Refreshing my thoughts on positioning ahead of the week.

We had an eventful week, with the Fed Chair confirming that rate cuts are being considered, while also suggesting an expected pause in the slowdown of the labor market.

Evaluating the pathway so far and where we are now Inflation data remain key to determine the magnitude of the cut and if there would be a cut at all in September. However, we now have a new complex, the recessionary fears stemming from a slow-down in the Labour market.

On the price action spectrum, we have seen ES, NQ, RTY, DJ and MDY rally close to previous ATHs and trying to gather momentum to surpass them:

From my perspective the factors which market are currently pricing are:

Scenario 1: Positive Growth, Falling Inflation Regime, Monetary Easing

Scenario 2: Weakening Labour Market, Falling Inflation Regime, Monetary Easing

Thematic: AI Theme, Geopolitical Tension and Defensive Growth

The recent data releases reflect both the current economic conditions and projections of where we might be headed, considering different regimes and associated concerns. While broad equities have rallied as the market prices in Scenario 1, there has also been a shift in positioning towards Scenario 2 as we approach all-time highs. This shift mirrors a degree of bearish price action in the market.

Active Macro Theme

Growth

Growth remain positive at 2.8%, while we have the Prelim GDP q/q data release this week to provide further insights on the pathway for growth, we currently remain positive. With positive contribution from Durable Goods, Equipment component and Business Investment

Fed Balance sheet has been relatively contractionary but not tight enough compared to trend in 2015 - 2019.

Household balance sheet remain firm, with increased holdings of Real Estate and Equipment assets, while durable goods remain steady.

Additionally, Corporate Profits have been strong, stemming from Financial, Utilities, Electrical Equipment, Transportation and Warehousing and Information industry.

Interest expense has also declined YoY and QoQ across industries, majorly from Beverage and Tobacco, Textile & Product Mills, Electrical Equipment, Transportation Equipment, Wholesale Trade, Food and Beverages, Clothing and General Merchandise

US Retail sales remain firm and growing notably from Electronics, Building Materials, Healthcare and Personal Product and Non Store Retailers.

Manufacturing orders are slowing down, but remain firm:

Industrial production index also confirms the slowdown in the manufacturing sector, but not significantly bad to cause a recession:

Inflation

On inflation, CPI has decreased marginally, no doubt we have made significant progress in reigning in inflationary pressures

While PPI also confirms the same narrative around a declining inflationary pressure:

Additionally, US Inflation Swaps continue to trend lower as disinflationary expectations dominate the market.

Overall, the current macroeconomic theme reflects a positive growth outlook with moderated inflation pressures, stable liquidity conditions, and a resilient consumer and corporate sector. While some signs of a slowdown in manufacturing are evident, the broader economic indicators do not suggest an imminent recession.

Equities Focus:

SPX

S&P flows are driven by the Valuation function, as rate cuts becomes the central focus amidst the oscillation on Growth, Inflation and Labour market tightening.

Relative Rotation Graph indicates Real Estate, Utilities and Consumer discretionary index as momentum drivers in returns, while the Energy sector lags primarily due to the Geopolitical tension.

Technology on the other hand has experienced a decline in momentum and weakening. However, NVDA earnings release on Wednesday will be a major driver on if Momentum will pick the pace or the index will continue to weaken.

COT on SPX is Net Short as Commercials hedge against an increase in prices, however, there seems to be an increase in the rate at which the short hedge is being unwound and potentially flipping into a Net Long position.

Mid Cap Index

Mid cap index also driven by Valuation function stemming from expected rate cuts and the anticipation of shift in positioning into small caps with a positive growth dynamic in the economy.

RRG also shows Passenger Airlines, Cable and Satellite Industry, Interactive Media, Fertilizers & Agriculture, Healthcare Suppliers, Pharmaceuticals and Diversified (Chemicals, Metals and Mining), while Apparel Retail, Home Furnishing and Research/Consulting leads the index

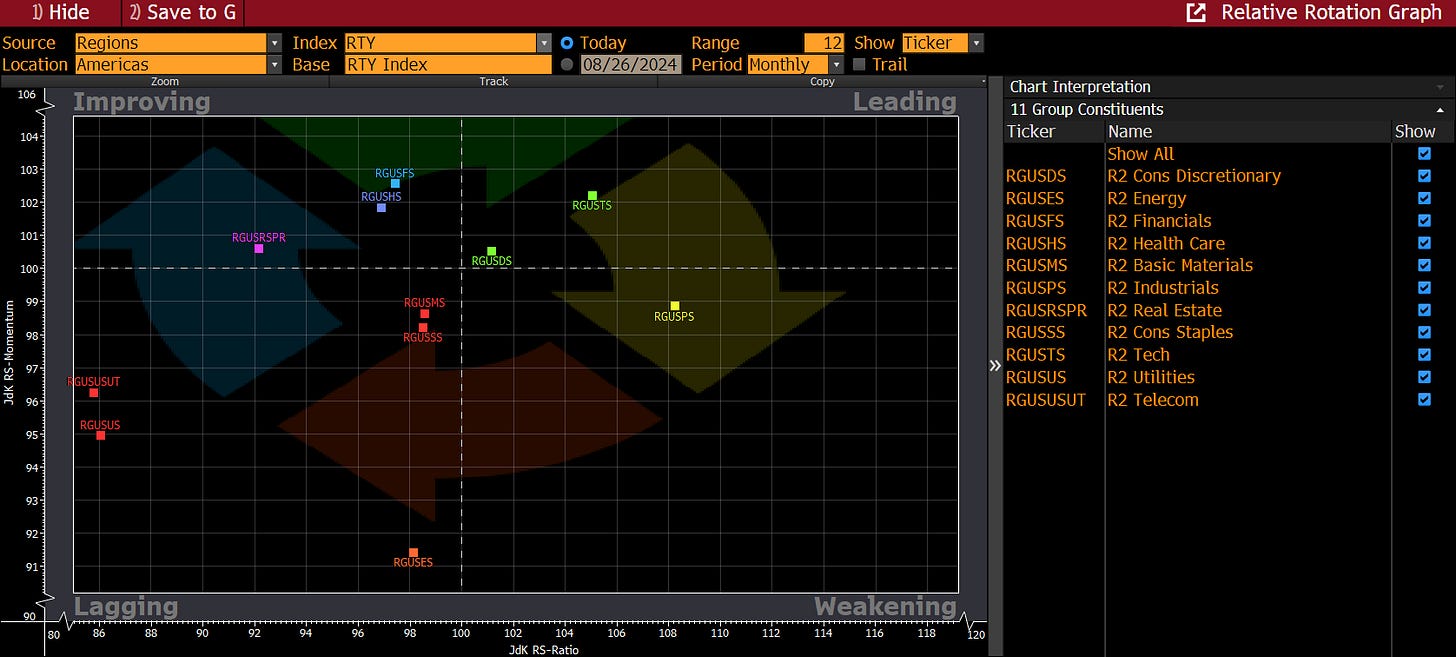

Small Cap Index

Similar function driver for the Russell:

RRG indicates Utilities and Telecom on the Momentum but lagging quadrant, while Consumer Discretionary and Technology are leading the index but weakening.

COT positioning is net long, but declining compared to the peak levels in 2022, as commercials unwind their hedge against an increase in price of the index.

Overall, the movement in prices is largely attributed to the decline in Inflation and expectations in rate cut which would have its impact on the valuation function of cash flows. Additionally, there seems to be more room for upside in RTY than SPX, I might be wrong, but if the current narrative around Growth, Inflation and Rates remain firm then we should see more upside in rotation trades until a regime shift occurs.

Positioning

I will continue to increase exposure in the following sectors:

Real Estate

Utilities

Financials

Healthcare

Energy

Transportation and Warehousing

I am less inclined to increase exposure to:

Technology and Information

Industrials and Consumer Discretionary

While I have some positions running across these sectors, I will basically maintain them and continue to use trailing stop losses to manage them.

On a Macro basis, we have quite a lot of data point going forward into the next FOMC meeting, they would provide insights on the direction of Growth, Inflation Labour market and Rate cut, and until those data prints crystalize I do not have any reason to change my macro narrative.

Currently working on models around macro economic data and my approach to the markets and I would like to share a book I am reading which I find incredibly enlightening on how to think:

Book recommendation, yeah.

Be safe.

This was a great equity market overview, thank you!