Market Color | Final Flow – June 27, 2025

Global Markets Ride Geopolitical Rollercoaster to Week's End Rally

Hello Metamacro Readers,

From the brink of chaos to a collective sigh of relief this week, global financial markets performed a dizzying tightrope walk, teetering precariously on the edge of a geopolitical precipice before executing a spectacular, albeit tentative, recovery.

Week Recap: Global Markets See Wild Swings as Mideast Tensions Flare and Subside

The week was dominated by a dramatic shift in the Middle East conflict, profoundly impacting global markets. Initially, U.S. airstrikes on Iranian nuclear sites last week, sent shockwaves through financial markets, triggering fears of escalating tensions and driving oil prices up sharply. Gold and the U.S. dollar surged as safe-haven assets, while equities faced an anticipated sell-off. Concerns about stagflation rose as higher energy costs threatened to fuel inflation and delay central bank interest rate cuts.

However, market sentiment quickly reversed mid-week with the announcement of a fragile U.S.-brokered ceasefire between Israel and Iran. This de-escalation sparked a relief rally, causing oil prices to plummet and global stock markets, including the Nasdaq 100, to hit new highs. Adding to this relief, President Trump indicated a potential softening of U.S. sanctions against Iran, allowing China to resume oil imports, which further eased oil supply concerns.

Amidst these geopolitical fluctuations, central banks pursued divergent monetary policies. The U.S. Federal Reserve maintained its cautious stance, acknowledging stagflationary pressures but still projecting two rate cuts this year, with Chair Powell emphasizing a "no rush" approach to cuts due to tariff uncertainties. In contrast, several European and Asian central banks, including those in Switzerland, Norway, Sweden, and the Philippines, enacted rate cuts, while the Bank of Japan held steady, grappling with persistent services inflation and cautious about weak domestic growth.

Economic data for the week presented a mixed picture, with strong manufacturing and services expansion in the U.S. but a surprising dip in consumer confidence. In the tech sector, Nvidia stock surged on strong AI momentum, while Circle's stock experienced a significant pullback despite earlier gains, as regulatory clarity for stablecoins also introduced concerns about increased competition.

Stocks Edge Higher as Fed Rate Cut Hopes Mount

U.S. equities saw a notable climb on Thursday, with both the S&P 500 and Nasdaq Composite indices making a strong push towards new record highs, though ultimately falling just short by the close of trading. This market rally was fueled by growing investor conviction that the Federal Reserve might initiate interest rate cuts as early as July. As the trading week concludes today, Friday, all eyes will be on upcoming economic insights, which are expected to provide further clarity on the Fed's next moves and potentially solidify these rate cut expectations.

China's Industrial Profits Take a Dip in May, Signaling Economic Headwinds

Profits at China's industrial firms unexpectedly declined by 9.1% in May compared to the previous year, according to data released Friday by the National Bureau of Statistics. This marks a notable setback, snapping a two-month streak of growth for the sector.

This recent slump also dragged down the cumulative industrial profits for the first five months of 2025, which are now down 1.1% year-on-year, a stark contrast to the 1.4% increase recorded in the January-April period.

This profit decline aligns with broader deflationary pressures in China, as factory-gate deflation deepened to its worst level in nearly two years last month, and consumer prices continued their downward trend. These figures collectively paint a picture of a challenging economic environment for Chinese industries.

Treasury Secures Deal to Protect US Firms from Foreign Taxes, Drops "Revenge Tax" Plan

The Treasury Department has successfully brokered an agreement with G7 allies that will provide significant relief for American businesses operating internationally. Under the terms of this deal, U.S. companies will be exempt from certain digital services taxes and other levies imposed by other countries.

In exchange for this crucial protection, the Trump administration has agreed to remove the controversial Section 899 "revenge tax" proposal from President Donald Trump’s upcoming tax bill. This proposed tax had been a point of contention, seen by many as a retaliatory measure that could have triggered further international trade disputes.

This agreement marks a key diplomatic achievement for the Treasury, aiming to simplify the international tax landscape for U.S. corporations and foster a more predictable environment for global trade. The deal reflects a cooperative effort among G7 nations to address complex cross-border taxation issues and avoid potential economic retaliations, ultimately benefiting American companies by reducing their foreign tax burden.

Global Stocks Rally to Multi-Year Highs, Dollar Weakens on Fed Concerns

Global equity markets are poised to conclude the week on a decidedly positive note, with Asia shares hitting their highest level in over three years on Friday. This broad-based rally across international stock indexes mirrored a strong performance on Wall Street, as investor anxieties surrounding Middle East tensions and uncertainties over tariffs and trade deals temporarily receded.

The optimism in equity markets is largely being driven by mounting expectations for early interest rate cuts by the Federal Reserve. However, this very anticipation, coupled with concerns over the Federal Reserve's independence, has put pressure on the U.S. dollar, causing it to struggle against other major currencies. The dollar's weakness, near multi-year lows, reflects market speculation that political pressure may lead to a more accommodative monetary policy, diminishing the currency's appeal.

As the week wraps up, the focus remains on central bank signals and economic data, with markets seemingly shrugging off recent geopolitical and trade uncertainties in favor of a more bullish outlook driven by potential monetary easing.

Trump Tariffs Boost US Treasury Coffers Towards Record Revenue in June

President Donald Trump's ongoing tariff policies are significantly bolstering U.S. government revenue, with June set to become another record-breaking month for customs duties.

According to the latest daily statement from the Treasury Department, dated June 24, receipts for "Customs and Certain Excise Taxes" have already exceeded $26.7 billion for the month of June. This substantial inflow of funds, collected from importers, indicates that the tariffs are continuing to pour billions into federal coffers, putting the nation on track for an unprecedented monthly collection. The consistent high revenue generated by these import taxes highlights the direct fiscal impact of the Trump administration's trade strategy.

US and China Announce New Trade Understanding, Bolstering Geneva Agreement

President Trump and Commerce Secretary Howard Lutnick have announced a significant new understanding with China, aimed at further implementing the previously stalled "Geneva agreement" on trade. While detailed specifics of the new agreement were initially slow to emerge, the announcement signals renewed efforts to de-escalate trade tensions between the two economic giants.

Key components of this new framework include a commitment from China to accelerate the licensing process for rare earth mineral exports. Rare earths are critical for numerous high-tech industries, and China's control over their supply has been a major point of contention in past trade disputes. In a reciprocal move, the United States has agreed to roll back certain export controls, notably including restrictions on ethane shipments to China, a detail that was highlighted in yesterday's market wrap.

This agreement, which effectively amounts to an additional framework for the Geneva talks held earlier, suggests a pragmatic approach to resolving trade impasses. It focuses on specific areas of mutual benefit and aims to restore a more predictable trade environment, particularly for crucial raw materials and energy exports. The move is expected to alleviate some supply chain concerns and potentially pave the way for broader trade discussions between the two nations.

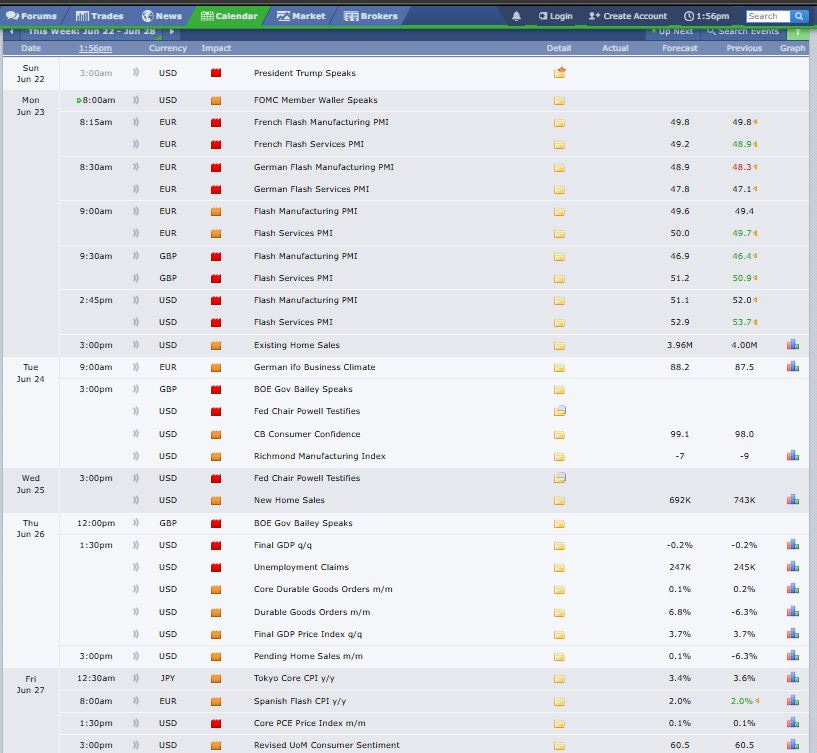

Economic Calendar

The final reading for Q1 GDP indicated that the U.S. economy shrank by more than earlier estimated. U.S. Preliminary Durable Goods Orders for May grew more than economists expected, providing evidence that the U.S. economy is holding up despite challenges.

Earning Calendar

General Mills delivered mixed results for its fiscal fourth quarter of 2025, with revenues missing estimates while adjusted earnings per share (EPS) beat expectations. However, the company provided a disappointing outlook for the upcoming fiscal year.

Micron Technology reported outstanding results for its third quarter of fiscal 2025, with both revenue and earnings per share significantly beating analyst estimates.

Nike reported its fiscal fourth-quarter 2025 results, with diluted earnings per share beating analyst forecasts, and revenue also surpassing expectations. However, overall revenues experienced a significant decline year-over-year.

Equities Color

S&P 500 Index(SPX)

The S&P 500 closed at 6142.09. It edged closer to its record high set in February, coming within just 3 points of that mark. The strong performance was influenced by positive economic data, including better-than-expected durable goods orders and fewer jobless claims.

Dow Jones Industrial Average Index(DJI)

The Dow gained approximately 400 points, closing at 43396.76. This marked a significant advance for the blue-chip index, although it remains about 4% away from its own record high.

US 100 Index(NDQ)

Nasdaq Composite closed at 20170.74. It was just 6 points shy of its record close posted in December, highlighting the continued strength in technology stocks, particularly chip-related companies.

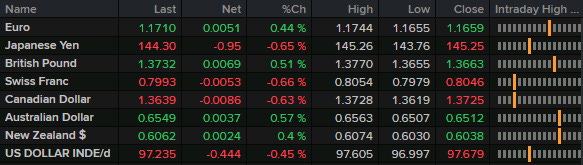

FX SNAPSHOT

The U.S. dollar's performance against major currencies is currently a complex interplay of shifting monetary policy expectations, geopolitical developments, and its traditional role as a safe haven. The overall picture suggests a weaker U.S. dollar compared to recent periods.

EUR/USD: The Euro has surged against the dollar, reaching its highest levels since 2021. Positive Eurozone economic data has also supported the Euro.

GBP/USD: The British Pound has also gained against the dollar, reaching multi-year highs.

USD/JPY: The Japanese Yen has strengthened, with USD/JPY falling as traders await the Bank of Japan's next moves and the yen's own safe-haven properties come into play.

USD/CHF: The Swiss Franc has reached decade-lows against the dollar

USD/CAD, AUD/USD, NZD/USD: These commodity-linked and risk-sensitive currencies have generally seen strength against the weaker dollar, also benefiting from the improved global risk sentiment.

FINAL THOUGHTS

As Friday draws to a close, casting a cautious calm over global markets, the echoes of this week's extraordinary volatility linger. Is this a genuine clearing of the clouds, or merely the eye of a larger storm? Only time, and the relentless march of economic and geopolitical events, will tell if this fragile truce can truly herald a sustained era of stability, or if markets are merely catching their breath before the next wild ride.

DISCLAIMER

Content on this site is for informational purposes only and does not constitute investment advice or a solicitation to buy or sell any financial instruments. MetaMacro makes no guarantees regarding the accuracy or completeness of the information provided. Unauthorized use, redistribution, or access to proprietary content is strictly prohibited. All information is subject to change without notice. Investments involve risk, including the potential loss of principal.

— Oghenetega

MetaMacro

I don't comment or react but this stuff is really great MetaMacro team. Know that it is appreciated🫡