Yesterday after-hours was quite the frenzy, with NVDIA declining by approx. 7%, the question is what next.

Just a quick note to anchor thought process around:

Maintaining bounded rationality by understanding the information flow, incentives and disincentive, goals, stresses and constraints

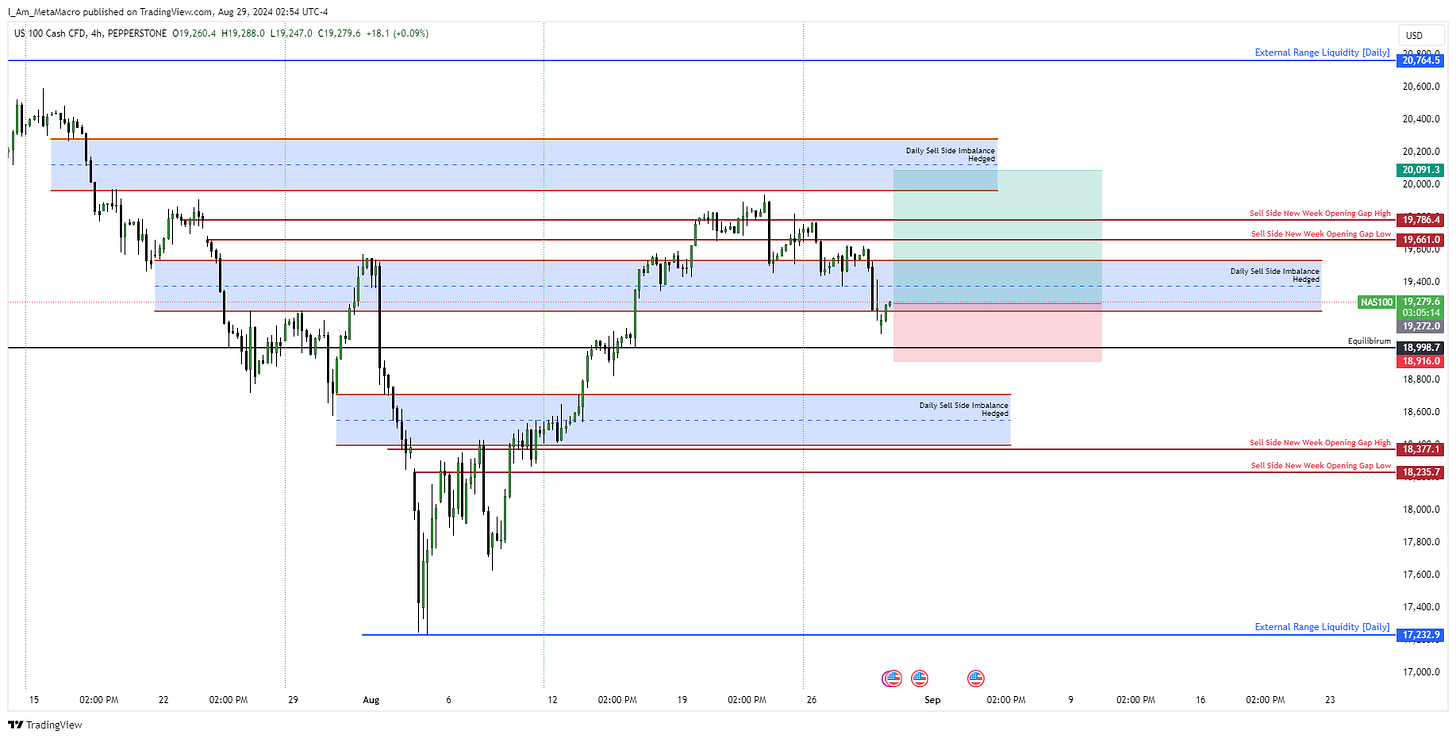

In the previous market color, I shared, I had anticipated a retracement in NASDAQ below 19,500:

NVDA earnings release served as an incentive for price to decline lower. However, in my opinion I do not think the earnings release is terrible to result in a bear market. Yes, there are concerns about slowing momentum in the AI thematic trade which is relatively normal, but they continue to beat expectations.

I think we should rally from here towards 20,000 level on NASDAQ. With earnings volatility concluded the core focus of the market now shifts to pricing macro data in line with where we are in the macro regime and where we are expected to transition into.

I am still long equities:

NVDA short term stress to the market due to future growth concerns around the AI industry and premium valuation caused the initial reaction lower. Pre earnings release yesterday I was examining the OMON and picked up some key levels there:

while I considered the probability of a downside, my expectations were anchored such that I did not expect us to drop to 110 levels, because if we do I do not think we will rally significantly higher above 128

Overall, I think we should rally on NVDA towards 130 levels, however if the macro data releases today are not positive on growth expectations, broad equity indices will decline and NVDA will follow suit, then we can see it at 110 levels, outside of this rationale, I think we should find some movement above 115 level.

Same rationale for S&P500: