In the previous macro pulse last weekend, I established operating via a cautious view going into the week, while still primarily long in Utilities, Real Estate and Financials into the end of the week, and holding the long Yen Currency ETF, while I was stopped out on the CADJPY short trade, which dropped significantly into the close of the week, and I also highlighted keeping in view a long Silver trade.

Last week, key macro data were not surprising, and largely in line with expectations for a positive growth economic condition in the US. Additionally, we also had some key events that took place within the Political and Monetary front.

Yen

On the political front, Japan elected a new prime minister Shigeru Ishiba as it’s next leader. Ishiba is a supporter of normalization of policy by the BoJ, and with both the BoJ and the PM aligned on the same views, it relatively makes it easier to implement hawkish monetary policy stance that has been signified by the BoJ when it raised rate to <0.25% which also sparked some sell-off in US Equities in the past months.

The event sparked sell-off in XXX/JPY FX currencies:

and it also supported in pushing active long FXY trade ITM:

NIKKEI on the other hand reacted negatively to the anticipation of increase in rates, a shift in monetary policy regime compared to what has been in place historically:

China Stimulus and Rebalancing Act

PBoC engaged in a series of monetary policy easing action, injecting liquidity into their financial system, as they face challenge of an implosion within the property/real estate market and deteriorating growth conditions.

The Hang Seng Index reacted positively to the policy action. However, it is important to note that this isn’t the first time China is engaging in a series of monetary policy stimulus to cushion its economy

Nonetheless, broad sentiment is that the PBoC is all in to ensuring it gets things right this time, coupled with the other policy measures in place, more specifically the Rebalancing Act, aimed at diversifying its economy from the real estate market to other industrial and manufacturing sectors. The Rebalancing Act coupled with these measures, could be the ignition to spark the change China aim for, and this is good for the household, the economy and global demand as a whole.

Furthermore, China being a major source of demand for commodities, coupled with its increased focus to diversify the economy to industrial sectors, this has also sparked the demand for Commodities: Copper & Aluminum being major inputs for industrialization were also bid into the close of the week:

Commodities and Geopolitics

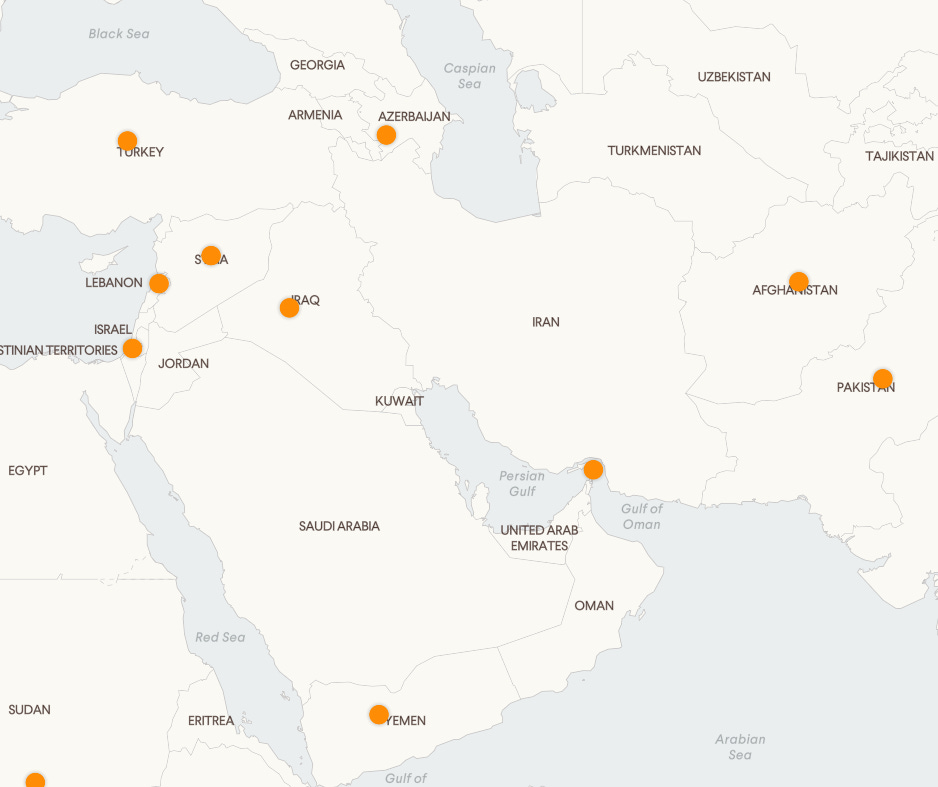

While, we have seen the impact of China stimulus on the commodities market, other factors are still in play and more predominantly, the geopolitical tensions between Israel and Middle East nations. Over the weekend, Israel had launched series of attack which has killed some key leaders within those regions:

The increasing tension alongside OPEC+ policy to increase Oil production in December adds some sell-side pressure to crude oil, the middle east tension hasn’t exactly increased pressure negatively on demand and supply, but the instability is being weighing into Crude oil:

We also see obvious divergences between the Oil complex commodities, with CL and Gasoline lower, while Natural Gas was bid into the end of the week:

Ratio analysis also confirms the better leg of the commodities to focus on:

Further out the curve on politics, the US Presidential election is drawing close, coupled with heightened uncertainty around the global economy, positioning is skewed to hedge exposure by allocating funds to commodities into the election, not to dissuade the fact that there still exist opportunities within the Equities market. However, the Labor market data due this week will provide further view on positioning.

As we move into a new Quarter, with S&P500 above historical high and Russell2000 also close to historical ATH, the catalyst to determine if we move further higher is the Jobs data this week. However, I am still maintaining holdings in existing positions within:

Defensive Growth

Utilities

Healthcare

Real Estate

Commodities

Silver

Safe Haven:

Yen Currency

In terms of where new opportunity exists given recent events my focus is skewed to:

Equities with a larger revenue segment from China, as the Stimulus measure will increase Consumer Discretionary spending

The Labor data this week, more specifically, my focus is on JOLTS Job Openings data will provide context for deciding to allocate funds to Small and Mid Cap

Also looking to add some commodities trade around Soybeans or find an Equity with beta to the aforementioned commodity, same goes for Cryptocurrencies

Exploring a short on weak sectors/names within Nikkei is also in view, but I would take into cognizance the volatility correlation between shorting Nikkei and long on Yen

As we move closer into the election, establishing position within Equities that are favorable to either administration( Trump or Kamala) is also on the table

Thanks,

Great post and thank you for including my most recent article! In regards to the Chinese stimulus news I’m wondering if you’re looking into adding any exposure to Chinese equities? Also great summary on the Japanese election that was very helpful for me.

Solid as always Ridwan. Very important to see the labor market data from the US this week, and also the ISM numbers, these will be decisive for the market to decide whether to start pivoting again into the recessionary story or not.