming from the extrapolation of the effect in trade tensions. We think that for the Dollar to continuously decline, we would require a new catalyst stronger than the current trade tension, or an aggressive shift in the current stance of trade policy decisions made in the past few weeks, that has tilted risk sentiments positively:

There's been a shift in net positioning. Speculators are now net short the dollar while it's at the bottom of its range:

Growth forecasts have been lowered but still positive and there isn't much impetus to lower rates:

Even if the United States experienced rapidly falling inflation alongside a few expected rate cuts, it still wouldn’t be able to significantly lower the dollar’s price from current levels.

The UK, on the other hand, has posted higher growth forecasts and sticky CPI compared to the US. This dynamic—along with the UK’s relative insulation from tariffs—has driven the recent Pound rally. There is far more weighting on the "insulation" factor than on sticky CPI, as evidenced by bond yields falling even as the pound rallied.

Notably, the pound’s extended rally began around the same time the Euro topped:

Coinciding with a top in implied vol in both currencies on April 11:

The euro retraced far lower than expected and a lot less lower than the Swiss Franc, thereby driving the EURCHF cross higher:

The EUR/CHF rally is most likely a result of asymmetry to the downside between the respective currencies and the degree of retracement each can undergo, rather than any inherent divergence in fundamentals. There isn't much fundamental divergence between the Euro and the Franc: both are in their rate-cutting cycles, and both served as safe havens during the tariff scare.

The Yen, however, did not act as a safe haven during the tariff scare. Context on this was provided in my last report before transitioning to the MetaMacro Team:

We shorted the Yen via GBPJPY Longs:

Bottom up view on the Yen is definitely bullish but we are not seeing flows or price action respond to this

A very interesting currency is the Canadian dollar. The BOC has lowered interest rates the most among the G20 in the rate cutting cycle bringing it closer to achieving neutral (rates neither stimulative or restrictive). As this happened speculators reduced their short positions in the Canadian Dollar substantially from the extremes:

This confluence makes the cad very tradable to both the upside and the downside

Tactical play

Long EURCHF

This would have obviously been beneficial if it came far earlier than now. We still feel both currencies has to take a breather. So a retracement to 0.937 or just a choppy range as both currencies are in a downtrend:

Market participants could also push the Euro price up till Friday to hedge for a upside surprise in CPI

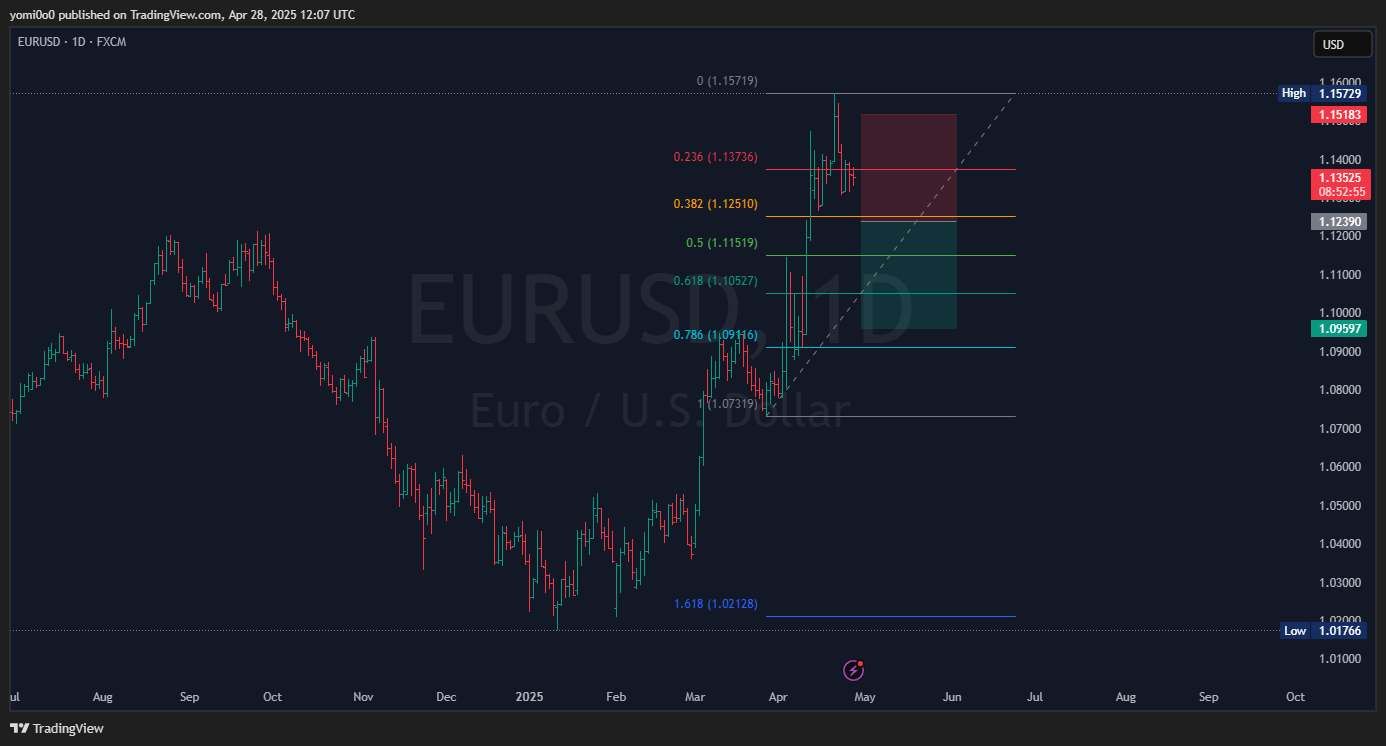

Short EURUSD

Price breaking below the 0.382 fib level would confirm our thesis on a substantial tariff scare reversal

We have both the EU and the US reporting growth data on Thursday. This is unlikely to be a disruption in the current market direction, as both reports are unlikely to deviate significantly from consensus. NFP and Unemployment for the US on Friday could lead to some revaluation on policy pathway.