It has been a difficult week, but as we move into a new week, I would offer this dialogue from Fyodor Dostoevsky:

Man is a mystery. It needs to be unraveled, and if you spend your whole life unraveling it, don't say that you've wasted time. I am studying that mystery because I want to be a human being.

With that said, we focus on what’s next in front of us.

A quick review on positioning before proceeding into my thoughts on positioning into the new week and the month as a whole.

The FXY Yen Long trade failed, as the newly elected PM stated that the BoJ should be cautious with hiking rates and to consider if that is really the best course of action for the economy. This comment paired back broad market sentiment bets around the rate hike, with a significant portion of positions being unwound. The key learning point here for me, was that despite a global monetary easing, I took a bet on Japan being contrary and it failed:

Post-NFP I also closed out gains in Utilities, the Utilities sector play held since August:

I was long an Energy ETF last week before the further exacerbation of the Geopolitical tension and I am still long on Silver:

Real Estate Play also held since September, 1 running position ITM and a booked loss on the other:

Themes in Play

For the past couple of months, positioning has been anchored around the rate cut and goldilocks. However, with the Fed proceeding to cut rate by 50bps in lieu of being focused on the Labor market, and with communicated confidence that inflationary pressures has been reined in and well on its path to the Fed 2% target.

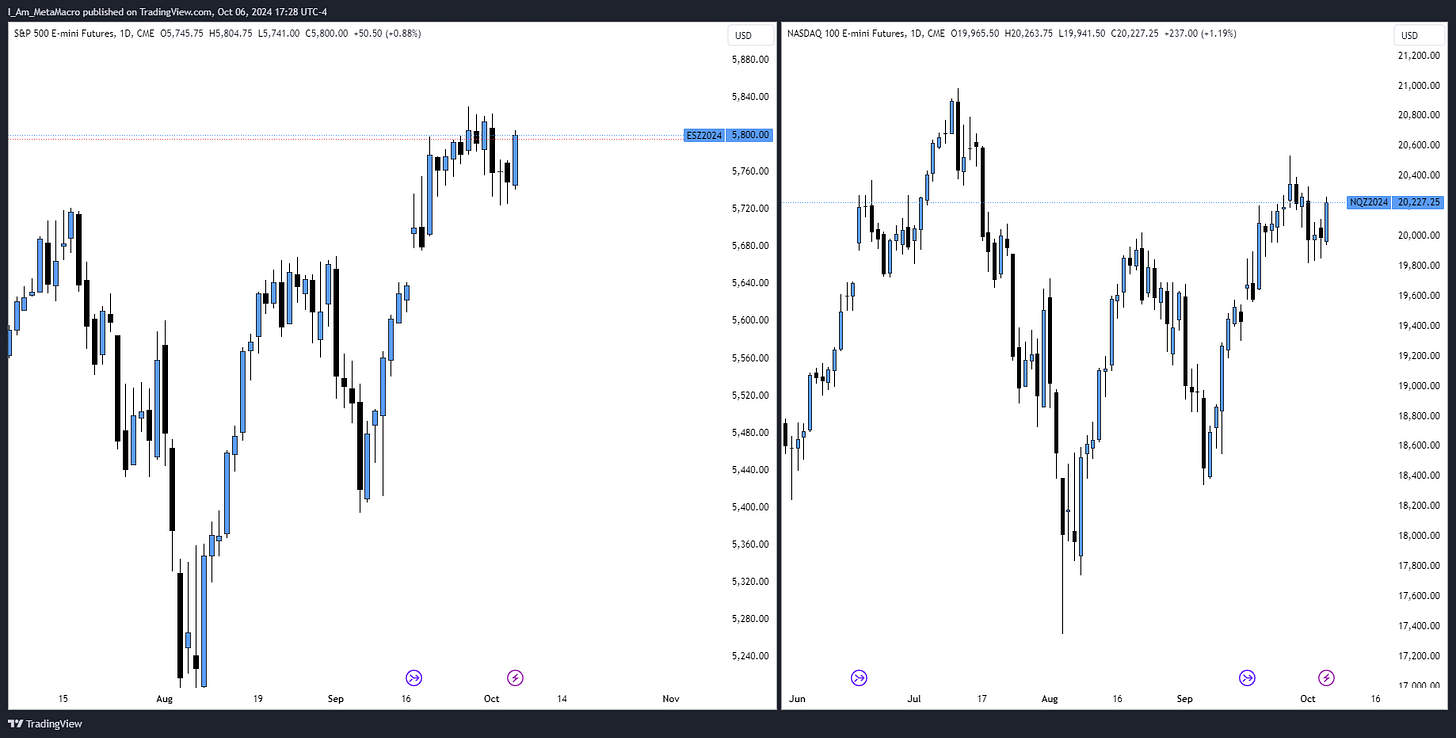

The S&P500 rallied to ATHs, while NASDAQ and RUSELL2K hasn’t exactly shown that strength. The current risk around the Fed mandate being explored is around reinflation, and for the Fed cutting rates by a huge 50bps as opposed 25bps. This view was relatively reinforced by the NFP data earlier in the week and declining unemployment rate indicating that the US Labor market still remain very strong and no imminent risk of a recession.

The market doesn’t exactly seem to be pricing in the strong positive Labor market data in a positive bias, neither is it pricing it in from a negative bias also:

Some of the losing positions on the equity end on my book has been from the expansion of positive rate cut reaction within the mid and small cap amidst strong labour market data. However, that hasn’t exactly been the case, neither does it mean the trade thesis is invalidated, the data still support it, and I think its a matter of timing and other factors in play.

The other factors in play being:

US Election

Geopolitical Tension

China Stimulus

Japan Rate Hike Push-Back

The US election is due in November just couple of days from October, and the market is likely to stay in check until volatility kicks in post-election. However, Geopolitical tension has risen on the radar in the middle east which has direct link with the Commodities market(Crude Oil and Safe Havens - Gold and Silver):

Crude Oil Volatility Index has been rising since mid-august, but the market was discounting the risk due to abundance of supply and OPEC policies to not impose cuts, which has subdued the prices of crude oil, and also explains the lagging return from energy sector.

However, with continuous escalation on the geopolitical front, an opportunity exists in the Energy sector.

Additionally, China round of Stimulus continue to have positive impact on industrial metals commodities and global liquidity. Also with the commentary by the PM on the push-back from hiking rates, the Nikkei rallied and if this same stance continues we could see another bullish run in the Japanese Equity markets:

Positioning Strategy

Based on the themes highlighted:

Geopolitics (Energy & Commodities):

Energy Stocks: Oil and Gas Exploration, Security , Natural Gas and Renewable energy

Indices: S&P GSCI Crude Oil, Petroleum, Energy and TSX Canada Composite Energy

Aerospace and Defense

Defensive: Utilities and Independent Power & Renewable energy stocks in US and Canada

China Stimulus:

Commodities: Metals

Sector Indices: Industrials and Industrial Materials, Mining Sectors

Japan Rates Play:

Long Nikkei

Re-inflation Theme:

Look out for commodity ETFs, but first will wait for this week CPI report to attribute the driver of re-inflation, if inflation print doesn’t show sign of disinflation.

Overlay Factor Profile across themes:

Growth

Value

High Dividend Yield

Low Beta

Enhanced Value