Macro Pulse: Tectonic Shifts

Event Update

The US Fed cut interest rate by 50bps, above market expectation of 25bps amidst oscillating views on the size of the cut, however as we move closer to the meeting, estimates converged to a 25bps rate cut.

Post 50bps rate cut, US Unemployment Claims declined to 219k from 231k prior and below market expectations of 230k, and lastly, the BoJ holds policy rate unchanged at <0.25% in line with market expectations.

Macro Views

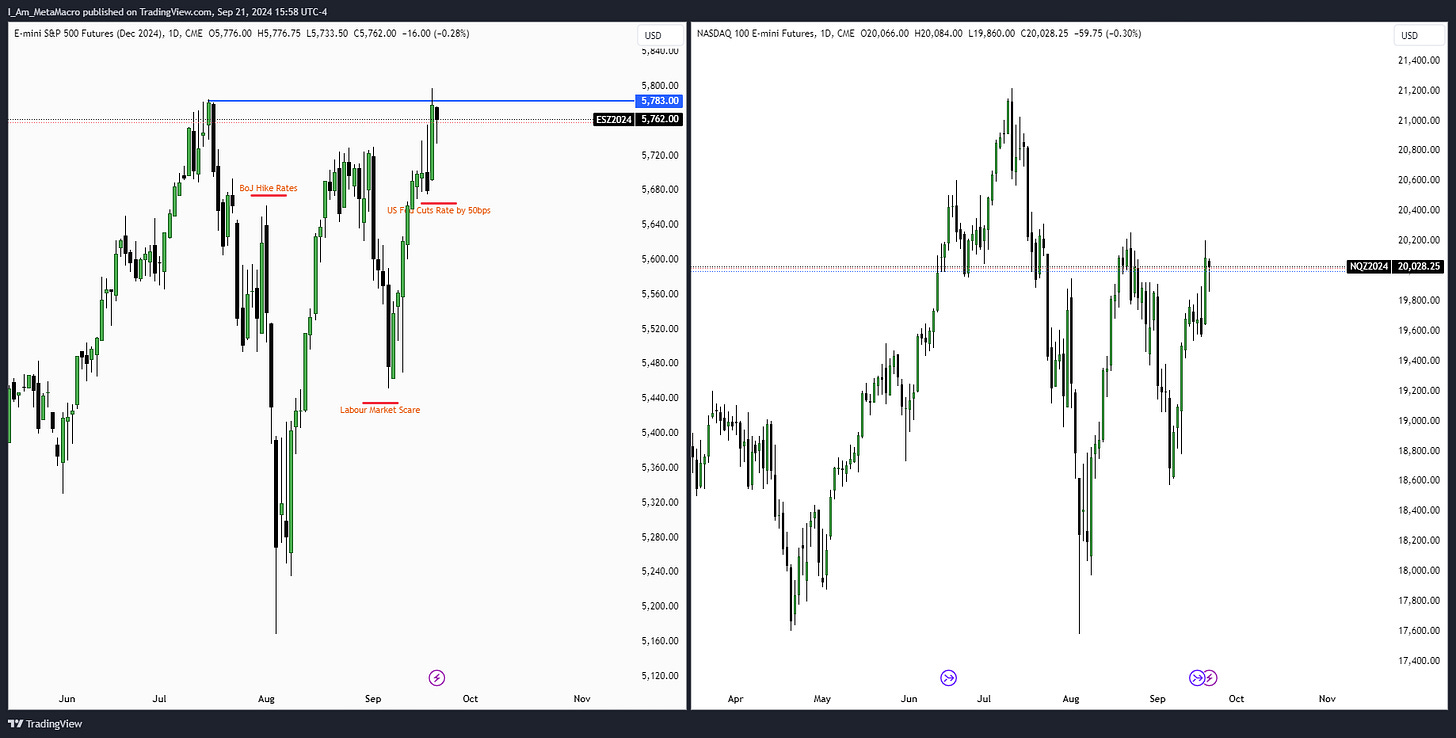

Leading into the FOMC meeting, broad market concerns was primarily focused on inflation slowing down. However, we had a shift towards concerns around a potential recession stemming from contraction in the Labour market from Jobs data in the first week of September, which led to a repricing of the Equity market as it attempts to breach ATHs:

Furthermore, leading into FOMC, broad market attention shifted towards the size of the cuts and its implications on existing views. While some participants expected a 25bps as adequate given the positive growth situation, and other participants expected a 50bps due to the slowdown in the Labour market.

The risk end of both expectations on the size of the cut was such that a 25bps would probably imply that the Fed would potentially place the US economy in a trajectory for Hard Landing, whereas a 50bps cut could also imply that the Fed is cautious about the potential of a recession(slowdown in the Labour market), and market participants could extrapolate this as a recessionary view into asset prices.

However, what mattered the most is that we were cutting into a positive growth economy. Nonetheless, there were concerns that a 50bps initial rate cut poses some risks on inflation reaccelerating.

Growth Views

GDP still remain positive above 2%. Retail sales declined MoM to 0.1% from 1.1% prior, but over a moving average still positive above 0.3% MoM, driven by increase in sales from the following segments:

Sporting Goods, Hobby, Book and Music Stores

Health and Personal Care Stores

Building Material and Garden Equipment and Supplies Dealers

Furniture and Home Furnishing Stores

Motor Vehicles and Parts Dealers

The Labour market continue to indicate a slowdown, but still largely positive and not at a threshold for recession. The key data point to continue observing are:

Layoffs and Discharges

Hiring

Employment from Manufacturing PMI

The Manufacturing Sector, while showing signs of a slowdown, activity still remain positive, with continued demands within the following segments:

Nondefense Capital Goods Excluding Aircraft

Non Durable Goods:

textile

Paper

Construction Supplies

Business Supplies

Chemical Products

Energy

Home Electronics

Construction spending remain positive and stable, with notable attribution to:

Non-Residential:

Office

Commercial

Transportation

Overall there are obvious slowdown in Growth variables, but still notably positive and not close to a threshold that increases concerns for a potential economic recession.

Inflation Views

CPI continue to show signs of disinflation within the Food and Beverages, Energy, Medicare and Education segment. However, the Housing component of CPI still remain sticky:

Overall, there has been a considerable and notable slowdown in inflation, and I expect the trend should persist.

Financial Asset Positioning

Establishing that we are still in a positive growth condition and disinflationary regime, with rate cuts, this is largely bullish for the economy, as we continue to see the positive effects of an expansionary policy in economic agents balance sheet.

We are at a point where expectations around what assets should do seems skewed around different narratives, from premia bulls and bears. However, how I would like to think about things is allocating exposure from a spectrum of aggressive to defensive positioning to extract returns given current market factors.

For the past 2 months, we have seen returns in the equity market stemming from defensive growth sectors: Utilities, Real Estate and Healthcare, while returns in Technology and Information sector paired back. However, there seem to be a shift in positioning due to the rate cut:

Information Technology is now leading returns, and from a factor profile, High Beta, Momentum and Growth factors are also leading returns, while Real Estate, Utilities and Consumer Staples are laggards, this can be attributed to sector rotation as market sentiment shifts to risk on.

Notably, there are obvious divergence across the broad equity indices, with the S&P rallying to ATHs, NASDAQ still within a range and Russell2000 also gaining momentum towards ATHs:

Examining flows within NASDAQ, also notable divergences, META continues to lead the index, rangebound movement in MSFT and NVDA, AMD and AAPL indicating some upside movement.

While directional bias is bullish for equity index, from macro analysis, if we do continue with this momentum next week, I would expect NASDAQ to rally.

Overall, on the Equity sector spectrum, I am maintaining a cautious view on things, with long positioning within the following sectors:

Utilities

Real Estate

Financials

Overlaid with the following factor profiles:

Low Beta

Low Volatility

Momentum

Growth

On the inflation side of things, we continue to see buyside delivery in Gold as DXY continues to decline in value. However, I think there are some concerns around a rebound in inflation, hence demand for inflation hedge securities. Gold could still press higher:

I also think Silver could see some demand over the next couple of months. The broad view here is basically to gain some Commodity Inflation hedge exposure.

Lastly, we are approaching the end of the month and quarter, hence, I wouldn’t really push things too hard into the end of the month. The most important thoughts I lingered on this week, is how I could expand my coverage globally, and deepening my understand of macro mechanics. I will be putting in the work for that into Q4.