Macro Report: Nigeria and US Inflation Prints, US Labor Market Watch

Investigate The Cause, Identify The Emotion, Apply The Analysis of Logic

Good afternoon, from the MetaMacro Desk, Ridwan says HI 👋

Some housekeeping before I delve into this week macro report.

Early in the week I picked up a book by Barton Biggs, and I have learned quite a few things. One of the habit I picked up is journaling my Macro thoughts daily, and hopefully to share them as Letters at the end of the month to you.

If there is anything I can say to my readers or macro enthusiast is that there is no right or wrong way of carrying out macro analysis, but there are some agreeable principle. Ultimately as an Analyst, what makes you a breed is how you formulate your thoughts, logic and hypothesis, and testing them as market price action unfolds.

Additionally, I had a question raised on how to start an investing pathway and utilizing the information I share. I worked on that question and I have written answers in my notes, which I will publish soon. I am also working on an Equities Trading/Investing Primer, if you’d stick with me long enough, all of these tie together with the Macro Report, of which you will appreciate the foundation and how things will fit together coherently.

With that said, let’s delve into this week Macro report.

Global Scene: US Inflation Print

Over the week, we had US inflation numbers cooling off across board. From last week macro report I said this:

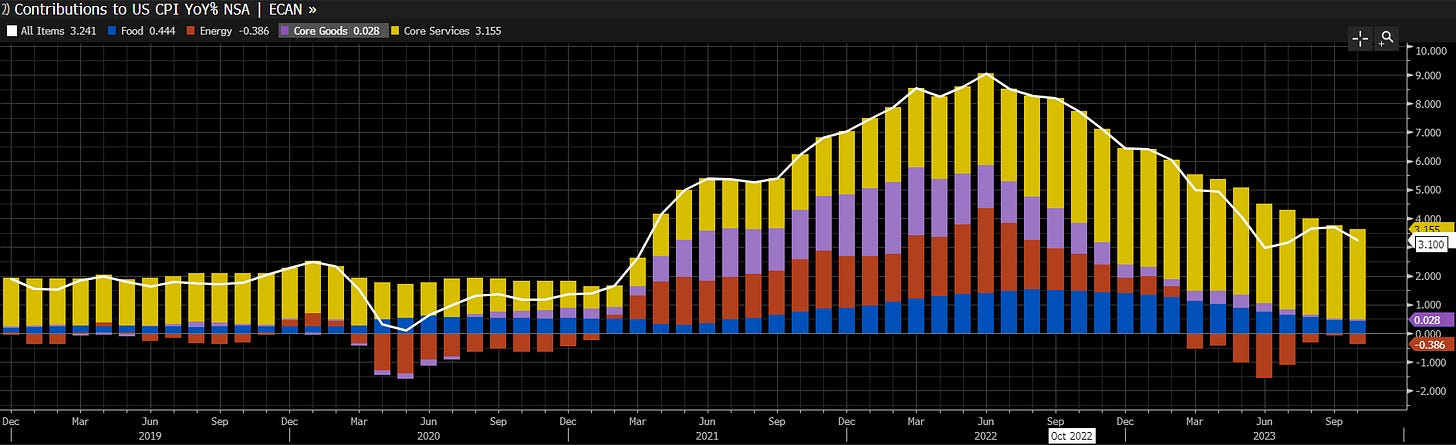

The market did just as I said, with the Stock market rallying and the Dollar declining on the heels of softening inflation data with CPI Y/Y at 3.2% from 3.7% prior.

As I quoted last weekend that “ What is good for the Stock market is bad for the Dollar”, and that’s exactly what the market did from the CPI data release.

The implication of the cooling CPI numbers shifted market expectation of future rate cuts by the Fed, potentially signaling the end of the hiking cycle.

The Fed Fund Futures plot shows the market is expecting the Fed to cut rates by the December meeting and into 2024 next year. I do not think the Fed would want to make the mistake of easing off too early, so I expect rates to remain at current levels, but that could change ahead of the FOMC meeting minutes next week Tuesday. Overall, the theme remains Stocks Long, Dollar Short until there is a shift in market focus.

One key risks, I am trying to monitor is in the Labor market, at the expense of the Labor market cooling down being a positive sign for the Stock market, at what levels does a cooling down become a problem? that’s a question that I intend to delve into over the week, which involves building macro models and setting hypothesis for what threshold becomes worrisome.

The Oil Market:

Last week, I said I expected the Crude Oil market to trade below 70$ per barrel, but the question for me was more of what could be the macro event to trigger this.

Over the week the Crude Oil market traded as low as $76 per barrel. Based on information I have, the Israel-Hamas tension isn’t the driver for the decline but more of a supply glut, as we have seen increased supply in the US by 3.6 million barrels and other Oil inventory countries, above market expectations.

The other driving factor is the supposed weak demand outlook stemming from weakening economic data from China. If its worth it, commodities trader should focus on what’s happening here, a bit more focus on OPEC+ is required and to monitor how bad things could get.

This week Friday, it does seem the market is now paying attention to the Oil market, as Bloomberg headlines and couple of tweets on my twitter feed popping up around the asset class. I expect some upside movement to upset existing positions before we decline further.

Local Scene: Nigeria Inflation Print

Early in the week we had Nigeria inflation print with increase inflation on a YoY basis at 27.33% an increase by 62bps from 26.71%. But on a Month-on-Month basis, inflation has slowed down to 1.73% and Annualized Inflation has declined to 7.1%

Analyzing the components of inflation, with Food being the focus, imported food inflation has declined from 2.7% in September to 2.3% in October, coupled with other food inflation component:

Health inflation still hovers at previous month levels at 1.7%. I saw some Instagram posts with users lamenting on the increase in the prices of pharmaceutical products since the exit of GSK Pharmaceuticals and other small players in the market. In my bias, there are obvious economic challenges that makes it difficult for an international and domestic player to operate, but growth potential still remains and other top players according to market share such as Emzor, Fidson and May & Baker will most likely fill in the gap, while GSK operates a distribution-based model, which has been their original business model before they established operations in Nigeria.

I expect inflation to keep cooling down ahead of next month release, given the appreciation of the Naira as the CBN clears some FX backlog and the reset in the transmission mechanism of policy decisions. Next week Tuesday, we have the CBN MPC meeting which I look forward to as much as the market does.

I do not think we are out of the woods yet, cause Food items in the market are still expensive, and to serve as a guide, the following are guidance level for inflation levels:

Imported Food inflation has to stabilize below 1.3% on a MoM basis

Food & Health inflation has to stabilize below 1.0% on a MoM basis

We are far from it yet, but I remain optimistic.

The Nigeria Equities Market

As I mentioned earlier in the post that I will be releasing an equities market primer, but just to touch base on the Nigeria markets, the Nigeria ASI (All Share Index) has reached new highs:

If you’d ask me, the Banking and Consumer goods index has been in an extended consolidation while the ASI rally, so most of the ATHs (All Time Highs) movement we are seeing is as a result of speculative activities in the Oil & Gas names (SEPLAT) and the Pension Index.

The MPC meeting on Tuesday will set the tone for how the year will end and potentially Q1-2024, so fingers crossed.

That brings me to end of this report.

Thank you once more for reading.