Good day, MetaMacro readers! Here's the latest update on FX market flows and catalysts for price movement

FX News

FX update: FX implied vol, FX positioning

Economic dashboard

FX Views

FX News

Trump's decision to delay the 50% tariff hike on European Union goods until July 9

Trump warns attempts to conquer all of Ukraine will lead to ‘downfall’ of Russia

Increased Currency Market Volatility

How is the Federal Reserve reacting to Donald Trump’s trade war?

ECB Faces Greater Risk Inflation Will Undershoot 2%, Simkus Says

FX update

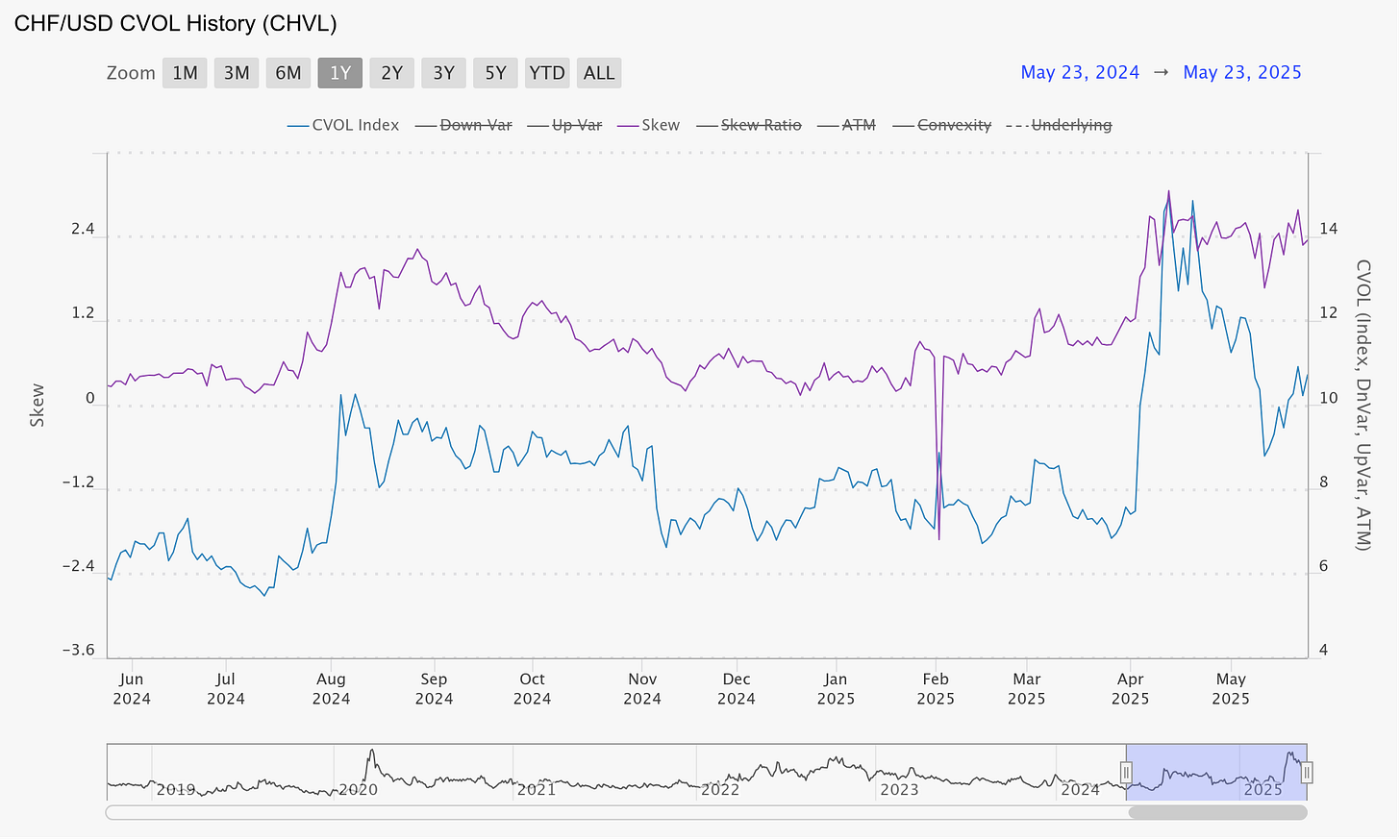

Implied Volatility

COT Positioning (Non commercial net positions)

Economic dashboard

FX Views

Positioning in the euro and the yen remains relatively elevated. The former currently has an inverse relationship with the dollar that's currently breaking down and the latter struggling to climb higher. Economic data coming out of Japan has been less encouraging overall compared to previous releases. In addition, forecasts for growth and inflation have been downgraded due to tariffs—though that's old news. We have substantial economic reports for Japan this week that will confirm or invalidate our thesis. Europe on the other hand has just inflation expectations and consumer sentiment this week.

Skew has retraced marginally for all major currencies except the Canadian dollar and the swiss franc. Although skew is elevated in the Canadian dollar, it's unlikely to make a substantial move in price.

The BOE, Fed and BOC are expected to hold rates in their next meetings. It's unlikely to new macro developments—particularly related to tariffs—will meaningfully shift the current trajectory of major currencies. The ongoing back-and-forth and constant compromises have eroded the impact of tariffs on financial assets.