Crosscurrents: Trade War Escalation, Volatility Surge, and Positioning

Current Views and Broad Strategy

There is quite a lot happening, lot of moving parts and views going on, so will try to give our view on how we see things, and how we would likely position as things go haywire - China just retaliated on Tariffs.

Volatility Index

Mapping out historical levels of VIX in major crisis period 2008 and 2020, but more importantly the levels where VIX repriced lower when market participants probably anticipated a bottom, which has been a pattern in major crisis period, and this week so far is no different, since we had the fake news rally in equities and corresponding repricing in VIX, but that has changed with new headlines on the tariff risk:

I do think if we continue with the current trajectory of events then 65 levels on VIX and then back to 2020 levels is plausible. The 9D VIX is already at 67.63 as uncertainty still lurks on the horizon.

Oil VIX

Correspondingly on Crude Oil, we have seen the OVX move above 41.72 levels as the trade war takes center stage between US and China:

If we also continue at this pace we could see Crude Oil VIX trade to 60 levels and back to 68 levels. Implying the above Oil VIX levels on Crude Oil, in 2020 we traded negative on Crude, the odds of that happening is on the table but not incredibly high. However, there could be a further decline to 50 levels and perhaps the 40 level region.

The rise in Oil VIX is largely connected to the geopolitical tension between US and China, with China obviously ready to take this fight to the hills.

MOVE VIX

Similarly, we have seen an increase in volatility within the bond market over the past couple of days, there are quite a lot of theories on what’s happening within the bond market, as US long end rose to 5%. The current core narrative is that there is a deleveraging event going on majorly amidst hedge funds:

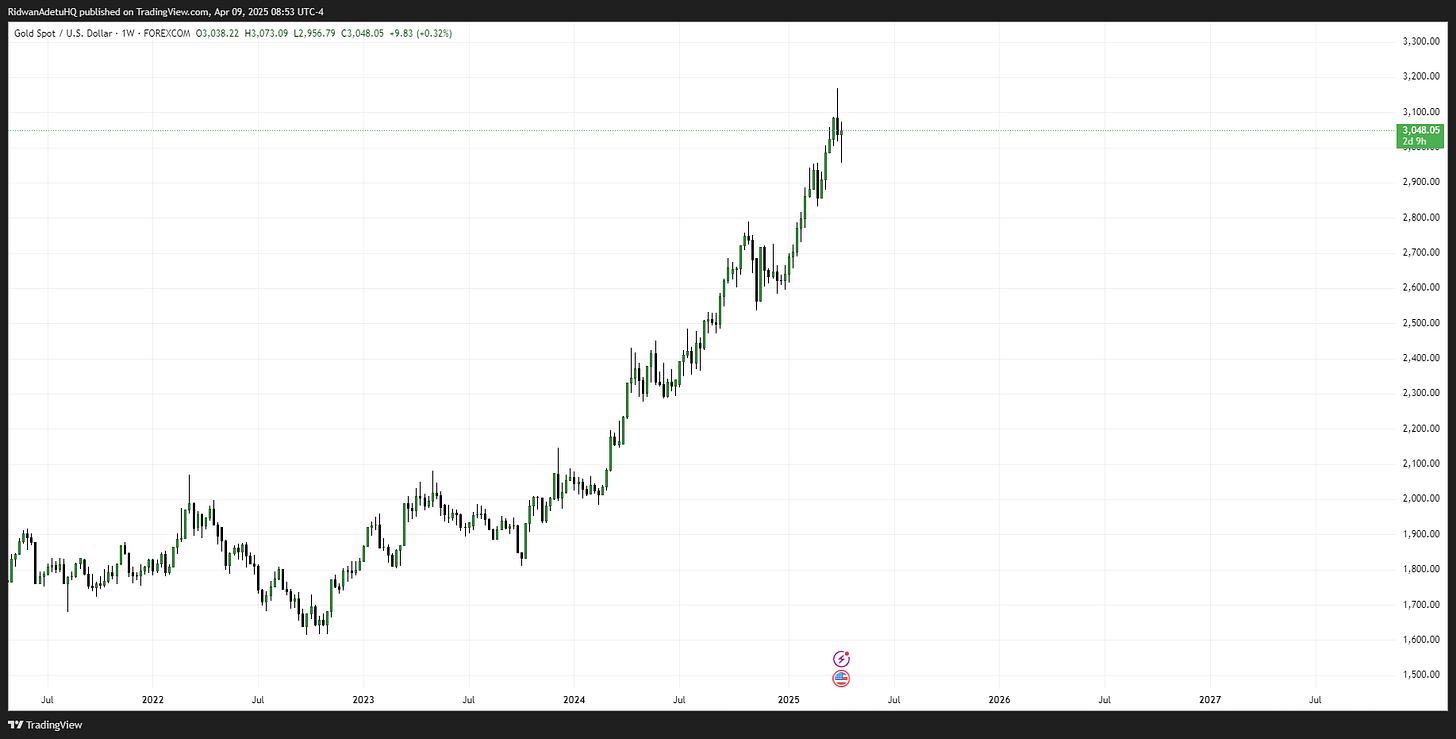

Commodities: Gold & Copper

Gold seems to have been ahead of the curve within the unfolding saga, and its probably why we haven’t had some major move to the upside. But with increasing uncertainty around the policies in place, we might see a continuous rally here.

If the market participants are taking the risk off equities and also bonds, then the alternative options are:

Gold

Commodities (exclusive of energy)

Cash

I do think another asset to watch is the Copper, as we continue to see increasing tension on the tariff front, especially with China, global growth slowdown becomes a major concern and there might be some further downside in Copper:

Global Currencies

With increasing concern on the market confidence level within the US, there isn’t a strong bid for the US Dollar following the risk off move, clearly the Dollar hasn’t been the top choice for safe haven or flight to safety given the increasing volatility and uncertainty is particularly stemming from the US right now.

If the current directional flow continue, we might see a sell off in Dollar back to 100 level or below.

Correspondingly, the Yen continue to see marginal bid compared to DXY as flight to safety/safe haven remain top of mind. Similarly, on the Swiss Franc we have seen some major directional flows here even more than the Yen:

EUR continue to maintain strength relative to the Dollar as we see trade tension in place between the EU and US:

The EUR also remain the favorite relative to the GBP:

Aussie Dollar and Kiwi are the weakest on the currency board amidst the global tension and flight to safety:

Canadian Dollar has bee mixed for two reasons:

Lower crude oil prices

Trade war with the US

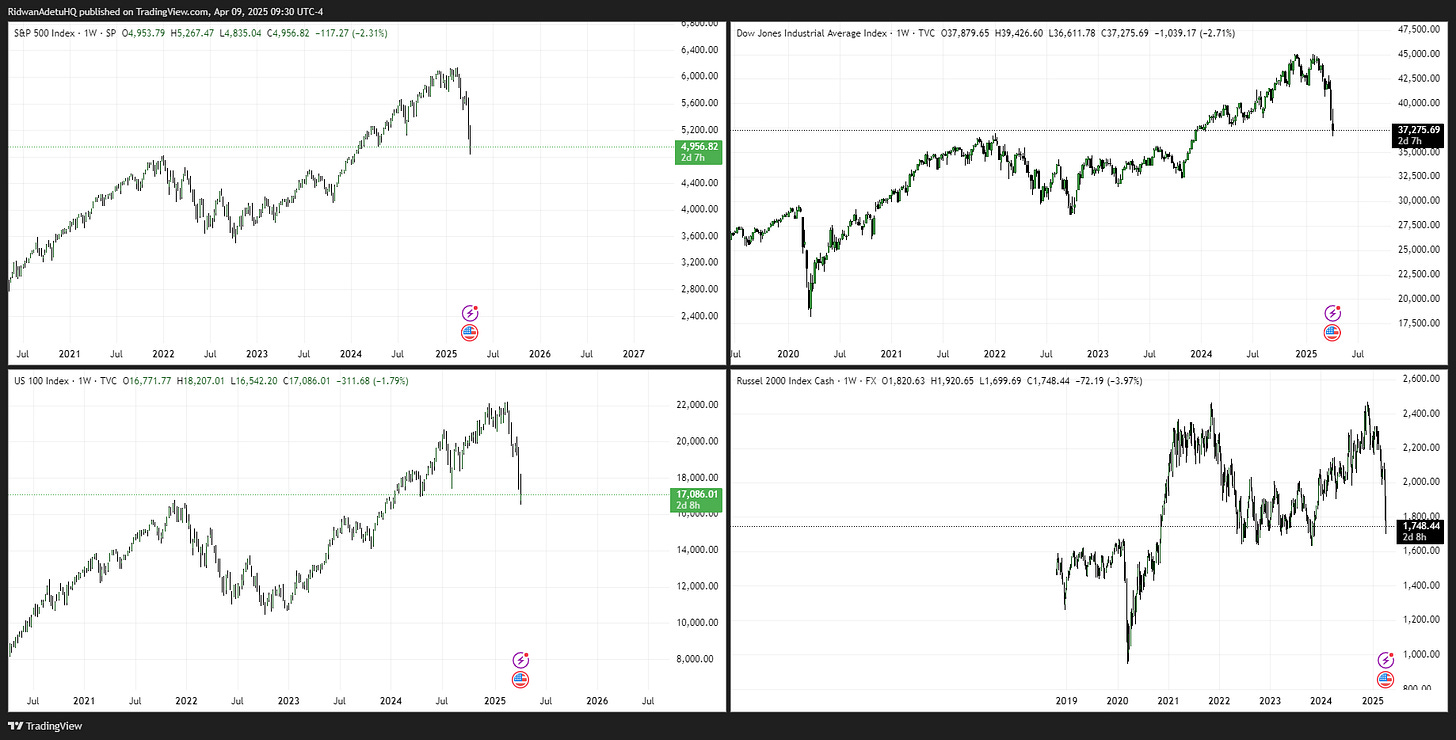

Equities

We have traded to extreme points on the downside across S&P, NASDAQ, RUSSELL and DOW, and there is currently no catalyst to flip to the long side:

With the current trajectory and sequence of events taking place on the trade war front, there is no catalyst to be long equities index. While we have also extended considerably to the downside and it does seem like we are probably due for a retracement, I don’t hold a similar view, I think at best we close this week on a neutral note on the weekly timeframe.

The catalyst for longs is clearly a function of how these events taking place shape up over the next couple of days, in conjunction with the events on the economic calendar.

Current flows on sectors relative to SPX:

Directional Bias View

This is not set in stone, evolves based on events over the next couple of days

Short Crude

Long Gold

Neutral/Bearish Equities

Long CHF and JPY

Short CADCHF and CADJPY

For the rest of the week, we have FOMC meeting minutes on the calendar today and CPI tomorrow:

Yields on US 5s and 2s are moving higher, yet today's price action suggests that the short end of the curve is not experiencing the same degree of selling pressure as the mid and long ends. This points to a mix of broader aversion to US bonds and the deleveraging event taking place. The surge in yields could be driven by several overlapping factors:

Expectations of a higher CPI print

Institutional selling to raise cash for margin calls on equities

A broader shift to risk-off positioning and cash, reflecting waning confidence in the US outlook

Of the above scenario, CPI expectation appears to have a mixed outlook on whether it prints higher, perhaps a 60/40 split favoring a hotter-than-expected print this week. If CPI does come in higher, the current steepening in the long end of the curve would be justified, and we could see a modest bid in the DXY. However, if CPI surprises to the downside or comes in line, the move in yields may be more indicative of the other risk-off narratives gaining traction.

The Fed, meanwhile, remains firmly hawkish/neutral. With the labor market and broader economic data still showing resilience, and inflation above the Fed’s 2% target, there is currently no strong incentive for a policy pivot, except if we see a complete meltdown in the market.

However, a key risk event coinciding with the CPI release is the potential for China to impose or raise tariffs on the US - which has already taken place. How, and what Trump does in response to this, and the timing are factors to consider. If Trump fight back overlaps on the same day as the CPI print, this could overshadow inflation data in terms of market impact, and this adds a layer of geopolitical risk that may shift focus away from domestic macro data.

In any case, the Fed appears comfortable keeping rates elevated at current levels. Doing so not only attempts to rein in sticky inflation, but also provides them with greater flexibility to cut rates if recessionary conditions or financial stress emerge.