To succeed as an active manager in a shifting macroeconomic regime, identifying opportunities is critical for wealth allocation and generating exceptional returns. This primer provides a foundational introduction to trading Equity REITs and highlights the key variables that influence price movements, enabling analysts to capitalize on market dynamics.

This primer is structured as follows:

Introduction to REITs

Income Sources of REITs

Type of REITs

Capital Structure of REITs

Debt and Equity as Funding Sources

Impact of Economic Factors on REIT Capital Structure

Role of Credit Spreads and Economic Sentiments

Valuation Function of REITs

Return Drivers and Risk Factors

Equity REITs Sector Overview

Interest Rate Impact on REIT Sectors

Case Studies

2008 Financial Crisis

2020 Covid Lockdown

2023 AI Thematic Rally

Brief Macro Outlook and Positioning

Introduction to REITs

REITs (Real Estate Investment Trusts) are pooled investment vehicles, similar to mutual funds, that allocate capital into real estate assets. Their structure includes key participants such as the Manager, Unit Holders, Trustee, and Property Managers. The Manager oversees the investments, the Unit Holders provide the capital, the Trustee ensures that the REIT operates in the best interests of the Unit Holders, and Property Managers handle the day-to-day management of the real estate assets.

The Unitholders are essentially shareholders who invest in a REIT with the aim of earning returns, which are distributed to them as dividends. Once the funds are invested, the Trustee ensures that the REIT's operations are conducted in the best interest of the unitholders, and the Trustee earns a fee for overseeing these activities.

The manager of the REIT provides management services by allocating unit holder funds into real estate properties with the goal of generating returns on these investments. In exchange, the manager earns a management fee and distributes profits to unit holders in the form of dividends. Additionally, a property manager is hired to oversee the day-to-day management of the real estate assets, for which they earn a property management fee.

A REIT primarily earns two types of income:

Rental Income proceeds from the real estate properties invested in by the REIT

Capital Gains from sales proceed of real estate properties in the portfolio.

Furthermore, there are majorly two types of REITs:

Equity REITs: Equity REITs focus on acquiring, managing, developing, renovating, and selling real estate properties. They generate income primarily through rental revenue from the properties they own and manage, as well as capital gains from property sales. Equity REITs typically invest in various property types, such as residential, commercial, or industrial, and play an active role in property operations and value enhancement.

Mortgage REITs: Mortgage REITs (mREITs) focus on earning income by borrowing money at short-term interest rates and lending to real estate owners or investing in mortgage-backed securities (MBS). These loans are typically collateralized by real estate properties. Unlike Equity REITs, mREITs do not prioritize asset ownership; their primary objective is to profit from the spread between the interest rates at which they borrow (short-term) and the higher interest rates they charge on the mortgage loans or earn from MBS investments. This spread, or margin, is the core of their business model.

There are other types of REITs but these are the major focus for now.

Capital Structure of REITs

If you recall, the unitholders in REITs earn returns primarily through dividend payments. In the U.S., most REITs operate as tax-exempt entities, provided they distribute 70-90% of their income to shareholders in the form of dividends. This requirement typically results in a high dividend payout ratio and yield, making REITs an attractive option for income-focused investors.

The capital structure offers valuable insight into the funding sources of REITs. By analyzing the capital structure of these assets, we can gain a comprehensive understanding of how economic data influences the movement of the underlying asset—primarily Equity REITs in this context.

At the core, REIT holdings consist of illiquid assets tied to the property markets, making them vulnerable to economic fluctuations. REITs primarily source their funding through two key channels:

Debt

Equity

The decision on raising debt as a form of leverage to finance the business operations takes into consideration the following factors:

Risks associated with the firm

Asset & Liability Matching

Earnings volatility,

Duration/Maturity Profile of the Debt Structure

Risk Free Rate

Credit spreads

All of these factors are taken into consideration when REITs are raising debt capital or to evaluate their impact on the debt liability in their balance sheet.

Debt and equity are fundamental capital sources for REITs, acting as their financial lifeblood. If a REIT holds unsecured debt and there is a rise in credit spreads due to market sentiment of widespread credit defaults, this can impair the REIT’s ability to secure additional capital for new investments. Such challenges can negatively affect earnings and returns to unitholders, which, in turn, can lead to a decline in the REIT's equity share price as investor sentiment turns bearish.

Overall, the asset price of a REIT reflects both the current and anticipated future conditions of its business. Valuation for REITs operates similarly to broader equities, particularly in relation to bond yields. When bond yields increase, REIT valuations typically decrease, and conversely, when bond yields fall, REIT valuations generally rise. This inverse relationship is akin to the Discounted Cash Flow (DCF) valuation model, where changes in bond yields impact the discount rate applied to future cash flows, thus affecting the REIT's valuation.

The key valuation variables in the REIT market include the Market-to-Book Ratio, which provides insight into how the market values the REIT relative to its book value. Additionally, constructing a view on cash flow and the growth prospects of the REIT is crucial. These factors are interconnected with various performance metrics such as:

Asset Tangibility: The proportion of physical assets versus intangible assets.

Firm Size: The scale and scope of the REIT’s operations.

Growth Options: Potential for future growth based on current investments and opportunities.

Profitability: Overall financial performance and efficiency in generating profits.

Interest Coverage Ratio: The ability of the REIT to meet interest obligations from operating income.

Operating Metrics:

Funds From Operations (FFO): A key measure of cash flow, excluding gains or losses on sales of properties and depreciation.

Earnings Per Share (EPS): The portion of a company’s profit allocated to each outstanding share of common stock.

FFO Yield: The yield derived from FFO relative to the REIT’s market price.

Margin on Operating Income: The profitability ratio reflecting the REIT’s income from operations relative to its property investments.

These metrics provide a comprehensive view of a REIT’s financial health, performance, and potential for returns.

Return Drivers and Risk Factors

By analyzing the capital structure of REITs, you can develop insights into the asset pricing model that influences the discounted expected future value of the firm. This understanding helps in generating strategic positioning ideas based on how various factors affect the valuation and performance of REITs.

On a foundational level, the following factors are key:

Interest Rate

Expected and Unexpected

Term Structure Spreads of Interest Rate

Inflation Levels

Expected and Unexpected

Risk Factors:

Market Exposure (Index Sensitivity)

Interest Rate and Credit Default Risk - more impact on Mortgage REITs

Inflation Risk

If we layer these macroeconomic factors with fundamental industry data, we can craft powerful, data-driven insights that guide allocation to Equity REITs. Understanding the broader economic environment—such as interest rate changes, inflation levels, and market sentiment—enables us to anticipate shifts and identify key opportunities for positioning within specific REIT sectors. Before diving into the current market performance and forward-looking strategies, it's essential to examine the various REIT sectors, each with its own unique characteristics and sensitivity to macro trends.

Equity REITs Sector Overview

Industrial REITs: Primarily focus on investment in industrial buildings by owning, managing, and renting space in industrial facilities such as warehouses distribution centers and pharmaceutical and scientific facilities.

Office REITs: Own and manage offices and lease space in office real estate, ranging from urban to suburban office buildings

Retail REITs:

Malls: Focuses on investment in malls

Strip Centers: Focuses on investment in small and local/community shopping centers

Factory Outlets: Focuses on outlet centers, where national brands sell merchandise products

Residential REITs:

Apartments: Focuses on investment in multi-family dwellings

Manufactured Homes: Focuses on investment in manufactured home communities for individual households

Hotels/Lodging REITs: Focuses on investment in hotel or resort properties

Self-Storage REITs: Own and manage rental storage facilities

Diversified REITs: Focuses on investment in diversified property types

Healthcare REITs: Focuses on investment in properties used in the healthcare industry such as hospitals, assisted living facilities (senior housing and nursing homes) and healthcare laboratories

Specialty REITs:

Net Lease: Leases properties on a long term basis with the tenants responsible for upkeep and expenses of the property

Timber: Own and manage a variety of timberland properties, with revenue sources from the sale of lumber and wood products

Tower: Own and manage facilities specialized in telecommunications, towers, fiber cables and wireless infrastructure

Data Center: Own and manage facilities that store data and provide computing and communications facilities for tenants

Overlaying the interest rate factor, which plays a significant role in the capital structure of REITs, reveals that different REIT sectors exhibit varying degrees of sensitivity to changes in interest rates. This variation is largely due to the differences in maturity and duration profiles within their balance sheets.:

There are numerous long/short trading and investment opportunities across the REIT sector. By contextualizing these opportunities from macroeconomic, thematic, and fundamental perspectives, we can enhance our strategic advantage. To illustrate this, let's examine a few case studies.

Case Study: 2008 Financial Crisis

In 2008, during and following the Global Financial Crisis (GFC), the housing market faced significant disruptions. Real estate properties, particularly Office and Residential REITs, were adversely affected, experiencing notable declines in value and performance:

Case Study: 2020 COVID Lockdown

Similarly, during the COVID-19 lockdown, as economic activity was confined to homes and offices, various REIT sectors experienced a broad sell-off. The demand for certain types of REITs declined, leading to a decrease in asset pricing and a reduction in their overall market value.

Case Study: 2023 AI Thematic Rally

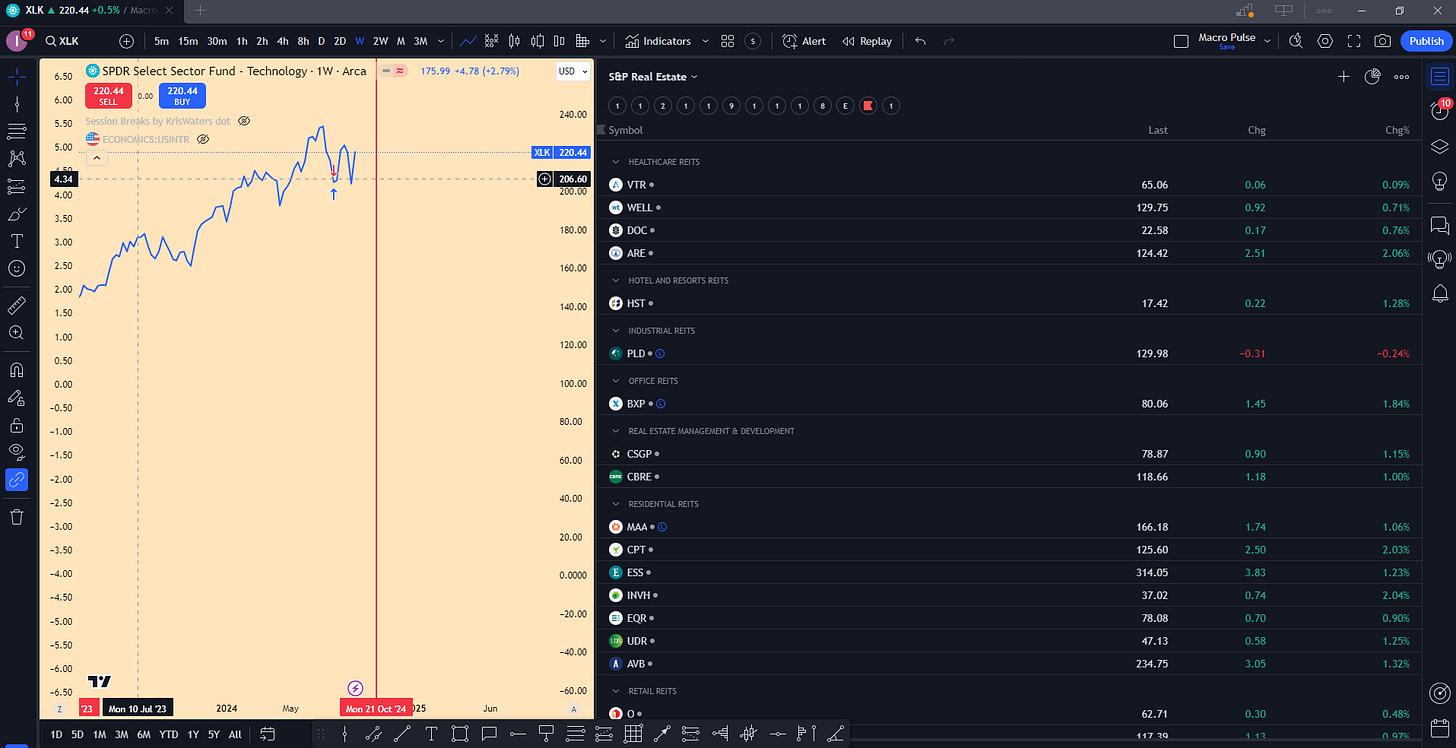

Recently, the AI thematic rally has significantly impacted the broader equity and technology indices. As AI innovation accelerates, there is a growing demand for Data Centers, leading to a corresponding rise in the demand for Specialty REITs that focus on data center investments EQIX 0.00%↑ and DLR 0.00%↑ . The chart below illustrates a noticeable correlation between the rally in the Technology ETF XLK 0.00%↑ and the increased performance of Specialty REITs.

The REITs market are very much interconnected, with correlations across multiple sectors, see correlation matrix below:

Brief Macro Outlook and Positioning

I have shared my macro outlook for the month of September, an additional update with recent macro data releases this week will be provided. However, I had expressed my allocation views to Utilities and Real Estate:

Macro Pulse: September

Towards the end of the month of August, I shared my views on where I think we are across the macro regime, and my sector focus within the equities market:

With this primer, you can start to build some views around allocation to specific REITs sector, I already have the S&P Real Estate Members on my TradingView:

But in terms of views going forward as we pivot into a monetary easing regime, attributable to the expected rate cut by the Fed next week, we should start thinking on how to position into that narrative:

Despite concerns about a potential recession and economic slowdown due to labor market tightening, the Real Estate, Utilities, and Healthcare sectors have demonstrated significant positive returns. In my September Macro report, I indicated that we are not currently in a recession. Therefore, there is no compelling reason to adopt a short position in the equities market at this time.

As we approach the first rate cut, we are beginning to observe inflections in the equity markets, with real estate emerging as a prominent sector of interest. Specific real estate names have started to reach their lows since the Federal Reserve held rates steady and market sentiment shifted towards a more dovish stance:

Overall, the outlook remains positive. I have outlined key variables to consider and how to integrate them to generate signals. Additionally, I have provided guidance on focusing on specific REIT sectors and strategies for developing informed investment views.

As always:

I will continue to optimize my information flow and pay attention to what is important right now even if everything is quantifiable.

Great break down of equity REITS! Good work