March has been a very difficult month for me amidst getting in tune with the market, updating frequently on the substack and managing my personal life.

Letter from the Desk

The first quarter of 2025 is coming to an end with Monday 31st March as the last trading day of the month. February has been the worst performance so far with a negative return of -12.98% vs the index -1.36%, while January posted a 2.72% return vs the index 2.73%. March record is a bit better with a positive return of 8.31% vs the index return of -6.57% return.

The key lessons from February was taking sizeable bet on names we had conviction in such as SNOW 0.00%↑ and DOCN 0.00%↑ which eventually delivered but after market sold off. Then as we led into March it was clear the market environment had made a shift in comparison to the buy the dip season we had in 2024.

In this environment, passive Long only management doesn’t offer you outsized positive return broadly, except you find outliers in individual stocks, this was the main takeaway for us, shifting the ground from Passive Long to Active Long/Short management.

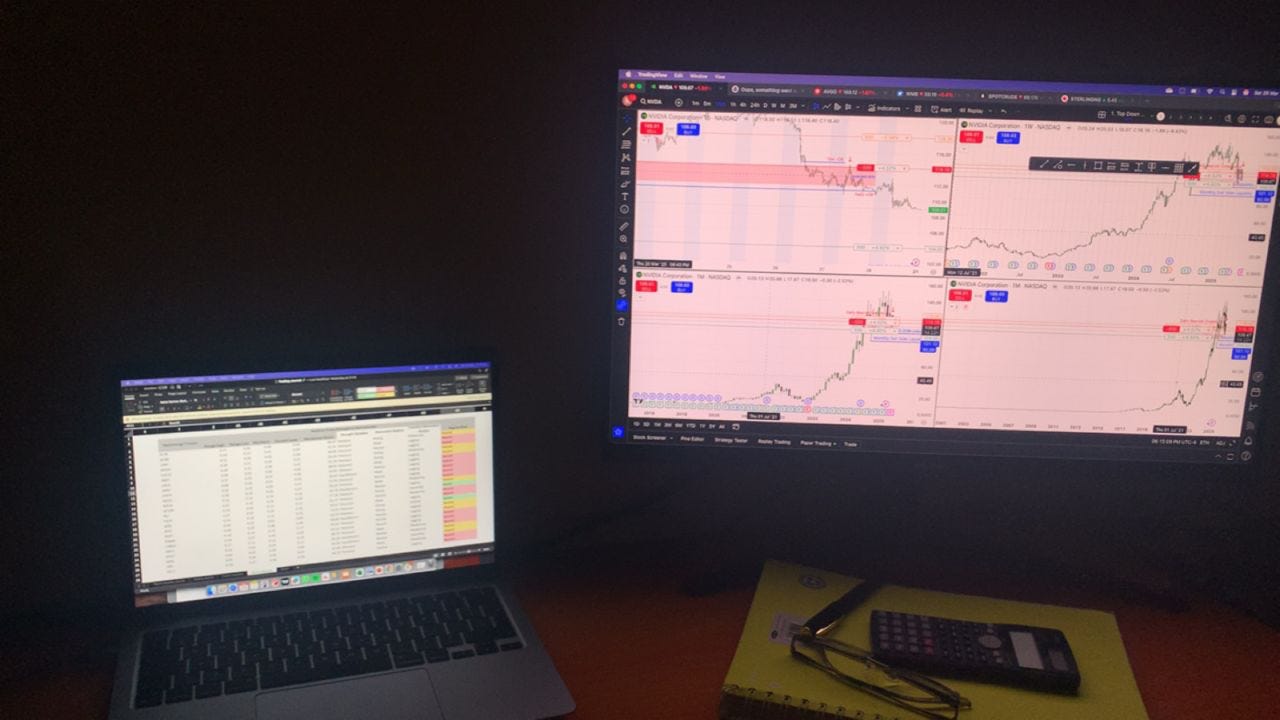

The turnaround was via waiting hands until we had a clear picture on short term moves which we sized up on particularly on NVDA 0.00%↑ and CRWD 0.00%↑ both as short term and day trades:

We currently have a short position on NVDA 0.00%↑ as we move into the end of the month:

Took a couple loss in and out, of trades, and also holding longs on Crude Oil that is in drawdown

While none of this trades were actively shared on the platform to the audience some other trades on the Currency market, where we hinted at a potential rally in GBPUSD, although the daily market mapping PDF shared offered our discretionary bias on some sector and technology names:

Overall, it has been a challenging month, I had the thoughts to write out this in a letter format to the audience last night and to the readers who reach out to me in my DM asking for my views and opinions while I have been lax on sharing updates majorly, and this statement from God of War scene captivated me:

We are not our failures, they are not who we are, we must be better. Do not be sorry, be better.

I’m not one to share my personal life on social media, but if I had to sum up this quarter, I’d liken it to a hero who fell overboard. I experienced grief, but I was reminded to give myself grace and time to heal—advice I’ve found invaluable and would share with anyone facing their own struggles. Thankfully, incredible friends lifted me up, ensuring I swam back from the depths and made it onto the deck. Their support, along with the care of medical professionals, kept me going. One word from the doctors stood out: Resilient. And yes, I truly believe I am— in everything I do. That resilience is my Edge.

Moreso, if there is also another way to express this, I would say it as follows:

God’s plan is like a beautiful tapestry and the tragedy of being human is that we only get to see it from the back, with all the ragged threads and the muddy colors, we only get a hint at the true beauty that would be revealed if we could see the whole pattern on the other side as God does.

It’s a soul’s call to action, an indication of something being wrong and the only way to rid your heart of it is to correct course and keep going.

Quarter Ahead

I think a bit of story on how I came through the name MetaMacro, it was initially meant to be Metanoia, but of course had to tweak it to relate into FinTwit style:

The key point is that I am once again going through a process of Metanoia, and so is MetaMacro. For the past two years, I have single-handedly managed the articles, model/research, ideas, trades, and overall strategy to deliver value to readers. However, changes are on the horizon. “I”, now, “We” will gradually introduce diverse authors and analysts who will contribute their perspectives, share collective insights, and guide our outlook on opportunities—both long and short—across various assets, sectors, and industries.

In addition to that, we are also building a small technology team running some of the processes I execute manually on excel to become automated and algorithmic, which is currently being developed, but the last few set of Market Mapping report received has been done manually by me. Once we are able to build the systems around that, then the timing of the output will be immediate and could be guaranteed to be delivered daily, but for the time being new versions will only be delivered if there is a drastic change in our model output and our discretionary bias or views on the market:

We have also received feedback from the first three edition shared, and we will continue to iterate until we have a version that the team deems fit. Lastly, we also intend to cover primarily two asset class which are Equities and FX. Occasionally we would oscillate around Commodities assets, but at the interim our core view and process is on: Macro Systematic Discretionary Long/Short Equities and FX.

Thank you everyone for your feedback and to the new subscribers welcome on board. Looking forward to another positive performance in April and a positive quarter, and to the dear Muslim readers here, happy Eid al-Fitr.

Cheers,

MetaMacro

Awesome stuff. Been loving your work. Wishing you the best in your personal life.