Market Color | Opening Gambit- June 9, 2025

🚀 Stocks Soar, Tariffs Rise & The Fed Holds Steady—Game-Changer Ahead?

Hello, MetaMacro readers! Here’s to a fresh start and a great week ahead!

From record-breaking stock rallies to tariff tensions and central bank moves, last week has been a whirlwind for global markets. Are we seeing the start of a new bull run or signs of deeper volatility ahead?

Stay locked in as our market insights have everything you need to stay informed.

Weekly Economic Recap: Key Market Trends & Developments

Inflation & Economic Data: April’s core PCE inflation showed slight moderation at 0.1% m/m and 2.5% y/y, but tariffs and base effects may drive prices higher later in 2025. ISM manufacturing PMI fell to 48.5, signaling ongoing contraction, while construction spending declined by 0.4%, raising concerns about slowing growth.

Trade & Global Markets: The U.S. trade deficit shrank to $87.6B due to a sharp drop in imports and modest export growth, lifting Atlanta Fed’s GDPNow tracker to 3.8% (Q2). Meanwhile, China’s manufacturing sector remained in contraction, fueling speculation about potential stimulus measures.

Stock Market Trends: The S&P 500 surged 6% in May, its best month since 1989, fueled by optimism over Trump’s tariff rollbacks. AI stocks soared, with Nvidia surpassing Microsoft in market value.

Tariffs & Trade Talks: Trump doubled steel tariffs to 50%, citing protection of U.S. industry, while legal battles continue over broader trade restrictions. The U.S. dollar weakened amid trade tensions but later rebounded as negotiations progressed.

Federal Reserve Moves: The Fed lifted Wells Fargo’s $1.95 trillion asset cap, marking a milestone in CEO Charles Scharf’s turnaround efforts. Policymakers remain divided on tariff-driven inflation, debating whether it’s temporary or requires caution.

Energy & Supply Chain Struggles: OPEC+ raised July oil output by 411K BPD, prioritizing market share over price stability. Meanwhile, supplier delays hit a three-year high, reflecting tariff-related disruptions.

Jobs & Consumer Sentiment: The University of Michigan sentiment index stabilized at 52.2, ending a four-month decline, though expectations remain weak. April job openings unexpectedly increased, suggesting labor demand resilience despite policy uncertainty.

Economic Uncertainty Weighs on Markets: The ADP jobs report and ISM services index disappointed, heightening concerns about slowing economic momentum and potential Fed policy adjustments.

Global Market Developments: China’s services sector expanded, but manufacturing contracted, impacting business sentiment and exports. A Trump-Xi call lifted investor confidence, while U.S.-Canada trade talks gained traction ahead of the G7 summit.

Central Bank Decisions: The ECB cut interest rates by 25 basis points, citing revised inflation forecasts and a weaker growth outlook.

Trade & Market Volatility: Tesla’s stock plunged 14%, weighing on Wall Street sentiment, while Japan’s household spending declined, reinforcing the Bank of Japan’s cautious rate stance.

Markets saw strong AI-driven stock rallies, trade tensions kept currencies volatile, and tariffs continued reshaping economic forecasts. We remain cautious, watching trade talks and inflation risks closely.

U.S. April Jobs Report: Mixed Signals as Wage Growth Accelerates

The U.S. labor market saw 139K new non-farm payrolls in April, slightly surpassing expectations (130K). However, two-month net revisions showed a downward adjustment of -95K jobs, indicating weaker prior estimates.

The unemployment rate remained steady at 4.2%, but the unrounded figure hit 4.244%, marking its highest level since October 2021. Labor participation dipped to 62.4%, down from 62.6% in March, suggesting fewer workers in the labor force.

Wages showed stronger-than-expected growth, with average hourly earnings rising 0.4% m/m and 3.9% y/y, exceeding forecasts and signaling potential inflationary pressures.

Private payrolls increased by 140K, beating estimates (120K), while manufacturing jobs declined more than expected. Government employment fell by 1K, reversing last month’s +10K gain.

A sharp drop in full-time jobs (-623K) contrasted with a modest rise in part-time employment, reflecting shifting labor dynamics. The household employment survey showed a steep decline (-696K), raising concerns about labor market softness.

While wage growth remains strong, declining full-time employment and labor participation suggest underlying weaknesses, keeping policymakers on edge ahead of upcoming Federal Reserve decisions.

Markets Surge as S&P 500 Nears Record High

Stocks closed last week on a strong upswing, fueled by a broad-based rally after the May jobs report reinforced investor confidence. All three major U.S. indexes posted weekly gains, with the Nasdaq Composite leading the charge, soaring over 2.3%. The S&P 500 climbed 1.6%, pushing within 2% of an all-time high, while the Dow Jones Industrial Average gained more than 1%, reflecting growing optimism across sectors.

With markets eyeing fresh records, economic data and Federal Reserve signals are closely watched for the next move. Momentum remains strong.

Will the rally hold, or is volatility lurking ahead?

Microsoft Reclaims Top Spot as World's Largest Company, Surpassing Nvidia

On Friday, Microsoft surged to a new all-time high, overtaking AI chip powerhouse Nvidia to reclaim its position as the world’s most valuable company. The tech giant’s strong performance reflects growing investor confidence in its cloud computing, AI advancements, and enterprise solutions, which continue to drive its market dominance.

Economic Calendar

Markets will be closely watching fresh updates on consumer and wholesale inflation for May, as we look for signs of pricing pressures and potential shifts in Federal Reserve policy. These inflation readings could provide critical insights into how costs are trending across businesses and households, shaping expectations for rate moves ahead.

Wrapping up the week, the University of Michigan’s initial consumer sentiment survey for June will be released, offering a first look at how Americans feel about the economy, inflation, and future financial conditions. This indicator will be key in gauging consumer confidence, which plays a vital role in spending and investment trends.

Earning Calendar

This week’s corporate calendar features a lighter slate of earnings, with GameStop , Oracle , and Adobe leading the lineup of quarterly releases. The market will be watching these reports for insights into retail trends, cloud computing growth, and software innovation, as market sentiment continues to shift.

Adding to the week’s buzz, Apple’s Worldwide Developers Conference (WWDC) is set to take center stage, drawing attention from tech enthusiasts and Wall Street alike. With expectations for major software updates, AI advancements, and potential new product reveals, the event could have far-reaching implications for Apple's future strategy and industry trends.

Equities Color

S&P 500 Index(SPX)

The S&P 500 crossed the 6000 mark and closed the week at 6000.37, rising 1.6% after Friday’s May jobs report provided a lift to investor sentiment. The market’s momentum was fueled by better-than-expected employment data, reinforcing optimism about economic resilience despite ongoing uncertainties.

With the index now sitting comfortably above the 6000 mark, traders are eyeing whether the rally will sustain or if upcoming inflation readings and Federal Reserve signals will introduce fresh volatility.

Dow Jones Industrial Average Index(DJI)

The same key factors that fueled investor flows into the S&P 500 also played a significant role in influencing the Dow Jones Industrial Average. Optimism surrounding economic resilience, strong earnings, and the latest jobs report contributed to broad-based market momentum, lifting both indexes.

US 100 Index(NDQ)

The NASDAQ Composite finished the week at 21,761.78, posting a 2.3% gain as investors reacted positively to the better-than-expected May jobs report. Strong employment figures helped boost market sentiment, reinforcing optimism about the economy’s resilience despite ongoing uncertainty.

The tech-heavy index benefited from broad-based buying momentum, with investors encouraged by signs of continued labor market strength. As markets digest the latest economic indicators, attention now turns to inflation data and central bank policy signals, which could shape the next moves in equities.

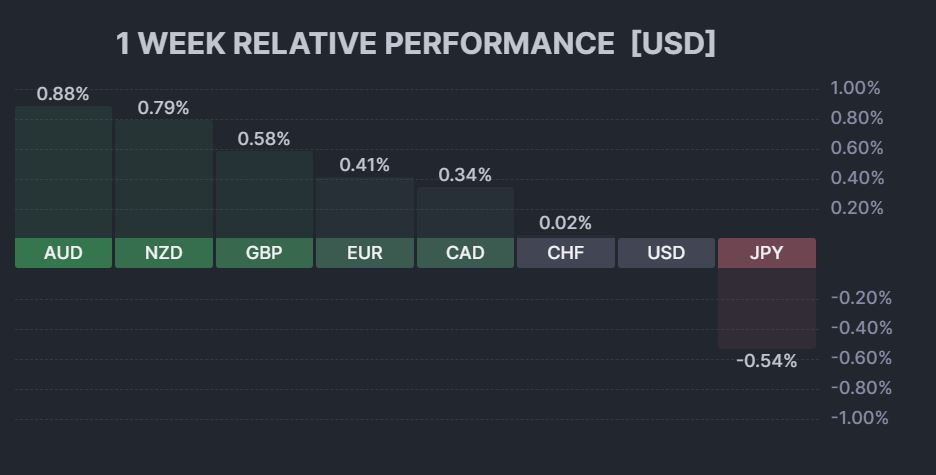

FX SNAPSHOT

The U.S. dollar strengthened across major currencies last week, posting the following increase

0.41% against the euro (EUR)

0.58% against the British pound (GBP)

0.02% against the Swiss franc (CHF)

0.34% against the Canadian dollar (CAD)

0.88% against the Australian dollar (AUD)

0.79% against the New Zealand dollar (NZD)

The U.S. dollar weakened by 0.54% against the Japanese Yen(JPY)

FINAL THOUGHTS

The week ahead brings crucial economic data, corporate earnings, and policy decisions that could reshape market sentiment. With inflation updates, Fed signals, and global trade developments on the radar, investors face a mix of opportunity and volatility.

Will the bull run continue, or are we heading for a new wave of uncertainty?

Content is for informational purposes only and does not constitute investment advice or a solicitation to buy or sell any financial instruments. MetaMacro makes no guarantees regarding the accuracy or completeness of the information provided. Unauthorized use, redistribution, or access to proprietary content is strictly prohibited. All information is subject to change without notice. Investments involve risk, including the potential loss of principal.