Assessing the USDA World Agricultural Supply and Demand Estimates on Sugar, its supply and stock-to-use ratio, the United States has raised sugar supply by 190,000 Short Tons Raw Value (STRV) in Jan’24 increasing its forecast on a record-high sugar production of 14.54million. There has also been a reduction in Mexico’s production, however, the US has increased its exports to Mexico from 60,000 STRV to 160,000 STRV. However, stock-to-use ratio still remain elevated at 13.7% despite reduced production in Mexico.

In addition, Cane Sugar production has also increased significantly with cumulative sugar extraction increasing from 13.79% in Sep’23 to 15.28% in Nov’23 and expected to remain marginally elevated at current levels into 2024, while still above 10-year average of 14.5%.

In summary, Sugar supply is elevated, with increased stock to relative usage ratio over the past 2 years.

Seasonal Tendency and Technical Analysis

Sugar has a strong bearish seasonal tendency in the month of April.

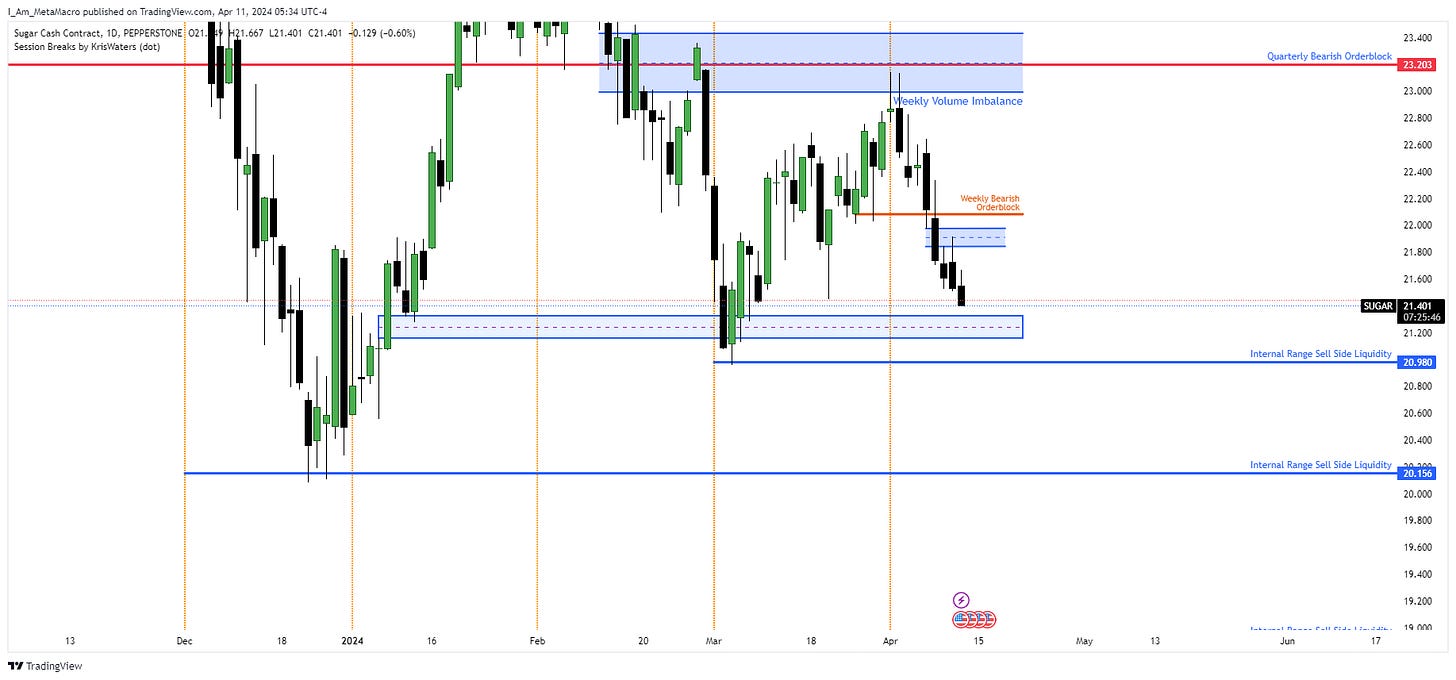

Sugar made an high around Q4’23 and has declined towards the year end 2023. In 2024, we had a repricing into premium levels and a continuation lower. In March we see a relatively tight range almost similar to seasonal tendency price movement in March.

Zooming into April, I expect a sell side delivery lower into the 20.98 levels. It could extend lower, but that’s primarily the target. The short idea becomes invalid, if price trades above 21.919 level.

Outlook: https://www.ers.usda.gov/webdocs/outlooks/108308/sss-m-425.pdf?v=3049