Hi, I haven’t written a macro report of recent, and majorly running tactical intraday and short term duration trades. In the effort to also have some edge in that niche while also keeping in view the bigger picture, it is critical for me to recalibrate my views and how to navigate the rest of the month and the month ahead.

Growth

Growth remain modest from the last GDP print, largely attributable to PCE, however, we have seen modest contraction in the Gross Private Domestic Investment contribution to GDP.

Furthermore, on a QoQ basis, GDP has slowed down from 0.76% to 0.56%, although, PCE expanded from 0.91% to 1.04% attributable to growth within Motor Vehicles and Parts, Furnishings and Durable Household Equipment, and Recreation Goods and Vehicles, Clothing and Footwear.

Overall, GDP growth regime is in a mixed state, while we have had an obvious slowdown on a QoQ basis, it hasn’t completely implied a recession, hence implying a neutral stance on the direction of the economy, further data releases would inform if the contraction is expected to continue, and also the rate of acceleration.

Inflation

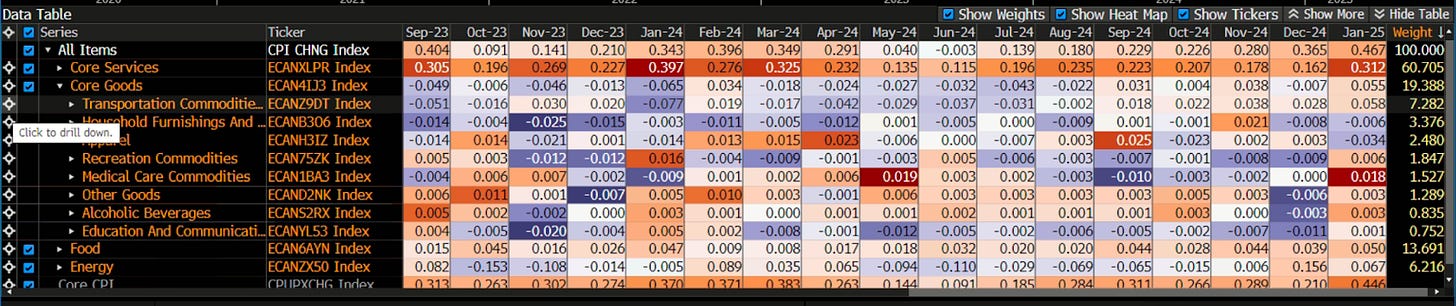

MoM inflation continue to remain sticky, accelerating from 0.365% to 0.467%. Core Services continue to accelerate on a MoM basis closer to levels seen in Jan’2024.

However, reviewing the attribution analysis, the heavily weighted component of Core Services hasn’t experienced any major acceleration, we have majorly seen an uptick in the lower weighted component of inflation MoM:

Core Goods component of inflation have accelerated marginally, with contribution from Transportation Commodities and Medical Commodities:

Liquidity

While the Fed hasn’t increased rates despite a slight uptick in inflation, there has been a consistent follow through in Quantitative Tightening with the holdings of US Treasuries and MBS Securities declining since 2022, although well above pre-covid levels.

Policy

Fiscal policy factors within the macro regime has been Tariffs and DOGE actions. Tariffs are expected to be inflationary, but we haven’t seen that follow through effect trickle down into the inflation prints, while DOGE is expected to impact Government expenditure contribution to GDP.

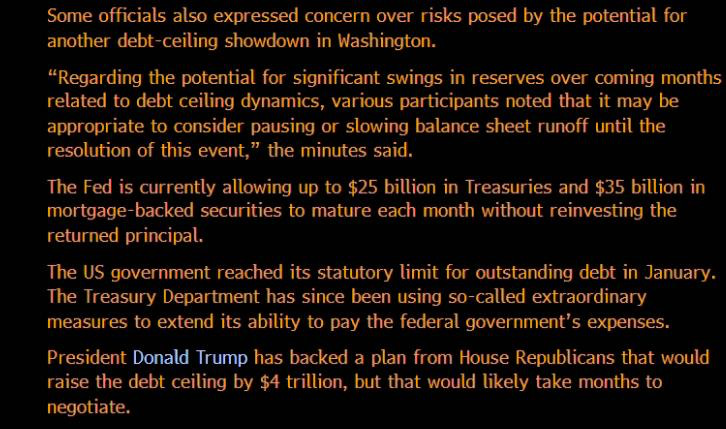

On the monetary policy side, the Fed continue to hold rates at restrictive levels but sighted that labour conditions remain solid, while inflation remain sticky, but they wouldn’t react to the upticks we have had in inflationary numbers, hence they hinted on slowing down Balance Sheet run-off, potentially signalling the end of QT, although not necessarily to begin QE but to ease off on tightening system liquidity within the economy and keep factors to support growth.

Key Macro Note Takeaways:

Growth is slowing down, but not rapidly for a recession.

Growth regime is currently in a mixed to neutral state.

Inflation remain sticky, but weighted components remain flat, uptick has been from low weighted component

No core effect of Tariffs yet on the economy

DOGE actions, expected to result in a marginal uptick in unemployment claims and cut in spending could impact sectors that have exposure to government contracts, which could also impact GDP component.

Fed watching Labour market conditions wouldn’t like to see a slow down

Fed watching inflation, but not reacting despite marginal uptick in MoM readings

Macro Risks in Play

These are the following broad risks in play:

Volatility Risk Premium

Inflation Risk Premium

Term Risk Premium

Monetary Policy Risk Premium

Equity Risk Premium

FX Risk Premium

Volatility Risk Premium

Into the close of trading hours on Friday, the VIX Index rose from 15 levels to 18.21 on speculation of COVID, however, we also had options expiry into the end of the month, which could have also resulted in the surge for demand for Call Options on VIX, in addition to that the economic data release fuelled negative sentiment both on Growth and Inflation expectations:

The forward futures contract rose towards the end of the trading session, and the futures curve on Monthly Generics are also pricing in an increase in VIX levels to the 20 levels:

Calls OI increased rapidly and flipped positive relatively to put:

Inflation Risk Premium

Inflation risk remain elevated, as 1Y, 2Y and 5Y inflation swaps remain elevated YTD:

Term Risk Premium

Term risk premium remain evident with the yield curve bear steepening, the major concern has been that the 10Y remain elevated, which has been the focal point of control for both the Fed on the monetary policy front and the fiscal policy front:

Monetary Policy Risk Premium

While the Fed continue to hold rates at restrictive level, they have hinted on easing financial conditions through other means, as elevated rate impacts duration exposed sector and cyclicals:

The Fed Futures Curve also remain neutral one expectations of a hike/cut with odds that the Fed would likely keep rates unchanged at the next FOMC meeting in March.

Equity Risk Premium

The first risk in play for equities is the elevated yield on the long end of the curve, which has declined in the past couple of weeks. With yields declining driven by the slew of economic data and declining consumer sentiment, in anticipation of a rate cut or dovish shift in policy, however, yields haven’t priced in the elevated inflation expectations we have seen in the swaps market:

The major indices declined into the end of the week primarily due to factors mentioned above and volatility risk cluster.

In terms of sensitivity to the conditions in play, momentum & relative strength in rate and cyclical sensitive sectors has declined in the following order:

Consumer Discretionary

Financials

Information Technology

Telecommunication

While we have seen a rotation to:

Health Care

Energy

Consumer Discretionary

And the following sectors remain mixed:

Materials

Real Estate

Utilities

Industrials

In addition to the above factors, we also had a Cross Border Risk in play, but not exactly sure on its weight at the moment is the rally in Yen:

Coupled with the decline in JGBs as yields rose across the curve:

Like I said not exactly sure on the impact of this on the market at the moment, but something to monitor going forward.

Love the read. Kudos