Market Color | Opening Gambit –June 30, 2025.

AI-Powered Rally Hits Record Highs, Shaking Off Inflation and Trade War Jitters

Hello Metamacro Readers ! Happy new week.

The global market finished last week like a high-tech engine bolted to a sputtering, analog chassis. In the cockpit, the AI-fueled technology sector engaged its afterburners, smashing through record altitudes with a conviction bordering on religious fervor. Yet, on the ground, the economic dashboard flashed a series of troubling warning lights: inflation remained stubbornly hot, the consumer engine was starting to misfire, and the geopolitical GPS was rerouting around a sudden trade war with a key ally. It was a week of profound cognitive dissonance, where Wall Street chose to listen only to the exhilarating roar of the AI boom, betting that its sheer velocity could defy the gravitational pull of a faltering real economy. The question now is not if the engine is powerful, but whether the frame can withstand the ride.

Sticky Inflation and Faltering Consumers Present Dilemma for Federal Reserve

The Federal Reserve's battle against inflation faced a setback in May, as its preferred inflation gauge, the core Personal Consumption Expenditures (PCE) price index, remained stubbornly above expectations. The annual core rate landed at 2.7%, slightly higher than the 2.6% forecasted by economists, signaling that underlying price pressures are persistent.

According to the Bureau of Economic Analysis report, the monthly increase for core PCE was a more moderate 0.2%. The overall headline PCE, which includes food and energy, rose just 0.1% for the month and 2.3% annually, meeting forecasts.

However, the report also revealed cracks in the economy's main engine: the consumer. Personal income unexpectedly fell by 0.4%, and consumer spending dipped by 0.1%, suggesting that high interest rates may be starting to restrain household finances.

This combination of sticky inflation and weakening consumer demand creates a complex challenge for policymakers. The data tempers the optimism that followed a softer-than-expected Consumer Price Index (CPI) report earlier in the month, reinforcing the Fed's cautious, data-dependent stance. As the Federal Open Market Committee (FOMC) weighs its next move, it must now balance the risk of persistent inflation against the threat of an economic slowdown.

S&P 500 Hits First Record High Since February, Reigniting Valuation Debates

Wall Street has officially broken out of its recent slump, with the S&P 500 surging to its first record-high close since the market's peak in early February. The milestone signals a powerful resurgence in investor confidence and a decisive end to the recent market turbulence.

However, this return to new heights brings a familiar and critical debate back into focus: market valuation.

With its latest surge, the S&P 500's price-to-earnings (P/E) ratio has once again climbed above its five- and ten-year historical averages. This means investors are now paying a premium for stocks compared to the prices paid over the last decade, reigniting discussions about whether the market has become overvalued.

As the S&P 500 charts new territory, the central question for investors is whether this peak is a sustainable plateau built on solid fundamentals or a precarious summit with a steep drop ahead.

Tech and AI Stocks Continue to Power Markets

The technology sector, particularly semiconductor stocks, was a major driver of market activity. Micron Technology (MU) surged after delivering a stellar earnings report and an optimistic forecast on Wednesday, citing booming demand for its high-bandwidth memory (HBM) chips used in AI data centers. This positive news lifted the entire chip sector and provided a strong tailwind for AI bellwether Nvidia (NVDA), which continued its climb and set new all-time highs during the week. The performance of these companies underscored the market's conviction in the long-term AI investment theme.

U.S.-Canada Trade Relations Plunge as Trump Kills Negotiations, Vows Imminent Tariffs.

In a dramatic escalation of trade tensions, President Trump announced on Friday an immediate halt to all trade negotiations with Canada, a critical economic partner. The move, which sent ripples through financial and diplomatic circles, was accompanied by a direct threat to impose a new round of tariffs on Canadian goods within the next week.

The sudden breakdown in talks was triggered by Canada's decision to proceed with a new Digital Services Tax (DST). The 3% levy, which applies to revenue generated from Canadian users by large technology firms, is set to affect major U.S. companies like Google, Meta, and Amazon. In a statement, President Trump characterized the tax as a "direct and blatant attack on our country."

This development abruptly derails months of diplomatic efforts aimed at stabilizing the crucial trade relationship, valued at nearly $3.6 billion in daily cross-border activity. For weeks, officials from both nations had been engaged in complex discussions to resolve existing disputes and navigate a landscape already complicated by U.S. tariffs on steel, aluminum, and autos.

Wall Street Shakes Off Trump's Trade Threats to Score First Record Close Since February

Wall Street ended a volatile week on a high note, with the S&P 500 and Nasdaq closing at new all-time highs despite a dramatic mid-session shakeup caused by geopolitical developments.

The market experienced a sharp, sudden dip on Friday afternoon after President Trump announced he was "terminating" trade negotiations with Canada, a move that introduced significant uncertainty into North American trade relations. However, the sell-off was short-lived. In a remarkable show of resilience, stocks staged a powerful rally in the final half-hour of trading to close at their best levels since early February.

This surprising strength was fueled by two overriding factors that ultimately trumped the negative Canadian news. Firstly, investor sentiment was buoyed by reports of a new trade framework agreement between the U.S. and China, suggesting a de-escalation of tensions between the world's two largest economies.

Secondly, and perhaps more importantly, the market's optimism was underpinned by growing expectations that the Federal Reserve will cut interest rates sooner rather than later.

The Second Wave of AI Investing is Here, And It's Not Just About Chips

While Nvidia continues to dominate headlines as the titan of the artificial intelligence boom, a powerful secondary trend has quietly emerged, signaling a significant broadening of the AI investment thesis. Since the market bottom on April 8th, the top performers in the S&P 500 have been dominated by companies that form the critical ecosystem surrounding the AI revolution.

This shift shows that investors are now looking beyond the primary chip designer to capitalize on the massive infrastructure buildout required to power AI. This "AI 2.0" trade is unfolding across several key sectors:

The Data Center & Chip Ecosystem: Recognizing that data centers are more than just one type of chip, investors have piled into companies essential to AI hardware. Chipmaker Broadcom, rival GPU designer AMD, and server specialist Dell have all seen their stock prices surge by approximately 70% or more as they capture a growing share of the AI infrastructure spend.

The AI Energy Trade: The immense electrical power required to run AI data centers has created a new and explosive investment theme. Energy producers like Vistra Corp and NRG Energy have become unexpected AI beneficiaries, with their stocks soaring over 80% on the thesis that AI's insatiable energy demand will drive significant future profits.

The AI Cloud Infrastructure: The AI revolution is built on the cloud, and companies providing the essential platforms are reaping the rewards. Enterprise software giant Oracle, for instance, has rallied more than 70% to reach all-time highs as its cloud infrastructure business experiences a massive influx of demand from companies developing and deploying AI models.

Economic Calendar

U.S. Labour Market in Focus: The week culminates with the U.S. Nonfarm Payrolls, Unemployment Rate, and Average Hourly Earnings on Thursday, July 3rd. A significant deviation from expectations could spark market volatility. Other key U.S. data includes the ISM Manufacturing Index on Tuesday and Factory Orders on Thursday, which will provide further insight into the health of the industrial sector.

Inflation Readings from Europe: The Eurozone will release its preliminary Consumer Price Index (CPI) for June on Tuesday, July 1st. After May's inflation dipped below the European Central Bank's (ECB) 2% target, this reading will be critical. A return to target could solidify expectations for the ECB's policy path, while a surprise could introduce new uncertainty.

China's Economic Pulse: China's official NBS Manufacturing and Non-Manufacturing PMI data for June, released on Monday, June 30th, will set the tone for the week. This will be followed by the Caixin Manufacturing PMI, offering a view of the country's smaller, private firms.

Earning Calendar

The upcoming week marks a quiet period for corporate earnings, as it falls between the end of the second-quarter reporting season and the beginning of the third-quarter releases. The schedule is particularly light due to the holiday-shortened week in the United States, with markets closed on Friday for Independence Day.

Equities Color

S&P 500 Index(SPX)

The S&P 500 broke through its previous all-time high in a broad-based rally that demonstrated significant resilience. The benchmark index was propelled higher by strong performance in growth-oriented sectors like Technology and Consumer Discretionary. A key driver was the renewed enthusiasm for AI-related stocks following a blowout earnings forecast from memory-chip maker Micron. This confirmed that the AI investment theme extends beyond just Nvidia and is lifting the entire ecosystem.

However, the week was not without turbulence. The index briefly dipped on Friday following the release of the May Personal Consumption Expenditures (PCE) report, which showed core inflation remaining stubbornly above the Fed's target. The market ultimately shook off these concerns, choosing to focus on the prospect that weakening consumer spending, also highlighted in the report would encourage the Federal Reserve to cut interest rates sooner rather than later.

Dow Jones Industrial Average Index(DJI)

The Dow also had a strong week, though it still trails its all-time high. The index was significantly boosted by a massive 15% jump in shares of Nike on Friday after the apparel giant issued a better-than-expected forecast. This, along with gains in industrial bellwether Boeing on hopes of easing U.S.-China trade tensions, helped the 30-stock average keep pace.

US 100 Index(NDQ)

Nasdaq was the week's clear outperformer, surging to a new record. The index's performance was overwhelmingly driven by the AI narrative. Micron's blockbuster report sent its stock soaring and created a powerful tailwind for other semiconductor giants like Nvidia, which continued its march toward a $4 trillion market capitalization.

The rally was not confined to chipmakers. The broader technology sector saw strong buying interest as investors looked for other ways to play the AI revolution, from data center providers to software companies. The Nasdaq's strong performance, despite the headwind of "higher for longer" interest rate fears, underscores the market's powerful conviction in the long-term growth story of artificial intelligence.

FX SNAPSHOT

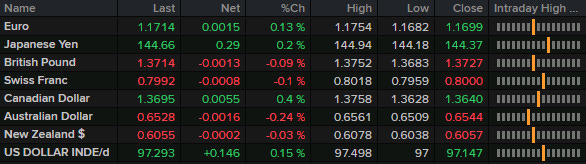

The US Dollar showed significant gains against commodity-linked currencies and the Japanese Yen but surprisingly weakened against the Euro and the Swiss Franc.

FINAL THOUGHTS

Ultimately, the week concluded not with a resolution, but with a doubling down on a high-stakes bet. The market stared directly at rising trade tensions, sticky inflation, and a weakening consumer, and decided that the transformative power of artificial intelligence was the only fundamental that mattered. It has wagered that the productivity boom promised by AI will be so immense it can single-handedly solve for inflation, neutralize geopolitical shocks, and render traditional economic cycles obsolete.

As we head into a new week, this audacious bet faces its next critical test. The upcoming jobs report and inflation readings from Europe are no longer just data points; they are verdicts on the market's defiant reality. Will they provide the fuel needed for this rally to achieve escape velocity, or will they serve as the harsh voice of economic gravity, reminding everyone that even the most powerful rallies cannot ignore the ground forever? The chips, both silicon and speculative, are all on the table.

DISCLAIMER

Content on this site is for informational purposes only and does not constitute investment advice or a solicitation to buy or sell any financial instruments. MetaMacro makes no guarantees regarding the accuracy or completeness of the information provided. Unauthorized use, redistribution, or access to proprietary content is strictly prohibited. All information is subject to change without notice. Investments involve risk, including the potential loss of principal.

— Oghenetega

MetaMacro