Trump's proposed "Big, Beautiful Bill," projected to increase the federal deficit by $3.8 trillion over the next decade, has significantly increased risk-off sentiment, exacerbated by his threats to Apple and the EU over manufacturing and trade. The market had previously priced out the earlier risk-off sentiment. This was supported by the progress made in negotiations between the US and China. People have probably already forgotten about that.

Final passage of the bill is scheduled for July 4, with possibilities for revision. The proposal of this bill isn’t the type of catalyst to start a trend. It may incite caution, yes—but a trendsetter? we don't think so.

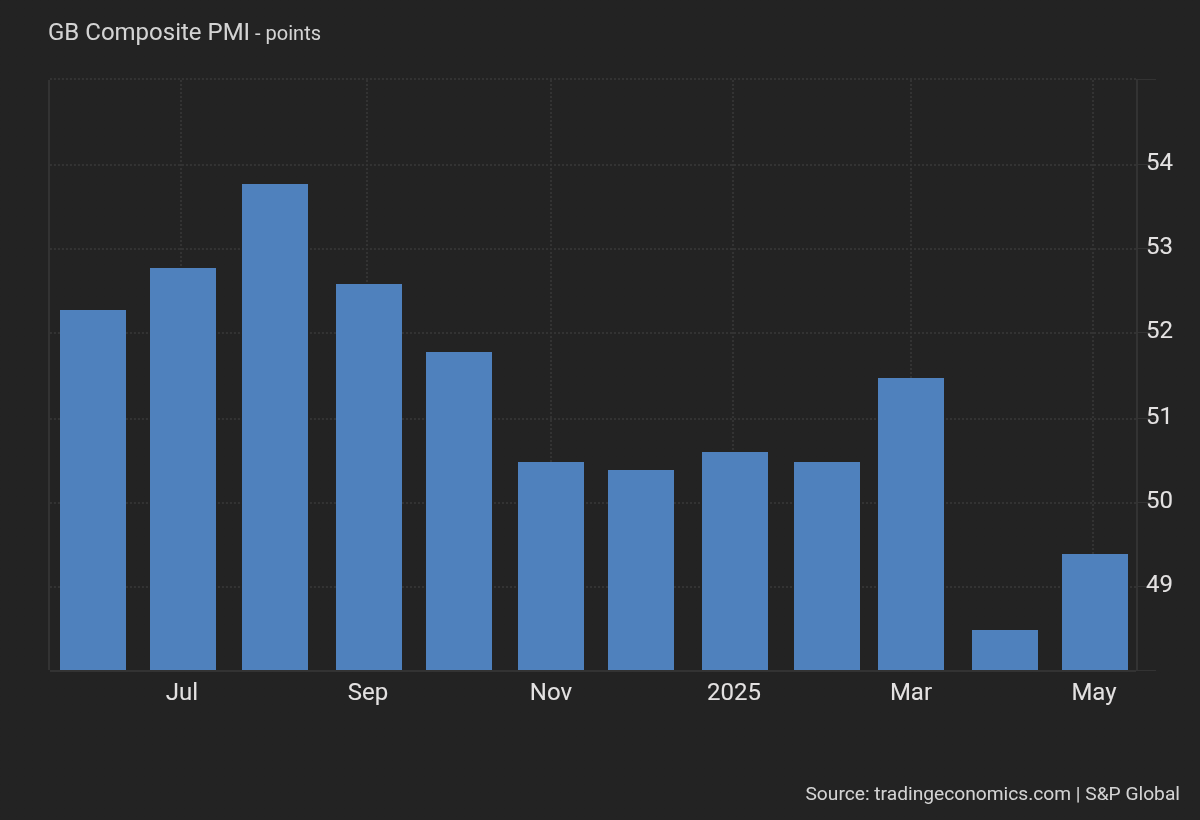

The pound has rallied, reflecting high inflation and stable growth dynamics. UK employment is showing weakness, but not enough to increase the likelihood or number of rate cuts. The Composite PMI on Thursday rose to 49.4 from 48.5.

It is still below the contraction threshold but marks an improvement from the previous reading. Retail sales surged 5% year-over-year, beating expectations of 4.5%.

We’ve been long on the pound since April 14, and we were hoping for a retracement before going long again, but it seems like we’re not going to get it.

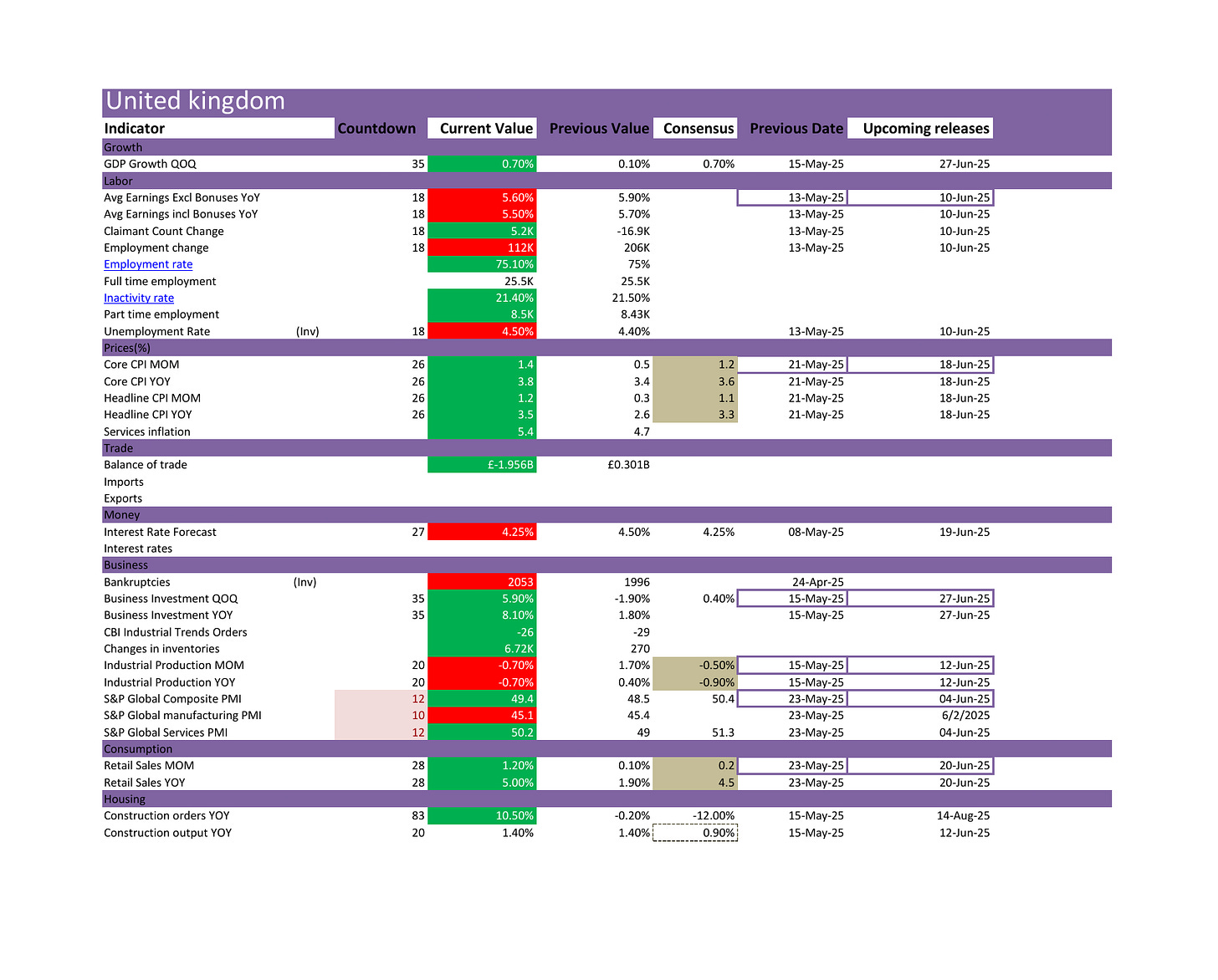

The countdown column shows the number of days left until a report is released.

We aren’t expecting any economic reports from the UK soon.

A long pound trade from here doesn’t seem prudent, but we’re also lacking significant tail risks for the pound.

In other news, Japan's core CPI increased from 3.2% to 3.5%, not far from the consensus estimate of 3.4%. The yen is having trouble rallying from here.

It is certainly rallying, but struggling to gain momentum. We’re very cognizant of downside risks to the yen, as that’s where the most asymmetry lies.

Core machinery orders (MoM) jumped 13%, up from 4.3%

Our observation of recent economic data shows it's evident Japan is on track for normalization. The BOJ will keep tightening although that has had some dent on it from downsized forecasts due to uncertainty on tariffs.

We will keep writing our observations in changes in price action patterns and how they respond to different catalysts as they emerge