Primer: Trading Emerging Market FX

A Framework for Navigating Emerging Market FX, Rates, Credit and Equities.

I had a split thought on whether this should be an educational primer or practical delve in, such that a model can be built around this to operate in Emerging Market FX (EMFX).

There are quite a number of resources that serves as a complete guide to trading EMFX, this report will be succinct but provide actionable connection as the MetaMacro team expands its FX coverage from Majors and Crosses across G10s into the Emerging Market.

Introduction

The FX market is a critical component of the financial market cause it also links with the bond market (local and international credit), equities and rates. Understanding the framework around this offers plethora of opportunities and a unique lens towards trading Emerging Market FX.

The team already have a model approach to trading FX, the unique characteristics of EMFX will be taken into consideration to be meshed into our existing model for G10 FX.

Understanding Emerging Markets

Emerging Market(EM) are countries that are currently on the pace of rapid economic development often characterised by:

Economic growth and growth potential

Volatile macroeconomic environment

Lower level of economic development

Additionally, there are also evidence of improvement in government polices favouring economic liberalisation and the adoption of a free-market system which are often characterised by:

Increased inflow/outflow of foreign direct investment

Growth and development of Factor markets

The EMFX market has developed significantly, since the 1990s, it has also become a major component for the debt market of Emerging Market (EM) economies. For investors aiming to diversify their portfolio across geopolitical borders, the FX market serves as the entry point especially for Foreign Portfolio Investors to exploring international opportunities.

EM Groupings and Countries

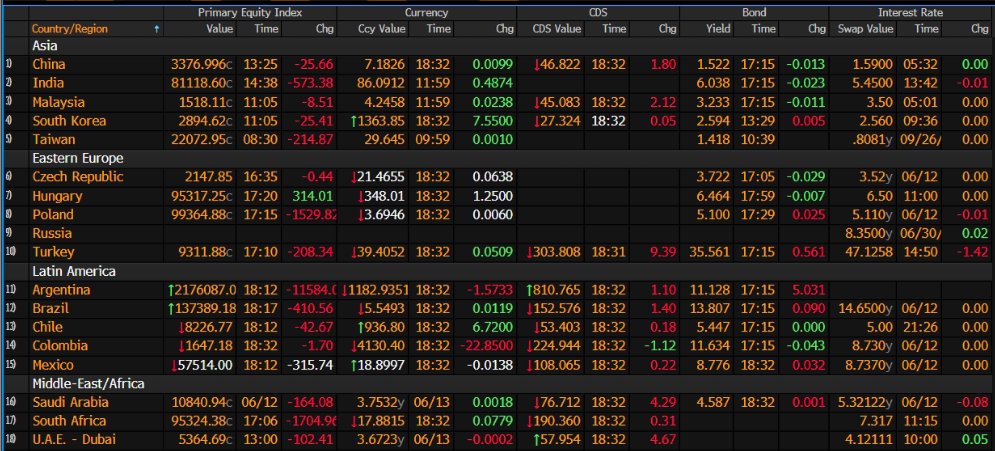

Trading EMFX has increased significantly amongst hedge fund, prop firms and investment banks as growing appetite of global investors for EME assets increase. While there are wide arrays of EM countries:

There are some uniquely focused countries that are categorised as EM within the Asia, Africa, Middle East, Caribean, Central and South America Region, via acronyms as follows:

BRIC - Brazil, Russia, India and China

MIN - Mexico, Indonesia, Nigeria

Others - Bangladesh, Egypt, Indonesia, Iran, South Korea, Pakistan, Turkey, the Philippines

While most of these countries do not include all or some other major Sub-Saharan Africa (SSA) EMs such as Angola and Kenya amongst others. Each of these countries play a role in globalisation and international trade, and thus they pique the interests of institutional players in the financial market and subsequently speculators.

Amongst the EM countries, the BRIC nations take central focus in the market flow dynamics into EM financial assets, which are also contingent on macro conditions within the US financial market. Hence, they are not exactly isolated from the global mechanics of macro. What impacts the US Economy, spills over into the BRIC nations and subsequently into other EM countries.

As an illustration, the MSCI Emerging Market Index is a universal way to gain exposure to the Equities market of EM:

The countries in the MSCI Emerging Market Index is also a good barometer to classify EM economies or to build a universe of countries to consider investing in:

With the background on the EM countries, let’s delve into the structural trading aspect on how to approach this segment of the market.

Trading EM: Global Macro Approach

Trading EM is no different from how we trade the G3 countries across equities and FX. An approach of Macro Systematic and discretionary thinking offers some edge, and the same macro approach is applicable.

Given that there are multiple EM markets, the global macro environment has a higher weighting component than the local environment almost on a 70-30 ratio. The combination of both aids in relative value decisions between multiple EM countries to decide where to allocate funds into.

On the global macro perspective, the first layer is building a view on the major US macro instruments:

Currency:

Dollar Index

Rates:

Fed Fund Policy

STIR

Credit Market and Spreads:

Investment Grade

High Yield

Commodity Market

Agriculture

Energy

Metals

Equity

S&P500

Volatility

VIX

The performance of EM markets are tightly connected or correlated to the US market. Primarily because they are the funding source for liquidity/investments into EM markets for Foreign Portfolio Investment(FPI) and Foreign Direct Investment(FDI). Thus, the factors that impact the availability of aforementioned liquidity also impact flows into the EM market.

When evaluating the transmission effect of the macro variables into an EM economy, we need to conceptualise the flow into EM assets.

EM Asset Classes

The major EM assets in focus are:

EM FX

EM Rates

EM Debt

EM Sovereign Credit

Eurobonds(USD, EUR) and Local Bonds

EM Corporate Credit

Investment Grade

High Yield

EM Equities

Our focus is on FX and Equities broadly at MetaMacro, but understanding the lever across board also provides an edge in framing the flow into FX and Equities, hence no asset class lives entirely in isolation.

EM Assets and US Rates

Back to the Global Macro. The first layer is understanding the policy regime of the US Federal Reserve, how that transmits into the Short Term Interest Rates (STIR) market and correspondingly positioning in the Dollar.

Understanding the current macro regime whether expansionary or contractionary on the Growth, Inflation and Liquidity spectrum and how it connects to the US Rates front is key to deciphering the spillover effect of funds into other markets outside the US economy, and more specifically the EM economy.

Deconstructing the yield curve for the US Treasury market and the spreads across the curve, as they connect to the macro hypothesis in play, within the US economy. The fundamental idea here is to understand the rate policy and potential pathway, and how it transmits into the EM Rates market:

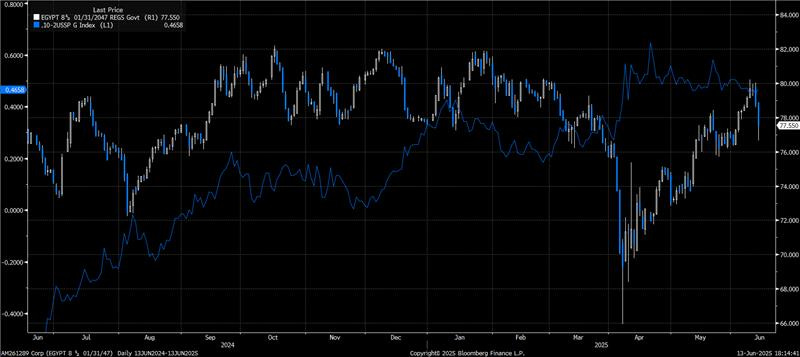

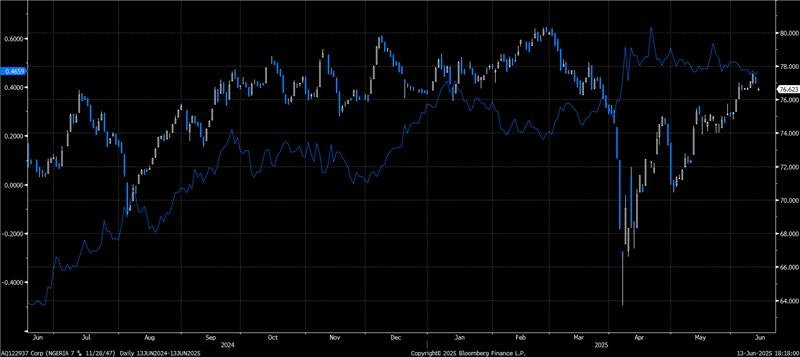

Above is a classic example of the spread between the US10s and US2s, recently the context has been how the yields on the long end of the curve has been rising due to sticky higher inflation expectations, as the curve continues on a bear steepener. When the spread widens, we saw a correlating decline in the price of Angola Sovereign Credit (USD) and when the spread stabilised between late April’2025 into May’2025 the price rose as yields decline for Angola Sovereign Credit(USD)

Similar example is shown below on Egypt and Nigeria Sovereign Credit (USD) :

The central tenet is to be able to frame the behaviour across the yield curve to macro factors in play and how that could potentially impact the fed policy and expectations for rates in the US, then connecting the transmission effect into EM Rates market. The spreads we actively track for the US markets are:

Policy/Growth: 02s10s

Policy/Inflation Expectations: 02s30s

Macro Caution: 05s30s

Duration Demand for Hedging Risk: 10s30s

Sensitivity to Rate Path: 03ms02s

Timing: 03ms10s

Policy Pivot/Business Cycle Turns: 02s05s

Quantitative Easing/Fiscal Premium: 05s10s

Short Term Rate Vol: 10s02s

Positioning/Flow: 07s10s

Duration Demand/Risk Asset: 20s30s

EM Assets, Currency and Commodity Dynamics

The other component is connecting the Currency leg into EM FX market. The golden rule when trading US Currency Index for positioning in EM FX market is that: Weaker USD leads to Capital Inflows into EM and Stronger US leads to Capital Outflows out of EM. While this is the golden rule, there are also other components related to the Dollar that impact the dynamic of these flows, which is primarily connected to the Commodity market and how it impacts the terms of trade for EM countries.

It is important to understand the capital structure of EM countries by evaluating their Balance of Payments, Terms of Trade and National Income Accounts. This would provide insight on the fundamental driver of the economy from a macro perspective, and this also relates more to the commodity drivers of certain EM economies.

A case in point is by reviewing the products that are being exported or imported by respective countries and how they connect to the commodity market, then mapping out the impact on other asset classes. Angola for example has a large exposure to Crude Oil related product:

Brazil on the other hand has more exposure to Agriculture related commodities:

On effectively linking the commodity component, it is important to classify EM countries into Net Exporter or Importer (Producer/Consumer) of commodities, as the performance of respective commodities also flow into the performance of EM countries. Furthermore, understanding commodity price cycles aid in contextualising the relationship between the government primary balance and its commodity export/import.

We monitor the commodity price cycles via the following sub-asset class and index:

Goldman Sachs Commodity Index

General Index

Energy Index

Agriculture and Livestock

Precious Metals

Industrial Metals

Crude Oil

Agriculture & Livestock

Industrial Metals

Precious Metals

The fundamental idea is that commodity dependent sovereigns may feel the impact of commodities boom and bust across the economy, at first through their balance of trade, government fiscal position, FX reserves and subsequently their economic growth. All of the net transmission effect is then reflected or priced into various EM asset class.

The systematic approach here is to identify and quantify a country's commodity exposure and assess how it influences growth through GDP. Take Angola, for example, a crude oil exporter. A breakdown of its Real GDP by contribution reveals oil as a primary growth driver. Consequently, a significant decline in crude prices would impact its trade balance, erode FX reserves, and weaken overall growth conditions. These macro pressures typically manifest in the country’s currency. (However, it’s critical to also factor in the prevailing currency regime, as this shapes how such shocks are absorbed and transmitted.):

As part of the macro framework, it is essential to break down a country's total exports and imports by commodity type. This decomposition offers insight into how fluctuations in commodity price cycles transmit into the performance of EM assets. For instance, a rally in crude oil prices may justify a long position in oil exporting EM currencies against the dollar, or alternatively, a short position in oil importing EM currencies, depending on the directional bias of the trade.

Lastly, Volatility, as captured by the VIX index, is a key driver of performance in EM rates and broader asset pricing. Fluctuations in VIX often coincide with widening U.S. HY credit spreads, both of which serve as proxies for global risk sentiment and liquidity. These dynamics exhibit measurable correlations with EM FX depreciation and sovereign spread widening, making them critical variables in EM risk modelling.

Trading EMFX

The principles at play here stem from a top-down global macro framework, with EM FX influenced by a broad array of global factors, including risk sentiment, U.S. credit conditions, commodity cycles, and the interplay between U.S. and EM interest rates.

EM Rates and US Rates becomes critical for Long/Short Carry strategy, as funds flow into high yielding EMFX against low yielding EM FX.

Another key lens for evaluating and trading EM FX is through the risk components embedded in Global Equities, U.S. Interest Rates, and Commodity markets. These factors, when analyzed cohesively, form the basis for building directional views on both the broader EM economy and its currency.

Furthermore, during high-impact economic data releases, particularly from the U.S. and China, the model-based approach focuses on assessing the transmission effects across Equities and Credit markets, and subsequently how those impacts cascade into EM asset classes, including FX and Rates.

We hope this serves as an introductory guide into EM FX, as we publish reports on the asset class and further research on how we approach trading the markets from a macro perspective, the dots become clearer to connect.

Additional Resource:

https://www.researchgate.net/profile/Oliver-Hossfeld/publication/327573751/figure/tbl1/AS:669618502901768@1536660900593/List-of-emerging-market-economies.png

https://findresearcher.sdu.dk/ws/portalfiles/portal/146416150/Reviewing_emerging_markets.pdf

https://www.msci.com/documents/1296102/38312924/Sizing+Up+Opportunity+in+Emerging+Capital+Markets.pdf

https://www.msci.com/indexes/group/emerging-markets-indexes

https://www.msci.com/indexes/fixed-income-indexes

https://am.jpmorgan.com/us/en/asset-management/adv/products/jpmorgan-usd-emerging-markets-sovereign-bond-etf-etf-shares-46641q746

Latin America: https://www.msci.com/indexes/index/127273

https://info.loomissayles.com/meaningful-distinctions-emerging-market-corporate-bonds-versus-emerging-market-sovereigns

https://www.sipa.columbia.edu/sites/default/files/migrated/migrated/documents/Moodys_After%2520the%2520Commodities%2520Boom.pdf

https://www.theemergingmarketsinvestor.com/category/commodities/