Good day, MetaMacro readers!

Here’s your latest update on FX market flows, positioning, catalysts, and economic developments.

FX News

FX update: FX implied vol, FX positioning

Economic dashboard

FX Views

FX News

U.S. Fed is holding steady at 4.25–4.5%, while the ECB has cut to 2%, creating its widest interest‐rate gap since 2019

President Trump is publicly pushing for aggressive Fed cuts, heightening uncertainty around U.S. monetary policy moves

ECB cut rates by 25 bp to 2%, its 8th cut since June 2024 nearing pause after eighth rate cut

President Lagarde signaled cautious optimism and warned the ECB may pause further cuts unless trade tensions hit hard

The Swiss National Bank now may reintroduce negative rates or intervene—options previously shelved

Tariffs are triggering capital outflows, currency depreciation, and volatility in EM currencies

Global growth slowing: IMF/OECD projects ~3.1% for 2025 with regional divergences — U.S. ~2.0–2.2%, eurozone ~0.9–1.3%, China ~4.5%

Bulgaria’s Euro adoption in 2026 clears another stage, but domestic protests and snap election risk remain—potential volatility for BGN/EUR

The 50th G7 Summit in Canada brings tariffs, Ukraine, and Middle East tensions into focus. Expect joint statements, but limited breakthroughs, leaving tariff negotiation uncertainty alive

UK Chancellor Reeves previews a major spending review—markets are watching how fiscal plans (e.g., infrastructure) may impact GBP and BoE positioning

FX update

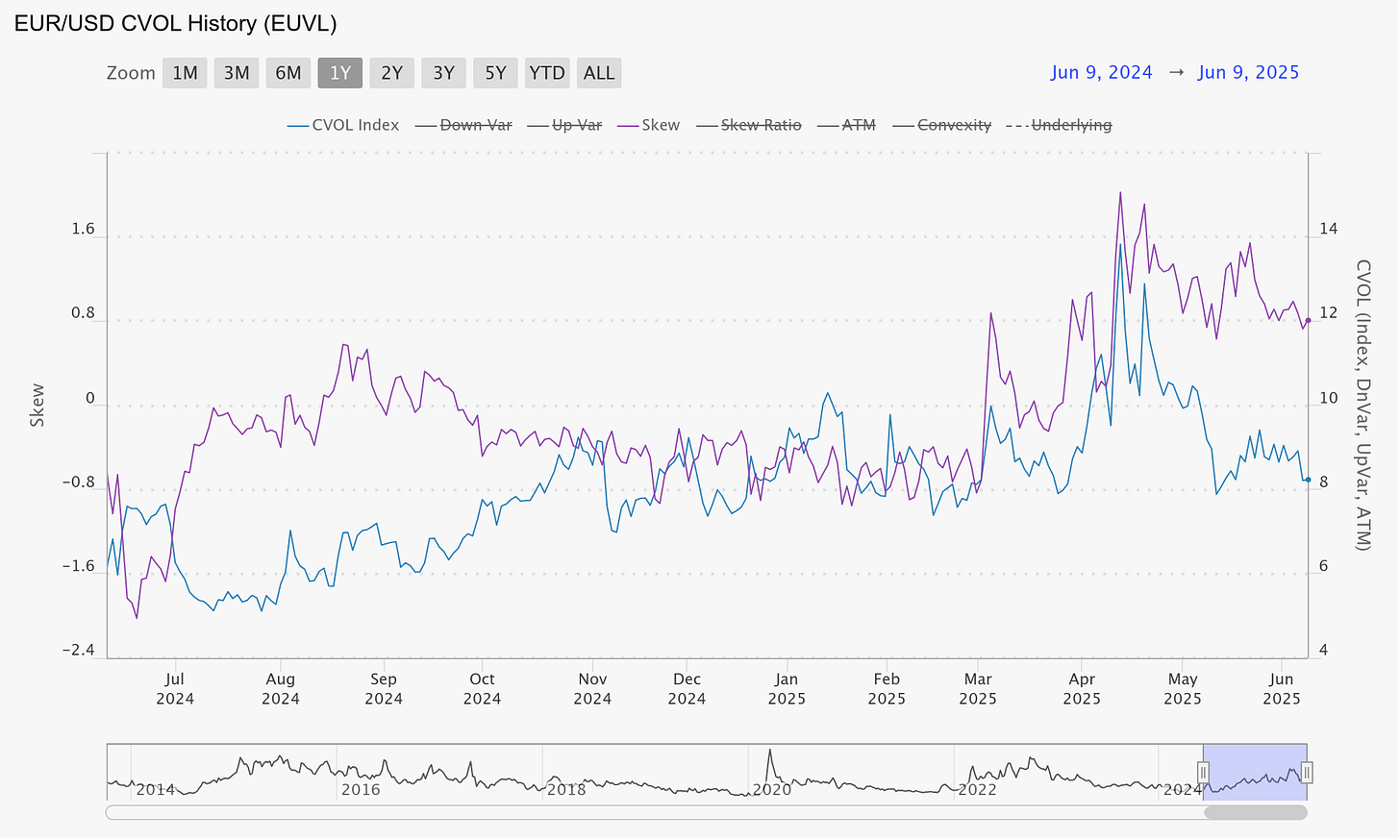

Implied Volatility

COT Positioning (Non commercial net positions)

Economic dashboard

FX Views

FX traders—especially swing traders—may find current market conditions frustrating. Range-bound price action dominates across majors and even exotics. The Scandinavian currencies (SEK, NOK) have stalled

Silver is catching up to gold, tariff story still has weighting on majors, positioning in the dollar is very indecisive even though the dollar is at a bottom (at the time of writing). Carry (blue) is at a support as well as USDJPY(white)

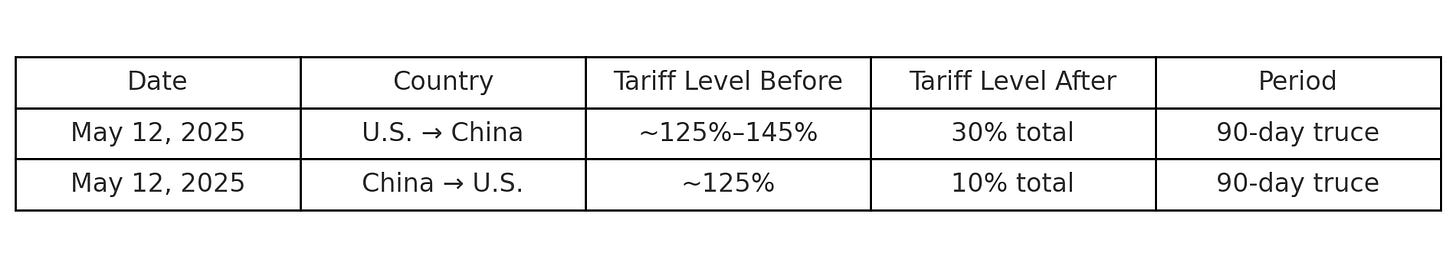

HEFA vs. EFA) to infer how much of the performance is due to carry.It is unlikely that Wednesday’s CPI release will be a market-moving event. The consensus expectation for core inflation stands at 2.9%, up slightly from the current 2.8%, suggesting limited scope for a surprise. The recent substantial move in the dollar was primarily driven by news of tariff reductions between the U.S. and China, rather than inflation dynamics.

Price action in the dollar rallied ahead of U.S. Treasury Secretary Scott Bessent’s announcement that trade negotiations with Chinese officials are scheduled to take place in Switzerland on May 7. Despite a –0.2% contraction in U.S. growth—driven primarily by a surge in imports (frontloading of cars and consumer goods)—the Fed remains unmoved. Initial and continuing jobless claims remain elevated, highlighting underlying economic fragility. However, these downside risks are not yet sufficient to trigger a change in Fed policy.

In contrast, the euro area presents a more favorable macro backdrop. While the ECB continues to ease rates, growth remains relatively stable and fiscal policy is broadly consistent—without the continuous radical change in fiscal policy. These relative advantages have positioned Europe as a more attractive destination for capital, as reflected in the outperformance of European equities and currencies versus their U.S. counterparts.

Labour data in the Uk tomorrow could open the door for short pound trade ideas. We've been long the pound for a while now due to its relative insulation from tariff actions and a stuborn UK inflation. Wage growth surprised to the downside and unemployment to the upside albeit marginally

Australian Employment data on the 15th of May was above expectations. A bottom for AUD is probable if things get better here, the possibility owing mostly to positioningpositioningand price action. Growth and business were below expectations but projected to get better

Content on this site is for informational purposes only and does not constitute investment advice or a solicitation to buy or sell any financial instruments. MetaMacro makes no guarantees regarding the accuracy or completeness of the information provided. Unauthorized use, redistribution, or access to proprietary content is strictly prohibited. All information is subject to change without notice. Investments involve risk, including the potential loss of principal.