Over the past couple of months and the last quarter, the focus of the market has been on Inflation direction, Growth concerns and the US Fed path on rates more specifically around inflation.

I am currently working on an Equity Model which to be honest I have completed and will share that soon. Anyways, back to Macro Pulse check and trades I have in play.

Manufacturing and Services PMI

Manufacturing PMI data has been slightly range bound on the downside, but there seem to be some accelerations in the rate of change to the upside. Production and Inventory levels have improved significantly, while Employment still remain negative, but the rate of change to the positive side seems to be improving. Overall the Manufacturing Sector is improving but at a slower pace.

ISM Services PMI on the other hand, has been declining below market survey. While it has been range bound for the most part of 2024 so far, it is beginning to decliner toward Dec’2023 levels , attributable to the impact of rates held at higher levels.

Producer Price Index

MoM Producer Price Index remain rangebound, but largely increasing. The increase is ascribed to activities within the Energy and Services sector.

While MoM is relatively volatile and range bound, on a YoY basis, PPI has picked up the pace, refuting the US Fed expectations and confidence around a slow down in inflationary pressures.

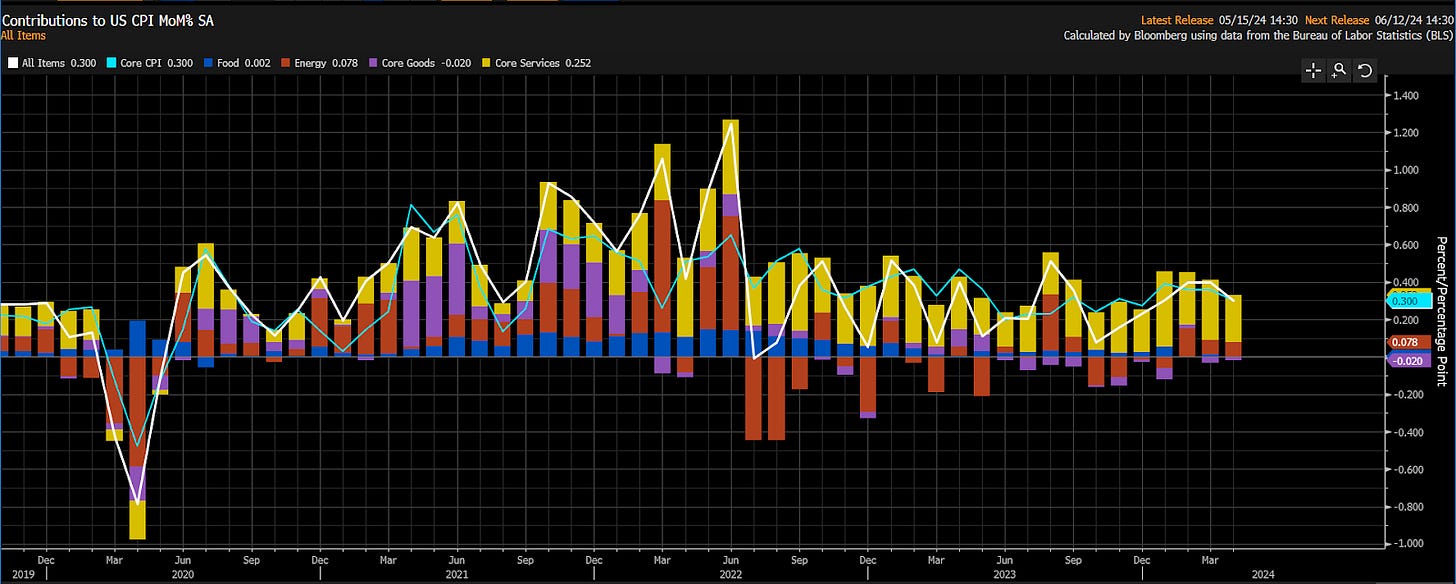

Consumer Price Index (CPI)

CPI MoM appears to be flattening, despite higher prints from PPI. However, on a YoY basis, CPI still remain elevated and albeit slightly range bound. To the US Fed concern, inflation isn’t slowing down as they would expect and at recent press conferences, the Fed has signaled its stance to keep rates higher for longer - now, this doesn’t necessarily mean an increase in rates above current level ( I will drill down into how I am thinking about this shortly).

In summary, how I see the macro narrative is as follows:

Higher for longer rates as a function of how inflation related data evolves and rate of change

Inflationary pressures from PPI

Range bound CPI, with no strong conviction of a slowdown in inflation level

Now, connecting the above narrative to asset class:

US 2-Year Yields

I have highlighted some key event and the respective price levels around the event. We have seen a rangebound price action around US 2Yr Yields, driven by mixed data round inflation and growth variables. The 2s set an intermediate high at 5.041% from the May NFP print, and declined lower, now trending higher subsequent to the Fed press release re-emphasizing higher for longer and lower conviction around the slowdown in rates.

My view is as yields goes higher, US Dollar will follow suit, however, I do not necessarily see a long term trend in bulls around the DXY, except if subsequent inflation prints continue to show an acceleration in the rate of change to the upside, then we can potentially start to see the market price in future expectations of higher yields.

Whether the 2s breaks above May NFP high would be a function of the magnitude of change in inflation related print. As such I don’t see the DXY trending higher or lower for a long period, but rather opportunities will exist within the range.

US DOLLAR (DXY)

Extending the US 2s narrative and price levels into the DXY, we see a similar structure in play on the Daily timeframe. The intermediate high on DXY at 106.372, while correcting lower as yields decline to c.4.76% level. However, with the US 2s rallying higher we only see a slight retracement to the upside in the DXY.

Overall I expect continued range bound action between the 104 figure and 106 figure or 106.5 levels based on the criteria set in place for the US 2s to trade above May NFP levels.

EURO FUTURES (6E1!)

With a long/short dollar range bound narrative, and taken into cognizance the EU monetary policy levels into price, we see the EU has also been range bound, I do not have a strong conviction of EU trading above the 1.1 figure level odds are we would still continue trading between 1.07525 and 1.09375 until the catalyst I mentioned above crystalize.

Long EURUSD

Connecting all of the above factor, I have a long trade on EU expecting a distribution above 1.08876 level, not exactly sure we would see a runner close to 1.09500 level, but I am playing this on a short term view.

I would most likely distribute my positions at 1.08591 levels and then leave a runner for the short term buy stops on the Daily timeframe:

On the side, the other trade I am running is the Cotton long, would probably share my thesis behind that:

Cheers.