Market Color | Midweek Motion-July 9, 2025.

Global Markets on Edge: Trump's Tariff Blitz Sparks Commodity Surge, Fed Minutes Eyed

Hello Metamacro Readers!

Global markets are bracing for increased volatility as a new wave of U.S. tariffs, championed by President Donald Trump, threatens to reshape international trade.

Trump Unleashes New Wave of Tariffs: August 1st Deadline Looms for Global Trade Deals

President Donald Trump is pressing ahead with an aggressive trade agenda, announcing a new set of tariffs effective August 1, 2025, for countries that fail to finalize trade agreements with the United States. This move extends the previous July 9th deadline, offering a brief reprieve for negotiations amidst a flurry of "tariff letters" dispatched to numerous nations.

Japan and South Korea are among those facing a 25% tariff, with warnings that rates could fluctuate based on negotiation outcomes and any retaliatory measures. Other countries receiving notification of new duties include South Africa (30%), Kazakhstan (25%), Laos (40%), Malaysia (25%), Myanmar (40%), Tunisia (25%), Bosnia and Herzegovina (30%), Indonesia (32%), Bangladesh (35%), Serbia (35%), Cambodia (36%), and Thailand (36%). These rates represent slight adjustments from the "reciprocal" tariffs initially declared on April 2nd, dubbed "Liberation Day."

Adding another layer of pressure, Trump has threatened an additional 10% import duty on nations supporting "Anti-American BRICS policies." Beyond these broad measures, new sectoral tariffs are also on the horizon, with a 50% tariff on copper imports and plans for "very, very high rate, like 200%" tariffs on pharmaceutical drugs at an unspecified future date. These new impositions are in addition to existing 50% tariffs on steel and aluminum, and 25% on autos.

Despite an initial aim for a high volume of deals, negotiation progress has been limited. So far, the administration has secured a restricted framework with the UK, a temporary truce with China (setting US tariffs on Chinese imports at 55% and Chinese tariffs on American imports at 10%), and an outline of a deal with Vietnam. The Vietnam agreement reportedly sets a 20% levy on Vietnamese exports to the US (down from an initially proposed 46%), in exchange for zero tariffs on US goods entering Vietnam, with transshipments facing a higher 40% levy.

The Trump administration maintains that these tariffs are crucial for boosting domestic manufacturing, safeguarding national security, reducing the U.S. trade deficit, and generating revenue.

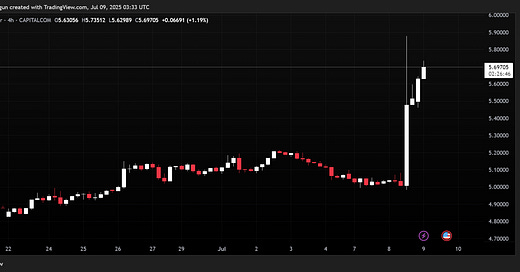

Copper Skyrockets: Record-Breaking Surge Ignited by Trump's Tariff Threat

The global copper market was rocked on Tuesday as prices witnessed an unprecedented surge, recording their largest intraday gain since 1989. The front-month copper contract soared by an astonishing 13.3% to close at $5.645 per pound, establishing a new all-time high and shattering the previous record set just this past March. This monumental leap also marks the largest single-day percentage increase in the metal's history.

The dramatic price action appears to be directly fueled by the latest pronouncements from the Trump administration. Earlier this week, President Donald Trump announced his intention to impose a 50% tariff on imported copper, a move far exceeding market expectations and intended to bolster domestic production.

Beyond the immediate tariff impact, several underlying factors are contributing to copper's meteoric rise. Persistent weakness in the U.S. dollar, which has been on a downward trend for seven consecutive days, is making dollar-denominated commodities like copper more attractive to international buyers. Furthermore, growing demand from China, a leading consumer of the metal, due to improving factory activity and potential easing of trade tensions, is providing significant upward momentum.

While the surge is a boon for mining companies and domestic producers, it raises significant concerns for industries heavily reliant on copper, such as manufacturing, construction, and electronics. The imposition of a 50% tariff, coupled with the record-high prices, is expected to lead to substantially higher costs across a broad spectrum of the U.S. economy, potentially impacting profitability and even slowing down crucial infrastructure projects.

Crude Oil Edges Higher Amidst Geopolitical Tensions and Supply Concerns

Crude oil prices continued their upward trajectory in early Wednesday trading, with the benchmark contract currently standing at $68.28 per barrel, up $0.35. This modest but consistent climb reflects a delicate balance of global supply dynamics, geopolitical uncertainties, and ongoing demand considerations.

The EIA's latest July Short-Term Energy Outlook (STEO) revised its 2025 forecast slightly upwards, attributing the near-term strength to geopolitical risks stemming from the Israel-Iran conflict. While a ceasefire has been in place, the lingering instability in the Middle East continues to inject a risk premium into the oil market.

Adding to the complexity, OPEC+'s recent decision to raise production targets for August is being closely watched. While this might suggest an increase in supply, some interpret it as a strategic move by the cartel to reclaim market share, signaling confidence in global demand recovery. However, there are also reports of internal rifts within OPEC+ regarding compliance with existing output quotas, which could influence overall supply levels.

On the demand side, summer driving season in major consuming nations like the United States and Europe is providing a seasonal boost to consumption. Furthermore, improving factory activity in China, a key oil importer, coupled with easing trade tensions could further support demand.

U.S. Stocks End Mixed as Tariff Concerns Persist, Tech Sector Shows Resilience

U.S. equities concluded Tuesday's trading session with a decidedly mixed performance, as investors continued to digest the implications of President Donald Trump's latest tariff announcements and navigate a landscape of persistent trade uncertainty. After a broad sell-off on Monday, the market struggled to find clear direction.

The Dow Jones Industrial Average finished the day down, reflecting continued pressure on traditional industrial and financial sectors. Meanwhile, the broader S&P 500 Index also saw a modest decline of , indicating widespread caution across the market.

In contrast, the Nasdaq Composite managed to eke out a slight gain. This resilience in the tech-heavy index suggests that investors may be rotating back into growth-oriented technology stocks, perhaps viewing them as less vulnerable to the direct impact of import tariffs, or finding renewed appeal in their underlying innovation and strong earnings potential.

The muted trading activity comes on the heels of President Trump pushing back the deadline for new tariffs to take effect from July 9th to August 1st, 2025. While this provides a brief window for countries to negotiate trade agreements, the ongoing threat of substantial duties on a wide range of imports, including the recently announced 50% tariff on copper and potential 200% tariffs on pharmaceutical drugs, continues to cast a long shadow over market sentiment.

Conversely, some tech giants and specific pharmaceutical stocks experienced gains, showcasing pockets of strength amidst the broader uncertainty.

Economic Calendar

Markets are keenly awaiting the release of the Federal Reserve's minutes from its June policy meeting, due later today, Wednesday, July 9, 2025.

Other releases include the U.S. weekly employment claims and the United Kingdom's month-over-month GDP report.

Earning Calendar

Aehr Test Systems , a global supplier of semiconductor test and burn-in equipment, announced its financial results for the fiscal 2025 fourth quarter and full year, ended May 30, 2025, on Tuesday. The report revealed a period of revenue decline but also highlighted the company's strategic efforts to expand its total addressable market and diversify its customer base beyond its traditional silicon carbide focus.

Equities Color

S&P 500 Index(SPX)

S&P 500 Index also saw a slight dip, to finish at 6,225.52. While a smaller percentage decline than the Dow, this still reflects a cautious sentiment across a wide range of U.S. companies. The S&P 500 has now declined for two consecutive trading days, and remains just under 1% off its record high set last week.

Dow Jones Industrial Average Index(DJI)

The Dow Jones Industrial Average experienced another day in the red, declining to close at 44,240.76. This marks a second consecutive day of losses for the blue-chip index, indicating sustained pressure on its industrially sensitive components, likely due to concerns over global trade and manufacturing costs. The decline also represents its largest two-day point and percentage drop since June 13, 2025.

US 100 Index(NDQ)

Nasdaq demonstrated resilience, managing a modest gain to close at 20,418.46. This slight advance suggests a continued preference for technology and growth stocks, which are sometimes perceived as more insulated from the direct impacts of tariffs compared to traditional manufacturing or export-oriented businesses. The Nasdaq's closing value marks its second-highest close in history, underscoring the ongoing strength in the tech sector.

FX SNAPSHOT

The USD is ending the day mixed vs the major currencies. The USD gained versus the following major currencies:

JPY, +0.43%

GBP +0.09%

NZD +0.02%

The USD fell versus the following currencies:

EUR -0.14%

CHF -0.30%

AUD -0.57%

The USD was virtually unchanged on the day vs the CAD.

FINAL THOUGHTS

The global financial landscape is currently dominated by President Trump's assertive trade policies, which are directly impacting commodity prices, driving volatility in equity markets, and adding a layer of complexity for central banks.

DISCLAIMER

Content on this site is for informational purposes only and does not constitute investment advice or a solicitation to buy or sell any financial instruments. MetaMacro makes no guarantees regarding the accuracy or completeness of the information provided. Unauthorized use, redistribution, or access to proprietary content is strictly prohibited. All information is subject to change without notice. Investments involve risk, including the potential loss of principal.

— Oghenetega

MetaMacro