FX Weekly Report

Weekly update on FX markets and views

Good day, MetaMacro readers!

Here’s your latest update on FX market flows, positioning, catalysts, and economic developments.

FX News

FX update: FX implied vol, FX positioning

FX Views

FX News

The Federal Reserve cut its benchmark rate by 25 basis points to a range of 3.50%–3.75% on December 10. However, this was not a “mission accomplished” signal.

Trump enlists 5 allies to counter China on rare earths and tech

The Fed signaled a slower pace for 2026, driven by “sticky” inflation still hovering above the 2% target.

Powell says he wants to ‘turn this job over’ with economy in ‘really good shape’ before departure

The Bank of England is cornered into a more dovish stance. After the UK economy unexpectedly shrank by 0.1% in October

13D Filings: The U.S. Economy Is Poised to Grow Faster in 2026 — Barron’s

China recorded a historic $1 trillion trade surplus, driven by weak domestic consumption and aggressive manufacturing exports. (This structural imbalance is a primary source of tension within the G20, as it exports deflationary pressure to the rest of the world.)

Investors are abandoning the long end of the curve in favor of 5 year notes (the belly). (The logic is that sticky inflation and persistent US fiscal deficits create a floor for long term yields, making the 5 year maturity the sweet spot for risk adjusted returns.)

The political reaction to China’s export dominance in EVs and advanced manufacturing is escalating. Unlike the cheap consumer goods of the 2000s, this second shock competes directly with G7 industrial bases. {Expect continued volatility in Western industrial sectors (autos, green tech) as the US and EU weigh tighter tariffs or non tariff barriers to counter the $1T surplus.}

Belgium is blocking a G7/EU plan to use frozen assets to back loans for Ukraine, fearing legal blowback on Euroclear (the massive clearinghouse based in Brussels.

Administration pressure on the Fed has increased following the recent government shutdown that delayed key economic data releases.

Disagreement persists within the EU regarding the use of frozen Russian assets, with Belgium blocking G7 proposals due to risks to Euroclear.

Canada GDP growth is tracking above prior expectations, leading analysts (e.g., RBC) to forecast an end to rate cuts or a potential hike if housing reinflates.

The economy (UK) contracted by 0.1% in October, solidifying the central bank’s dovish pivot despite “sticky” service sector inflation.

The government is under pressure to revise fiscal rules to allow for more public investment to counter the recessionary trend. The Reserve Bank of Australia (RBA) held the cash rate at 3.60% in its final meeting of 2025.

Australian government bond yields have risen relative to US Treasuries, reflecting the RBA’s lagging easing cycle.

The Reserve Bank of New Zealand (RBNZ) continues its easing cycle, with the official cash rate trending toward a terminal projection of roughly 3.0%.

Government announcements focused on mitigating the impact of new global trade barriers on agricultural exports.

The RBI has cut the repo rate by a cumulative 100 basis points over the last cycle; GDP growth is tracking at 8.0% with CPI inflation low at 2.2%.

UNCTAD reports global trade grew 7% in 2025 (adding $2.2 trillion), driven largely by service exports from China and India.

EM sovereign debt issuance has increased, but lower global rates are easing servicing costs for local currency borrowers.

FX update

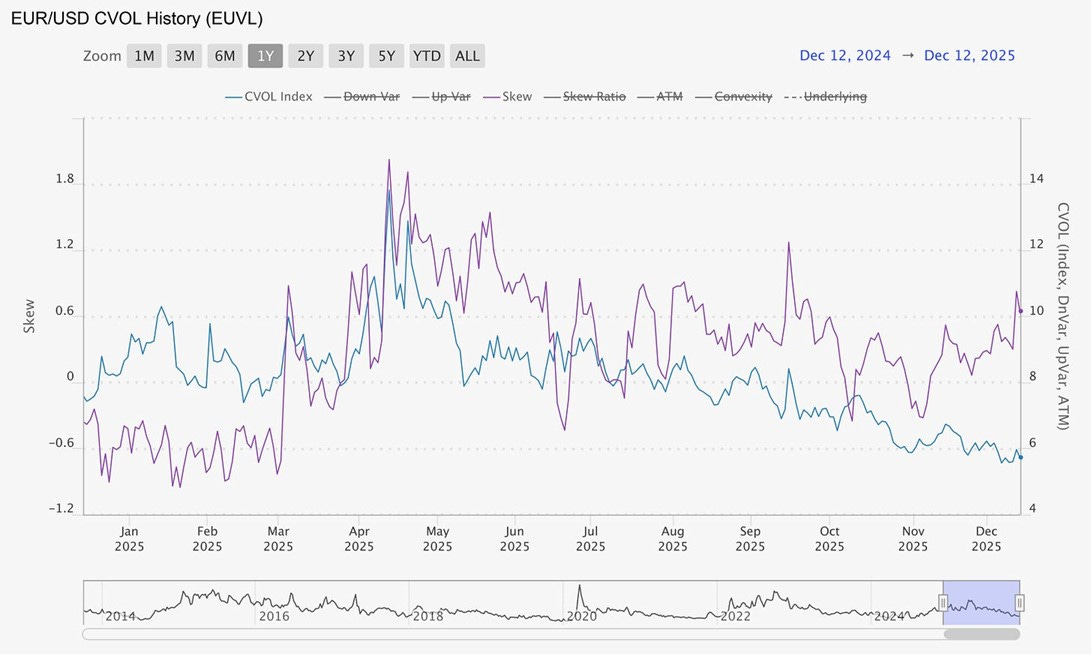

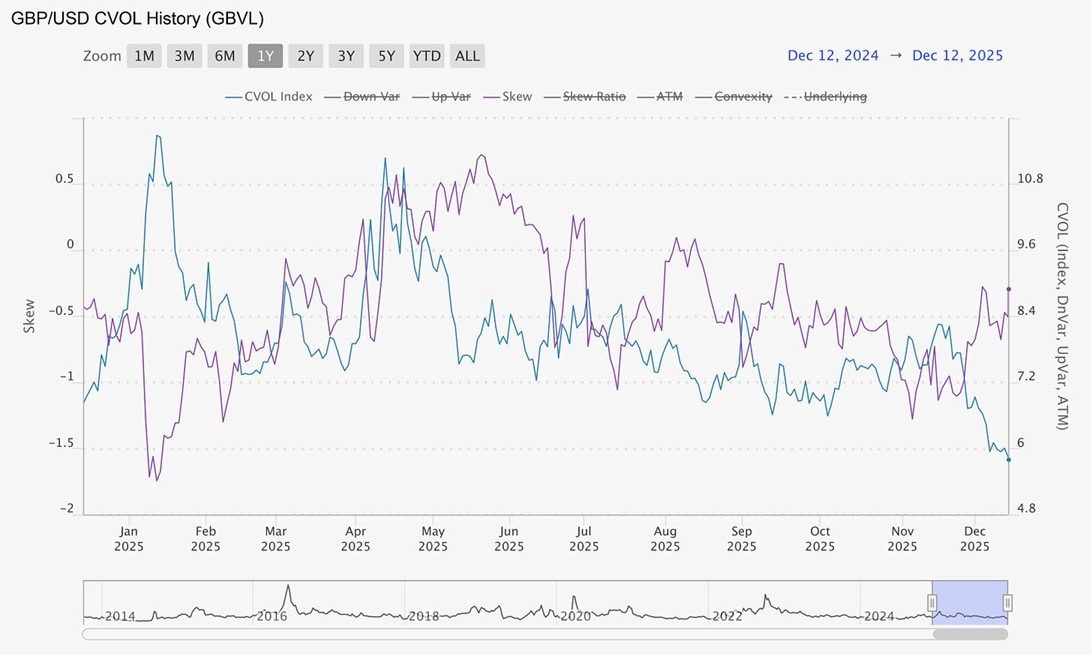

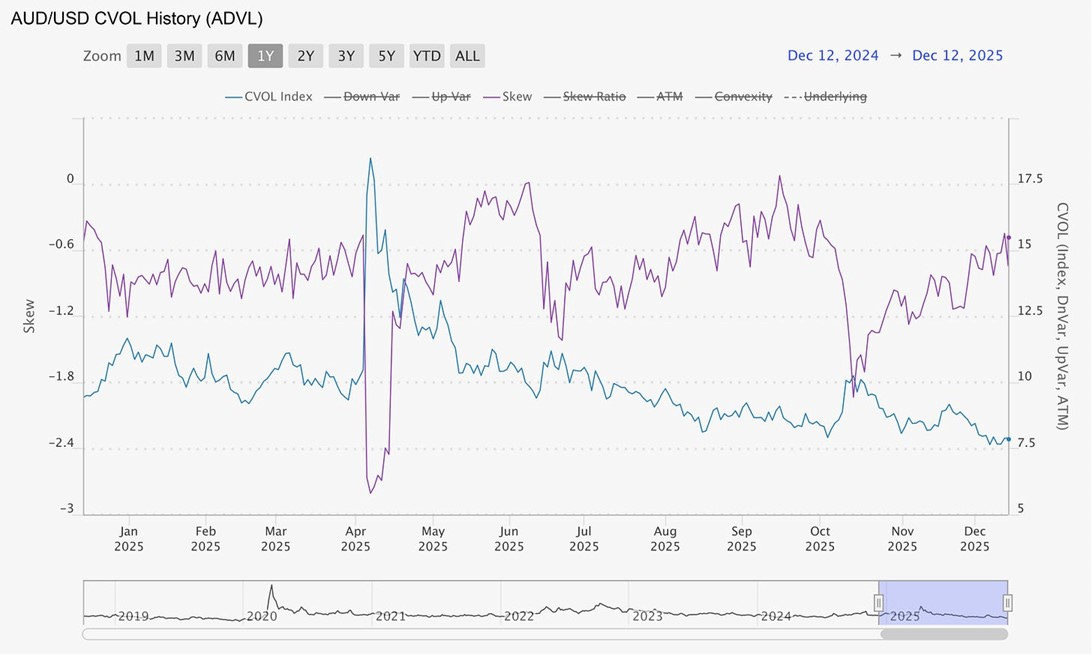

Implied Volatility

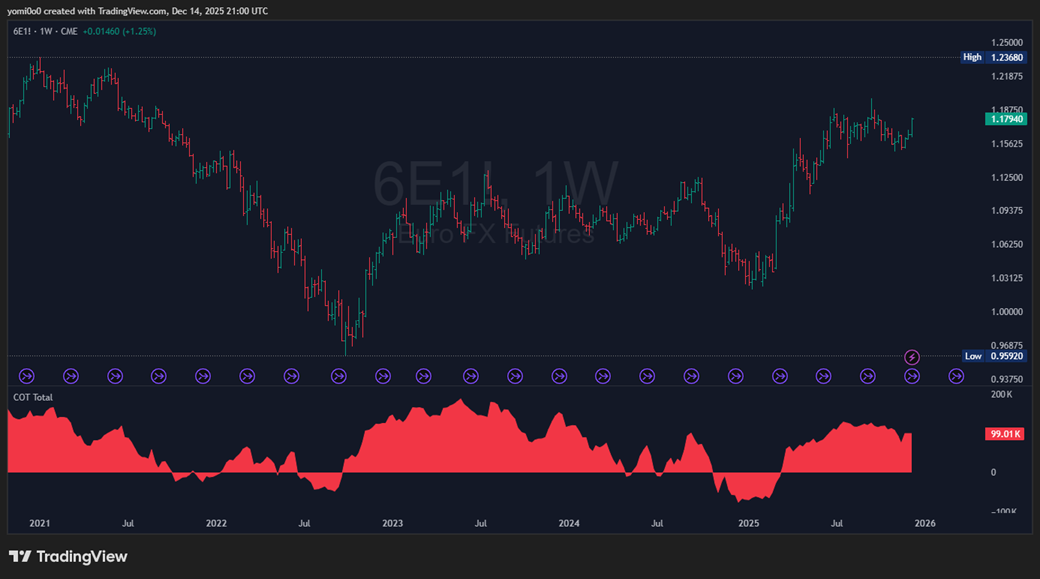

COT Positioning (Non commercial net positions)

FX Views

The U.S. dollar hovered near two month lows around 98.3 on Friday, booking its third consecutive weekly decline as markets digested a contentious Federal Reserve decision that highlighted deepening fractures within the central bank.

In a move widely anticipated by futures markets but fiercely debated inside the FOMC, the Fed lowered its benchmark interest rate by 25 basis points to a target range of 3.50%–3.75%. This marks the third consecutive reduction in a cycle that began earlier this year. However, the accompanying policy statement and economic projections signaled a “hawkish cut,” with officials paring back expectations to just one additional rate reduction in 2026.

While the decision to cut was carried by the majority, the dissenters stole the spotlight, revealing a committee at odds over the economy’s true trajectory.

Kansas City Fed President Jeffrey Schmid broke with the majority to vote for a hold. Citing inflation that remains too hot—with headline CPI sticky at 3%—Schmid argued that the current policy stance is not sufficiently restrictive to finish the job on price stability. His dissent underscores a growing skepticism among hawks that the long run neutral rate of interest (r star) may be significantly higher than the Fed’s traditional 2.5% estimate.

According to recent research by Jonathan Hartley (Stanford/Hoover Institution), policymakers may be facing a substantial divergence in how this neutral rate is estimated. While traditional structural models (like Holston Laubach Williams) suggest r star has fallen, survey based measures from market participants indicate it has actually risen significantly post COVID. If the market perceived r star is indeed higher potentially around 2.0% in real terms or higher as suggested by long run bond yields the current policy rate of 3.50%–3.75% may be far less restrictive than the dovish contingent believes. This divergence supports Schmid’s fear that the Fed is easing into an environment where capital is structurally more expensive, risking a reignition of inflation that is currently stalled at 3%. While a rate cut generally lowers hedging costs, the uncertainty surrounding the policy path highlighted by the split vote keeps volatility premiums elevated.

On the other side of the aisle, Chicago Fed President Austan Goolsbee also dissented, though for markedly different reasons. Despite being one of the committee’s most vocal doves projecting more aggressive easing in 2026 than his colleagues Goolsbee argued for a pause at this meeting. He contended that waiting for clearer inflation data would have been prudent before committing to another ease, a signal that even the doves are wary of reigniting price pressures prematurely.

Looking ahead to 2026, the committee’s composition will shift. Philadelphia Fed President Anna Paulson, who took the helm in July and joins the voting rotation next year, has already staked out a dovish position. In comments following the decision, Paulson emphasized that labor market fragility is now a “greater concern” than inflation, aligning herself with those prioritizing the Fed’s full employment mandate.

The Data Dilemma: Bad Jobs vs. Sticky Prices

The Fed’s dilemma is rooted in contradictory data. On one hand, inflation has stalled at 3%, refusing to glide the final mile to the 2% target. On the other, the labor market is flashing recessionary red lights.

Data released earlier this month revealed that private businesses cut 32,000 jobs in November 2025, a sharp reversal from the upwardly revised 47,000 gain in October and defying forecasts of a 10,000 increase. This represents the deepest monthly contraction in private payrolls since March 2023. The pain was acutely felt on Main Street, with small establishments shedding 120,000 jobs, a clear sign that higher financing costs are crushing the most interest sensitive sectors of the economy.

Market pricing reflects this uncertainty. Futures for the January 28, 2026 meeting now imply a 75.6% probability of a hold,(at the time of writing) with only a 24.4% chance of a further cut, suggesting traders believe the Fed will indeed pause to assess the damage.

Market Reaction: Rotation and Divergence

The shift toward a loosening regime should theoretically decrease these costs and steepen the curve, transferring relief to non financial firms and banks with asset liability mismatches. However, if inflation expectations remain unanchored or if the market fears a “stop and go” policy response—hedging costs could remain punishingly high, amplifying vulnerabilities in the financial sector. This dynamic helps explain the rotation into small caps (Russell 2000); smaller firms, often reliant on floating rate debt, are desperate for the reduced hedging costs that a steepening, loosening curve promises.

As we move through mid December 2025, the global economic narrative is diverging. While the Eurozone’s labor market recovery shows signs of fatigue, the United Kingdom is bracing for a pivotal week of data releases. Meanwhile, in Australia, robust consumer resilience is complicating the Reserve Bank of Australia’s (RBA) path toward monetary easing.

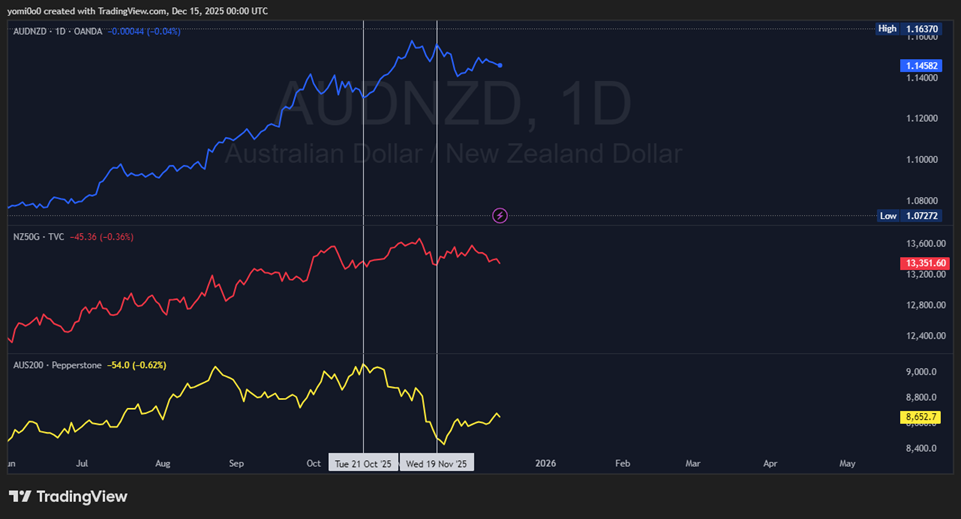

The AUD/NZD cross has rallied sharply as the Reserve Bank of Australia (RBA) signals further tightening, diverging from the Reserve Bank of New Zealand (RBNZ), which is expected to cut aggressively. The ASX’s weakness relative to global peers confirms that Australian markets are pricing in a painful higher for longer reality.

Canadian Dollar (CAD): Despite expectations that the Loonie would weaken ahead of Monday’s CPI report a classic hedge the currency has remained resilient. Canadian yields have ticked marginally higher following the (BoC) signal that its rate cutting cycle has concluded. If the BoC is indeed “one and done” while the Fed lingers in uncertainty, the CAD could see further upside against the greenback.

Eurozone: The Unemployment Decline Hits a Floor

The post pandemic recovery in the Euro Area labor market has been remarkable, but the momentum appears to be waning.

Technical analysis (Not Prediction) of the Euro Area Unemployment Rate (EUUR) suggests that the consistent downward trend observed since 2021 has stalled. As illustrated in the daily chart, the unemployment rate has found support near the 6.4% 6.5% level, with the trend flattening significantly as we close out 2025.

Despite the stall, it is important to contextualize this data. An unemployment rate hovering near historical lows indicates a labor market that remains tight.

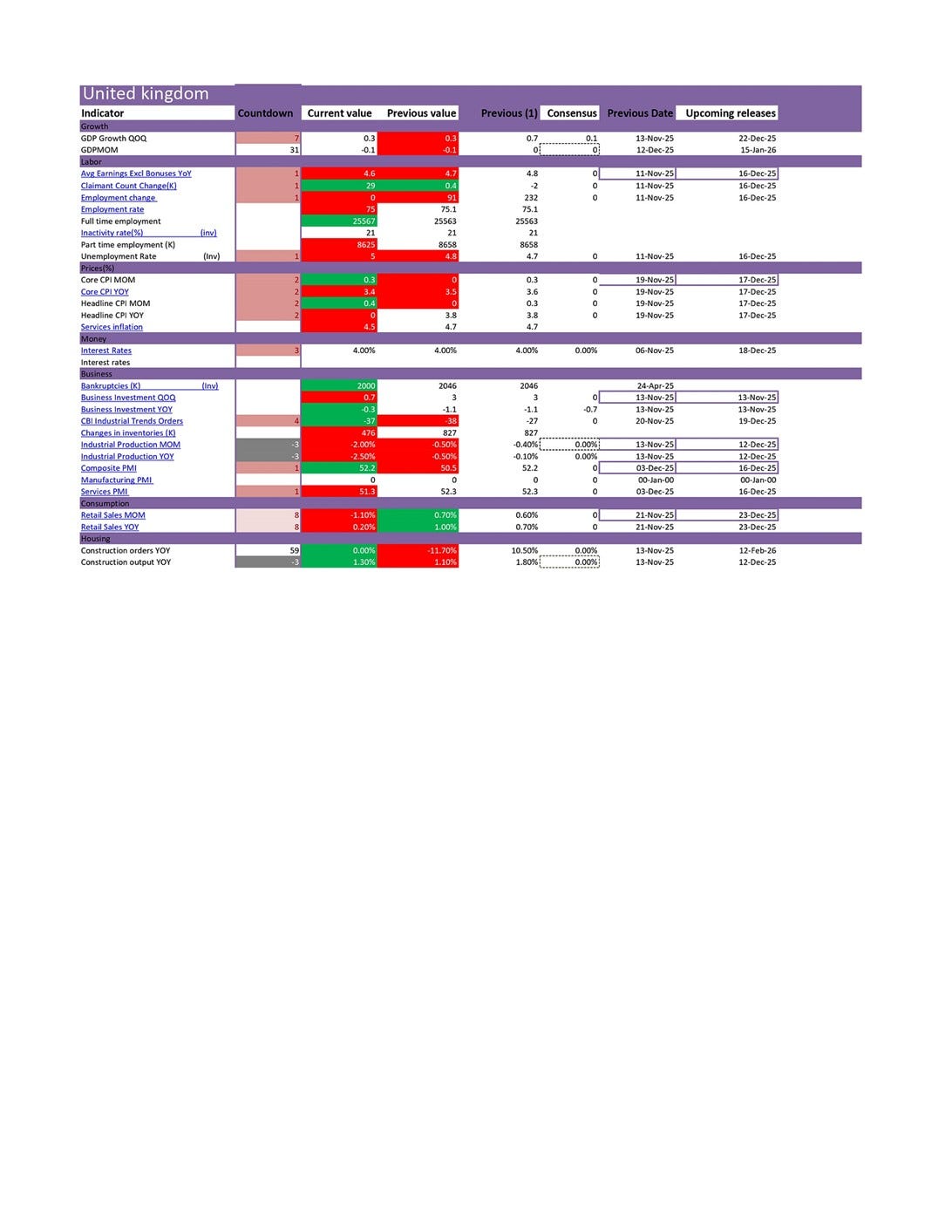

United Kingdom: A Critical Week for Sterling

Volatility is expected for the British Pound (GBP) this week, as the economic calendar is packed with high impact releases. Traders are keeping a close eye on the Countdown to key indicators that will dictate the Bank of England’s next move.

Australia: Strong Spending Discourages RBA Easing

Down under, the narrative is starkly different. Hopes for RBA rate cuts are facing a reality check in the form of the resilient Australian consumer.

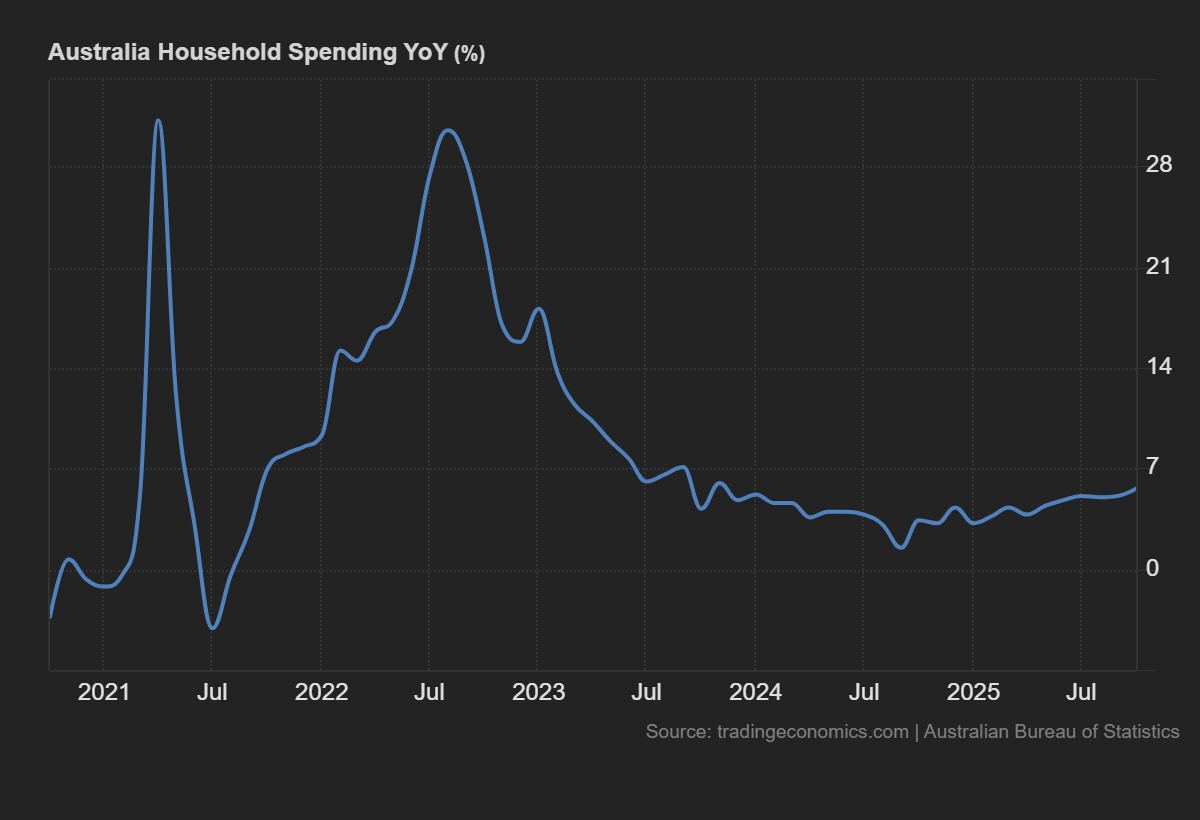

Recent data highlights a surge in Household Spending, which has accelerated to 5.60% Year over Year (YoY).

As shown in the Australia Household Spending YoY chart, consumption has been on a relentless upward trajectory throughout late 2025, defying the restrictive interest rate environment. This spending is supported by a robust labor market. Full time employment surged by 55.3k, and the unemployment rate remains low at 4.30%.

The Reserve Bank of Australia cannot easily pivot to easing when household demand is running this hot. With Inflation Expectations still elevated at 4.50% and spending accelerating, the RBA may be forced to keep the cash rate at 3.60% (or higher) for longer than the market anticipated. The recent data effectively prices out near term easing, as stimulating an economy that is already spending at >5% YoY would risk unanchoring inflation.

Japan: Fiscal Risks Outweigh Policy Shifts

Investors are selling off long-term Japanese bonds not because they think the Bank of Japan is about to aggressively raise rates, but because they are demanding extra compensation premium for the risks of holding Japanese debt over the next 10–30 years. The market is not repricing the central bank’s next move (which would move the front end), but rather repricing the economy’s long-term structural risks.

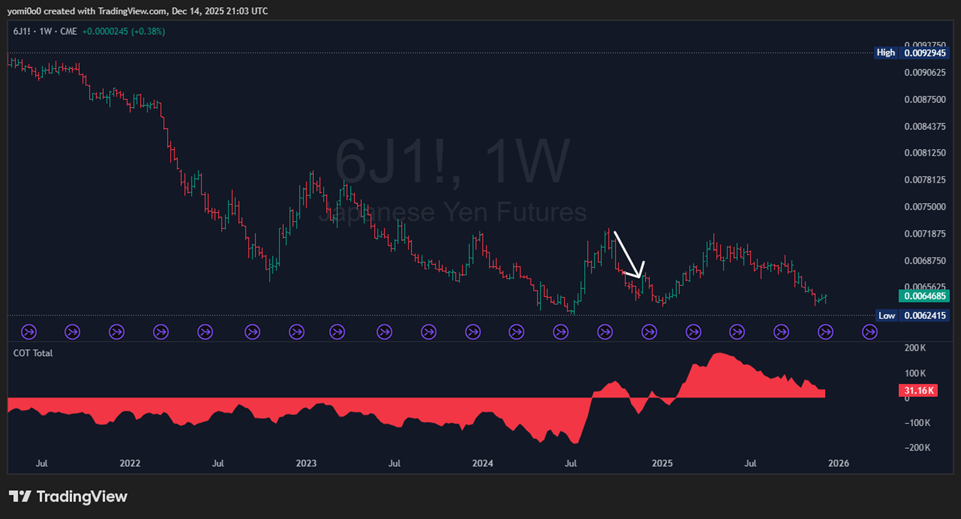

while the yen looks like this

There also exists political uncertainty on the LDP’s leadership struggles and the rise of pro-spending factions like Sanae Takaichi’s circle. If the government is unstable, it is more likely to try to buy popularity through massive spending (fiscal stimulus). This means issuance of more government bonds.

If there is going to be a flood of new 30-year bonds to fund spending, I need a higher yield to buy them.

If inflation is “sticky” at 2-3% and the BOJ is too cautious to hike rates to stop it, the value of money locked in a bond for 20 years will erode faster.

This creates a scenario where the central bank cannot raise rates because the government debt is too high, forcing them to let inflation run hot to inflate the debt away.

In short, the steepening is a vote of no confidence in Japan’s long-term fiscal discipline, rather than a bet on immediate rate hikes.

Summary Outlook

EUR: Neutral. The labor market is safe but lacks the dynamism to drive the currency higher alone.

GBP: Volatile. Prepare for choppy price action this week driven by CPI and Labor prints.

AUD: Strong consumption and employment data reduce the likelihood of rate cuts, potentially supporting the Aussie dollar against weaker counterparts.

JPY: Rising long-term yields are driven by fiscal risks rather than hawkish policy, leaving the currency unsupported as the BOJ keeps the front end anchored.

Content on this site is for informational purposes only and does not constitute investment advice or a solicitation to buy or sell any financial instruments. MetaMacro makes no guarantees regarding the accuracy or completeness of the information provided. Unauthorized use, redistribution, or access to proprietary content is strictly prohibited. All information is subject to change without notice. Investments involve risk, including the potential loss of principal.

The dual dissent from both hawks and doves really underlines how lost the Fed is right now. Schmid's point on r-star being structurally higher post-COVID is probaly underpriced in how markets are positioning for 2026 cuts. Ran into this exact debate working through fixed income positioning last quarter where the HLW model vs survey-based r-star estimates were showing a 100+bp gap, making any duration call feel like picking sides in an unresolved academic fite.