Canada Macro Primer: Country Profile and Monetary Policy Framework

Expanding Coverage into Canada Equity Markets.

Expanding my views around equities from US into Canada, I think there are plethora of opportunities in the Global Financial Market, and with a structured and modelled approach to analyzing them, opportunities present themselves to take bets on.

The following is how the primer reports will be structured:

Primer 1: Country Profile and Understanding its Monetary Policy Framework

Primer 2: Economic Data and Understanding Asset Performance During Key Global Events

Primer 3: Macro Regime and Equity Market Analysis

I have no idea how many primers I will be writing, but certainly enough to solidify a strong grasp of the economy.

Origin of Canada and Provinces

Canada was officially setup on July 1, 1867, through the British North America Act with three separate territories - Canada, Nova Scotia and New Brunswick all united in Confederation, which further divided the province of Canada into Quebec and Ontario, all collectively becoming the country of Canada. The reason for the union was primarily for mutual defense, economic unity and to promote internal stability, driven by concerns around US expansion.

In 1871, British Columbia joined the Confederation after being promised a transcontinental railway (The Canadian Pacific Railway) which would link the province to the rest of the country, so did Prince Edward in 1873 with similar incentives.

Furthermore, Manitoba, Alberta and Saskatchewan was created as population grew rapidly to offer cheap land to immigrants, and to also enable and allow them manage their own local affairs.

In 1949, Newfoundland and Labrador was created after suffering severely from the Great Depression, and subsequently joined the Confederation to receive economic assistance and for long term stability. Additionally, Quebec was also identified as a province to preserve its unique identity as predominantly French speaking province.

Lastly, in 1999 Nunavut was established as a result of land claims agreements between Canadian government and the Inuit people. The creation of this territory aimed to give the Inuit greater political autonomy and control over land resources in the Arctic.

The complete provinces are:

Alberta

British Columbia

Manitoba

New Brunswick

Newfoundland and Labrador

Nova Scotia

Northwest Territories

Nunavut

Ontario

Prince Edward Island

Quebec

Saskatchewan

Yukon

Overall, the creation of some of the Provinces took root in the ability of local populations to manage their own natural resources and to have some control over economic decisions, and they all serve as economic and strategically integrated regions for defense and economic growth.

Post War and Great Depression Synopsis

In the post-war ear between 1947 - 1991, close to a million veterans reentered civilian life, marrying and having children, then embarking on a massive consumption binge.

Since the Great Depression between 1929 - 1939, Canadians indulged themselves with a shift in consumption pattern putting tremendous pressure on Canada’s balance of payments with its neighboring country, the United States. The demand also resulted in import driven inflation which agitated unions resulting in strikes to demonstrate their strength in major sectors being Auto, Steel and Transportation.

Within the post war era, Canada had experienced a series of seismic shifts through rapid urbanization, industrialization and technological change, with the development of Transport Systems, large scale Electronic, Aeronautic , Nuclear and Chemical engineering, and also Steel production. Furthermore, it also discovered deposits of radium, petroleum and natural gas, which gave Canada resources.

Mining became a major activity within Canada and it also revealed the extent to which Canadian economic growth was financed by American capital in the form of direct investment and American ownership of factories. Also, foreign investment aided by the American demand for Canadian materials, made the Canadian economic boom possible, as such investment from abroad was eagerly sought, especially by the provincial governments, and Canada prospered both because of it and because of its own advanced development in technology and resourced management.

Canada growth, positioned the economy to adequately balance its economic growth via three economic sectors:

Agriculture

Land Farming

Marine Activities

Mining of Minerals

Services Sector

Canada has utilized its resources to increase output of physical goods, playing a role in employment domestically and export in the real sector of the economy.

Demography

Canada has an approximate total population of about 41.289 million with a balanced proportion of Male and Females, slightly more females than male. The population is distributed with about 63.4% in the 1-64 years age group, which is attributed as the baby boom generation from the post-war era, also indicative of the growing dependent age group.

Canada population is made up of about 5% of indigenous citizens, as a significant portion of the population consists of immigrants from regions like Asia, Europe and the Middle East.

Geography

Canada is geographically located as a neighbor to the United States and Greenland, inheriting some major advantages and disadvantages.

The major advantages from Canada location includes:

Access to abundant natural resources which include Forests, Minerals and Hydroelectric Power

Vast land area, offering ample space for population growth and economic development. Its vegetation are among the world’s most productive agricultural regions, especially for grains such as wheat and canola.

Strategically located, due to its close proximity to the United States, providing Canada with numerous trade opportunities and diplomatic advantages. Also, its long coastlines offers access to the Atlantic and Pacific Oceans, giving it strategic access to key global markets.

Renewable Energy potential, with is Hydroelectric Power in Quebec and British Columbia, Wind and Solar Energy, which can further boost its position as a major energy exporter.

The major disadvantages to Canada location includes:

Harsh Winters, with extreme cold and heavy snowfall, which can pose challenges for transportation, infrastructure and outdoor activities

Increased transportation costs due to vast distances between major cities and regions

Sparse population density in some areas, leading to challenges in providing infrastructure and services in remote regions.

Prone to Natural Disasters such as Wildfires, Floods and Earthquakes, which can cause significant economic and environmental damage

Shortage of Ice-Free Port Season in the North, limiting the potential for Arctic shipping routes and year-round trade through northern regions

Natural Resources

Canada is the second largest country endowed with the following resources, which can also be found as the major resources in certain provinces:

Crude Oil: Saskatchewan, Alberta and Newfoundland & Labrador

Natural Gas: Almost all provinces and territories

Potash: Saskatchewan and New Brunswick

Iron Ore: Quebec, Newfoundland & Labrador and Nunavut

Uranium: Saskatchewan

Coal: British Columbia and Alberta

Softwood Lumber: Quebec and Ontario

Water: All provinces, and advantage from its geographical location

Political System

Canada operates a similar system to that of the United Kingdom, a constitutional monarchy and parliamentary democracy that recognize the Queen or King as the Head of State, while the Prime Minister is the Head of Government.

Canada’s Parliament is composed of the monarch of Canada who is officially represented by the Governor General, then the Senate and House of Commons. Elections in Canada are held at least once in every five years:

The King or Queen represented by the Governor General

The Senate

The House of Commons

Prime Minister and Cabinet

Members of Parliament

The Members of Parliament (MPs) sit in the House of Commons to represent their local communities known as electoral districts. Each MPs belong to a political party, while those that do not are referred to as independents. The Prime Minister and Cabinet also sit in the House of Commons.

The major political parties are:

Liberal Party of Canada

Conservative Party of Canada

Bloc Quebecois

New Democratic Party

Green Party of Canada

All of which have distinct ideologies that appeal to different segments of the population.

The current administration are:

Prime Minister: Justin Trudeau of the Liberal Party of Canada

Governor General: Mary Simon, representing King Charles III

Currency Regime

Canada adopted a fluctuating exchange rate system in September 1950, the value of the Canadian Dollar determined by the interplay of market forces. The model is such that the value of the exchange rate is determined by the demand for and supply of FX over a quarter, and the factors that drives the demand and supply includes:

Exports and Imports of Goods and Services

Long Term Capital Movement

Purchase or Sales of Gold or FX by the Central Bank

Short Term Capital Movement.

Financial Market Structure and Monetary Regime

The Bank of Canada aim to achieve a sustainable and efficient financial system for sustained economic growth and increasing living standards through key economic agents being:

Banks

Credit Unions

Financial Markets

Clearing and Settlement Systems

Historically, the Canadian financial system was based on five principal groupings of financial institutions:

Chartered Banks which are involved in personal and commercial lending and personal business taking. The chartered banks are grouped into Schedule 1 (no entity own more than 10% of any class shares) and Schedule 2 banks(one person can own more than 10% share, but must be adjusted after 10 years), in terms of ownership share within a bank.

Trust and Mortgage Loan Companies that specialize in consumer and residential mortgage lending

Co-operative Credit Movement that specialize in consumer and residential mortgage lending

Insurance Companies

Securities Dealers involved in the underwriting and selling bond and stock issues

Also, from a regulatory perspective:

The Federal government is responsible for the banking sector

Provincial government are responsible for the co-operative sector and securities industry

Over time, there has been a change in the Canadian financial system due to the following economic factors:

Technology Information Evolution

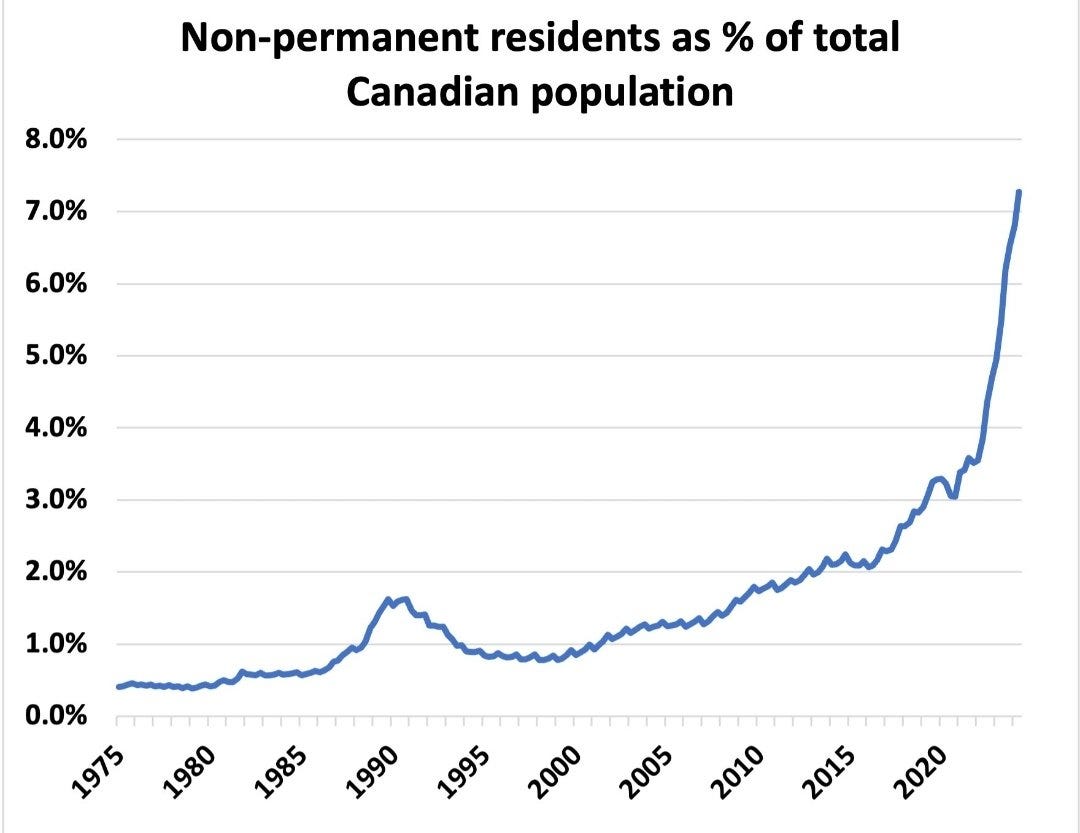

Demographic Shift

Variability of Inflation and Interest Rates

The evolution of technology has led to the development of Securitization market such as Mortgage Backed Securities(MBS) which enabled banks to package the residential loans on its balance sheet for resale, aiding in reducing risk and borrowing costs and to free up liquidity and capital for other purposes. Additionally, the Repo and FX Swap markets also developed, which enabled banks to manage risk and offer broader range of services to customers, and no doubt the technology advancement also led to the development of industries, and improvement in alternative method of financing beyond traditional bank loans to Equity, Bonds, Bankers Acceptances and Commercial Paper which became more important source of funds for Canadian corporations.

The second factor has been the Demographics which was set in stage during the post war era, as the economy demographics shifts to that of the baby boom generation, whom are expected to begin to retire, gradually shifting the demographics to an increased dependency ratio, which would have a significant effect on aggregate savings behavior.

The gradual shift in Demographics has led to demand for financial assets and increased personal savings largely within Mutual Funds, Pension Funds and other institutional holdings, resulting in the increase in financial holdings in Canadians household balance sheet.

Lastly, the movement from a period of severe inflation in the 1970s and high real interest rates, which contributed to domestic and foreign fiscal policy imbalances, and now to a period of low and stable inflation has led to a change in economic agents behaviors with household increasing their holdings in financial asset vs real asset, and their increased debt weightings has also made households vulnerable to changes in interest rates.

Canada Financial Markets

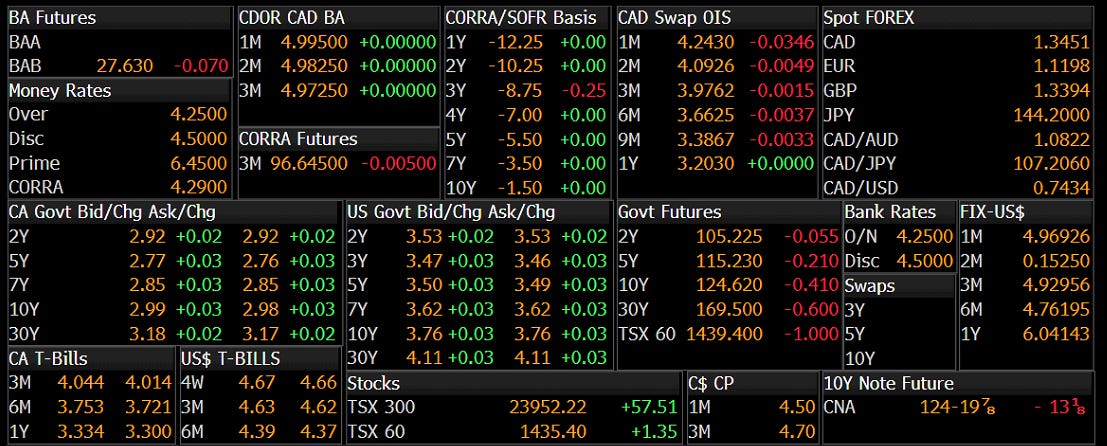

The key instruments traded are:

Equities

Fixed Income: Government Bonds, Corporates Bonds and Debentures

Derivatives

ETFs

Mutual Funds

Commodities: Oil, Gas, Gold and Agricultural Products

The major index are:

S&P TSX Composite Index

TSX 60 Index

TSX Venture Composite Index

The major exchanges are:

Toronto Stock Exchange (TSX)

TSX Venture Exchange: This focuses on early stage and emerging companies, providing a platform for smaller businesses to raise capital and gain exposure

Montreal Exchange (MX) specializes in derivatives trading, including futures and options contracts on various underlying asset such as Equities, Commodities and Interest Rate

Monetary Policy Framework and Tools

Over the past 100 years, Canada has used several monetary frameworks which included:

The Gold Standard framework between 1935 - 1945

Bretton wood system of pegged exchange rates between 1945 - 1975

Monetary targets between 1975 - 1990

Inflation targeting from 1995 to present

Canada inflation measured by CPI has largely lingered at and/or below 2% since the Great Financial Crisis in 2008, and the collapse of commodity prices in 2014-2015, and before the COVID19 shock in 2020.

The COVID19 shock presented a unique challenge to monetary policy, due to the widespread closure of many sectors of the economy which was buoyed by both fiscal and monetary policy stimulus which supported faster but uneven recovery across sectors.

The strong global recovery led by increased demand for goods amidst supply constraints and higher energy prices led to an increase in inflation above 5% and well beyond the 2% inflation target.

With inflation being the key focus for monetary policy post-covid, the Bank of Canada(BoC) focuses on the following CPI measures beyond the Consumer Price Index (CPIX):

CPI-Common (tracks common price changes)

CPI-Trim (excludes upside and downside outliers)

CPI-Median

BoC review the above CPI data variation alongside the following factors:

Determinants of inflation

Broad Capacity Measures:

Labor market indicators

Wage and other input costs such as commodity prices

Estimates of the output gap

Business and Consumer survey results

To achieve its monetary policy objectives, the most commonly used tool is the policy rate, which influences the interest rates that financial institutions use to set borrowing costs for households and businesses, while other array of tools are employed when the policy rate is at the effective lower bound level(25bps below the policy rate).

The transmission channels for BoC monetary policy include:

Interest Rate/Credit Channel: Through affecting market interest rates and bond yields.

Exchange Rate Channel: Changes to the level of interest rates or yields relative to those of other countries can affect the exchange rate

Signaling Channel: To influence expectations about future policy actions, thereby lowering longer term rates and reducing uncertainty

Liquidity Channel: By purchasing financial assets, to make it easier for buyers and sellers to carry out transaction in the markets

Portfolio Balance Channel: By purchasing financial assets, central banks can affect the quantity and mix of financial assets available to investors. Changes to the available supply of assets or to the amount of risk in the financial system can also lead to a repricing of those assets.

Reviewing the monetary policy action from recent economic events being COVID, the bank first priority was to restore and maintain the smooth functioning of the financial markets when widespread selling pressures caused liquidity to dry up sharply in multiple key funding markets.

The BoC was able to intervene in the market through Bankers Acceptance, Commercial Paper purchase program, which provided funding for a wide range of firm, businesses and financial institutions and also through the Provincial Money Market Purchase Program.

The BoC also intervened through the Provincial Bond Purchase Program, Corporate Bond Purchase Program Government of Canada (GoC) bonds in the secondary market through the Government of Canada Bond Purchase Program (GBPP) to restore adequate system liquidity.

With the policy intervention to ensure stable system liquidity, the BoC also embarked on Quantitative Easing (QE) to lower borrowing costs for households, businesses and government costs.

Monetary Policy Framework for Market Operations and Liquidity Provision

The BoC activity in the financial market is to:

Reinforce the target for the overnight rate

Support the efficient functioning of Canadian financial market

Provide backstop liquidity under extraordinary circumstances

All of these activities in turn influence the size, structure and management of the bank balance sheet.

The BoC sets the target for the overnight interest rate (Policy Rate), which influences the interest rates at which banks and other financial system participants borrow and lend funds for a term of one business day. The level of the O/N rate and expectations about its future path also influence other longer term interest rates, as well as a broader range of asset prices.

The implementation of monetary policy is closely linked to the country’s payment system (Lynx), which also supports the transactions between major participants in the interbank and financial market broadly. Part of the Bank aim is to ensure trading is done at the target overnight rate, which has a floating band to the upper and lower quadrant operating band.

The bank can adjust the level of settlement balances (system liquidity) available in the system to address some frictions in the payment system and to further support trading at the target rate for the overnight rate. However, unexpected shocks can cause the overnight rate to move away from the Bank’s target rate and this could be indicative of pressure on liquidity, which is then offset by adding liquidity with overnight repo or withdrawing with overnight reverse repo operations

In 2020, market operations indicate increased repo activity to inject liquidity into the financial system, via Overnight Repo and cutting Policy rate. Also, with a switch in objectives to rein in inflation, we see increased Overnight Reverse Repo as the BoC mops up excess liquidity while also increasing rates. However, in 2024, there has been an increase in Overnight Repo as monetary policy stance shifts to a dovish regime

The operating band corridor is defined as 25bps below and above (50bps total range) around the bank target for the overnight rate, and at the end of the trading day any positive balances in participants settlement accounts must be left on deposit with the bank via SDF and are renumerated at the deposit rate of target/policy rate minus 25bps which is the bottom of the operating band.

Conversely at the end of the trading day when the Lynx participants are in a deficit position , they must take on overnight collateralized advance from the Bank through the Standing Liquidity Facility (SLF) at the Bank Rate (target rate plus 25bps)

Through its SLF, the BoC provides overnight credit on a routine basis to participants in Lynx that are experiencing temporary liquidity shortages. These advances are made on a secured basis against a high range of high quality collateral. The higher cost of using the SLF provides an incentive for Lynx participants to undertake interbank transactions within the operating band. However, if institutions are experiencing persistent liquidity shortages, they would request Emergency Lending Assistance (ELA) from the bank.

Furthermore, the bank conducts Overnight Repo and Reverse Repo operations to support the effective implementation of monetary policy by injecting or withdrawing intraday liquidity to reinforce the bank’s target for the overnight rate. When the conditions in the general collateral overnight repo market requires liquidity, the bank intervene through repos and reverse repos to add and/or withdraw liquidity.

If transactions are taking place above the bank’s target rate indicative of tightening system liquidity, the bank will purchase Government of Canada(GOC) securities from Primary Dealers with an agreement to resell those securities to the same counterparty the next business day, with the difference in price equal to the interest for one business day.

Conversely, if transactions in the general collateral overnight market are generally taking place at rates below the banks target, it is usually an indication of excessive system liquidity, the bank may withdraw liquidity using overnight repo by selling some of it holdings of GoC securities (typically treasury bills) to primary dealers, with an agreement to repurchase them at a value that includes interest for one business day.

Assessing Vulnerabilities in the Canadian Financial System

In line with the BoC market operations, they also continuously evaluate vulnerabilities in the financial system, by assessing the following:

Degree of leverage

Funding and liquidity issues

Pricing of risk

Opacity

And connecting them across the following areas:

Financial Sector entities

Banks

Smaller Banks

Credit unions

Trust companies

Life insurance companies

Pension funds

Shadow banking

Securities markets, repo, ABS

Asset Markets

Equity, Bond, Currency and Money Markets

Asset valuations and their deviations

Earnings yield on equities vs govies and corporate bonds

Property markets

Inventory levels

Housing starts and resale activity and housing prices

Price to Income and to rent ratios with deviations too

Non Financial sector

Household

Debt and Income levels

Components of credit

Borrowing rates and repayment activity

Debt to income ratio

Non-Financial Corporations and Government

Sensitivity to changes in asset prices, interest rates and income

All of these factors are considered to form a foundational understanding of some working of the economy and how we can connect into specific asset class within the economy. Subsequent primer will be focused on Economic Data, Macro Regime and synthesizing views across asset class.