Market Color | Opening Gambit- June 23, 2025

Beyond the Brink: US-Iran Escalation Threatens Global Economy, Sparks Safe-Haven Dash

Hello Meta macro readers! what an eventful start to the week.

The world enters the new week on tenterhooks. Over the weekend, the Middle East conflict dramatically escalated as the U.S. launched targeted airstrikes on Iranian nuclear sites. This direct military involvement by President Trump has sent geopolitical tensions soaring and left global financial markets reeling, poised for significant turbulence. This comes as major central banks continue to diverge on monetary policy, creating a complex and uncertain economic landscape already grappling with inflation fears.

Weekly Recap: Oil Soars on Mideast Tensions, Central Banks Diverge (June 16-22, 2025)

The past week saw a dramatic shift in global market sentiment, dominated by escalating geopolitical tensions in the Middle East. An Israeli airstrike on Iran, followed by Iranian retaliatory strikes, sparked widespread risk aversion, prompting a retreat from equities and a flight to safe-haven assets. Crude oil prices surged to multi-month highs on supply disruption fears, raising renewed inflation concerns globally. Despite the broader flight to safety, gold surprisingly remained flat. Central bank actions diverged, with the US Federal Reserve maintaining rates, while the Swiss National Bank cut its policy rate, and the Bank of England held steady amidst a split vote. The upcoming week will be closely watched for further geopolitical developments, key economic data releases, and central bank commentary

Geopolitical Tensions and Market Reaction:

Middle East Conflict: An Israeli airstrike on Iran, followed by Iranian strikes on Israel resulting in casualties and destruction, intensified the conflict. This led to widespread risk aversion among investors.

Safe Havens and Oil: Investors shifted from equities to traditional safe-haven assets. The U.S. Dollar and Treasury bonds saw increased demand. Crude oil prices, highly sensitive to Middle East stability, surged to multi-month highs, initially nearing $76 a barrel before settling around $73.97, amidst concerns of supply disruptions, especially concerning the Strait of Hormuz. Surprisingly, gold, a traditional safe haven, traded flat, defying typical behavior.

Economic Data and Central Bank Actions:

U.S. Economy: The U.S. economic picture was mixed. Retail sales for May were weaker than expected overall, influenced by declines in gasoline and auto sales, and potentially tariffs. However, core retail sales and industrial production showed strength.

Central Bank Divergence:

The U.S. Federal Reserve kept its benchmark interest rates unchanged at 4.25%-4.50% on Wednesday, with Chair Jerome Powell emphasizing a "data-dependent" approach to future adjustments. U.S. markets were closed on Thursday for Juneteenth.

The Swiss National Bank (SNB) unexpectedly cut its policy rate by 25 basis points to 0% on Thursday, effective June 20, citing easing inflationary pressures and even negative consumer prices in May.

The Bank of England (BoE) maintained its Bank Rate at 4.25%, though a split vote among its Monetary Policy Committee members indicated ongoing debate amidst disinflation and global uncertainties.

Japan's Economy: Japan faced renewed economic pressure. Its exports experienced their first year-on-year decline since September 2024, raising recession fears. Inflationary pressures mounted, with May's headline CPI easing slightly to 3.4% (from 3.5% in April), but the BOJ's preferred core inflation measure rose for a third straight month to 3.7%, hitting its highest since January 2023, largely due to a dramatic 102% surge in rice prices. BOJ minutes revealed a divided board, with most supporting future rate hikes but some advocating caution due to U.S. trade policy uncertainties.

Trade and Corporate Developments:

Tariff Deadline: The July 9 "Liberation Day" tariff deadline remained a key focus. President Trump indicated flexibility for extensions and confidence in some deals, but maintained a tough stance on negotiations with Japan and the EU, reiterating tariff threats.

Nippon Steel-U.S. Steel Acquisition: Nippon Steel secured conditional U.S. approval for its $14.1 billion acquisition of U.S. Steel. This approval came with pledges of substantial future investments in American operations and the issuance of a "Golden Share" to the U.S. government to oversee compliance with a national security agreement.

Global Equities (S&P 500, Dow, Nasdaq): The week saw a retreat from equities due to risk aversion, with the S&P 500 and Dow declining. The Nasdaq's slight gain highlights the resilience of specific tech stocks. The underlying sentiment remains cautious due to geopolitical tensions. Further escalation could trigger more significant sell-offs, while de-escalation could lead to a swift rebound.

FX Snapshot: The US dollar closed mixed against major currencies, strengthening against EUR, GBP, CHF, but weakening against JPY, CAD, AUD, and NZD.

US Strikes Iran Nuclear Sites: Markets Brace for Turmoil and Soaring Oil

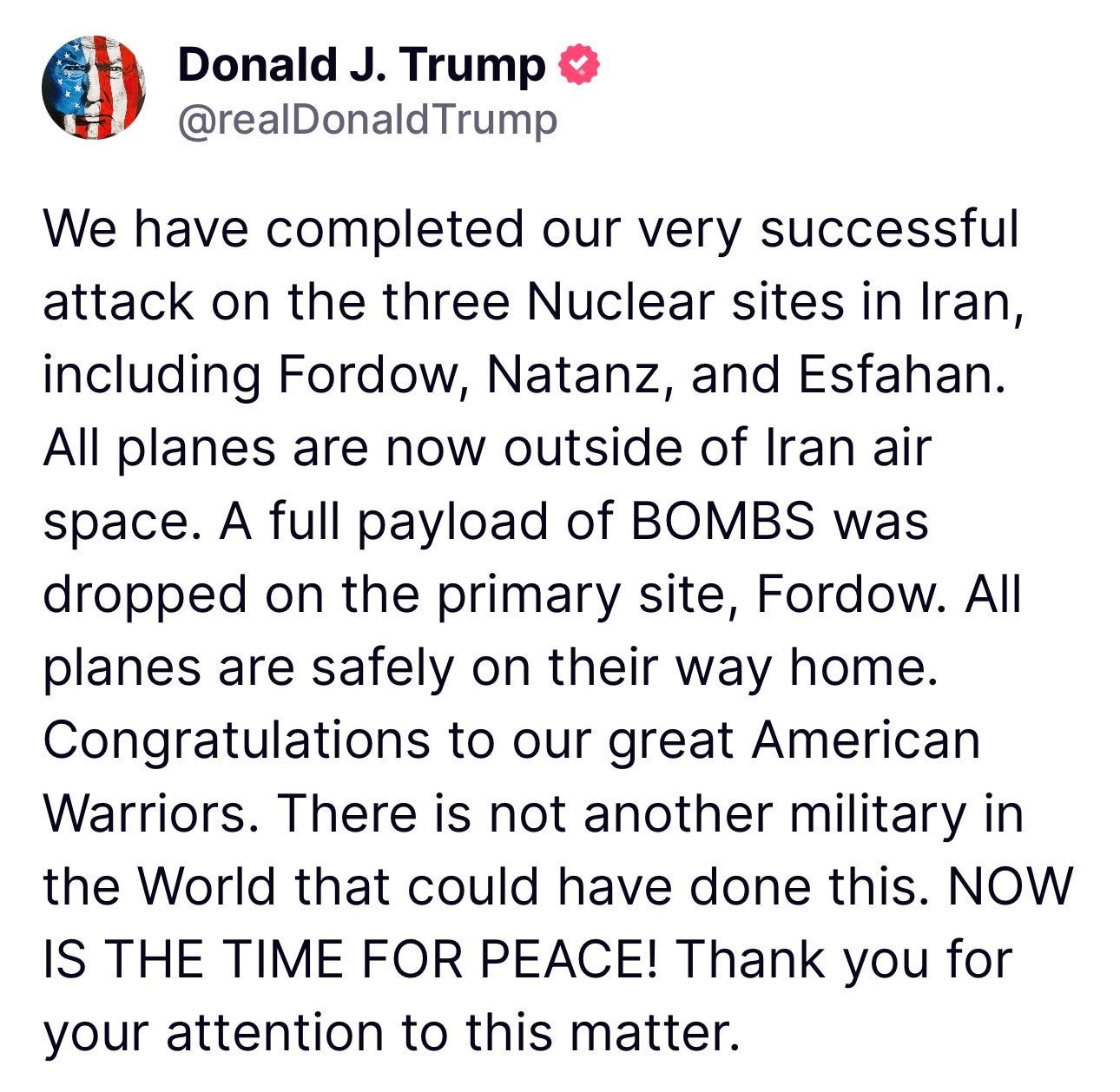

Global financial markets closed the week in a state of high anxiety after the U.S. dramatically escalated the Middle East conflict. On Saturday, June 21, 2025, President Trump announced targeted U.S. airstrikes on three key Iranian nuclear sites: Fordow, Natanz, and Isfahan. This direct military involvement follows a week of Israeli strikes on Iran's defenses and nuclear facilities, marking a critical intensification of the conflict. Trump declared the operation a "spectacular military success" and warned of further strikes if Iran retaliates, demanding "unconditional surrender." Iran's Foreign Minister Abbas Araghchi swiftly responded, vowing "everlasting consequences" and asserting Tehran's right to retaliate.

The market reaction is expected to be pronounced. Oil prices, already up nearly 3% last week (with Brent above $76 and WTI around $73), are set to surge further. Equities are anticipating an immediate sell-off, with U.S. indexes expected to drop 400-500 points and the Hang Seng projected to decline by up to 2.25%. Conversely, safe-haven assets are seeing a rush, with the U.S. dollar expected to benefit from a "safety bid" and gold projected to reach $4,000 per ounce by Bank of America.

The primary driver of market response is the high uncertainty surrounding the conflict's trajectory and the potential for Iran to close the Strait of Hormuz. While unlikely, such an event would severely tighten global oil supply. The U.S. involvement, particularly targeting nuclear facilities, signals a profound escalation, justifying a sustained geopolitical risk premium in energy markets. This implies that even a swift de-escalation wouldn't erase the elevated risk perception in the Middle East, leading to potentially higher, sustained energy costs globally.

Crucially, this oil price surge directly exacerbates existing inflation concerns. Higher energy prices feed into broader inflationary pressures, which could dampen consumer confidence and reduce the likelihood of near-term interest rate cuts by central banks. This directly contradicts earlier expectations for monetary easing and the Fed's projection of two rate cuts this year. This environment introduces significant stagflationary risk, forcing central banks to choose between combating inflation and supporting economic growth, potentially leading to prolonged higher interest rates and impacting overall economic activity.

Central Banks Diverge Amidst Stagflation Fears: A Global Policy Puzzle

Amidst escalating geopolitical turbulence, major central banks are charting increasingly divergent monetary policy paths, signaling a complex and uncertain global economic outlook.

The U.S. Federal Reserve maintained its fed-funds target range at 4.50% (upper bound), citing "unusually elevated uncertainty." In its June 2025 Monetary Policy Report, the Fed revised its year-end inflation projection higher to 3.0% (from 2.7%) while marking economic growth down to 1.4% (from 1.7%). These revisions explicitly acknowledge stagflationary pressures – a challenging mix of higher inflation and subdued growth. Despite this, the Fed's median projection still anticipates two rate cuts this year, reaffirming its dual mandate of maximum employment and stable prices with a 2% long-run inflation target.

Beyond the U.S., other central banks are acting quite differently:

The Swiss National Bank (SNB) cut its policy rate by 25 basis points (bps) to 0%, even hinting at negative rates due to the Swiss Franc's strength.

Norway's Central Bank surprised markets with a 25bps cut to 4.25%, citing "sufficiently tamed" inflation and signaling further reductions.

Sweden's central bank also cut rates by 25bps to 2.0%, as expected.

The Philippines Central Bank implemented a 25bps cut to 5.25%.

The Bank of Japan (BOJ) is expected to hold rates steady, grappling with persistent inflation (core CPI above 2% despite declining real wages) against slowing growth. Any hawkish guidance from the BOJ could strengthen the Japanese Yen.

Markets are pricing a 90% probability of unchanged rates at the Bank of England's (BOE) June meeting, with expectations for two cuts later in 2025 (likely August and December).

This divergence in monetary policy has significant implications for currency markets. While the Fed maintains a cautious, subtly hawkish stance (higher inflation projection), several European and Asian central banks are actively pursuing rate cuts. This can lead to increased FX volatility, potentially weakening currencies of countries with aggressive cuts (CHF, NOK, SEK) against those with stable or higher rates (USD, potentially JPY). The U.S. dollar's safe-haven status during geopolitical tensions could further amplify its strength.

The Fed's revised projections, showing higher inflation with lower growth, underscore fragile global economic recovery susceptible to external shocks like rising Middle East tensions and higher oil prices. This environment suggests sticky inflation and subdued economic growth, which could favor defensive sectors in equities and maintain the appeal of safe-haven assets. Investors should brace for an environment where central banks navigate a difficult path between combating inflation and supporting growth amidst "unusually elevated uncertainty.

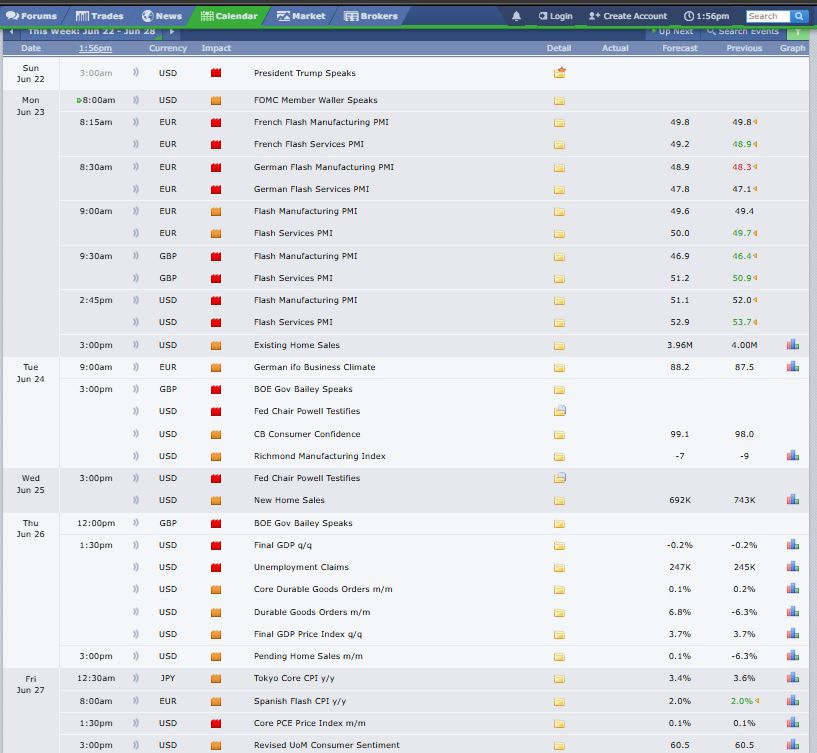

Economic Calendar

The coming week (June 23-27, 2025) promises a flurry of crucial economic data releases, with early PMI survey results from major economies kicking things off on June 23. These forward-looking indicators for the U.S., Eurozone, UK, and Japan will provide the first insights into global business conditions and confidence for the current month, arriving amidst heightened geopolitical tensions.

For the United States, the week will unfold with a series of significant reports that could heavily influence market sentiment and the Federal Reserve's future policy decisions:

Housing Market Insights: May Existing Home Sales (June 23) and May New Home Sales (June 25) will shed light on the health of the housing sector.

Consumer Pulse: June Consumer Confidence (June 24) and the final University of Michigan Consumer Sentiment for June (June 27) will offer a read on consumer attitudes and spending intentions.

Industrial Activity and Growth: May Preliminary Durable Goods Orders and the final reading for Q1 GDP will be released on June 26, providing updates on manufacturing and overall economic expansion.

Key Inflation Gauge: The week culminates on June 27 with the release of the May Core PCE Price Index, the Federal Reserve's preferred inflation measure, alongside May Personal Income and Spending data. This will be closely watched for any further signs of persistent inflation or changes in consumer behavior.

Earning Calendar

The upcoming week is set to bring a wave of corporate earnings reports, offering key insights into the financial health of various sectors. Investors will be particularly focused on results from:

FedEx (FDX): The global shipping giant is slated to report its Q4 2025 earnings on Tuesday, June 24. FedEx's performance often serves as a barometer for global trade and economic activity.

Carnival Corporation (CCL): The cruise line operator is also expected to release its Q2 2025 earnings on Tuesday, June 24. As the travel sector continues its recovery, investors will be looking for strong indications of continued demand and financial improvement.

Micron Technology (MU): The semiconductor company is scheduled to report its Q3 2025 earnings on Wednesday, June 25. Given the ongoing excitement around artificial intelligence (AI) and the demand for high-bandwidth memory (HBM), it will be watching closely for strong revenue and earnings growth, as well as insights into the broader semiconductor market.

General Mills (GIS): The consumer food giant is expected to release its Q4 2025 earnings on Wednesday, June 25. Investors will be assessing the impact of inflation on consumer spending habits and the company's ability to manage costs and maintain profitability in the current economic climate.

These, along with other companies reporting, will provide crucial updates on corporate performance amidst the prevailing geopolitical and economic uncertainties.

Equities Color

S&P 500 Index(SPX)

The S&P 500 concluded the week nearly unchanged, registering a slight decline to 5980.12 from its prior close of 5982.72, as geopolitical concerns, mixed economic indicators, and the Federal Reserve's steady interest rate stance collectively weighed on sentiment.

Dow Jones Industrial Average Index(DJI)

Mirroring the S&P 500, the Dow Jones Industrial Average registered a modest dip for the week, closing at 42,161.46. Its performance was similarly weighed down by escalating geopolitical concerns and the Federal Reserve's monetary policy decisions.

US 100 Index(NDQ)

Despite the broader market's struggles, the Nasdaq Composite edged higher last week, closing at 19,544.75. The index's gain was fueled by the strong showing of its tech and growth stocks.

FX SNAPSHOT

U.S. Dollar (USD): The dollar initially benefited from safe-haven flows due to the Middle East conflict but closed mixed. Its performance in the coming week will hinge on the balance between ongoing geopolitical risks (supporting safe-haven demand) and incoming US economic data (influencing Fed policy expectations).

Japanese Yen (JPY): The JPY gained slightly against the USD. Given Japan's economic pressures and the BOJ's nuanced stance amidst rising inflation, the yen's movement will be sensitive to both global risk sentiment and any further BOJ commentary.

Swiss Franc (CHF): The CHF depreciated following the SNB's surprise rate cut. This suggests the SNB is actively managing its currency amidst easing inflation.

Other Major Currencies: EUR, GBP, and NZD depreciated against the USD, while CAD and AUD saw slight appreciation. The divergence in central bank policies will continue to drive movements in these pairs.

FINAL THOUGHTS

As the new trading week dawns under the shadow of a potentially widening Middle East conflict, and with central banks marching to different beats, investors face a true test of nerves. Will safe havens continue their ascent, or will the promise of corporate earnings and fresh economic data provide a much-needed pivot? The answers will dictate whether markets can navigate these turbulent waters or if the currents of uncertainty will drag them deeper into unchartered territory.

DISCLAIMER

Content on this site is for informational purposes only and does not constitute investment advice or a solicitation to buy or sell any financial instruments. MetaMacro makes no guarantees regarding the accuracy or completeness of the information provided. Unauthorized use, redistribution, or access to proprietary content is strictly prohibited. All information is subject to change without notice. Investments involve risk, including the potential loss of principal.

— Oghenetega

MetaMacro