I have been engaged in series of reading, books and papers to understand the mechanics and drivers of the currency markets, to enable a trader or investor make sound reasonable judgement based on a consistent framework and approach, and to be able to that requires some level of understanding of the workings of the market.

This is not an holy grail model, or a verified single approach to the currency market, nor does it guarantee consistent profit. I have tried to put some of the pieces together and this is the best I can come up with so far, barring the additional reading or research I am yet to embark on, but overall, they will build upon this.

How this report is structured:

Fundamental and Foundational View

Monetary Policy

Currencies and Currency Pairing

Currency Price Drivers

Interest Rates

Interbank Offer Rates

Repo Rate

Swap Rates

Overnight Index Swap Rate and Spread

Cross Currency Basis Swap and Spread

Timing

Market Hours

Fixings

Intermarket Currency Relationship

Stock vs Bonds vs Commodities

Technical Analysis

Reports & Information

Things I Read, That Might Be Useful to You

In the appendix section are books, papers that I find useful and insightful.

Fundamental and Foundational View

At the core front of currency trading are nations/economy, and what we do is speculate or position towards taking bet in what side of the currency will appreciate or depreciate. However, to effectively arrive at a sound conclusion to a bet, it is key to understand the drivers of currencies and relationship between currencies which would provide into what currencies to pair together in executing a trade and factors to consider.

At the core of it the movement of a currency is largely driven by five factors:

Interest Rate

Cost Factor

Liquidity: Supply and Demand

Economic Events

Policy

Interest rates is at the forefront of currency movements as they are the price of money. However, interest rate can not be viewed in isolation, it also has to be assessed within the context of economic conditions of the currency in focus. Overall, it is important that currencies/money will move up and down based on the factors listed above, either to seek yield, due to the cost of funding, liquidity factors and also economic events that links into inter currency relationship.

The cost factor of a currency can be assessed by the following:

Interbank Offer Rate

Effective Central Bank Rate

Repo Rate

The demand for once currency or another will largely be dependent as a function of the above factors, such that in layman terms if the cost of assessing EUR is higher than the cost of assessing USD, there would be less demand for EUR against USD, which would transcribe to a short EUR, long USD trade on a very very basic level.

Given that the market is a complex system, it is quite critical to understand how various variables interact with each other and what factor is driven currency movements or return on a macro scale.

As all of these factors interplay also impacted by a policy variable, which is largely from Monetary Policy, the currency price will move up and down to reflect the cost and funding structure underneath, all of which can be interpreted by behaviors in other asset class such as Spot FX, Swaps and Forward derivatives.

Currency Pairing - Trade Weighted Index

A currency paired together at the foundational level is a trade between two different economies, and the exchange and flow of goods and services, which connects into the balance sheet of the country - Current and Capital Balance of Payment account.

Before trading a currency, it is important to understand the economic activities of such country, and the structure of its balance of payment, more specifically:

What is imported

What is exported

How revenue is generated

What factors on an asset class in the financial market could impact the strength or weakness of the currency

The other shortcut approach to this, is to understand the Trade Weighted Index(TWI) of the currency. The TWI is the price of a currency in terms of a group or basket of foreign currencies based on their share of trade with Australia, it provides a broader measure of whether a currency is appreciating or depreciating against the currencies of its trading partners.

The data on the TWI can be found from the Central Bank of respective countries, in addition I think it is advantageous to go the extra step to understand what commodities are being traded which impacts the current account of the balance of payment, or whether it is just flows of capital that reflects in the capital account of the target country.

The importance of a TWI is emphasized because a movement in other country’s currency can be important for the other nation currency for the following reasons:

It can be a significant import or export from and to the country

The country is a significant exporter to countries where the target country is also a significant exporter

With focus on the G10 currencies, let’s evaluate their TWI and what it implies:

AUSTRALIA TWI:

Australia has a higher TWI against Chinese Renminbi, Japanese Yen, European Euro and US Dollar in that order. From an FX trading or speculating point of view, the large flows would be between AUDCNH, AUDJPY, AUDUSD and AUDUSD.

Before I delve into what goods/services is being exchanged between the major TWIs, I think it is important that since there is a core trading relationship, Central Bankers have a core interest on both side of the currency to ensure their currencies are neither too cheap or too expensive, in order to ensure continuous facilitation of the trading relationship.

Case Study: AUDCNH

A classic example is the Australian Dollar paired against the Offshore Chinese Yuan. Before examining the charts, let’s examine what commodities are traded.

On the export side Iron Ore accounts for 58.8% of what is exported from Australia to China, then Petroleum Gas also accounts for 11.6%.

On the perspective of both countries there are couple of factors to consider, which includes:

Who are the major producers of Iron Ore and Petroleum Gas globally, since it accounts for a larger proportion of Australia revenue

Since China is a dependent on Iron Ore, China would attempt to engage in foreign exchange interventions or adjusting interest rates to reduce the cost pressure of the commodities it relies on

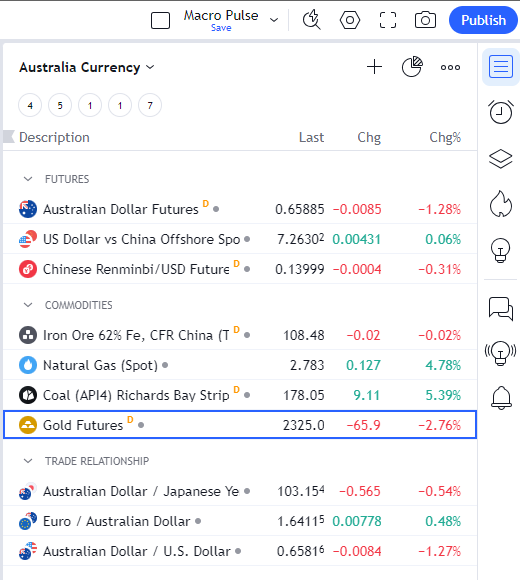

Overall, the Australia Currency Relationship, alongside commodities of focus cascades into:

CANADIAN TWI:

Canada TWI is majorly with the following countries:

United States - 46.69%

Euro - 12.63%

China - 13.91%

Mexico - 8.12%

In terms of trade relationship, Canada has 74.5% of it exports proceeds to United States and China, largely from Crude Petroleum:

Overall, the Canadian Currency Relationship, alongside commodities of focus cascades into:

EURO TWI:

I won’t be able to add the image of the Euro TWI due to the numerous trade partners in the Euro area, but the major countries are:

United States - 16%

China - 15.8%

United Kingdom - 10.4%

Switzerland - 5.9%

Japan - 3.7%

Link to the breakdown: https://www.ecb.europa.eu/stats/balance_of_payments_and_external/eer/html/index.en.html

The major import items are petroleum products.

JAPAN TWI:

The BOJ doesn’t have the breakdown of their TWI directly on their website, but it is available as part of a broad report on the BIS website: https://www.bis.org/statistics/eer.htm

The major countries are:

Euro - 13%

US - 16%

Australia

The major imports are Petroleum and Coal from the US and Australia

POUND STERLING TWI:

Euro Area - 40.8%

United States - 21.8%

SWITZERLAND TWI:

The index weightings for Switzerland TWI can be found here, and the details are as follow:

Euro - 41.6%

US - 17.3%

UK -7.5%

By examining the trade index across currencies, it gives a view of the currencies to pair together and the commodity assets that influences them. However, this is one leg of the currency market. While the TWI is published annually by all central banks, the other alternative to check if there is a shift in weightings in trade relationship is by examining the trade reports and running the nominal value weightings across countries on the import and export side.

Interest Rates

This is a broad component of currency trading on its own, and I am in no way attempting to summarize all it entails in here, however, I will shed light on what I find useful in trading FX.

Before delving into the world of interest rate, it is important to understand the monetary policy goals and approach of various countries and of course linking it to economic event. Linking interest rate to the fundamentals, it fits into the cost factor of the currencies. Now, remember that you are essentially trading two currencies when you execute a trade (buying/selling one side of the currency), keep this in view as we move forward.

Interbank Rate

The interbank rate is a widely used indicator of funding conditions in the interbank market. It serves as a top level market where foreign currency is being traded/exchanged between large banks, and not just currencies, but other currency derivatives.

The interbank market, serves as a platform for banks to manage their own exchange rate and interest risks through derivative instruments and also to take speculative position based on research, and a key rate to that has been the LIBOR (London Interbank Offered Rate)

The LIBOR has been used as indicator of funding conditions in the interbank market, as it serves as a reference at which banks can borrow short term wholesale funds from one another on an unsecured basis. Due to the LIBOR serving as a reference rate for unsecured borrowing, it is always higher than the Effective Interest Rate.

The LIBOR serves the following purpose:

As a reference rate for financial instruments to contract upon (short term contracts like swaps and futures)

A benchmark rate that reflects relative performance measure for investment returns or funding costs

It also serves as an indicator of the health of financial market, such that spreads between LIBOR and other benchmark rates offer signal on the tides of the broad financial environment.

To better understand how the LIBOR or more generically the Interbank Offer Rate (IBOR) is a useful tool for the market, let’s examine what makes up the LIBOR rates:

LIBOR = overnight risk free rate + premium + bank credit risk + liquidity risk + risk premium

**all variables accounts for the duration the rate references (term)

As LIBOR rate rises it is usually an indication of rising risk either on the credit side or liquidity crunch to meet funding needs, which impacts the demand and supply for the underlying currency. As such to gain adequate insight, it should be paired with monitoring Credit Default Swap (CDS) and LIBOR-Overnight Index Swap Rate (OIS)

To truly understand the importance of monitoring interest rates for trading the currency market, I will draw on the 2008 Great Financial Crisis (GFC) and how it impacted the S&P500, US Dollar and EURUSD.

The peak of the financial crisis occurred between Aug’08 and Sep’08, and we see rising LIBOR across different term indicative of rising risks in it variables. Connecting that into the asset class, between the same period, we see a flight to safety (demand for dollars) to meet funding needs which drove USD(Orange line) up and EUR lower, resulting to a short trade on EURUSD spot, the catalyst of rising LIBOR also cascaded into the equities market, evident by a decline in the S&P500 (Red line)

The widening spread in the LIBOR signaled concerns around credit risk, which paired back funding, resulting in an inability to access funds further raising concerns on liquidity risk which also further widened the spread. From a demand and supply perspective, on the supply side, banks were unwilling to tie up funding for long duration (evident by higher LIBOR rates on the 12m tenor), which resulted to supply shortage of the Dollar, and with persistent demand for the Dollar for funding liquidity purpose, we see a rise in the USD and a short for EURUSD.

However, worthy of note that there has been concerns about the manipulation of the LIBOR during the GFC as such there is a transition from IBOR to overnight risk free rates (RFRs) to eventually replace or complement the IBOR benchmarks. New RFRs include:

SOFR: US

SONIA: UK

ESTER: Euro Area

SARON: Switzerland

TONA: Japan

While monitoring the new RFRs the following are the IBOR for respective currencies which should be monitored for different currencies:

Repo Rate

The repo market is a securitized market compared to the IBOR for financial institutions to meet liquidity need. It serves as a crucial engine for financial stability and monetary policy, such that Banks utilize repos for refinancing and to satisfy their liquidity needs, while Central Banks use them to steer liquidity in the market.

The repo rate is the interest the reverse repo counterparty receives for holding the asset, with the main players being Central Banks, Cash Rich Institutions, Fund Managers, Brokers and Triparty Agents.

The repo market is an important engine for liquidity in many countries and currency areas, as it serves as an important mechanism for the implementation of monetary policy, a marketplace for liquidity, which is central to the financial system.

Due to the fact that the Repo market is highly collateralized compared to the IBOR, it reduces credit and liquidity risk. However, since it is a market for financial institution to access liquidity it provides signal on potential liquidity crunch in the system, largely due to low confidence in collateral holdings on the repo counterparty end.

Such that, the higher the cost of liquidity in the security market, the higher the repo rate. The key thing here is to measure the Overnight Collateral Spread, which is the difference between unsecured rate (IBOR) and repo rate.

Overnight Collateral Spread = IBOR - Repo Rate

Such that if Collateral Spread declines to negative, it is most likely a pointer of a liquidity crunch in the respective currency financial system. However, it is important to note the following drivers of the Collateral Spread:

The volatility in unsecured rate

Repo markets are sufficiently depressed in terms of prices, liquidity or volatility

Conditions in the unsecured market are sufficiently tight

As such, it is important to monitor which of the following is driving the level of the Collateral Spread in the market.

Swap Rate

At the very basic level, a Swap is essentially exchanging streams of cashflows in the same currency between two counterparties, and the rate denotes the fixed rate that a party to a swap contract requests in exchange for the obligation to pay a short-term rate(IBOR of the respective currency).

To drive the concept of engaging in Swaps, an analogy of why a trader or an investor or institution would want to engage in a Swap is always based one expectations of interest rate movement, for example:

If I have a position locked in, at say 3% for a USD instrument and I have an expectation that over the next three-months the US Fed would have a hawkish stance, as such I expect the market to reflect the expectation in the IBOR (SOFR). To hedge against my current position, I would enter into a swap agreement with a counterparty such that I would pay the counterparty a fixed rate of 3% on the notional/principal amount, while in exchange the counterparty pays me the floating rate referenced to IBOR(SOFR for the US), whereby, the swap rate is quoted as a spread between the Swap and Fixed/Counter Party rate.

Moving forward, at maturity if the Swap Spread is higher, that means the IBOR(SOFR) increased relative to the fixed rate, say from 3% to 5% then I earn the difference of 2% on the notional amount paid to me and if the Swap Spread is lower, say from 3% to 2%, I pay the difference of 1% to the counterparty.

With the concept of Interest Rate Swap(IRS) home and dry, the key focus for Swap are:

Overnight Index Swap Rate (OIS)

Overnight Index Swap Spread Rate (which involves two currencies)

Cross-Currency Basis Swap

Overnight Index Swap Rate (OIS)

Our starting point of focus relative to trading the currency market is the OIS. The OIS is a variation of the IRS, in which the floating leg/rate is tied to the IBOR, such that it pays the daily compounded rate over the coupon period without actual exchange of principal amount.

The OIS serves as a tool to anticipate interest rate expectations, closely linked to investors’ expectations of the future level of the actual IBOR.

The chart above is the UK 3 month OIS, an increase in the index is an indication of expectations of higher rates and vice versa, to pair this with actual interest rate level in the UK:

We observe the rising expectations of rising interest rate in the 3 month OIS, which also reflects in persistent rate hike by the BOE from September. While rates has remained flat since August 2023, the OIS has been pricing in an expectation of rate cuts into the current date. ,

However, what is more useful for FX spot trading is the OIS Spread.

Overnight Index Swap Spread Rate (OIS)

Recall I stated that currency trading is essentially trading two currencies or expressing your views between two currency in a long on short position, but you are actually trading both side of the currency simultaneously, such that:

If you buy GBPUSD, you are buying GBP and Shorting USD

If you short GBPUSD, you are shorting GBP and Buying USD

Now in terms of the Swap Spread Rate, the fundamental pinning to this is Interest Differentials based on Monetary Policy and taking long/short positions based on funding/reserve currency relationship.

A funding currency is a currency with low interest rate, while the reserve currency is the currency with a high interest rate. What this implies is that, you would borrow from the currency with a low interest rate and invest/lend in a currency with a high interest rate(funded by the low interest currency).

What the OIS Swap does is compare the interest rate differentials between two currency to highlight which side of the currency is likely to see demand and thus an opportunity to long a currency. A case in point is with the GBP, borrowing a live example from

report:Moving forward, the other component of Swap derivatives that is important to Currency trading is the Cross Currency Basis Spread.

Cross-Currency Basis Swap and Spread (CCBS)

A CCBSwap is a swap that exchanges both principal amount between two currencies at the beginning and at the maturity of the swap. While also exchanging interest payments periodically between two currencies based on two money market reference rates in two different currencies.

The CCBSwap provides insight into the following between the two currencies:

Credit and Liquidity Risk

Supply and Demand Pressure

The CCBSwap has an edge over the OIS because the OIS does not account for the different credit and liquidity risk by simply evaluating the OIS Spread between two currencies, as it only shows monetary policy differentials. As such, the CCBSwap Spread is a cleaner measure of the balance between demand and supply for the currencies.

On the liquidity side, the currency liquidity profile can be assessed by evaluating the spread and the term structure (yield curve) between the IBOR and the OIS Rate e.g for the EUR:

it is the Liquidity Spread = EURIBOR - EONIA such that if the spread between the two are declining, it suggests that there is easy access to EUR liquidity and low funding costs and vice versa when it is increasing. The underlying reason for this lies on the Interbank Market.

Furthermore, on the CCBSwap side, when a supply and demand imbalance occur which results in an increased pressure on Dollar funding, the EUR/USD CCBSwap Spread widens(negative) as demand for dollar increases

The key thing to note when utilizing CCBSwap Spread is to monitor it with the Credit Default Swap (CDS), Monetary Policy Rates (OIS Spreads ) and the Central Bank Balance Sheet action in terms of QT or QE.

In summary, by understanding the fundamental drivers of flows between currency based on Interest Rate, Monetary Policy and Economic Events, this gives you a sense of direction for positioning between two currencies.

Moving forward to the next component: Timing

Currency Timing

There are five component of timing as it relates to currency trading:

The specific Currency market open

The overlapping relationship into the Cross Currency market open

Fixings of the Currency Interbank Rate

Start and end of Repo Market Activity

Stock Market Open

The reason timing is important is due to the fact that activities across other market impacts the currency market given that at the core of every market a currency is transacted upon. The other reason is due to the fact that every currency is positioned differently on the world map and there is a time zone difference, which implies that banking activities in the core currency location is crucial, however, banking activity in other major trading hub is crucial depending on the cross currency pair you are trading:

Broadly, the currency market is segmented into:

Asia Session:

Trading Hubs: Tokyo, Hong Kong, Singapore

Active Currencies: JPY, AUD, NZD

London Session:

Trading Hubs: London

Active Currencies: GBP, EUR, CHF

Chicago into New York:

Trading Hubs: Chicago, New York

Active Currencies: USD, CAD

Below are trading times, that I have been able to collate together, I do not have the Repo market timing for other markets, but this would do for now:

Yes, that’s a lot of timing. The thing is timing is very important for each asset class especially when cross currency trading. To not beat this too much, the key is to understand that at specific currencies market trading hours especially in their domestic market, the prices of the spot currency would gyrate based on the relationship in other market (Bonds/Interest Rates and Stock Market), however, it becomes a different story when other market open simultaneously.

Here is an example, in NZD, while trading the spot currency during its trading hours, the US market is closed and what that means is that the NZD doesn’t have to seek yield, as such it trades in relationship to its bond price movement or the sentiment of trades relative to its economy. However, when other market opens the movement of the currency switches from only following it domestic bond price to yield seeking against other currency and markets, while also having a leaning effect to reaction of trades to other currencies in other market.

I also included the IBOR fixing times, the opening price within the hour window could be useful to trading, I personally would just use it as a reference point for price to retrace (seek premium or discount) or use it as a starting point to find key levels to the left side of the chart that price might trade into.

Overall, timing is important especially when participating in intraday trading.

Intermarket Currency Relationship

The key message here is to try to identify intermarket assets that are driving flows into the spot currency either from the Bond market, Stock market or Commodities market. Hence, evaluate movement of the stock indices, alongside other market movement plus economic data/performance and see if it offers a pointer to the likely direction of the currency on a macro basis.

For the currencies stock index:

USD: S&P500

NZD: NZX

JPY: Nikkei 225

Australia: S&P/ASX200

GBP: FTSE250 Index

Bond market: Gilts and German Bund

EUR: DAX

Bond market: German Bund also

On the commodity side, if you refer back to the Trade Weighted Index and evaluate what each country exports or imports with its trading partner, you would have identified the commodity asset that could have an impact on the respective currencies:

The above does not encapsulate all the relationship, put in some work here to identify it.

Technical Analysis, Report & Information

Technical analysis is a subjective topic, personally I would say do what works for you. However, what I do are:

Transpose macro narrative to the chart

Gauge Open Liquidity float from a Month and Quarterly Shift Perspective

Try to make an estimated guess of order flow on the weekly/daily timeframe

Build my directional bias for short term or day trading

In terms of report and information:

Bank of International Settlement Quarterly Review

Major Global Investment Banks Monthly and Quarterly Outlook

To get a sense of what macro variables is in focus or thematic

E-Quotes from CME: https://www.cmegroup.com/market-data/e-quotes.html

CME Tools: https://www.cmegroup.com/tools-information/

This covers the Currency Market Model, its a lot of information that can be utilized to build a model on how you want to approach trading the currency market. Future market analysis shared would build on this, and this is not an holy grail system, at the end of the day its subjective to the analyst analysis and taking bets on your ideas, some you win, some you lose. The last section are list of books I read and research papers that solidified understanding of how things functioned with actual market sample, I would recommend to read as much as you can.

Things I Read, That Might Be Useful to You

FX Trading: A Guide To Trading Foreign Exchange, 2nd Edition - Alex Douglas

The Trader's Guide to Key Economic Indicators, 3rd Edition - Richard Yamarone

The FX Bootcamp Guide to Strategic and Tactical Forex Trading - Wayne Mc Donell

Inside the Currency Market: Mechanics, Valuation, and Strategies - Brain Twomey

Foreign Exchange: A Practical Guide to the FX Markets - Tim Weithers

BIS Quarterly Review: https://www.bis.org/quarterlyreviews/index.htm?m=158

https://data.snb.ch/en/topics/ziredev/chart/devwkieffinerech?zoomType=custom&min=2009-10&max=2024-12

https://www.cmegroup.com/tools-information/quikstrike/short-term-interest-rate-analytics.html

https://www.rba.gov.au/publications/bulletin/2010/dec/pdf/bu-1210-4.pdf

Great breakdown

youre on the right path

you have the majority of the moving parts. now its about understanding how they hierarchically connect to one another to produce a net effect.